Strategic Investment Potpourri

-

John Mauldin

John Mauldin

- |

- June 18, 2021

- |

- Comments

- |

- View PDF

If it seems I have been talking about the Strategic Investment Conference for weeks… well, you’re right. It really was that much to unpack, and I’ve still only scratched the surface. I will wrap up next week.

First, however, I want to make sure you get a few other important points. I’ve been organizing the SIC letters by subject: China, inflation, deflation, technology, and politics/geopolitics. In general, that is how I organize all my letters, typically around one topic. But throughout the SIC, speakers made important points that don’t neatly fit into a broader theme. I’ll cover some (not all) in this letter. We’ll jump around a bit as the sections don’t necessarily connect to each other. They are in no particular order, but all important.

Let me also apologize to the SIC speakers whom I haven’t featured. It was all wonderful and I can’t possibly cover everything. If you like what I’ve been sharing, you need to join us next year, for what most believe was the single best economic conference ever. How we will improve the experience next year, I’m not sure. But for 19 years we’ve made each event better than the last.

Now, let’s jump in.

Build to Rent

On Day 1 we heard from two of the country’s top residential real estate experts: Barry Habib and Ivy Zelman. I invited them because housing is both personally important to most people and also an important (and neglected) investment opportunity.

I shared some of Barry Habib’s wisdom back in April (see Tiny Housing Bubbles), and he expanded on those ideas at SIC. I want to draw your attention to Ivy’s presentation because she talked about something new: the “build-for-rent” segment. Large investors are building single-family homes not to sell, but to rent. This concept has been growing for several years and has now really caught on as the potential investment returns become so clear. It’s now a fundamental part of the commercial real estate pantheon. Quoting from Ivy:

We rarely think of build-for-rent. It's really part of single-family development, but we jokingly call it the prettiest girl at the dance right now because there is a wall of capital that has shifted to this asset class. And there's a tremendous amount of incremental “right-now money” being poured into this asset class.

And it is countercyclical, but there's no question that there's an uncertain amount of supply that's coming. And will this rental product actually hold up with respect to rental prices rising at the rate they're rising?

So, just to give you some perspective, build-for-rent actually in 2020 was twice what it was in 2018. But even with that number being double from that time period, it still only represents today a 4-1/2% market share nationally. Now, keep in mind though, at a national level, that doesn't really give you the perspective of what's happening in the Texas market or the Carolinas and Florida, and in Arizona and Nevada where I believe that single-family rental just today with what's in the pipeline probably accounts for 10-plus percent of that market. And what we do know is that when I talk to builders, and I'll say, "So, how many of your sales this quarter went to build-for-rent operators?" And they'll say, "I don't know. We probably this year in total could do 200 units, but our plans for next year are to do 2,000."

There's a massive ramp coming. And everybody's trying to find a dance partner on the dance floor whether they’re hedge funds, pension funds, private equity firms, or sovereign wealth funds. There's just more capital than I've ever seen other than the multi-family back before the great financial crisis.

Alarm bells may ring when you hear about capital flooding into a segment. In this case, though, it’s for an asset necessary to a growing number of young Millennials. For whatever reason, they aren’t home buyers but have to live somewhere. They need more than an apartment as they start families.

Further, they want the apartment-like convenience of walking away at the end of the lease for another job somewhere else or to actually buy a home. They want the pleasure of living in the single-family home without actually having to purchase one.

In many ways, the financial aspects look similar to the multifamily market (apartments) but simply adjusted to the new generation’s tastes and priorities.

Room to Breathe

Constance Hunter, chief economist at global accounting giant KPMG, gave us a fantastic update on her team’s economic outlook. She talks to as many as 40 global CEOs a week, truly at the center of the information spiderweb. Unlike the section on housing above, which was focused on the US, Constance is looking at the world.

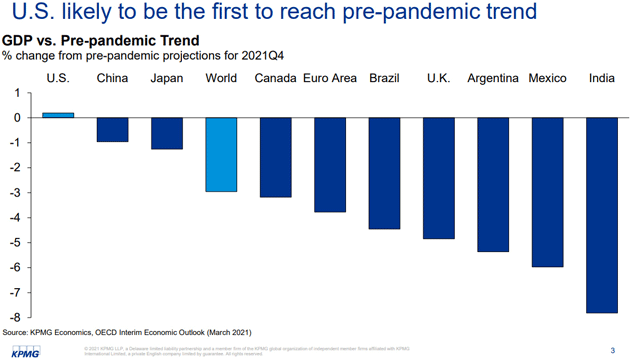

With that perspective, Constance reminded us the COVID recovery won’t proceed at the same pace everywhere. It depends on the prior trends, virus conditions, vaccinations, and other factors. But in any case, the US will probably be first to regain its pre-pandemic trend.

Source: Constance Hunter

Note the UK, which is relatively ahead of most others in vaccinations, isn’t in the same position economically. Even Brazil is slightly ahead. That speaks to the continuing Brexit turmoil and trade uncertainty the country faces.

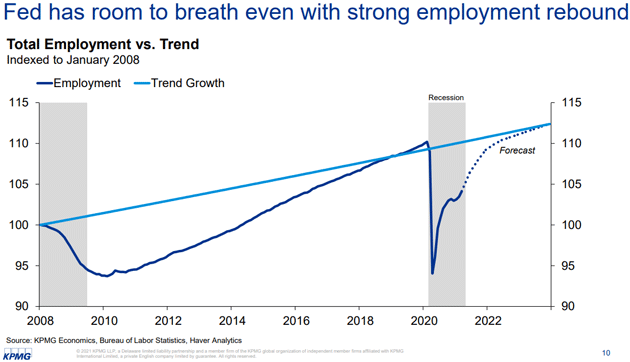

As for the US, Constance noted the Fed is heavily focused on employment, not just inflation. Even if jobs keep growing strongly from here (which isn’t guaranteed), we are still a couple of years away just from recapturing the pre-pandemic jobs trend. Will the Fed tighten when the economy is still millions of jobs underwater? Unlikely, if we are to believe their rhetoric.

Source: Constance Hunter

A Rare Asset

Cryptocurrencies were a big topic at SIC, and not just with the younger crowd. I was interested to hear Felix Zulauf, who is about as conservative a Swiss investor (not to mention personally) as you can possibly be, make positive comments on Bitcoin. Rather than put words in his mouth, I’ll just quote him. Felix was interviewed by Grant Williams. They went from talking about gold straight into Bitcoin, which is itself important.

Grant Williams: I want to come back to the point you made about liquidity there in a second, but let's stick with gold and cryptocurrencies for the time being, particularly Bitcoin. No matter what you say, whichever side of the debate you stand on, there's some kind of legitimacy problem with Bitcoin simply because there are so many doubters. Has the recent action, do you think, with people clearly kind of using gold [and going] into Bitcoin as an inflation hedge, as a risk or an asset, whatever you feel it might be, does that legitimize it in any way or is it really pure price speculation at this point? Because Bitcoin has been so aggressive and [in its volatility].

Felix Zulauf: It is a rare asset because it is limited, and you know that it won't go beyond that limit. That is not true for all the cryptocurrencies, because each one is limited, but there are more and more of them, so therefore, there is no limitation. But for the one that dominates the marketplace like Bitcoin, there is a legitimate reason to own it. I do not believe that Bitcoin will disappear very quickly.

The problem with Bitcoin is that several countries have now declared it as illegal. It's not allowed in China. I think it's not allowed in Turkey. It's not allowed in India, if I'm not mistaken. So, those countries are countries that feel potential capital outflow. And therefore, this is actually a harbinger of capital controls where they are not in place yet. Countries that fear that their capital flows away outside of the country are fearful, and therefore, they forbid buying and transacting in cryptocurrencies like Bitcoin. That's not the case in the western world yet.

I do believe that Bitcoin will stay, will probably go higher over the years because the fear of currency development that is logical, will mean that the central banks will become much more aggressive in the next cycle when the next problem shows up, et cetera. And therefore, I think it's legitimate. It's more volatile. It's probably not a replacement for a currency, but it's an asset where you can store some value and some savings. It's not a currency because it's too complicated and it's too much energy consuming for its transactions… But I think your cryptos will stay.

Narrative Water

I put John Hussman and Ben Hunt as a panel of two because they’re both fascinating yet misunderstood. Neither mind saying controversial things, and eagerly engage their doubters. Personally, I found their session to be one of the most enjoyable and enlightening of the conference. Putting two great thinkers together draws out important insights.

John Hussman, for instance, has taken a lot of heat for being labeled a permabear. Which lately turned out not to be the case. He held to classic standards of valuations which have simply not been useful the past few years. In his defense, he is not the only person to hold such views

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Yet faced with undeniable error, John adapted. I liked the way at SIC he segued from his own history to Ben Hunt’s idea of “narrative” as a market driver.

John Hussman: Finally in late 2017, after a number of incremental adaptations that were not sufficient, I finally threw my hands up and said, "There's not a limit. We can't rely on [historical] limits to speculation. There is something in people's heads that is different here that is not based on fundamentals. That is not based, not even constrained by historically reliable limits." That doesn't mean that valuations will persist forever to go up. What it does mean is that we have to constrain any bearishness we might have to periods where market internals are also negative. In other words, where people's mentality has shifted toward risk aversion, and we can talk about why that's important, Ben and I, but it has a lot to do with narrative.

With that, Ben, I think probably what I'll do is pull you in this way—you've talked about this David Foster Wallace story of these two young fish swimming, and then there's an older fish that comes by and says, "How's the water, boys?" and swims away. After a while, the two younger fish look at each other, one of them says, "What the hell is water?" You talk about that water being a narrative. It's swimming without even knowing that we're swimming in it. Talk about that. Then what I want to do is wind that back to what happened with quantitative easing and zero interest rates, because I think it's enormously related and it's something that investors should really think about.

Ben Hunt: I think that's right, John. The water in which we swim is the water of narrative. Look, we all know this. By narrative I mean it's the articles that we read, it's conferences like this, the speakers that we hear at a conference like this, it's what we hear on CNBC, it's what a politician says to us, is what Uncle Warren tells us at the Omaha conference. It's all of that.

We know, I think in our hearts, that we are impacted by this. We're human beings, we're a human animal, and we've evolved over millions of years to respond to these messages. That's what it means to be a social animal, a truly social animal like human beings are.

We know it's part of us, but I think the problem or the difficulty has always been, I'll say, recognizing how pervasive and how impactful it is on us. Because I’ve got to tell you, John, I had a very similar, John, call it an epiphany, but it's a very similar process for me as well, I think a little bit earlier than yours. For me it really happened in the summer of 2012 with Draghi's “Whatever it takes,” with these words around an OMB program. It was just words and it was so impactful to me that that's all it took, the words. The words were enough.

John Hussman: Yeah. In Buddhism, it's interesting, there's a distinction between reality, what you would call truth with a capital T, and what are sometimes called objects of mind. Objects of mind are mental formations that we use to construct our own reality of the world.

This is, I think, really important. If you read, for example, Soros, he talks about reflexivity. I did my doctorate in, basically, asymmetric information and equilibrium and that sort of thing, inference from other people's information through prices and so forth. If you think about markets, markets are basically places where people have beliefs, they turn them into behaviors, they produce market behavior, and then that market behavior comes back around and informs their beliefs.

Read John’s last sentence again, and then again. Mental beliefs become individual behaviors, which become market activity, which then affects beliefs. Knowing where you are in that cycle is critical to investing success. It’s also incredibly difficult.

That self-fulfilling process creates the water that we swim in, what Ben calls the narrative, the massive amount of information that inundates us daily. In the early part of my career, we had The Wall Street Journal and a few other publications. Certainly no financial TV. Now we “swim” in an ocean of information (to which Mauldin Economics and I contribute our own few gallons). If we’re not careful, we absorb information from sources that simply reinforces our beliefs rather than challenging them.

We especially see this in political information, but I think we tend to consume economic and investment information in the same way, without realizing it. Behavioral economists call this “confirmation bias.”

I try to seek out competing ideas by reading many sources, purposely seeking those who disagree. A few SIC attendees said they were frustrated all of the speakers at the conference didn’t agree. I smiled, because that meant I did my job. The SIC is designed to make us think, not tell us what to think.

Labor Scarcity

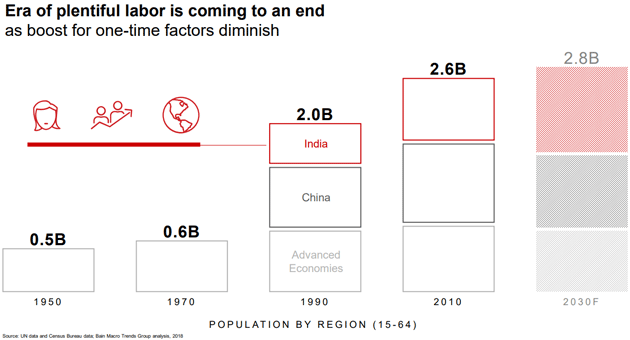

Karen Harris heads Bain’s Macro Trends Group, which produces some fascinating research. Her SIC presentation on the Post-COVID World unearthed a bunch of important issues. One of her comparisons I found especially enlightening: In recent decades we enjoyed not just abundant capital but abundant labor. Yet as her chart shows, growth in the number of workers probably won’t continue because it came from non-repeatable factors.

Source: Karen Harris

In the 1970s we had a large Baby Boom generation entering the workforce. The number of working women grew rapidly. And then we had India and China integrating their enormous populations into the global labor supply. None of those are going to happen again, or anything like them. The working-age population is now flat or even declining in some large economies, including China and other parts of Asia.

That will be a problem for business. Karen thinks the solution will be more automation as labor becomes scarcer and more expensive. It will increase productivity, but with significant side effects we will have to address.

Help Wanted

Mauldin Economics is looking for a few great people to join our team. We have several positions open.

Editorial Director: Work with a team of managing editors, writers, and analysts to ensure the highest quality content across our publications. Duties include developing exciting new products, constant improvement of existing products, collaborating with our marketing team to expand circulation, set and maintain high editorial standards, act as a mentor to new editors, and help our writers and analysts express their ideas. This position is part of the management team. Experience in the financial research/publishing industry is required. Must be self-motivated, collaborative, and driven to help investors succeed.

Managing Editor: Work with one or more of our writers on line edits and content creation; strengthen arguments, streamline prose, cut unnecessary words, proofread, fact check, and scrutinize every detail of our content prior to publishing; collaborate with the Publisher, Editorial Director, and marketing team on product development and marketing. Must be able to communicate in a clear, concise manner. A degree in English, PR, Communications, or similar discipline is ideal but not required. An understanding of financial markets is desired.

Research Analyst: This entry-level position involves supporting our editors and analysts. Duties include gathering of basic financial information, producing charts, research, tracking and updating our portfolios, and writing short essays and articles. If writing is new to you, we can help, so long as you have interest and are willing to iterate with our talented editors.

All positions are remote, but you’ll be speaking with our team every workday and you’ll have a chance to meet in person several times a year. If you are interested in a position, please write a letter telling us about yourself and why you’d like to join our team. Send your letter along with a resume to Talent@MauldinEconomics.com, with the position title in your subject line. We hope to hear from you!

New York, DC, and Maine

I leave for New York on Sunday for meetings Monday through Wednesday. When I originally scheduled the trip, I did not check my calendar and did not realize that Sunday is Father’s Day. I just assumed I could schedule a dinner meeting for Sunday night. It turns out everybody I talked to had obligations. So, if you find yourself in New York on Sunday evening and would like to talk to your humble analyst, I will be in the lobby bar at the Marriott Renaissance on 37th near Seventh Street (which is on the sixth floor) at 6:30 pm.

I will also be on the Larry Kudlow show (Fox Business) between 4 and 5 pm.

Finally, a thought on dumb and dumber lumber. Longtime readers know that I am not a big believer in tariffs used for protectionism. Therefore I was not pleased with Trump’s imposition of tariffs on Canadian lumber. It might help a few businesses here and there, but it runs up the cost of housing and construction for the rest of us. Now, I read that Biden may actually increase the lumber tariffs when there is clearly a shortage. Color me perplexed. Isn’t the cost of lumber high enough already? You can’t tell me American producers don’t have enough margin room today.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

And with that thought, I’ll hit the send button. Have a great week and I’m looking forward to not being as socially distanced next week. Follow me on Twitter.

Your ready to get on a plane analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin