Time to Buy Beaten-Down Tech Stocks?

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- February 28, 2022

High-flying tech stocks are falling back to pre-Covid levels.

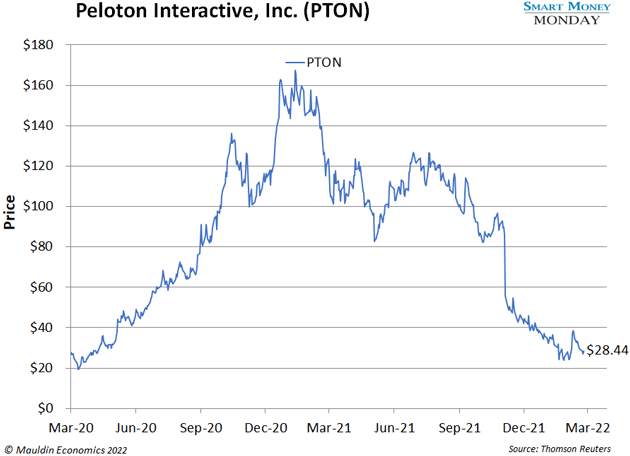

Just look at Peloton (PTON). It skyrocketed from $28 in March 2020 to an all-time high of $167 in December 2020. At the time, investors thought Covid had killed the gym—and that a never-ending parade of people would shell out $1,500 for a stationary bike, plus $39/month for Peloton’s interactive experience.

At one point, founder John Foley said Peloton would become “one of the few trillion-dollar companies.”

Today, Peloton has spiraled 83% from the highs. And it’s sunk 20% this year alone, putting it a few pennies away from pre-Covid levels.

Meanwhile, the company has laid off 20% of its workforce. And a former Netflix CFO has replaced Foley as CEO. The question now is: Will Peloton ever regain its 2020 highs?

We’ll get to that in a moment. But first…

-

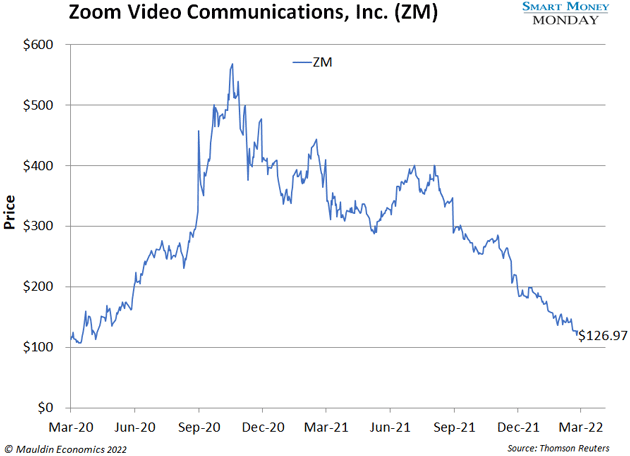

Let’s look at another tech stock falling back to Earth: Zoom (ZM).

Zoom was the video conferencing darling of the Covid era. As workers holed up in home offices, Zoom soared from $113 in March 2020 to an all-time high of $568 in October 2020.

Now workers are returning to office life in fits and starts. And the stock has sunk back down to $126—about where it was pre-Covid.

-

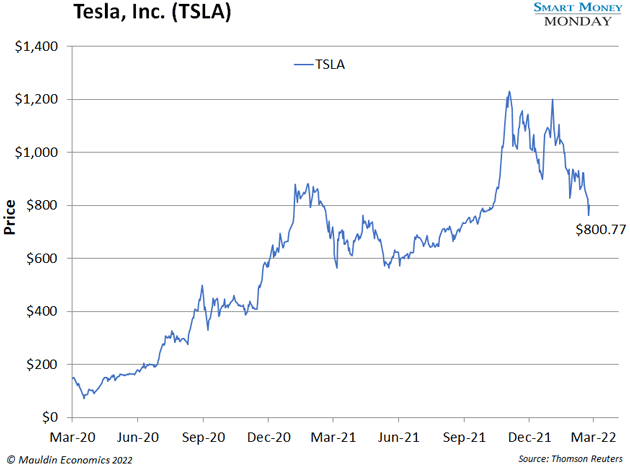

Electric car maker Tesla (TSLA) has also gone on a meteoric ride.

It shot from $149 in March 2020 to an all-time high of $1,230 in November 2021. That’s a 727% gain in just 20 months.

Though it’s still trading well above pre-Covid levels, Tesla has dropped 34% from its peak. And it’s pulled back 24% since New Year’s.

With all of these tech stocks heading south, investors are wondering…

-

“Is this my second chance? Maybe they’ll bounce back to their highs.”

For Peloton, Zoom, and Tesla I think the answer is no. Covid-era animal spirits sent the valuations for these (and many other) tech stocks soaring to nonsensical levels.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

We hadn’t seen anything that nutty since the dot-com era. The valuations didn’t make sense. And even after sinking 70%–80%+, they still don’t make sense.

Today, Peloton still makes no money. Yet it has a $10 billion market cap. Zoom is facing stiff competition from Microsoft and Google, yet still sports a hefty $30 billion market cap.

And Tesla, well, it’s still worth more than Ford (F), General Motors (GM), Stellantis (STLA), Toyota (TM), and Volkswagen (VWAGY) combined. You might love Tesla’s cars—a lot of people do. But from an investment standpoint, the valuation is tough to justify.

-

One quick and dirty filter I use to source stock ideas is the “new low” list.

It’s a list of stocks hitting new 52-week price lows, or even all-time lows. Sometimes these lows are unwarranted and short-lived. For investors willing to look past negative sentiment or a bit of temporary bad news, the list can steer you toward opportunities to buy cheap stocks. Then you kick back and watch as they return to their 52-week highs.

Many tech stocks are popping up on this list. Unfortunately, they will likely never return to their Covid-era highs. There’s certainly precedent for that. Tech veterans Cisco (CSCO) and Akamai (AKAM) soared to crazy-high valuations during the dot-com era. Both stocks collapsed when the dot-com bubble burst. And despite having 22 years to prove themselves, neither company has returned to its previous high.

Remember, just because a stock is cheaper than it was, doesn’t mean it’s a bargain. Despite the ongoing market correction, there’s still froth out there. You need to be a shrewd stock picker (or know one) to avoid it.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Tags

Suggested Reading...

|

|

Thompson Clark

Thompson Clark