The Green Shoots of 2020

-

John Mauldin

John Mauldin

- |

- October 23, 2020

- |

- Comments

- |

- View PDF

On Your Doorstep

Working from Home

Healthy Robots

Are We There Yet? A Timeline for the Recovery

Where Then Should I Invest?

Needing a Neurologist in Tulsa

Those who lived through the last financial crisis might may recall the Green Shoots episode. It drew laughs on March 15, 2009, shortly after the Federal Reserve fired its heaviest artillery and, we now know, launched the longest bull market in history.

Appearing on 60 Minutes, Fed Chair Ben Bernanke said the recession’s end was in sight because the Fed’s asset purchases were generating “green shoots.” They turned out to be slow-growing shoots. The US unemployment rate kept getting worse for seven more months (peaking in October), and needed five more years to get where it was when that recession began.

Similarly, you can look around today’s economy and see green shoots here and there. As bad as things are—and make no mistake, they’re bad—we’ve regained some lost ground since the March/April depths. But the problem is in the “here and there” part. Some parts of the economy are literally booming even as others are in a deep, dark depression.

That’s kind of where we are. If you are in the right spot, you see whole forests of green shoots. You might think they are growing everywhere. And in due course maybe they will, but for now, a significant number of people just have dirt.

Last June in A Recession Like No Other I described this recession’s disproportionately hard hit on the service sector. Most lost jobs came from industries built on personal contact, like restaurants and hotels. The outlook for those sectors remains grim. Sadly, the industry is overrepresented in the lower income brackets. But at the same time, some industries aren’t just surviving; they are thriving.

I want us to notice this because it’s important. The economy is dynamic. It is constantly moving in all directions. We once talked about “cyclical” stocks that outperform when the economy is expanding, and “non-cyclical” stocks that take the lead in recessions. Now the virus has redefined what the “cycle” looks like, so we have a new set of non-cyclical players. My last few letters were generally negative. Today I want to discuss why the economy will recover, how that will happen and what it will look like. It won’t look like 2019, but the recovery will have its own flavor as we fast-forward future industries. I think that’s a good thing.

On Your Doorstep

As we all now know, respiratory viruses spread when people are in close proximity, sharing the same air. The best way to avoid infection is to avoid other people. Hence the urge, and in some places the requirement, to stay home as much as possible.

Yet even staying mostly home, people need supplies to sustain themselves. Furthermore, they continue wanting things that, while not strictly necessary, make life more comfortable. The problem is how to get those things without exposing yourself to crowds. The answer: have them delivered to you.

Sounds simple, but it’s economically profound. This year consumers suddenly and sharply increased their demand for home-delivered goods. For the most part, these aren’t new products. They are the same things people previously picked off store shelves. But now they want the goods brought to them. And, as it always does, the market is responding.

Amazon is the most obvious beneficiary. Its e-commerce platform and massive logistics network already dominated before the pandemic. Now they are in overdrive. So are the online arms of major bricks-and-mortar retailers. Even at the local level, stores are remodeling and reorganizing to provide curbside pickup.

All these changes come at a cost; smaller retailers often lack the scale or technology to provide what consumers now demand. That’s bad news for those business owners and their workers. But the same economic forces are creating new warehousing and shipping jobs to handle all this new demand. And it’s still not enough. From WSJ:

The primary reason for this year’s capacity shortage is that carriers already have been operating near maximum capacity for months as consumers stayed home, avoided stores and shopped online. The delivery surge has strained networks and led to longer processing and delivery times. Carriers can’t quickly boost capacity with new facilities as it often requires a multiyear planning process.

The carriers have imposed shipping limits on customers and added fees to offset the increased costs to staff up, secure protective equipment and other outlays during the pandemic. Pricing power has quickly shifted to the carriers, which are raising rates and being pickier about which shippers they want to do business with.

This is staggering to think about. In the middle of the deepest recession in generations, consumers are ordering so much stuff, shipping companies are raising prices and telling some retailers, “Sorry, we can’t do it.”

Yet, given where we are, it makes sense. Driving a truck around to drop off packages may seem like a simple job, and there are millions of workers available. But it’s also dangerous in a new way. Drivers have to come in contact with both packages and people. That limits the supply and raises its price. Plus, the companies don’t have an infinite number of vehicles, and they sometimes break.

The recession and recovery vary a lot. Some segments of the economy are in deep trouble. Others are booming at the same time. This confuses sentiment and adds to the uncertainty and apprehension so many feel.

Working from Home

If circumstances cause you to spend most of your time at home, you naturally want “home” to be safe and comfortable. That may be difficult to achieve if you live in a crowded city, where simply taking kids to the park is now an ordeal. But staying locked inside with them probably isn’t much better. Particularly if you also fear domestic violence.

Those simple realities are sparking a major migration. City dwellers (at least those who can afford it) are looking for suburban homes with yards, pools, garages and other conveniences. Some are moving further out, to rural areas. Corporations are enabling this with more flexible work-from-home arrangements, making it possible to live far from the office. In fact, many people are moving to new states because they can now work from anywhere.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Like the e-commerce boom, this demand surge is overwhelming supply. Real estate agents like to say “location is everything.” Now it’s “everything” in a new way no one expected. An easy commute is less important than being far enough out to be safe, but close enough to get your groceries delivered.

Existing homes in the right places with the right amenities are selling at high prices because their supply is so limited. Real estate tells us the supply of homes for sale is down to the lowest level since 1999. But never fear; entrepreneurs are responding as they always do. From CNBC:

US single-family homebuilding surged in September, cementing the housing market’s status as the star of the economic recovery, thanks to record-low interest rates and a migration to the suburbs and low-density areas as Americans seek more room for home offices and schooling.

The report from the Commerce Department on Tuesday reinforced expectations that the economy rebounded sharply in the third quarter after suffering its deepest contraction in at least 73 years in the second quarter. But the recovery from the Covid-19 recession has entered a period of uncertainty, with fiscal stimulus, which spurred the burst in activity last quarter, depleted.

Single-family homebuilding, the largest share of the housing market, jumped 8.5% to a rate of 1.108 million units last month. But starts for the volatile multi-family housing segment fell 16.3% to a pace of 307,000 units.

The drop in multi-family (apartments, condominiums) reflects both the move away from urban areas and this recession’s inequality. The lower-income and middle-income workers who tend to live in those places are taking the brunt of the pain. Many are behind on their rent already and in no position to move. Developers have little incentive to build more such properties.

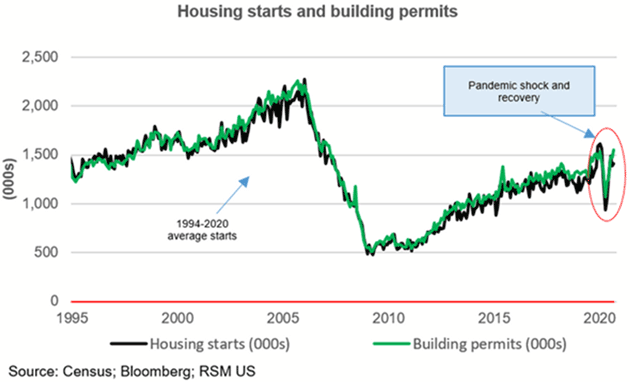

That’s creating an odd dynamic, visible in this chart.

Chart: RSM

In the last two recessions, building permits and housing starts peaked before the economy turned down. And in the Great Recession they kept falling for years. This time, though, the prior uptrend seems to have resumed after a brief interruption, even though we are now 8 months into a confirmed recession.

This wouldn’t be happening in a normal recession. Job losses would be affecting the people who buy single-family homes and builders would be pulling back. Note also, the commercial construction business is in deep trouble even as housing booms, and for some of the same reasons. People want houses that let them work from home, but that also reduces demand for office space. New mall and hotel construction is pretty scarce, too. But it’s a boom time for skilled workers in the building trades. They are worth their weight in gold right now, and being paid accordingly.

I talked with demography guru Neil Howe this morning, to get his take on things. One thing that is changing is families are moving back together. He believes this is good as it gets families more involved with each other. I would note that moving to the suburbs allows you to have more room to work from home and maybe have an extra family member. That is partly why we are seeing a remarkable boom in home remodeling, too.

Healthy Robots

The items Amazon is shipping, and the materials used to build all those houses, don’t appear out of thin air. Someone, somewhere makes them. Yet the pandemic is affecting factory production, too.

It started back in January when China’s massive shutdowns made much of the world’s manufacturing capacity grind to a halt. Then the same happened elsewhere. Even if not ordered closed, companies found the new health precautions and staff shortages both raised costs and reduced output.

The answer to that dilemma is technology. Automation was already growing simply because paying human workers often costs more than machines that can do the same work. The pandemic made human workers not just more expensive but bigger liabilities, too. This increased the incentive to automate.

Meanwhile, new tasks have emerged that are uniquely suited to automation. You can send in a robot to disinfect a room without fear it will get infected itself. But first you need to have the robot, so demand for them is off the charts. From the Financial Times:

The pandemic is driving a shift in companies’ use of technology, both official statistics and business surveys suggest, making the automation and digitalisation industry one of the few winners from this year’s economic turbulence.

The spread of the virus “has accelerated the use of robotics and other technologies to take on tasks that are more fraught during the pandemic”, said Elisabeth Reynolds, executive director of the Massachusetts Institute of Technology’s task force on the work of the future. “It is fair to assume that some firms have learnt how to maintain their productivity with fewer workers and they will not unlearn what they have learnt.”

Note that last sentence. If a manufacturer can produce the same number of products with similar speed and quality but fewer human workers, then of course it will do so. And having made that shift, it will never go back. That’s why automation is booming and is likely to continue to grow in the future. Not just robots, but artificial intelligence, virtual reality, and a host of related areas. And that is reflected in stock prices.

This may be bad news for employment longer term. Employers who install automation will reduce hiring and eventually reduce headcount as well. This will come just as we have millions of unemployed human workers. And that is not even counting the coming automation of trucks and transportation. It was always going to be a problem but might have developed gradually enough to let everyone adapt. Now the process has accelerated and businesses are more willing to put technology to work.

But for the moment, recession or not, the robotics and industrial automation industries are booming. Together with e-commerce and homebuilding, they are “green shoots” in an otherwise wilted economy.

Another green shoot that is not obvious but will make a very big difference: We are seeing an increase for the first time in a long time of new business startups. I keep trying to emphasize over the last few months that the very entrepreneurs whose 100,000+ businesses had to be closed (with thousands more coming) won’t just sit on the porch. They have an entrepreneurial gene in their DNA that almost forces them to launch new businesses. They can’t help it. And we are seeing it in the data.

Below I’ll talk about a new business I’m launching. We’ve been working on it for a very long time. It will start with about a dozen jobs. And hopefully grow. My experience tells me that it will grow slower than I would like, although I always dream about someday planning a business that would be like Uber or Airbnb or Amazon, you know, where growth just seems to be exponential.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Most small businesses start small and grow slow. But some succeed, and they will create jobs that power the recovery.

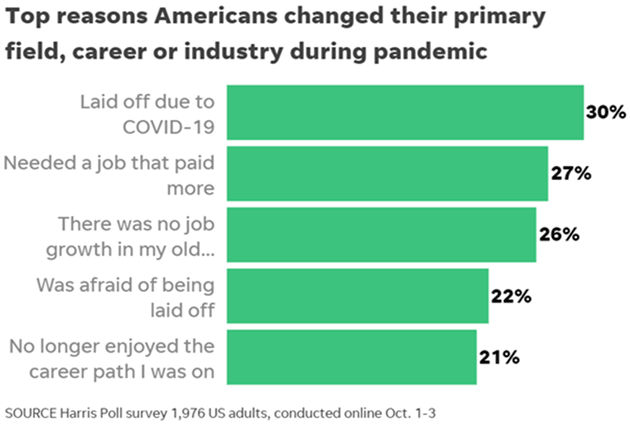

Another interesting development: People are switching jobs and careers at an unprecedented level. USA Today has a fascinating story on people switching careers. When you realize your job will probably not come back, you adapt. We are finally seeing more people being willing to move outside their local areas to where the jobs are.

Source: USA Today

Are We There Yet? A Timeline for the Recovery

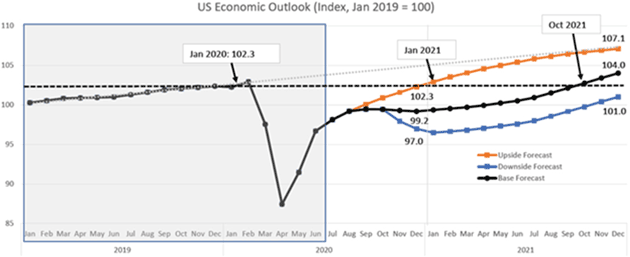

The Conference Board offers us three different recovery forecasts: upside, downside, and the base forecast. Note that in the base case forecast we would be back to January 2020 by October 2021. Color me skeptical. I do think, however, that what they call their “downside forecast” is more realistic. In that scenario we end 2021 almost back to January 2020.

Source: The Conference Board

Their methodology uses past performance to project future results, and I don’t think the past is relevant to this crisis. That being said, I think it would be completely unreasonable not to expect a recovery. This model gives us some idea of what we can expect. I think it will be a little slower as we really do have to completely rearrange much of our economy. That takes time.

In my conversation with Neil Howe, he said the trend is more people are doing things for each other and spending less money. If that continues, we will see less GDP growth. Simple illustration: If you find out that your friend can help you with your hair color and you can help her, you don’t visit the hair salon as much. Or neighbors helping each other with home repairs. Since no one is paid, it doesn’t add to GDP, even though the work was done.

This is critical to understand: Consumer behavior has changed more this year than any time since the Great Depression. That’s why we are not going back to 2019. So much has changed that we will be entering literally a new world.

The point is we will recover. The airline and hospitality industries will not look the same in 2022 as they did in 2019, but they will be there in a transformed state. Commercial real estate will be repriced as we continue to work more from home. It seems so ancient, but just three years ago we bought more food in restaurants than we made and ate in our homes. That certainly changed and will continue. Entrepreneurs will adjust.

Will we travel again? Will we eat out again? Will we go to mass sports events and concerts? Of course. It’ll just take a while (and a vaccine) to make people feel safe. And it will look different than it did in 2019. But that’s okay. The world has gone through numerous changes over the last few centuries and millennia and been better for the adaptations.

I sincerely hope that Congress can figure out how to pass a “recovery package” to help those individuals that still don’t have jobs and businesses that are barely hanging on. My base case becomes more pessimistic without that. That being said, my good friend Renè Aninao, who is truly wired into the relief package negotiations, believes it will happen this next week if not this weekend. Essentially, he tells me, the last disagreements being worked out are that Nancy Pelosi wants more money for New York and California and Trump wants bigger stimulus checks ($1,500 per person, $1,000 per child) than Pelosi would like to see. Much of the legislation has been written already. McConnell has most of the votes he needs to be comfortable (certainly not his majority) and as many as 50 House Republicans may vote in favor. If this bill passes, it would be fertilizer for the green shoots all over the economy. Let’s hope so.

Where Then Should I Invest?

Given all the volatility and uncertainty, successful investing is harder today than ever. I have been rethinking and actually reworking the ways that I can help you get from where we are today to the other side of The Great Reset. I am happy to announce I have found a simple way to access my best ideas and my network of relationships.

I have long worked with Steve Blumenthal of CMG Capital Management Group (CMG). In the last few years I closed my own investment advisory firm and moved to CMG, where I am chief economist and co-portfolio manager of the Mauldin portfolios platform. In addition, through my broker/dealer firm, Mauldin Securities, LLC, I’ve selected a broker/dealer, Amera Securities, LLC, (member FINRA/SIPC) to which I can refer you. The Amera representatives can show you various offerings like private fixed income and equity and other alternative investments. Steve Blumenthal and his CMG financial professionals are also registered with Amera Securities and will, if appropriate, introduce select ideas to you. So, while you are technically dealing with two firms, you are dealing with one professional who has access to both.

We have built what we call a “kitchen” where the ingredients are the numerous strategies and managers representing a wide variety of styles and opportunities, which we can blend into a portfolio to help you get a personalized portfolio tailored to your needs. That means we need to get to know you and your objectives. I am very comfortable with this team and their ability to help you. To find out more about what is in the Mauldin kitchen click here and find out how my network can help you achieve your goals. Do it now. (In this regard, I am president and a registered representative of Mauldin Securities, LLC, member FINRA and SIPC.)

Needing a Neurologist in Tulsa

The letter is already running on, but before I hit the send button, a personal request. My youngest son Trey has moved to Tulsa for a new job and to live closer to his sisters. He began to experience serious pain in his left arm and the local doctors were not really helping. I put Trey on the phone with Dr. Mike Roizen at the Cleveland Clinic, who upon hearing the symptoms said Trey should see a neurologist. The problem is his insurance company is in Texas and can’t or won’t cover it. Even paying cash, we can’t seem to find a neurologist available. So, we got him Oklahoma insurance but he can’t see even a primary care physician, and get a neurologist referral until December. He is in severe pain today. If you know a neurologist in Tulsa please write me at business@2000wave.com. Thanks.

Have a great week!

Your hoping your personal green shoot is growing well analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin