There’s a Government Bond Paying 7%+

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- January 17, 2022

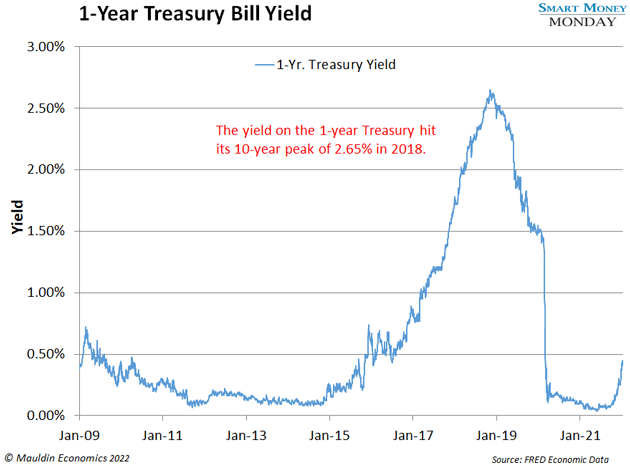

Remember the days when you could park your cash in Treasuries and earn a decent yield?

Well, that’s been more or less impossible for the past decade-plus. Just look at the chart below showing the yield on the 1-year Treasury bill since 2009, and you’ll see what I mean. Except for a modest bump in 2017–2019, it’s been hovering close to zero.

Investors buy Treasuries for safety. They’re backed by the US government. So, the risk of losing your money is virtually nonexistent. But it’s hard to get excited about risk-free returns when those returns are miniscule.

-

Fortunately, there’s a different type of government bond offering 7%+ returns right now…

It’s called the Series I Bond. And it’s the only fixed-income investment I’m buying right now.

A lot of investors have never even heard of the Series I. But the federal government began offering this unique savings vehicle in 1999. And just like other government bonds, it’s virtually risk-free.

-

So where in the world are these 7%+ returns coming from?

In a word: Inflation.

See, interest on the Series I is based on two factors. First, there’s a fixed-rate component. The Treasury sets this, and it’s somewhat arbitrary. Right now, it’s set at 0. The second component, though, is the Consumer Price Index for All Urban Consumers (CPI-U).

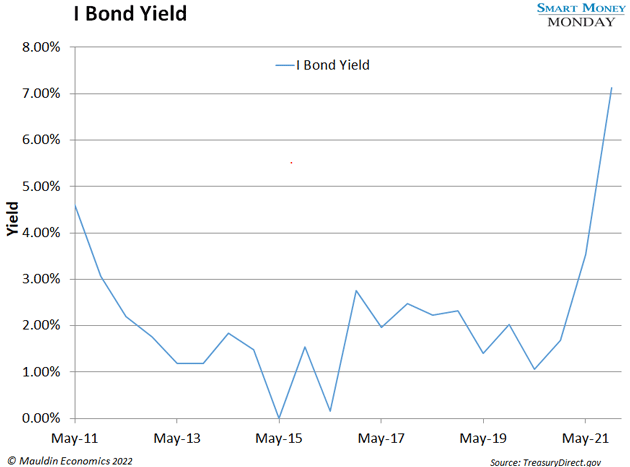

The CPI-U, as you likely know, is a government inflation index. Twice a year, in May and November, the Treasury releases the rate you can expect to earn on Series I Bonds, based partly on the latest CPI-U reading—which has shot up 7% in the past year.

So, basically, when inflation rises, the rate on the Series I Bond goes up, too. You can see this in the next chart, showing the Series I Bond yield since 2011.

-

Today, buying Series I Bonds locks in a 7.12% return until May.

Then the rate will reset, and there’s no way to anticipate exactly what it will reset to. However, given the current inflation trend, it’s likely to remain high, possibly around 5%–7%. That’s a very healthy risk-free return.

At this point, you might be wondering, “What happens if we get deflation?” Series I Bonds are protected from that. The returns never drop below 0%. So again, the risk here is next to nothing.

-

You can buy Series I Bonds directly from the US Treasury…

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

First, everyone is limited to $10,000 annually. So, a couple could buy $20,000 total for the year. There are ways to buy more through a business or LLC, but that’s a topic for another day.

Second, the bonds don’t pay cash interest like a typical interest-bearing account. Instead, the interest accrues until you sell the bond. And there’s a minimum holding period of one year.

-

The Series I also carries a major tax benefit…

You only have to pay taxes on the interest income when you sell your bonds. In the meantime, that money grows on a tax-deferred basis. And the interest income is flat out exempt from state and local taxes. (Check with your accountant if you have any questions about this.)

Unfortunately, you can’t immediately park loads of money in the Series I. But it’s a simple, virtually risk-free way to earn a healthy 7%+ yield on some of your cash right now. Yet it’s flying under the radar of most investors.

I’m buying the Series I for myself and my family. You should consider it, too.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark