Cracks in the Labor Market

-

Ed D'Agostino

Ed D'Agostino

- |

- May 7, 2024

- |

- Comments

So much happened in the spring of 2020 that it’s easy to forget we were on track for a recession just before COVID hit. QI Research founder Danielle DiMartino Booth mentioned this during her presentation with Lacy Hunt at our Strategic Investment Conference.

Danielle is seeing recession indicators today. Let’s look at one part of the economy of particular concern: labor.

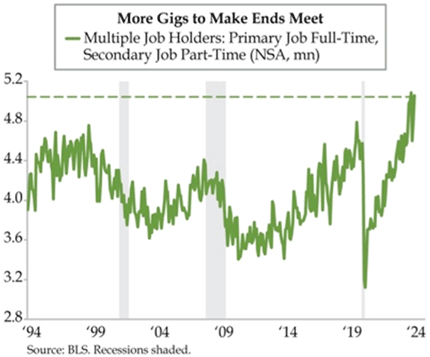

During her SIC presentation, Danielle noted that the percentage of people working second jobs on top of their primary full-time jobs is at a multidecade high. This underscores the disproportionate impact inflation has had on low and moderate wage earners. Yes, their wages have risen, but not enough to cover living expenses without driving for DoorDash on the side.

Source: QI Research

Then there is the growing number of layoffs. It started in the tech sector. Amazon has cut 27,000-plus workers since November 2022. Heavyweights like Google, Microsoft, Tesla, and Dell have all made significant cuts to their workforces this year.

To hear of software developers being laid off would have been unthinkable a few years ago. Today those high-paying jobs may not be as secure. Finding new jobs at the same rate of compensation is proving difficult. Thankfully, tech companies typically offer generous severance packages, making the job search a bit less painful. Google, for example, has promised a minimum of 16 weeks’ pay and 6 months of healthcare coverage.

|

You could argue that some of the giant tech companies had become bloated and simply needed to trim. At the end of 2023, Google alone had 182,502 employees. But layoffs are spreading to other industries. Manufacturing, retail, and even service sector employers have been laying off staff. Yesterday John Deere announced layoffs at its plant in Moline, Illinois, where it’s the largest employer in town. Fast food chain Wendy’s expects to close more than 100 restaurants this year, leaving hundreds of low-wage workers looking for work.

Last month Texas-based trucking company Arnold Transportation Services, which has been around for over 90 years, filed for bankruptcy and closed operations, eliminating hundreds of trucking jobs.

Macy’s and Nike have laid off workers recently. I could keep going… Estée Lauder, Wayfair, UPS, Southwest Airlines, and pharma giant Bristol-Myers Squibb have all announced substantial layoffs this year.

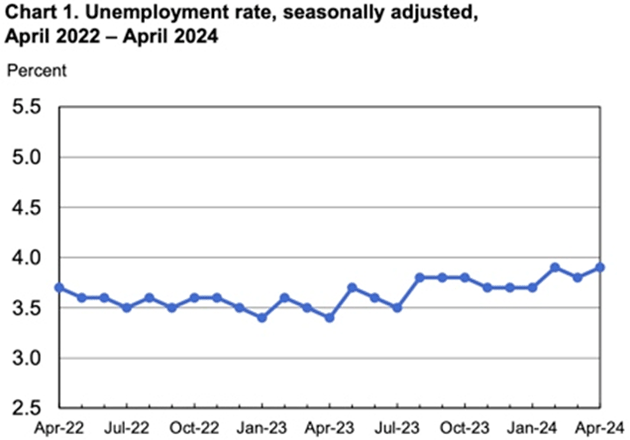

Unemployment inched up to 3.9% in April, but it is still well below the long-term average of 5.7%.

Source: Bureau of Labor Statistics

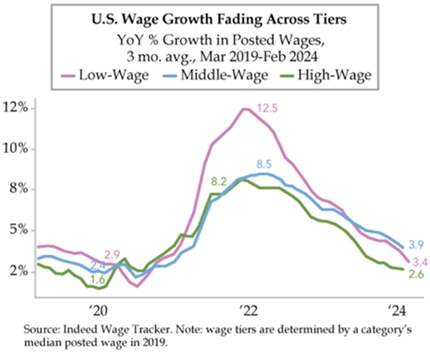

Wage growth is slowing across the board, as you will see in the chart below.

Source: QI Research

Does all this mean we are moving into a recession? I’ll discuss this with Danielle on Friday, as I resume my weekly interviews (I had to take a break during the SIC). Spoiler alert: Danielle believes we are already in a recession. She’ll explain why.

We’ll also discuss Jerome Powell’s recent pivot, the return of the Fed’s dual mandate, and the abuse of the public purse via PPP loans and other COVID-era policies.

|

Thanks for reading.

Ed D’Agostino

Publisher & COO

Ed D'Agostino

Ed D'Agostino