Great Reset Update: $50 Trillion Debt Coming

-

John Mauldin

John Mauldin

- |

- September 25, 2020

- |

- Comments

- |

- View PDF

Absurd Assumptions

Breaching $50 Trillion

But Wait, There’s More!

MMT Coming

The Consequences of $50 Trillion of US Debt

Amid all 2020’s new problems, it’s easy to overlook the old ones. Yet they are still there and, like a silently spreading virus, silently getting worse.

One such problem is debt, and specifically government debt. All debt shares one common characteristic. A bill comes due at some point and, if the borrower doesn’t pay, the lender either loses their money or finds someone else to pay. Governments often do this.

I’ve warned for several years now that our growing global debt load is unpayable and we will eventually “reorganize” it in what I call The Great Reset. I believe this event is still coming, likely later in this decade. Recent developments suggest it will be even bigger than I expected. You could even say I’ve been too optimistic.

Today we will see how the federal debt problem has grown considerably worse than my admittedly somewhat gloomy 2020 forecast said to expect. It will get even worse. But I end the letter telling you why I’m still optimistic and you should be, too.

Absurd Assumptions

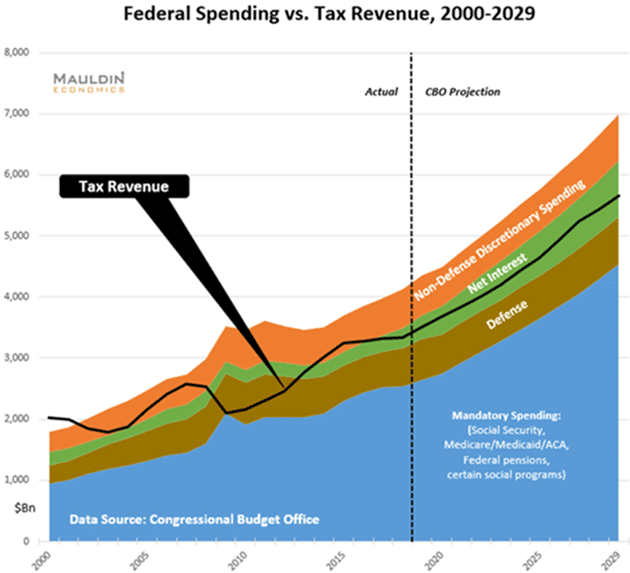

Way back in June 2019, I wrote a series of letters responding to Ray Dalio on government debt and related issues. In one of them I showed a series of spending and revenue charts my associate Patrick Watson prepared from Congressional Budget Office projections. Here is the primary one, exactly as published in June 2019.

Again, the underlying spending and revenue numbers came straight from CBO. They make numerous unrealistic assumptions yet still show a bleak picture. I noted at the time:

Under these projections, total federal debt will rise to $25 trillion sometime in 2021. If there is a new president, he or she will not have enough time to change that. Total debt by the end of the decade will rise to the mid-$30-trillion range. Note that these projections do not include off-budget spending (more on that later) which is significant.

The CBO also assumes the bond market can and will absorb almost $35 trillion worth of US government debt. When combined with state and local debt it will easily exceed $35 trillion. (State and local debt is already over $3 trillion. It will certainly rise in the next 10 years.)

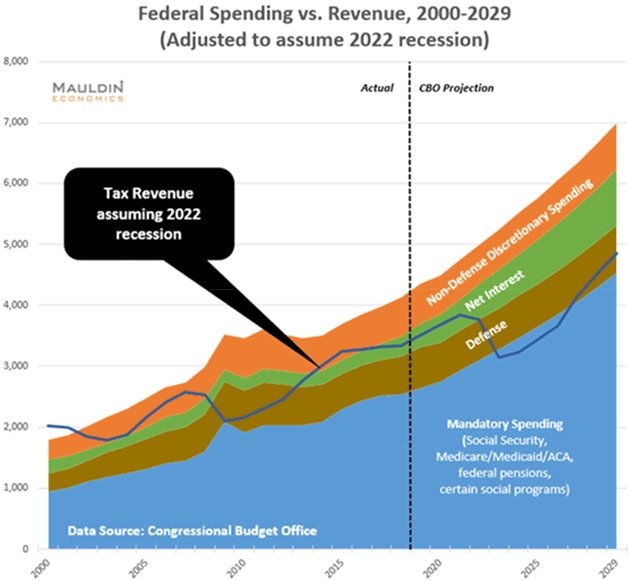

I also asked what would happen if we had a recession in 2022. I assumed revenue and spending numbers would look similar to the Great Recession in the following chart, demonstrating that the deficit would rise to over $2 trillion annually and pretty much stay that way for the rest of the decade. It turns out we had a much deeper recession this year in 2020. I was such an optimist… Anyway, this was my forecast in January 2020:

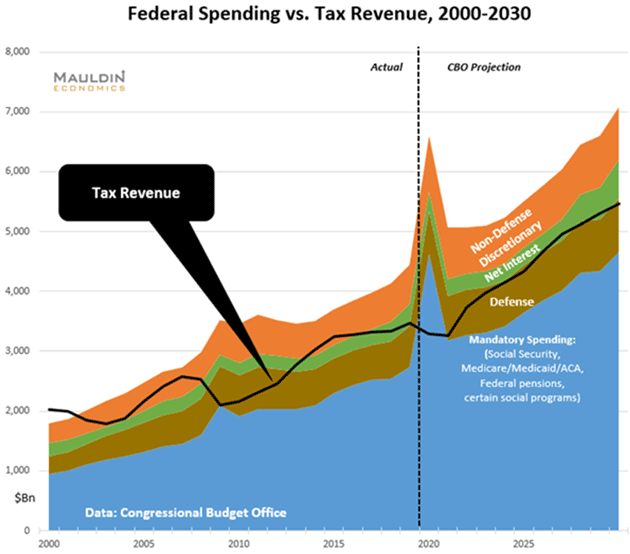

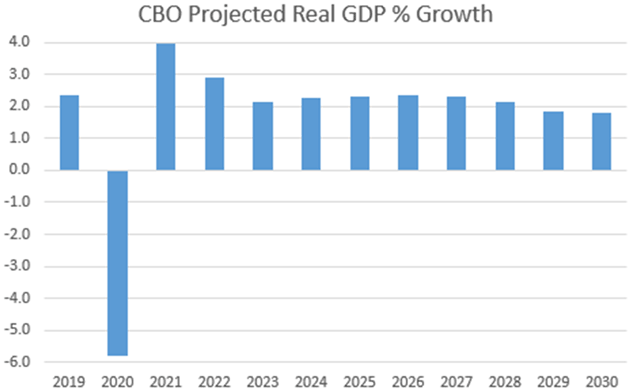

Now let’s fast-forward. The CBO just published its latest review. We updated the chart with CBO’s new numbers. It looks a little different now.

The most obvious change is a big spike in the blue “Mandatory Spending” area. That’s the unemployment and other benefits triggered by the recession. Less obvious is a small dip in tax revenue, after which the line continues upward as before. Even with the optimistic V-shaped recovery assumption, revenues barely cover mandatory spending (basically entitlements and social programs), defense, and only a little of the actual interest costs.

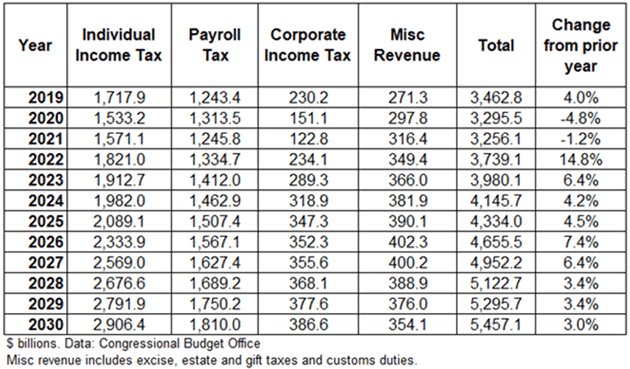

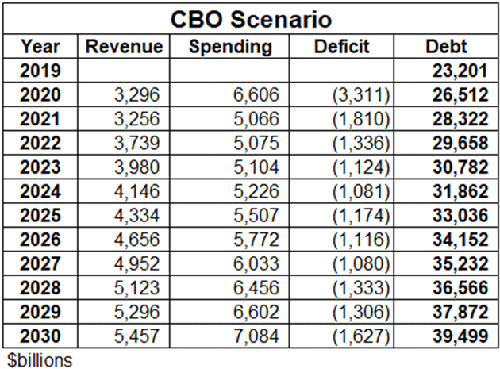

Let’s dig into that a little more. Here is a table summarizing federal revenue. The 2019 line is actual, the rest are CBO projections.

We see that in this severe recession year, CBO expects federal revenue will drop 4.8%, then fall another 1.2% in FY 2021, followed by a 14.8% surge in 2022. Definitely a rocket-fueled V-shape recovery. Realistic? I don’t think so. In 2008 federal revenue fell 1.7% and then plunged 16.6% in 2009. It didn’t fully recover until 2013, three years after the recession ended. And that recession was mild compared to this one.

Even more absurdly, CBO projects payroll taxes will actually rise this year despite record-high unemployment. Now, it’s true that the unemployed population tends to be lower-income workers (so far) with smaller tax liabilities. And payrolls were normal until almost halfway through the fiscal year. But for revenue to actually rise seems unlikely. It stretches credulity to think total US worker income will be slightly larger in 2021 than in 2019. But that’s what CBO forecasts.

This matters because these revenue assumptions go into the deficit estimates, which tell us how much federal debt will grow. (Spending assumptions are also absurd but set them aside for now.) Note, also, the substantial and uninterrupted revenue growth they project from 2022 through 2030. The last remotely comparable period was the 1990s.

It projects this revenue growth because it projects uninterrupted GDP growth, and especially high GDP growth in the next few years. These assumptions will be important at the conclusion of this letter.

Is CBO all wet? I think not. I think the very smart wonks who make these forecasts try their best. CBO is mandated by law to make the projections under current law as written and forced to make (within guidelines) positive projections. They don’t have the luxury of assuming there might be a recession in the future.

You wouldn’t hire a financial planner who used software that was guaranteed to give you an unrealistic projection with nothing but positive assumptions. Yet that’s what we do with the CBO numbers.

Breaching $50 Trillion

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In my 2020 forecast letters, published in January as the pandemic was just gaining attention, I revisited the charts above and noted this:

When we do have a recession, which again I point out is likely to be after the election (the only meaningful data point between now and the end of next year), the deficit will explode to over $2 trillion per year and, without meaningful reform, never look back. That puts US debt at $35 trillion+ by the end of 2029.

According to CBO, this deficit which I gloomily said would be over $2 trillion in a recession year will be more like $3.3 trillion. I was an optimist.

What does this do to the national debt? First, we have to define some terms. You’ll often see numbers for “debt held by the public” or something similar. These exclude amounts the government owes to internal entities like the Social Security trust funds, military pensions, and other “we owe it to ourselves”-type funds. Those trust funds are running down at some point and those bonds will have to be repaid or sold into the market just like any other form of government debt. There is no such thing as owing it to ourselves. Not in the real world. It sounds good if you’re a politician trying to ignore or minimize debt. This ostrich-like head in the sand approach courts disaster.

“Total Public Debt” is more inclusive, and at the end of FY 2019 it was approximately $23.2 trillion. If the latest CBO estimate is correct, it will be well over $26 trillion when FY 2020 ends on September 30.

If we plug that into CBO’s revenue and spending estimates through 2030, we get something like this.

Note again, this is the official CBO data. You don’t often see it this way because they usually express it as a percentage of GDP instead of raw dollars. Their own numbers now show an almost $38 trillion debt at the end of 2029, far more than the also-alarming $35 trillion I estimated earlier this year. Again, I was an optimist.

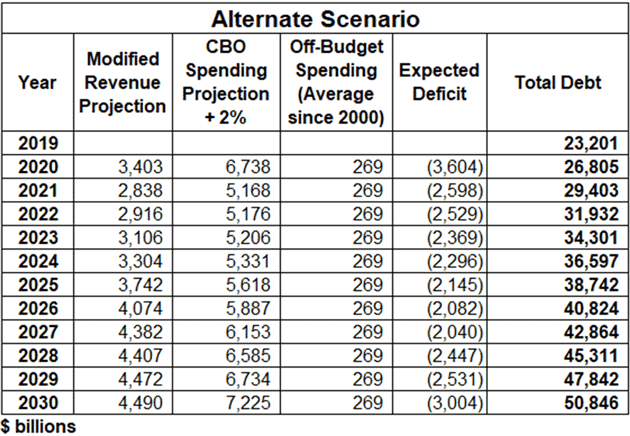

But CBO is optimistic, too. Some very slight and quite reasonable adjustments show the debt will be trillions higher by 2030. Below is the same table again with these changes:

- We reset revenue to change by the same annual percentages it did in 2008 and the following recession and post-recession years. That actually raises 2020 revenue a bit, after which it drops considerably lower than the CBO estimates.

- We take CBO’s spending projections and add 2% to each year, which I think is a fair and maybe even conservative expectation.

- We add $269 billion in yearly off-budget spending, which is the average since 2000. (You can take almost any 10-year period out of the last 20 and get close to that $269 billion average. Some years it has over $500 billion and some years it is negative. But the average is eerily consistent.)

Everything other than the above three changes is the same. When I asked Patrick to make those assumptions for the next table, we both knew that it would increase the total debt. I still admit to being quite surprised when I saw the final number. Here is the result:

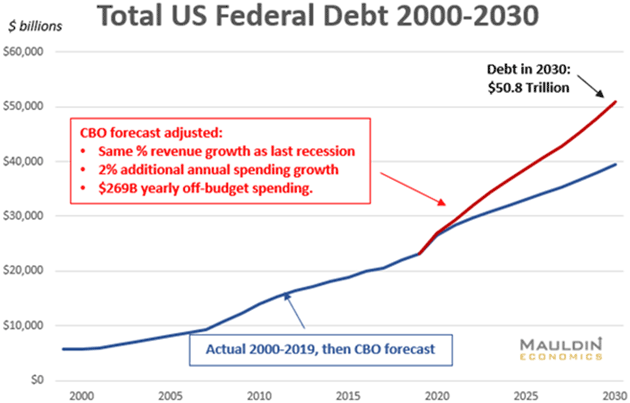

Under these (more likely) assumptions, the debt will breach $50 trillion in 2030. I bet it happens even sooner, because we probably won’t get through the 2020s without some other event blowing out the numbers—another recession or pandemic, an expensive war, who knows. But history suggests something will occur, with significant fiscal effect.

For those who prefer cool graphs, here is that $50 trillion in a simple line graph:

“Turning Japanese, I think we’re turning Japanese, I really think so.” (The Vapors)

But Wait, There’s More!

The CBO projections follow the government’s fiscal year, running from October 1 to the end of September. It is projecting a deficit of a little over $3.3 trillion for fiscal 2020.

Note that the CBO can only project current law. I expect House Speaker Nancy Pelosi and President Trump will agree to a “Phase IV” economic relief package well north of $2 trillion. My Twitter reading last night (follow me here) told me Pelosi expects to be negotiating with Trump in the next few days. Another tweet said her office and Mnuchin’s office are talking.

As I wrote last week, without another relief package the economy will fall into a depression by the end of the year. Neither party wants that. But that means adding another $2 trillion to the 2021 deficit, pushing it over $4 trillion.

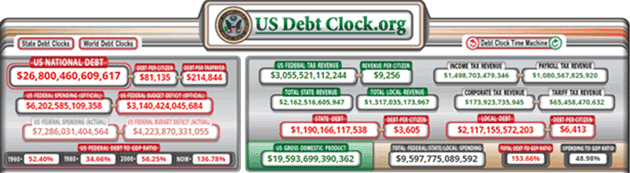

Here is where the wonderful www.USdebtclock.org says we are today:

You can click on any of the numbers at that website for an explanation and sometimes deeper links. This is just a small section. It tracks almost everything. On the left-hand side of the visual above, the third set of boxes show actual US federal spending and the budget deficit. When you click on the box labeled “US Federal Budget Deficit (Actual)” the definition includes off-budget spending. They project over $1 trillion in off-budget spending this year. Ouch! And they are not including the $2 trillion Phase IV relief package either.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

We are so going to blow through $30 trillion total debt sometime early next year, making my milder projections wildly wrong. Just a year ago, I naïvely expected it would be 2025 before we got to $30 trillion, and we would be short of $40 trillion by 2030.

Add an additional $2 trillion in Phase IV and the debt will easily be $40 trillion by 2025, and $50 trillion before the end of the decade.

MMT Coming

The next question is how will we finance all that debt. Americans and a shrinking group of foreign investors have been surprisingly willing to buy as much paper as Washington can print, even at near zero (or below zero, adjusted for inflation) interest rates. But there are limits, at least in theory, and they may draw closer if the global recession drags on.

The most obvious solution is for the Fed to buy whatever amount of bonds Treasury needs to sell using quantitative easing. Powell is definitely willing. Depending on how the Fed disposes of its bonds, it might be the practical equivalent of MMT. And the Fed’s willingness will not be lost on a future Congress, which could easily decide to test the limit. $50 trillion could just be the start.

The other question is what effect all this federal debt will have on private markets. Will it have a “crowding out” effect that reduces private lending? How will it affect legitimate business and investment activity? We’ll see the result in lower growth.

Remember, we aren’t just talking about federal debt. States and local governments owe over $3 trillion more, plus trillions more in unfunded state pension liabilities, some of which could easily end up at the Fed or Treasury. Then there are the wildly underfunded pensions (both government and corporate) that could easily default and force some kind of federal takeover. Plus corporate bonds, mortgages, student loans, auto loans, SBA loans…

I will probably be referring to this letter in five years when it becomes clear that the debt will be hitting $60 trillion or more as the US government takes on state and local liabilities and we find ourselves in another recession. I will be admitting that my $50 trillion projection was way too optimistic. Sigh. Double sigh.

You may be a debt-free, prudent investor but the fact remains, you are also a citizen and taxpayer. We are collectively in hock up to our ears. Some of this will end up on your shoulders and mine. Not a pleasant thought? Exactly. Which is why I expect a Great Reset. A real economist would probably call it Debt Rationalization. We will reach a point where it becomes the least-bad alternative.

The Consequences of $50 Trillion of US Debt

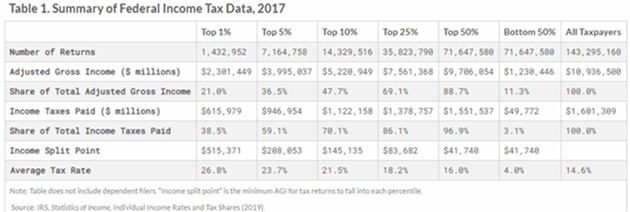

- Raising taxes will not solve the problem. Of course, it could help reduce the deficit some but it would be more of a token. That is just the reality. From the Tax Foundation here are the real numbers as of 2017.

If we double taxes on the top 25% it would only bring in another $1.3 trillion, assuming people didn’t change their behavior. (A 75% marginal rate plus 4% Medicare for a 79% top rate certainly will change behavior.) A less-shocking 20–25% increase would only bring in about $3-400 billion, and would have to raise rates on incomes above $83,000. Not exactly the rich. They already think they pay their fair share.

If we raise taxes next year in the teeth of a recession it will only make the recession worse. If we raise taxes but they don’t actually take effect until 2023 and then get phased in? That would probably avoid creating a double-dip recession.

One reason we cut corporate taxes was to make US companies more competitive. It worked. Do we really want to lose that? Not to mention what it will likely do to the stock market. Just saying…

- I know I keep saying this, but debt is future income brought forward. There is a point at which debt becomes a drag on US economic growth, and we have likely reached it. GDP growth in the US is going to increasingly look like Japan and/or Europe, i.e. almost nil. So, the CBO’s continued 2% average growth forecasts will simply get thrown out the window and the deficits will get worse. Ceteris paribus, ipso facto, QED and FUBAR. Don’t shoot me, I’m just the messenger.

- It is possible I’m being overly pessimistic about the need for a Great Reset which would include national debt. Japan reached 250% debt to GDP a few years ago, since which the Bank of Japan bought around half of total government debt (back of the napkin numbers) and Japan is doing just fine. The European Central Bank is buying anything not nailed down and is muddling through.

- Let me point out that while the practical results of quantitative easing look similar to MMT (modern monetary theory) the actual results and practice are completely different. I am not persuaded that the US Congress can understand the difference. Dear gods, I hope they can.

I was explaining this to a friend last night. He asked me what we should do, somehow believing that there has to be an answer. There isn’t one. We have no good choices left. It is as if we are on a trip through a desert and know for certain we don’t have enough water to go back. We don’t know where the desert ends, but we have to go forward.

That’s the reality. Unless you want to cut Social Security and Medicare, ignore military pensions, sell the national parks, abolish departments like State and Treasury, cut the defense budget in half along with Homeland Security, Education, Labor, the Justice Department and the FBI, etc. we are going to have to live with the $2 trillion deficits. In good years. There are no better choices.

We are going to learn how much the US can borrow before it all collapses around our ears. I have no idea where that point is. It’s probably a lot more than any of us currently believe. Japan is continuing to borrow, as is Italy and the rest of Europe. And China, etc. Sigh.

- While all of this is happening, we will continue to see accelerating technological transformation. I believe within five years we will have something that looks like the Fountain of Middle Age, and within 10 to 15 years actually make you younger, while at the same time beating cancer, heart disease, and so on. It will truly be the age of technological marvels.

There are going to be phenomenal investment opportunities. We will have to be very conscious of how we handle our portfolios, especially towards the latter half of this decade. That being said, I am currently making the largest percentage-wise single investment that I’ve ever made in a company (which is private so I can’t mention it) that I believe will have phenomenal dominance in its market within 10 years. It is one of the biggest markets in the world. Things like that are going to be happening more and more and more.

So yes, I fully understand that $50 or $60 trillion of US debt is a problem, but I’m not going to ignore the opportunities in front of me. I fully believe that the 100,000+ entrepreneurs who have lost their businesses are not simply going to sit on their derrieres and do nothing. It is in their DNA to launch new ideas. They will keep creating opportunities and jobs.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I think of myself as a realistic, rational optimist. I can admit the problems that we have with our government, debt, and political partisanship and still want to be long humanity and believe in a powerful future. You should too.

I’m going to close here, and apologize for not having enough room for my banana nut cake recipe so many of you have asked for. I will get it in a future letter. But we really do try to limit the words, and this letter is already overly long so let me just say have a great week!

Your wondering why the weights in my gym are heavier this time around analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin