Inflationary Angst

-

John Mauldin

John Mauldin

- |

- December 6, 2019

- |

- Comments

- |

- View PDF

According to the dictionary, the word angst refers to “a feeling of deep anxiety or dread, typically an unfocused one about the human condition or the state of the world in general.” It comes from a German word for “fear.”

Two weeks ago I referred back to my 2017 Angst in America series. “Deep anxiety or dread” is exactly what I described then, and it hasn’t improved for most people. For some, yes, life is good and getting better, at least financially. Not so for every American… or even most of us.

Yes, life could be even harder. “Poverty” living standards in the US are better than much of the world knows. But that doesn’t reduce the angst because we compare our conditions to what we see around us, or in the media we consume.

Today I want to bring some focus to this unfocused anxiety. We will see that much of it (though certainly not all) traces back to specific policies of a specific institution that has a specific mission it is failing to achieve.

Furthermore, that angst is going to rise up and bite us in our political derrière at some point in the future. And that gives me a great deal of personal angst, because I don’t think the results will be pleasant for anyone.

Before we begin, I want to call your attention to an opportunity to get six free months of a newsletter I read every day: Jared Dillian’s The Daily Dirtnap. Jared’s market analysis is almost supernaturally sharp. I’m genuinely not sure how he manages to keep it consistently top quality every single day he publishes, but he does.

And right now, he’ll give you six free months of The Daily Dirtnap if you sign up before December 9 – 18 months for the price of 12. It’s a truly wonderful offer. Click here to join me and thousands of other “dirts.”

Stable Prices, Sometimes

Contrary to popular opinion, the Federal Reserve System is not independent. Nor does it have to follow the president’s orders, as much as Donald Trump wishes it would. The Fed operates under a legal mandate from Congress. Its monetary policy role is “to promote maximum employment, stable prices and moderate long-term interest rates.”

So how is it doing?

Long-term rates are certainly moderate. Employment is historically high, though wages and job quality aren’t always great.

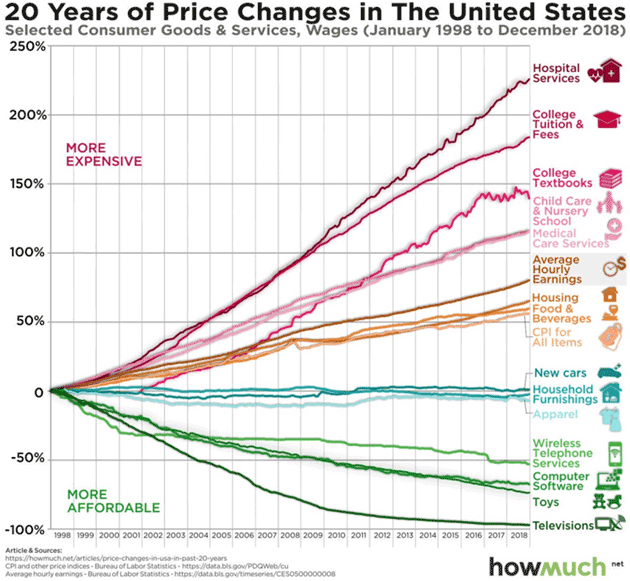

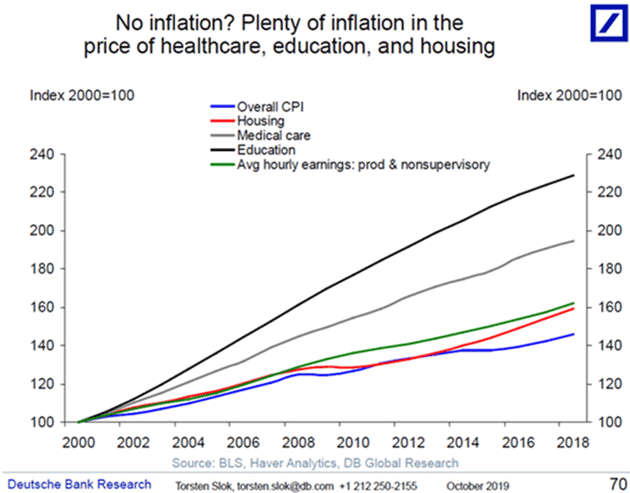

As for that “stable prices” part… it depends on what you are buying. As you see below, for many goods the price is nowhere near “stable.” Unfortunately, if you are in the bottom 60–70% of the income brackets, these are some of the things you buy the most.

Source: Sebastian Sienkiewicz

The Fed believes that 2% annual inflation equals “stable prices.” Yet that small amount adds up over time—to almost 50% in 20 years. Which is about where CPI lands in this 20-year chart, so the Fed is succeeding by that yardstick.

Think about that for a second. The Fed defines “stable prices” as a 2% average. And then another government agency tries to measure those prices, often using “Hedonic Quality Adjustment” to account for changes due to innovation or completely new products. So because the car you are buying has new features, they conclude it’s not more expensive. Does that match your experience? Thought so…

CPI doesn’t reflect real-life spending for most people. Prices have risen dramatically more than average for some of life’s basic necessities. So if you wonder why people are anxious, this might be a clue.

The Fed either doesn’t see this, or doesn’t think it is a problem. Officials have been wringing their hands for years at their inability to make inflation reach that 2% level. The Financial Times reported last week that they may soon change their rules.

The Federal Reserve is considering introducing a rule that would let inflation run above its 2 percent target, a potentially significant shift in its interest rate policy.

The Fed’s year-long review of its monetary policy tools is due to conclude next year and, according to interviews with current and former policymakers, the central bank is considering a promise that when it misses its inflation target, it will then temporarily raise that target, to make up for lost inflation.

The idea would be to avoid entrenching low US price growth which has consistently undershot its goal.

The key here is that 2% average inflation isn’t the same as 2% all the time. Having run below 2% for years, Fed leaders now want to go above it, potentially far above it and for long periods. In other words, give themselves permission not to worry about the inflation a low-rate policy might otherwise cause.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As my friend Samuel Rines noted yesterday:

Bottom Line: Inflation is not going to be an issue for the Fed—too high or too low—for a while. Whether looking at CPI or the Fed favorite PCE, it is difficult to see an impending surge in underlying inflation. This should help keep longer-term yields in check with a pick-up in activity in 2020. Tariffs are already showing up in the data, but do not matter (much) for the indexes.

While Fed officials may think they have tamed inflation, their ZIRP and QE actually drove real-world prices considerably higher than CPI or PCE show. It showed up mainly in asset valuations, like stocks and real estate. These, in turn, drove up other prices like housing. Aggregate inflation isn’t higher because technology and globalization reduced manufactured goods costs and the shale revolution kept energy costs low.

Try to look at this like an average worker. Your rent keeps rising, your kids can’t go to college without racking up debt, your health insurance is astronomical, and your wages, while up a bit, aren’t keeping up with your living costs.

Meanwhile, the people who are supposed to be looking out for you keep talking about how the economy is improving thanks to their brilliant policies. Of course you’re angst-ridden. How could you not be?

Deaths of Despair

In Part 2 of Angst in America, I talked about the “deaths of despair” among middle-aged white men. This alarming and uniquely American trend is getting worse.

Last month an American Medical Association study found US average life expectancy, which had been steadily increasing for decades, has now dropped for three consecutive years. It actually goes back a little further; all-cause mortality rates began rising in 2010. For some groups it went back to the 1990s.

AMA zeroes in on the driver:

A major contributor has been an increase in mortality from specific causes (e.g., drug overdoses, suicides, organ system diseases) among young and middle-aged adults of all racial groups, with an onset as early as the 1990s and with the largest relative increases occurring in the Ohio Valley and New England.

The opioid crisis apparently has a lot to do with this, as do the globalization-driven factory closures in the Midwest and New England. Economic changes are literally killing us.

But again, think about this from ground level. Under-employed factory workers don’t read a lot of economic analysis. They just know they can’t pay the bills, they’re in physical pain from a life of hard labor, and no one in power seems to care. Many go on disability, which is not even close to minimum wage, and massively discouraging for somebody who wants to work. For some it leads to depression and, tragically, overdoses or suicide. And it’s common enough to bend the curve in national life expectancy stats that had been rising for decades.

Worse, it’s not like we are powerless to treat these conditions. Medical science knows what to do, and does it pretty well for those with the means to pay. For Americans, that means people who (a) are over 65 and on Medicare, or (b) are poor enough to get Medicaid, or (c) get health insurance through their employers.

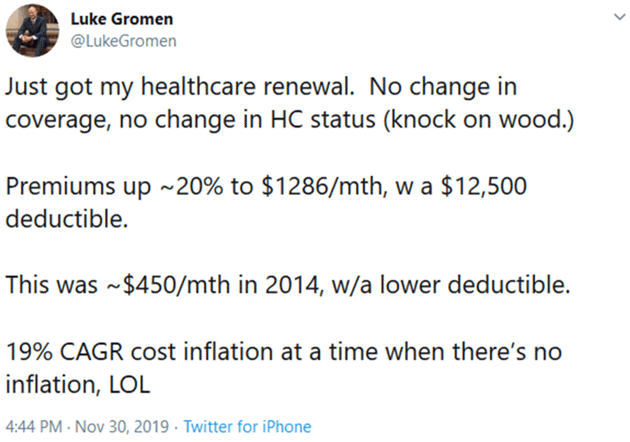

Everyone else, like self-employed people or “gig” workers? Not so much. Here’s a tweet from my friend Luke Gromen.

Source: Luke Gromen

Those prices are pretty typical if you’re trying to buy insurance on the Obamacare exchanges and you’re middle-aged and not subsidy-eligible.

For illustration, let’s apply Luke’s prices to a hypothetical self-employed person making $100,000 a year. The $1,286/month premiums add up to $15,432 annually. But you get no benefits (except a basic wellness exam) until you’ve spent another $12,500. That totals $27,932, or 27.9% of your gross income that will go to healthcare if anyone in your family gets even a minor illness. A lot of angst.

Let’s take that a little further. This self-employed person is paying $12,000+ in Social Security plus another $3,000 in Medicare, plus federal income tax, in addition to state and local taxes. Which means that if someone in that hypothetical family gets sick, the family has to figure out how to make all of their payments on maybe as little as $45,000 net, after taxes and healthcare.

And in that scenario, then what? Spending that much of your income on healthcare means something else must go. Or, it will turn into medical debt and possible bankruptcy, even if you have insurance.

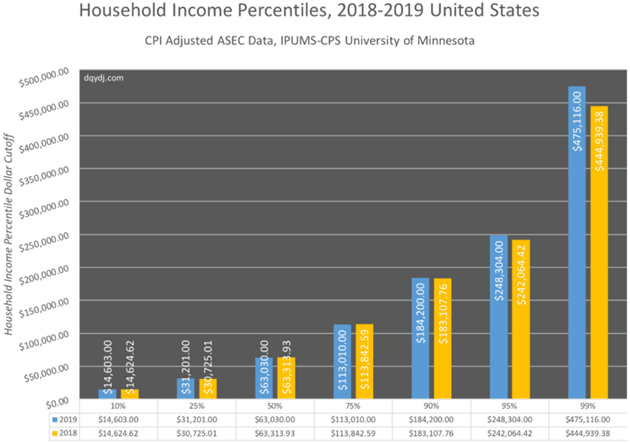

The irony is that much of the country thinks you are rolling in cash, and might be inclined to vote for someone who would raise your taxes.

Source: DQYDJ

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The angst isn’t just severe, it is creeping up the income ladder. Double that example worker’s income to $200,000 and they’re still spending 7.7% of it on insurance premiums and potentially another 6.3% to meet the deductible.

Imagine the outcry if we imposed extra income taxes at those rates. That’s effectively what is happening. Remember the “yellow vest” protests in France? They were about a new gasoline tax. Small potatoes really. But at the risk of a really bad pun, it just threw gasoline onto a stretched- too-thin public fire. At some point we may see the same kind of unrest here, and healthcare costs could easily trigger it.

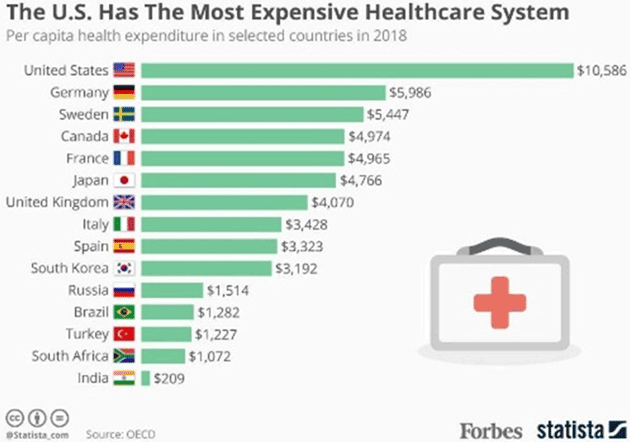

Yes, yes, I know, the US has the best healthcare in the world. That’s debatable, given these latest mortality numbers, but we certainly have the most expensive healthcare.

Source: Forbes

(By the way, this cost difference is roughly the same if you look at it in percent-of-GDP terms. OECD has the data here.)

How do we spend so much and still have people dying from despair? That’s another topic. My point today is that the way we distribute that spending is having seriously negative economic effects. We can and should debate reform ideas, but this can’t go on indefinitely.

|

Radical Solutions

Healthcare is just one source of angst. Here’s another look at inflation which, according to the Fed, is not high enough.

Source: Lisa Abramowicz

The education part deserves some comment. The narrative goes that today’s young people need more education because work is so much more complicated now. So, we push them to attend college. Higher demand and slow-growing supply raise the cost of college, so they (and/or their families) go into debt to pay for it.

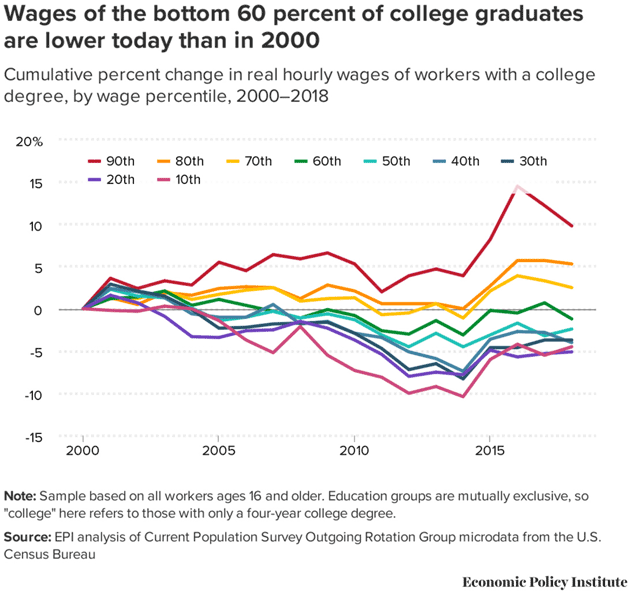

Does it pay off? Sometimes, but far from always. The chart below breaks down the change in college graduate wages since 2000 by percentile. In most cases, after that 2% average inflation the Fed thinks is too low, real wages actually dropped over this period. And note this only looks at those who actually earn degrees. Millions drop out before getting that far (but not before racking up debt).

Source: Economic Policy Institute

So not only is college more expensive, the economic benefit you get from it may well be negative. This is inflation on steroids.

Let’s think about that for a moment. You graduated in 2000 at age 22, got married, had kids, and right about now you’re facing college costs. What’s happened to the price of college? Up over 130% in 20 years. A tad more than 2% inflation.

Look, this isn’t complicated for most people. They need housing somewhere in proximity to their jobs. They want their kids to be safe and have opportunities. And they need to take care of their health. None of those are optional and their costs have risen far more than overall inflation.

To be clear, I’m not predicting higher CPI/PCE inflation, even if the Fed gets more dovish. Its present course will more likely produce more of the same: an asset bubble, lower prices for certain goods, and stable/rising prices for others. It won’t solve the problems regular people face.

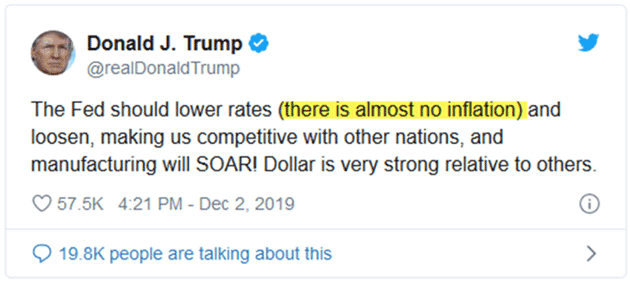

And in fairness, the Fed is not alone in thinking inflation is no problem.

Source: Donald J. Trump

Trump is correct if he means the broad inflation measures like CPI though, as we have seen, even 2% is not “almost no inflation” over long periods. He’s seriously wrong about the things middle-class Americans—including the millions who voted for him—must buy just to keep their heads above water. Those goods are expensive and getting more so.

What we really need are policies that make middle class life affordable again. Lower interest rates won’t likely do that. Not when, as my friend Peter Boockvar reported last week, the average price of a new car is $34,000 and median household income is $64,000, and it’s that high only because millions need those cars to commute to underpaid jobs far, far away from the distant suburbs where they can afford to live.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In my normal peripatetic research mode, I found a fascinating Time article by Emily Guendelsberger, who wrote a book called On the Clock: What Low-Wage Work Did to Me and How It Drives America Insane. She describes her experiences working in warehouses, call centers, and fast food. I have family members who have worked at the places she names and their stories match. Conditions are more than a little stressful.

I wasn’t prepared for how exhausting working at Amazon would be. It took my body two weeks to adjust to the agony of walking 15 miles a day and doing hundreds of squats. But as the physical stress got more manageable, the mental stress of being held to the productivity standards of a robot became an even bigger problem.

Technology has enabled employers to enforce a work pace with no room for inefficiency, squeezing every ounce of downtime out of workers’ days. The scan gun I used to do my job was also my own personal digital manager. Every single thing I did was monitored and timed. After I completed a task, the scan gun not only immediately gave me a new one but also started counting down the seconds I had left to do it.

It also alerted a manager if I had too many minutes of “Time Off Task.” At my warehouse, you were expected to be off task for only 18 minutes per shift—mine was 6:30 a.m. to 6 p.m.—which included using the bathroom, getting a drink of water or just walking slower than the algorithm dictated, though we did have a 30-minute unpaid lunch. It created a constant buzz of low-grade panic, and the isolation and monotony of the work left me feeling as if I were losing my mind. Imagine experiencing that month after month.

Vice is starting a series on what it’s like to work at low-paying jobs. The first installment from a young lady describing her experience working at McDonald’s for $9.30 an hour is deeply troubling. You can’t read it and not be emotionally moved.

It’s All Relative…

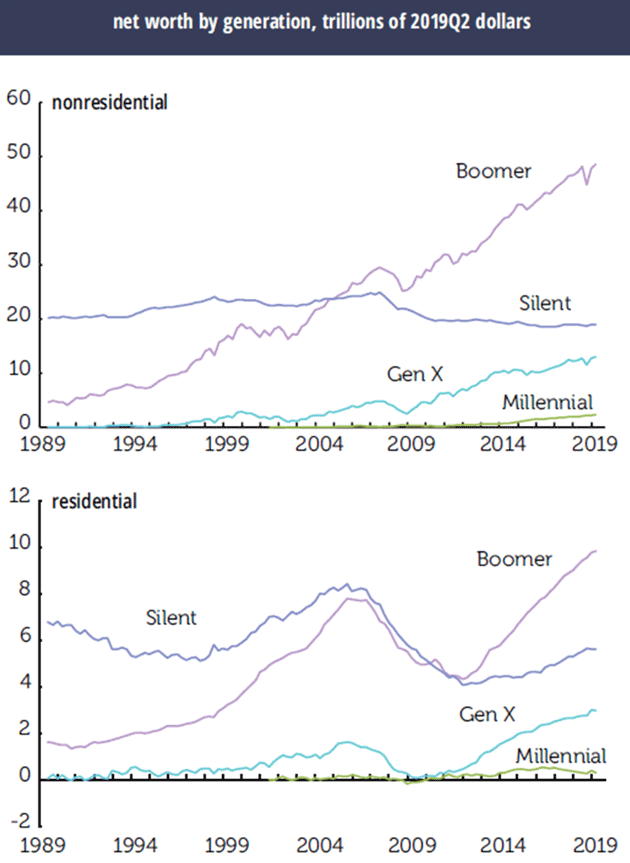

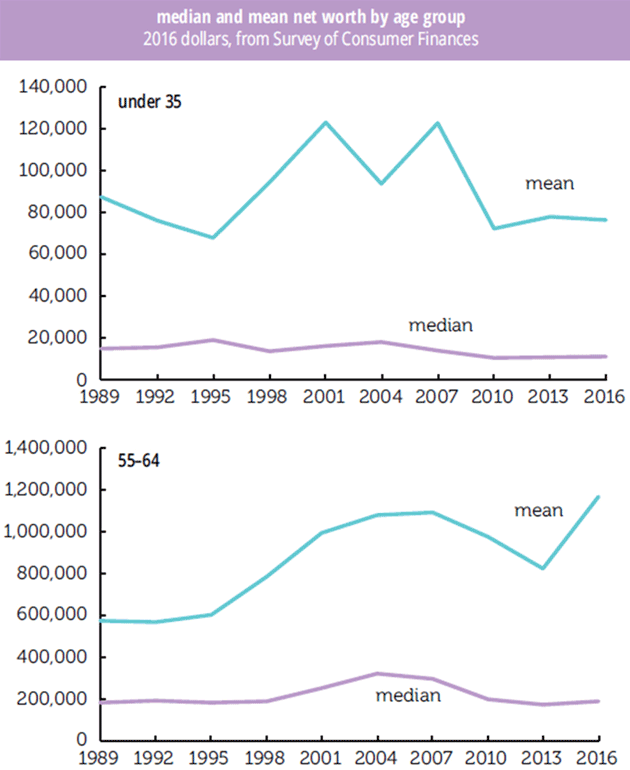

I mentioned above that even though the poverty level in the US is well above international average incomes, people compare their situation to what they see. My friend Philippa Dunne at The Liscio Report showed two charts demonstrating older generations (read Boomers) are doing much better than Gen-Xers and especially Millennials.

Source: The Liscio Report

Source: The Liscio Report

I understand the economic theories that GDP growth will eventually spread widely enough to ease the angst. But I am not sure we can wait that long. People are hurting now and they are increasingly willing to embrace radical solutions. “Just wait for better times” is not cutting it as technology eats into higher-paying jobs and aggravates the stress of lower-income jobs.

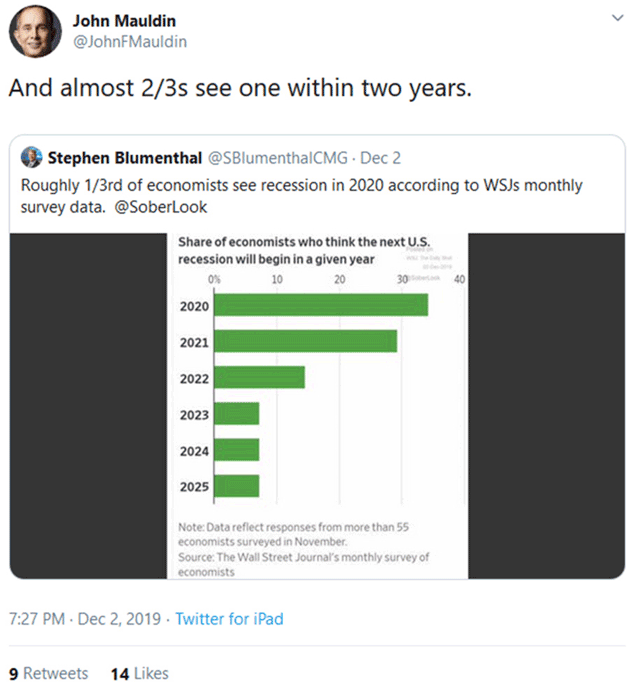

That’s doubly true if the economy weakens. Some of the data improved a bit in recent weeks. The November jobs report showed much stronger growth than we’ve seen in a while. That’s good to see and suggests we might postpone recession past 2020. But merely avoiding recession isn’t enough. Another year of sub-2% growth (which is my base case) will be another year of suffering for the millions whom this weak recovery hasn’t helped.

And it’s not clear that we can avoid a recession. One-third of economists surveyed by The Wall Street Journal think we will see a recession next year and almost 2/3s see a recession by 2021.

Source: John Mauldin

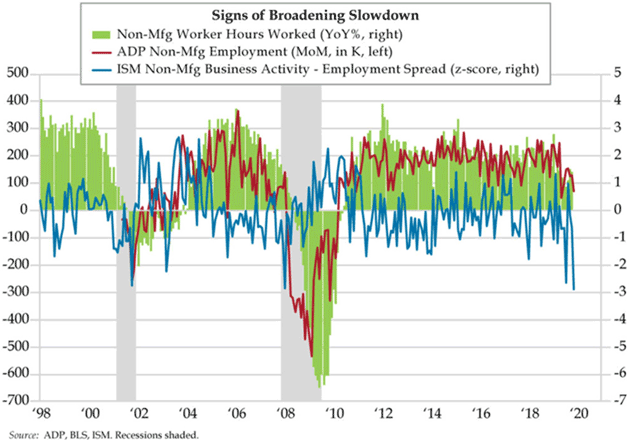

Danielle DiMartino Booth, whose Daily Feather is a must-read for me, showed this yesterday:

Source: Quill Intelligence

Danielle explains the above chart:

Non-manufacturing hours worked have slowed appreciably with growth falling below 2% in the seven months ended October; the ADP report confirmed the weakness in hours worked and exhibited broad-based job declines and slowing across the full spectrum of sectors.

Trade deal headlines and Fed liquidity continue to dictate market trading; the widening breadth of economic weakness suggests fundamentals will eventually prevail though it will take a weak nonfarm payrolls print to truly get the market’s attention.

Angst-Ridden Voters

No one should be surprised the lower 80% of the income pyramid is anxious and depressed. You would be, too, in their situation. And there’s a good chance you will be in their situation in a few years, because angst-ridden people can still vote. Economic theories aren’t relevant to them. They look at their own situations and want change.

History suggests that President Trump should win reelection unless recession strikes by next November. But even if we avoid a recession in 2020, what happens if there is one in 2021 or 2022? Democrats could gain power by 2024, if not sooner.

The already-growing annual budget deficit will soar to over $2 trillion. How do we finance that without creating more angst? I can easily imagine a populist Democrat winning the White House, followed by higher taxes and an echo recession. Then even higher deficits and the national debt spinning out of control. The Fed will give us massive quantitative easing and zero rates, but they may be in fact pushing on a string…

We don’t have much time to get our house in order, either in the US or globally. Everything I’ve said today applies, to various degrees, throughout the developed world. Thinking that 2% inflation or zero interest rates coupled with massive deficits will somehow help is beyond wishful thinking.

We can and should take steps to protect our individual families and lives, but that’s not enough. At the national level, I’m beginning to fear only an enormously stressful Great Reset will deliver the deep but necessary sacrifices. The partisan divide inhibits compromise, so nothing happens and the problems grow.

Think about the late 1930s… Hopefully with just economic turmoil, not kinetic war. It will be hard but without the kind of motivation, I really question whether we will do what it takes.

Sigh.

Normally I end these letters talking about my travels and some personal story, but this one has me in a far too reflective mood. So I will just hit the send button and wish you a good week.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Your personally angst-ridden analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin