SIC Mix

-

John Mauldin

John Mauldin

- |

- May 26, 2023

- |

- Comments

- |

- View PDF

Business media is famous for propagating buzzwords and phrases, especially if they produce more clicks. The latest is Artificial Intelligence. It’s everywhere and is now a fixture in earnings calls, too. Every CEO is getting asked how AI will fit into or affect their company. It’s not quite as bad as every CEO trying to figure out how to make their company a “dot com” in 1998–1999, but almost.

AI is indeed important, just like the web was back then. This week, we had a reminder that the “Artificial” part may need more attention. AI-generated images of a large explosion at the Pentagon spread online and caused a brief stock market dip.

In fact, there was no explosion. But the images looked completely real. Did someone manipulate the market for profit? I don’t know, but new technologies always have unintended side effects. They succeed when the benefits outweigh the costs.

I talked about this with AI pioneer Stephen Wolfram at SIC, some of which I shared last week. Today, I’ll continue mining the SIC transcripts for more conference highlights. There was just so much meat this year, far more than I can share in these letters. Next week, we’ll wrap it up with what was, for me at least, a “light bulb” moment about the global economy’s future as we cover the final panel and sessions. (Note: emphasis is mine in all the quotes below.)

Granddaddy Bear

Swiss money manager Felix Zulauf is a crowd favorite at SIC. His 2022 presentation was right on target, so I asked him back to tell us what he expects for the rest of 2023 and beyond. Unfortunately, he thinks a slowdown is coming that will hit markets hard.

Here’s a (too short) excerpt from the 14-page transcript of Felix’s interview with Ed D’Agostino.

“We only know by hindsight when the recession started, but there is an indicator you can watch that gives you some indication when the start of the recession is here, without knowing for sure. And that is when the inverted yield curve begins to flatten.

“And actually, in the last few days or two weeks or so, we saw some flattening of that yield curve, and this could be an indication that we are very close to the beginning of a recession. I do believe that such a recession will be short, not long. It could be deep because I think the Fed and other central banks are overtightening. They drive forward by looking into the rearview mirror because inflation is a lagging indicator, and monetary policy is a leading indicator.

“So, I think they overtighten, and it could be a sharp or deeper recession, but much shorter because once it’s here and once it’s recognized, the Fed and other central banks will come in and turn around and go from tightening to easing relatively quickly.

“I think that in the third quarter, we will see that the Fed will give up its QT policy, the quantitative tightening, and if the market declines the way I expect, and it could lead to lower lows, I still have a target that I told my subscribers in late ‘21, about 30% down, which is the low 3,000 in the S&P and maybe 9,000 in the Nasdaq or something like that. That means lower lows below the October lows, sometime in the second half towards later this year. If all that happens, then we start another mini-cycle that will be the last one in that long-term cycle that started in 2009, and I would expect to terminate sometime in ‘25.

“After that, you will have a recession because my view is that if the scenario plays out as I explained, then the money that is going to be injected into the system will not be used up by the real economy immediately. It will flow to all those assets that are scarce.

“I think there is structural scarcity in the commodity segment where we have an underinvestment for many years and where the two political situations of disturbing supply chains and disrupted supply chains will play a role. And then I think we will see a sharp rise in commodity prices. While crude oil could see $50 first over the next few months, I think we will probably see $150 to $200 in ’25, ’26, and that will bring us much higher inflation rates.

“So, we’ll have a second cycle of rising inflation into ’26, maybe even ’27, and that will bring on higher interest rates, higher bond yields, and a tightening again by central banks from ’24, ’25 onwards. And that should lead to a recession.

“And I think the next recession will be a very deep one because the situation as I see it is that the long cycle, the economic cycle, will then terminate, that we have by far the most extreme indebtedness in the world, and leverage works both ways, up and down, and therefore I think it’ll be an ugly bear market thereafter in equities. An ugly bear market or a granddaddy bear, I would call 50% or more. It could be considerably more, but let’s say 50% or more.”

A 50% decline would certainly count as extreme but may be necessary to flush out the extreme market overvaluations.

Cash Buyers

Real estate and housing are huge economic sectors with important macro effects. Moreover, many SIC attendees are active real estate investors. That’s why I invited two top housing experts, John Burns and Barry Habib, to give us an update from both perspectives. They know these markets cold and always give us some surprising facts.

Their session has a 19-page transcript, so I can only give you a couple of highlights. John Burns had an interesting stat on the growing corporatization of the home rental market.

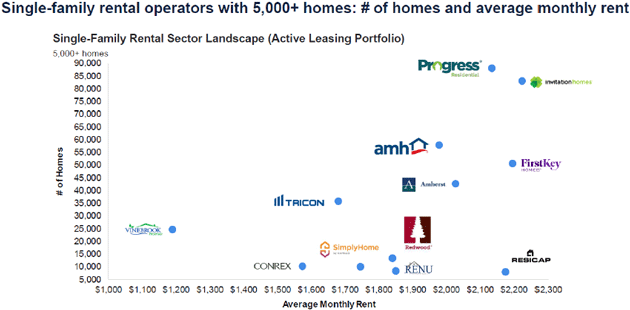

“A huge percentage of our clients are the big players in the rental housing business, which is becoming an institutional business. 16 million live in a large apartment complex. Another 12.8 live in a small apartment complex (think of row homes), then 12 million people rent a detached home, and another 3 million rent a condo that’s individually owned by somebody. Now, none of these were owned by large companies 10 years ago. Yeah, 10 years ago. It was really 2012 when this all got started. Today, 3% of all the homes are owned by 12 groups that own 5,000 or more homes, the big ones. I’m going to show you who those are and what they’re doing. And there are opportunities to invest with them in the private markets and in the public markets right now. And then another million in mobile homes.

“So here are the 12 groups that own 5,000 or more homes. I’ve got the number of homes they own on the Y access, the rent on the X axis… Those are the big players, but there are only 12 of them.

Source: John Burns

“And if you look at the X axis here, 11 of the 12 really play in the higher rent aspect of the market. So here’s the rental distribution of those people that pay single-family rents. 28% pay less than $750 a month. Clearly, that’s not a great location and a quality home, but a lot of the regulation that’s targeted—and particularly from Congress coming after these groups—acts as if the big guys are renting to the people that are really struggling, and they’re really targeting the more affluent renters because that’s where they’re making more money with the affluent renters.”

That’s some really useful info if you are a rental home investor/owner. The big corporate landlords are stiff competition, but they’re also uninterested in the lower end. That may be a gap you can fill.

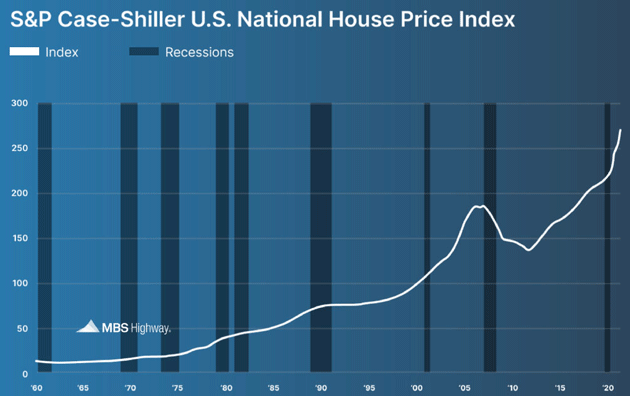

Later, Barry Habib made a simple but often overlooked observation about housing prices: Recessions historically haven’t had much effect. Here’s Barry:

“Recession has got to be bad for housing, right? Well, we’re going to lose about 1.5 million jobs, potentially. I feel sorry for those people. Of course, we wish them to recover quickly, and that means they’ll probably be out of the home-buying market. But if you see rates drop 1%, which I believe we will, on mortgage rates, 5 million people become eligible, and that’s what happens all the time. You get more eligibility than those who become less eligible, and that’s why home values always go up except for one time in the last 70 years through the last nine recessions up, both during and after.

Source: Barry Habib

“What we’re seeing here is home values pretty reliably go up during recessions. One time it didn’t. This was the housing bubble, but this was different. Just like any other price discovery, it’s based on supply and demand. Supply is determined by builders completing homes.”

We should note this is a national index, and local trends vary. Nevertheless, history shows recession isn’t necessarily bad for home values, except in bubbles. Texas and other states had a bubble during the Savings and Loan Crisis in the ’90s, even though the rest of the country was fine.

Barry went on to review the supply and demand factors, concluding that, in terms of home values, the next recession probably won’t be like 2008. Later, he talked about what sometimes seems like a startlingly high number of cash buyers—people purchasing homes without a mortgage. That requires substantial liquid capital and a willingness to spend it on a large, illiquid asset like a house.

“Yeah, there’s a mix there. 28% of purchasers are cash buyers, which is certainly above what we have seen historically. In fact, two years ago, it was closer to 16%. There are a few reasons for that. When your mortgage rates that you can obtain are like 3%, it may pay to take a mortgage for the cheap cash, but now 6% is a pretty good equivalent rate of return, so might as well pay cash because I’m getting the equivalent of 6% there. Yes, demographics. People are older. Yes, appreciation in homes means if I’ve sold my home and I’m downsizing, I may want to pay cash for the whole thing. And then, there are a lot of people that made money. The market’s been up, so equity market’s been up, giving people a boost there.”

John Burns added:

“Remember, there’s 30% less home buying. So out of that 28%, you took a lot of people that needed mortgages, and they’re gone. What you’ve got is all-cash buyers have the power, and a lot of them are moving from the Northeast to the affordable states. And if they’re selling their home, they’re paying half of what they sold their prior home for. So it’s a pretty easy decision.”

I remember a similar pattern in Texas in the 1990s. California residents could sell their homes and buy a better one in Dallas or Austin with the profit. Many did, too, and many are doing so now.

Change Agent

Two weeks ago, in “Plan for Paralysis,” I talked about my discussion with Howard Marks on the 2024 presidential election. It came up again later with George Friedman. George has been foreseeing a crisis for some time as a number of geopolitical and economic cycles coincide in the late 2020s. (See his book, The Storm Before the Calm.)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Looking at historic patterns, George thinks the next president (whoever it is) will fail to solve important problems as he gets no cooperation from feuding factions, then be replaced by some yet-unknown figure who will do the unthinkable in a crisis that forces cooperation. You might compare it to Carter being followed by Reagan, but George thinks this cycle will be even more dramatic. Here’s a bit from the 18-page transcript.

Ed D’Agostino: “Let’s get back to your socioeconomic cycle. You said Reagan inherited an economy starved for capital, and he changed that. He lowered taxes, created incentives for investment, and created a booming economy, but he also sowed the seeds for wealth disparity. And today, you say the US has too much capital.

“So, it seems like we’re right in the middle of these changes starting. We are entering a credit crunch, or at least, I believe we’re entering a credit crunch, a Fed-induced credit crunch. Is this all part of how your cycle plays out?

George Friedman: “There was a period of time when there was more capital than there was opportunity, not too many years ago.

“You always have an imbalance that can develop, and it has to be adjusted. The market adjusted that excess capital, and we wound up investing all over the world...

“We now are moving into a period that always happens here—of capital shortage, of rising costs, and declining demand. In each of the economic cycles, that happened. That signals that the system, the way it is built, has failed—as they all do—and now has to be reconsidered, restructured.

“And interestingly enough, in the history of the United States, that was never done by the market. That was done by government, and you can see the presidents that did it. The market utilizes it, makes it work, exploits it. But the change itself comes from something that a government, usually by the president, said had to happen.

“We talked about the Reagan change. That Reagan change created a system of growing excess capital. But everything fails in the end. But for every period, it was Roosevelt flooding the market with demand. Where everybody wanted to be careful about that, he flooded the market with demand.

“Rutherford B. Hayes, who was president after the Civil War, was printing money for free. It was dollars. He came in with two things. He says, ‘No, we’re not going to keep printing money,’ and ‘No, we are going to link it to gold, to a reasonable extent, but not enough to commit suicide.’

“Andrew Jackson looked at the fact that Eastern banks were wrecking any chance of settling the West by fluctuating interest rates so that you bought something—a piece of land from somebody—you borrowed money to pay for it, and it kept moving around. The Eastern banks did pretty well. We could not have settled the West. He put in process a system that kind of broke the Eastern banks, the crisis after Andrew Jackson. Everybody in the East was horrified at what he did. We don’t remember that if he hadn’t done that, I’m not sure who would’ve owned California.

“So, in each of these cases, you are faced with what appears to be an insoluble problem, a problem that can’t be solved. Along comes a president who states the problem, understands that it has to be solved—there is no such thing as not solving it—and comes up with a stupid solution.

“Each of these things that were done were mindbogglingly stupid. It was so obvious they couldn’t work. That’s what Reagan was. Reagan was loathed for being simple-minded and not understanding the complexities. But he understood that we had to make investments in companies and said we had to give them that.

“So, it’s a peculiar thing about the presidents that come along. And each of them had an intuitive sense of what was wrong, an intuitive sense of what the stupid solution was. And he didn’t care what people thought of him. That was the interesting thing about each of these presidents. Yeah, they like being elected and everything like that. They just did it.

“Now, at this moment in history, I don’t see that guy coming out of the woodwork, but I never saw Reagan coming out of the woodwork either.

“So, what happens is that it hurts more and more. The pain that we’re going through intensifies until it looks like the republic can’t stand it. And that’s when the solution comes. So, we’re looking close at it. Biden could surprise us, so could Trump. But I doubt it. So, the president after Biden will be a simple, stupid man who knows this can’t go on.”

George later clarified he sees this “change agent” rising to power in 2028, not 2024. Whoever wins in 2024 will be a transition figure. Also, note that George uses hyperbole when he says that president will be a stupid man. His opponents will certainly call him that!

Ed pulled so much more out of George. They talked about China’s intent for Taiwan, which George views differently than most. He also sees real danger ahead no matter who “wins” the Ukraine conflict.

As you know, we still have SIC video passes available for a limited time. But we also know many of you are primarily readers (like me!). You like sitting down to absorb knowledge in writing. So, we’re also offering a separate package with the transcripts and slides of every SIC session for only $249. Multiple hundreds of pages plus many hundreds of charts, each of which is worth a thousand words.

And here’s the crux: Somewhere in all those presentations, you’ll find a portfolio-changing and maybe life-changing “A-ha!” moment, easily paying for the small investment.

If you haven’t participated in SIC otherwise, this is the way to do it. Click here to order your full transcript set.

Nashville, Cancun, NYC, Memphis, and Palm Beach(?)

Next week, I will be in Nashville to attend Ben Hunt’s Epsilon Theory conference, where I will be with many old friends, including Neil Howe, and finally meet in person some writers that I have read for a good while. Then, still planning a trip to NYC. I’m beginning to arrange my schedule to go to Freedom Fest in Memphis in July because so many of my friends will be there, and a few business meetings.

My son Trey has been staying with us for the past week for his 29th birthday, although Shane has left for Dallas to deal with a tragic situation with her niece, whose fiancé tragically died. It’s been good to spend time with Trey. I like the man he is maturing into, although I admit to some despair during his teens. He has moved to Palm Beach and is getting ready to go to school and work there. I have so many friends in that area, it looks like I will probably make two or three trips for both business and visiting friends and now my family.

Number one son, Henry, is getting married in early July in Cancun and has asked me to be his best man. How cool is that? Henry will soon be 43, but it seems like only yesterday that I was flying to the Virgin Islands to finalize his adoption. I have often said that every white man in America should have the experience of having a black son (I have two). It truly will open your eyes. Someday, I need to unpack that in a letter.

It is time to hit the send button. Let me wish you a great week, and I hope you get to see as many friends and family as I do! And don’t forget to follow me on Twitter!

Your thinking of family and friends and missing Shane analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin