Forecast 2014: The Human Transformation Revolution

-

John Mauldin

John Mauldin

- |

- January 4, 2014

- |

- Comments

- |

- View PDF

The End of Growth?

Killer Robots

The Primacy of Human Capital

The Age of Transformation

Dubai, Riyadh, Vancouver, Edmonton, and Regina

It is that time of the year when we peer into our darkened crystal balls in hopes of seeing portents of the future in the shadowy mists. This year I see three distinct wisps of vapor coalescing in the coming years. Each deserves its own treatment, so this year the annual forecast issue will in fact be three separate weekly pieces.

The final letter of the series will discuss what I see as potentially developing in the markets this year, but such prognostication has to be framed within the context of two larger and far more important streams. Next week we will examine the larger economic problems facing much of the developed world, and specifically we'll consider the Era of Unfulfilled Expectations. What happens when governments and central banks find it impossible to live up to the promises that they have made to their constituencies? Throw in a mix of frustrating demographics and disastrous economic policy choices, and you have a witch's brew of uncertainties.

Thankfully, an even greater force of progress will ultimately overwhelm the unintended consequences of meddling governments to ultimately deliver a very positive future, even if the the benefits are somewhat unevenly distributed in the shorter term. In this week's letter we'll look at the economic effects of the Age of Transformation, countering the arguments that call for a bleak, low-growth future wherein all the marvelous innovations that have occurred in the course of the human experience are behind us. Are we not to see yet again a development with the impact of the steam engine, electrical grid, telecommunications, or combustion engine? I think we will – in fact, fundamental, life-changing innovations are happening all around us today. We are just looking in the wrong places, expecting the future to resemble the past. If the depressing models of zero future growth are right, then our investment choices should be far different than if we have an optimistic view of the human experiment. Yes, we must balance our optimism with an appreciation of the uncertainties that will inevitably result from the antics of overreaching governments and their hubristic economic and monetary policies; but we must first and foremost have our eyes wide open to possibilities for growth.

It might help to think of the process as one of exploration. I imagine a group of intrepid adventurers (I picture in my mind Daniel Boone) topping one mountain pass after another, each time gazing off into the distance … to the next mountain pass. Between them lie beautiful valleys and rivers – as well as parched deserts and dead-end canyons full of potentially hostile natives. So the path is both uncertain and unending, as we head toward some ultimate destination we can barely even speculate about. Such a journey should not be undertaken without a great deal of thought and preparation, and it helps if you can find an experienced guide to assist in the process.

Before we set off on this week's leg of the journey, since this New Year's Thoughts from the Frontline is normally the most widely read issue of the year, let me welcome new readers and note that this weekly letter is free, and you can subscribe at http://www.MauldinEconomics.com. And feel free to send this letter on to your friends and associates – I hope it will spark a few interesting conversations.

There is a school of thought that sees the first and second industrial revolutions as having been driven by specific innovations that are so unique and so fundamental that they are unlikely to be repeated. Where will we find any future innovation that is likely to have as much impact as the combustion engine or electricity or (pick your favorite)?

This is a widespread school of thought and is nowhere better illustrated than in the work of Dr. Robert Gordon, who is a professor of economics at Northwestern University and a Nobel laureate. I have previously written about his latest work, a paper called "Is US Economic Growth Over?"

Before I audaciously suggest that he and other matriculants in his school of thought confuse the products of industrial revolutions with their causes, and thus despair over the prospects for future growth, let's examine a little bit of what he actually says. (You can of course read the original paper, linked above.) To do that we can turn to an article by Benjamin Wallace-Wells that I cited in Outside the Box last June. He explains Robert Gordon's views better than anyone I am aware of.

"[T]he scope of his [Gordon's] bleakness has given him, over the past year, a newfound public profile," Wallace-Wells notes. Gordon offers us two key predictions, both discomfiting. The first pertains to the near future, when, he says, our economy will grow at less than half its average rate over the last century because of a whole raft of structural headwinds.

His second prediction is even more unsettling. He thinks the forces that drove the second industrial revolution (beginning in 1870 and originating largely in the US) were so powerful and so unique that they cannot be equaled in the future.

(A corollary view of Gordon's, mentioned only indirectly in Wallace-Wells's article, is that computers and the internet and robotics and nanotech and biotech are no great shakes compared to the electric grid and internal combustion engine, as forces for economic change. Which is where he and I part company.)

Gordon thinks, in short, that we do not understood how lucky we have been, nor do we comprehend how desperately difficult our future is going to be. Quoting from Wallace-Wells:

What if everything we've come to think of as American is predicated on a freak coincidence of economic history? And what if that coincidence has run its course?

Picture this, arranged along a time line.

For all of measurable human history up until the year 1750, nothing happened that mattered. This isn't to say history was stagnant, or that life was only grim and blank, but the well-being of average people did not perceptibly improve. All of the wars, literature, love affairs, and religious schisms, the schemes for empire-making and ocean-crossing and simple profit and freedom, the entire human theater of ambition and deceit and redemption took place on a scale too small to register, too minor to much improve the lot of ordinary human beings. In England before the middle of the eighteenth century, where industrialization first began, the pace of progress was so slow that it took 350 years for a family to double its standard of living. In Sweden, during a similar 200-year period, there was essentially no improvement at all. By the middle of the eighteenth century, the state of technology and the luxury and quality of life afforded the average individual were little better than they had been two millennia earlier, in ancient Rome.

Then two things happened that did matter, and they were so grand that they dwarfed everything that had come before and encompassed most everything that has come since: the first industrial revolution, beginning in 1750 or so in the north of England, and the second industrial revolution, beginning around 1870 and created mostly in this country. That the second industrial revolution happened just as the first had begun to dissipate was an incredible stroke of good luck. It meant that during the whole modern era from 1750 onward – which contains, not coincidentally, the full life span of the United States – human well-being accelerated at a rate that could barely have been contemplated before. Instead of permanent stagnation, growth became so rapid and so seemingly automatic that by the fifties and sixties the average American would roughly double his or her parents' standard of living. In the space of a single generation, for most everybody, life was getting twice as good.

At some point in the late sixties or early seventies, this great acceleration began to taper off. The shift was modest at first, and it was concealed in the hectic up-and-down of yearly data. But if you examine the growth data since the early seventies, and if you are mathematically astute enough to fit a curve to it, you can see a clear trend: The rate at which life is improving here, on the frontier of human well-being, has slowed.

"Some things," Gordon says, and he says it often enough that it has become both a battle cry and a mantra, "can happen only once."

Gordon has two predictions to offer, the first of which is about the near future. For at least the next fifteen years or so, Gordon argues, our economy will grow at less than half the rate it has averaged since the late-nineteenth century because of a set of structural headwinds that Gordon believes will be even more severe than most other economists do: the aging of the American population; the stagnation in educational achievement; the fiscal tightening to fix our public and private debt; the costs of health care and energy; the pressures of globalization and growing inequality.

Gordon's second prediction is almost literary in its scope. The forces of the second industrial revolution, he believes, were so powerful and so unique that they will not be repeated. The consequences of that breakthrough took a century to be fully realized, and as the internal combustion engine gave rise to the car and eventually the airplane, and electricity to radio and the telephone and then mass media, they came to rearrange social forces and transform everyday lives. Mechanized farm equipment permitted people to stay in school longer and to leave rural areas and move to cities. Electrical appliances allowed women of all social classes to leave behind housework for more fulfilling and productive jobs. Air-conditioning moved work indoors. The introduction of public sewers and sanitation reduced illness and infant mortality, improving health and extending lives. The car, mass media, and commercial aircraft led to a liberation from the narrow confines of geography and an introduction to a far broader and richer world. Education beyond high school was made accessible, in the aftermath of World War II, to the middle and working classes. These are all consequences of the second industrial revolution, and it is hard to imagine how those improvements might be extended: Women cannot be liberated from housework to join the labor force again, travel is not getting faster, cities are unlikely to get much more dense, and educational attainment has plateaued. The classic example of the scale of these transformations is Paul Krugman's description of his kitchen: The modern kitchen, absent a few surface improvements, is the same one that existed half a century ago. But go back half a century before that, and you are talking about no refrigeration, just huge blocks of ice in a box, and no gas-fired stove, just piles of wood. If you take this perspective, it is no wonder that the productivity gains have diminished since the early seventies. The social transformations brought by computers and the Internet cannot match any of this.

But even if they could, that would not be enough. "The growth rate is a heavy taskmaster," Gordon says. The math is punishing. The American population is far larger than it was in 1870, and far wealthier to begin with, which means that the innovations will need to be more transformative to have the same economic effect. "I like to think of it this way," he says. "We need innovations that are eight times as important as those we had before." [emphasis mine]

It is hard not to nod your head as you peruse Gordon's work, as it is well-written and speaks to many of our prejudices. But it makes several assumptions that are wrong, in my opinion.

First, we will not need innovations that are eight times as important. We just need eight times as many innovations. And there I bring hope, because we will see many times that number.

Let's go back to James Watt and the steam engine. When Watt was tinkering with the power of steam, there were maybe a dozen scientists in all of Europe who could understand what he was doing and fewer who had access to his tools. Today we routinely throw 1000 scientists and engineers at what are relatively trivial problems. In the grand scheme of things, perhaps most of them are wasting their time. But certainly not all, and the number of scientists and engineers is multiplying at an exponential rate.

Watt was able build his engine precisely because he was (1) building on significant research in a dozen different arenas (including metallurgy, fabrication, and mechanics) and (maybe more importantly!) (2) funded by an entrepreneurial investor who saw the potential for income from the invention. But the steam engine did not really take off until it was introduced to John Wilkinson, who immediately adapted his techniques for boring cannons to creating the cylinder for the steam engine, ultimately enabling the engine to increase its power by orders of magnitude.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Other scientists and engineers tinkered, modified, adapted, improved, and collaborated until we had railroads and steam turbines and so on. The steam engine was not just one invention but a series of inventions. Watt was not really the creator of the steam engine, as the concept had been around for decades. He was simply the first to make an effective, commercially viable apparatus.

The real sources of intellectual fuel and entrepreneurial oxygen that fired the Industrial Revolution were the cumulative mass of information available to scientists and inventors and the ability of entrepreneurs to profit from their own risk-taking ventures. Notice that for the vast bulk of human history up to the industrial age, feudal lords and dictators held tight control over the means of production and the ability to truly profit from personal endeavor.

Let me employ a crude analogy but one that I think illustrates the point. If one inch were added to the circumference of the standard ping-pong ball, I think most of us could immediately tell the difference. A competent player could tell the difference if you added one inch to the circumference of the tennis ball. It would take a professional to tell the difference if you added one inch to the circumference of a regulation basketball.

If you added one inch to the circumference of the earth, who would know? Or really even care? Think of the steam engine as adding one inch to the circumference of a tennis ball: the steam engine made a difference that competent inventors and manufacturers of the day definitely noticed! Are there likely to be innovations today that will have similarly profound effects, but on a global scale? I can think of a few, though they are mostly only discussed in science fiction novels now.

Let's look at one small latter-day innovation, a rather trivial one in the grand scheme of things. Two centuries ago, 90% of American workers labored on farms. Today we are vastly more productive, with only 1.6% of American workers engaged in what we think of as the quintessential American activity, farming. And while agriculture has become highly mechanized, there is still shortage of labor for many activities.

Lettuce has to be thinned. When you grow lettuce, you have to plant a large number of seeds close together and then come back after they germinate and thin them out. This is a labor-intensive process that typically takes 50 workers two days in a 15-acre field. Except now there is a new machine called Cesar that can do the entire process in three hours for a fraction of the cost. (You can watch a fun five-minute video on Bloomberg at Killer Robots.)

In his famous work The Wealth of Nations, Adam Smith marveled at the technological innovation and manufacturing skill that it took to make a pin. The combination of technology and the division of labor made the cost-effective production of pins possible.

Now think of the killer robot that thins lettuce. It is a remarkably complex and ingenious device that performs a very simple activity. How many thousands of inventions were required to make a machine that is so simple in its basic concept? The real-time pattern recognition that lets the machine instantly decide which plants live and which die is itself a technology that required numerous precursor inventions. And yet all this technology and performance is brought to fiscally conservative lettuce farmers at a cost that is compelling.

Is the robotic lettuce thinner a fabulous invention? Absolutely. Will that robotic machine change civilization? No, of course not. It will simply make lettuce a little cheaper for you and me, and I doubt we will even notice the difference.

But this is just one of a thousand innovations that are springing up in every tiny niche of the human experiment every day! We're talking about 10 million entrepreneurs waking up around the world every day trying to figure out how to deliver better products, how to be a little bit more productive, how to create something interesting that people will pay for. Most changes are so tiny or unimportant that they go largely unnoticed or are not even adopted.

There were not many intellects on the level of James Watt's when he seized his opportunity in the mid-1700s. Today there are tens of thousands of James Watt-level minds tinkering in all sorts of fields. I would argue that their cumulative output is adding at least 10,000 inches to our "innovation globe" every day.

Today the cost, per lumen of light, of illuminating an LED bulb is one millionth of what it was in the time of James Watt. And it will be 10 (or will it be 100?) times less expensive in 10 years as we shift to silicon-based LEDs. I've done business in Africa and understand the value and the cost of light. What happens when the production of light consumes miniscule amounts of solar power? How much more productive does Africa become? How do we measure that in terms of the quality and creative capacity of human experience?

It is not just robotics. It is nanotech and biotech and telecommunications and artificial intelligence, all driven by the burgeoning and increasingly important field of information technology. It is the cumulative information from hundreds of thousands of inventions, innovations, and discoveries that allows for the individual creations developed by each of those 10 million entrepreneurs. And as more and more budding Einsteins, Newtons, and Watts gain access to education and information through the internet, the innovations will continue to compound and accelerate.

The end of growth? Hardly. In 100 years we will look back and see the next 20 years as simply the beginning of the real acceleration of growth.

However, classical economics as it is currently formulated will miss the story that is unfolding. With its focus on models and measuring, with its physics envy, economics persistently misses the real story. As George Gilder notes in his groundbreaking book Knowledge and Power:

The central scandal of traditional economics has long been its inability to explain the scale of per capita economic growth over the last several centuries. It is no small thing. The sevenfold rise in world population since 1800 should have attenuated growth per capita. Yet the conventional gauges of per capita income soared some seventeen-fold, meaning 119-fold absolute increase in output in 212 years. And this is only the beginning of the story.

The leading economic growth model, devised by the Nobel laureate Robert Solow of MIT, assigned as much as 80% of this advance to a "residual" – a factor left over after accounting for the factors of production in the ken of economists: labor, capital, and natural resources. In other words, economists can pretend to explain only 20% of the apparent 119-fold expansion.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Earlier in his book, Gilder highlights the source of this mystery of the failure of economics.(all emphasis mine):

The passion for finding the system in experience, replacing surprise with order, is a persistent part of human nature. In the late eighteenth century, when Smith wrote The Wealth of Nations, the passion for order found its fulfillment in the most astonishing intellectual achievement of the seventeenth century: the invention of the calculus. Powered by the calculus, the new physics of Isaac Newton and his followers wrought mathematical order from what was previously a muddle of alchemy and astronomy, projection and prayer. The new physics depicted a universe governed by tersely stated rules that could yield exquisitely accurate predictions.

Science came to mean the elimination of surprise. It outlawed miracles, because miracles are above all unexpected. The elimination of surprise in some fields is the condition for creativity in others. If the compass fails to track North, no one can discover America. The world shrinks to a mystery of weather and waves. The breakthroughs of determinism in physics provided a reliable compass for three centuries of human progress. Inspired by Newton's vision of the universe as "a great machine," Smith sought to find similarly mechanical predictability in economics. In this case, the "invisible hand" of market incentives plays the role of gravity in classical physics. Codified over the subsequent 150 years and capped with Alfred Marshall's Principles of Economics, the classical model remains a triumph of the human mind, an arrestingly clear and useful description of economic systems and the core principles that allow them to thrive. Ignored in all this luminous achievement, however, was the one unbridgeable gap between physics and any such science of human behavior: the surprises that arise from free will and human creativity. The miracles forbidden in deterministic physics are not only routine in economics; they constitute the most important economic events. For a miracle is simply an innovation, a sudden and bountiful addition of information to the system. Newtonian physics does not admit of new information of this kind – describe a system and you are done. Describe an economic system and you have described only the circumstances – favorable or unfavorable – for future innovation….

Flawed from its foundation, economics as a whole has failed to improve much with time. As it both ossified into an academic establishment and mutated into mathematics, the Newtonian scheme became an illusion of determinism in a tempestuous world of human actions. Economists became preoccupied with mechanical models of markets and uninterested in the willful people who inhabit them.

Economics in general uses tools to measure growth that are inadequate at best and misleading at worst. As I've written elsewhere, the simple concept of inflation, except in a general sense, is so convoluted and so fraught with assumptions as to render any precise definition laughable. In economics as it is constructed today, we pay attention only to that which we can measure. If we can't measure it, surely it must be meaningless. We cling to our models and theories much as religious fanatics do to their understanding of the workings of God, as if somehow we can understand either.

Some economists become obsessed with market efficiency and others with market failure. Generally held to be members of opposite schools – "freshwater" and "saltwater," Chicago and Cambridge, liberal and conservative, Austrian and Keynesian – both sides share an essential economic vision. They see their discipline as successful insofar as it eliminates surprise – insofar, that is, as the inexorable workings of the machine override the initiatives of the human actors. "Free market" economists believe in the triumph of the system and want to let it alone to find its equilibrium, the stasis of optimum allocation of resources. Socialists see the failures of the system and want to impose equilibrium from above. Neither spends much time thinking about the miracles that repeatedly save us from the equilibrium of starvation and death.

It is not just that Gordon and others miss the importance of information and entrepreneurial effort in industrial revolutions, missing the forest for the trees. It is that they miss the most important factor of all: capital. But not capital in the sense of money. I am thinking of capital in the more important way that Nobel laureate Gary Becker describes it: as human capital.

It is the investments we have made in ourselves that have been the true source of economic growth. Education, training, information sharing, the transfer of knowledge have all been fundamental in the human experiment. The more open a society becomes, the more it shares its information and knowledge and the fruits of its labors, and the more empowered its people and the more productive its civilization become.

As Isaac Newton said, "If I have seen further it is by standing on the shoulders of giants." In Newton's time, there were a handful of giants; today there are thousands. And because of their ubiquity, most go unnoticed. The division of labor, the most significant of Adam Smith's insights, means that there are just so many more small but important realms of human endeavor where giants can roam and have an impact. When was the last time we celebrated the giants of material sciences? Who are the Newtons of the world of ceramics? We may not be able to name them, yet their work has a profound impact on our lives. I daresay that our Killer Robot would not be possible without their seminal work. Or the work of thousands of other innovators.

Yet those insights can walk out of a company at any moment. Ask Shockley Semiconductor (who, you ask? – which is the point) about losing Gordon Moore to Fairchild. Then Fairchild saw Gordon Moore leave to found Intel. It is the human capital that is truly important.

It is human drive and determination and the ability to piece together disparate bits of information, along with the ability to develop and deploy an ever-increasing abundance of new tools, that is driving economic growth. They were fracking shale oil in the Permian Basin in the early 1950s. And fracking went nowhere until George Mitchell worked on the problem in the 1980s and '90s. And there are now hundreds of significant innovations and tens of thousands of scientists and engineers working in just that one small field of human endeavor that was pioneered by Mitchell.

The next twenty years will see more technological change than we have seen in the last hundred years put together. My Dad would hitch up the wagon to drive seven miles to town in the 1920s. In twenty years the way we get around today will look just as quaint, though in different ways. Who was using the internet twenty years ago? Only early adopters had cell phones. The Human Genome Project was seen as an expensive joke unlikely to be completed in less than a few decades. Twenty years ago, robots were still very limited in scope, and AI had lost its mojo in the public eye. Only a few years earlier a serious Stanford physics professor said Qualcomm’s technology violated the laws of physics and was a hoax.

Back then, Paul Krugman told us,

The growth of the Internet will slow drastically, as the flaw in "Metcalfe's law" – which states that the number of potential connections in a network is proportional to the square of the number of participants – becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's…. As the rate of technological change in computing slows, the number of jobs for IT specialists will decelerate, then actually turn down; ten years from now, the phrase information economy will sound silly.

Not that I want to pick only on Krugman; he was expressing a widely held sentiment (although it's one I am sure you did not share – just those other guys who had no idea what the future held).

The true power of the internet is not just in human conversation. That is such an anthropomorphic view. It’s also about what machines can communicate to one another for us; it's about distributed computing power. But that power is easy to underestimate or dismiss entirely, because most of us cannot imagine what the increases in processing power or network connectivity and speed or nanotech or (pick a technology) can do for us. But we don’t have to. Those ten million entrepreneurs lie awake nights thinking about those things for us.

Nowhere else is the pace of scientific progress accelerating as fast as it is in the biological sciences. Already, biotech advances have outstripped the media's ability to stay abreast of important breakthroughs. This isn't surprising, as even scientists who work in one area are often unaware of major developments in other areas. One of the problems of the current explosion of information is the difficulty of simply keeping up with what is going on in your own field, let alone others. One of the new and important job descriptions is that of the generalist who can extrapolate and interpolate technological advances among disparate fields.

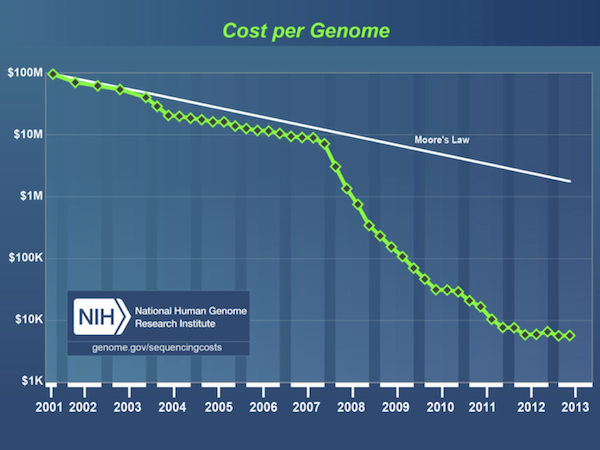

The gap between public perception and scientific progress will only increase as exponential advances in computer technologies give researchers powerful new tools to solve mysteries long thought unsolvable. Nothing better demonstrates the acceleration of biotechnology than the following chart from the National Human Genome Research Institute. You probably know that the cost of computer processing power is cut in half every two years or so. That is (Gordon) Moore's Law. You may not know, however, that the cost of mapping an individual human genome is dropping at twice that rate.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

What does this mean? It means that more and more genomes will be sequenced and matched to individuals' medical histories. As this database grows, advanced mathematical tools running on increasingly powerful computers will reveal genetic causes for diseases as well as individualized solutions. Truly effective personalized medicine will finally displace primitive cookie-cutter therapies.

Today a note came across my desk. A research group at Tel Aviv University has developed a computer algorithm that detects which genes can be "turned off" to create the same anti-aging effect as calorie restriction. Laboratory results confirmed the research done by computers, totally in silicon! This sort of work was not physically possible ten years ago, even in the most specialized labs. Now it is performed inside a computer without anyone even having to reach for a test tube. This is biotech research at the speed of light, powered by Moore’s Law. Today we do in mere days research that required years and massive amounts of money just ten years ago.

Reading and interpreting the DNA found in your cells, however, is only half of the story. The other half is harnessing your own DNA to repair and replace cells damaged by trauma, disease, or aging itself. The most powerful therapies will analyze and utilize your own cells and DNA.

This is why my colleague Patrick Cox (who writes our Transformational Technology Alert letter) and I volunteered to participate in a pilot project conducted by BioTime, Inc. We both donated cells taken from inside our left arms. Those cells were then multiplied many thousand of times.

Some of these cells were used for complete genome sequencing. The results are, in fact, posted here for John and here for Patrick.

This public posting of our genomes is somewhat historic for a number of reasons. One is that our genomes are linked with the world's most comprehensive library of genetic information, GeneCards, which is maintained by BioTime subsidiary LifeMap Sciences, in conjunction with the Weizmann Institute in Tel Aviv. In essence, LifeMap Sciences tracks and integrates all publicly known scientific information about the genome in this searchable database. Just a few weeks ago I was in a hotel lobby with BioTime CEO Mike West here in Dallas, and we were able to look at my genome results and see hundreds of links to research papers and a synopsis of what the research says about my particular genes. The web pages above have partial postings of our genome results today but in time will have full postings.

There were good news/bad news aspects to my genes. The good news is that both Patrick and I have a relatively rare gene associated with Ashkenazi Jews that, along with some other genes, suggests we have a propensity to live a rather long time. (One of the researchers asked if we had such ancestry. For what it’s worth, neither of us do.)

Since my mother is now 96, a gene that is associated with longevity is not much of a surprise. Patrick’s grandfather made it past 100. But the bad news is that I have several genes that are associated with a 3-6 times higher rate of multiple sclerosis and other genes associated with certain types of cancers. I will no longer argue with my doctor about that annoying prostate exam. And there are some weird genes in my mix. Who actually studies whether having a particular gene means you get larger mosquito bites? I apparently have one.

As time goes by, Patrick and I will learn more as LifeMap Sciences posts finds ever more research and links it to their database. Pat good-humoredly asked if I worry about someone cloning me in 100 years, since all the data will be there. I laughed and said, “I really don’t care, but I would suggest they make some serious modifications to the original.”

Given the trouble that 23andMe has recently had with the FDA, it should be pointed out that there are big differences between what that company did and what BioTime has done. First, 23andMe did a partial sequencing based on a saliva test, which is very different from a full sequencing using skin cells. Additionally, BioTime has not issued any statements or made any diagnoses that the FDA has halted. This isn't surprising, as ex-FDA chief Andrew von Eschenbach serves on the BioTime board. Patrick and I are free to use the GeneCards database to research our full genomes, but we would need a doctor or other clinician to make a diagnosis.

By the way, I asked Mike what it cost to run our genomes. He had to think a moment and guessed about $4,000. (I assume that is his cost.) For Mike the cost is clearly not even a consideration in his research. And it is dropping every year, almost monthly. The first human genome was fully sequenced less than a decade ago. The project took 13 years and cost $2.7 billion. That is an almost millionfold reduction in cost in a little over a decade. The first individual’s genome (the previous genome maps had been composites) – Craig Venter's – was sequenced just six years ago, in 2007.

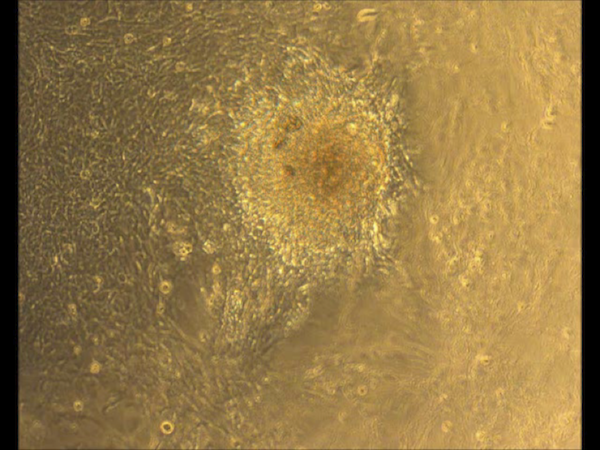

An even bigger difference, and far more important, between BioTime’s model and 23andMe’s is that our cells were not only used to provide the DNA for sequencing, they were also rejuvenated and banked. Our skin cells were turned into induced pluripotent stem cells, which are virtually identical to the embryonic cells that we came from. This means that our cells' telomeres – the actual clock of aging – are completely restored to their full length at birth. If transplanted back to us, the donors, they would function as well as youthful cells and have full, normal lifespans, unlike adult stem cells used in therapies now.

These rejuvenated stem cells have only our DNA, so they would provoke no immune reaction if returned to us. Moreover, they can be stored in this newborn state indefinitely; because until they start down the path to becoming an adult cell type (the process of differentiation), they don't age at all.

To demonstrate the differentiation process, BioTime CEO Dr. Michael West had some of Pat's cells programmed to become heart muscle cells, or cardiomyocytes. He did this because their function is apparent to the naked eye. These cells naturally self-assemble into clumps of beating heart muscle.

It's useful to ponder the fact that these cells are baby-young. Scientists believe, based on successful animal tests, that they could be used to repair damaged heart muscle following a heart attack. BioTime's subsidiary ReCyte is also working on endothelial precursor stem cells. If these cells were to be programmed from your own induced pluripotent stem cells and returned to you, they would form a youthful endothelium – the lining of your cardiovascular system. This would rejuvenate your cardiovascular system and help protect you from heart disease and other life-threatening conditions. Talk about healthcare with a lifetime warranty!

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The types of rejuvenated cells that could be used to reverse cellular aging in your body are unlimited. Already, BioTime has learned to engineer hundreds of important cell types from induced pluripotent stem cells.

The knowledge that will be gained from growing numbers of fully sequenced genomes, including ours, will help scientists learn to engineer fixes to problems caused by aging as well as by genetic mutations. The ultimate goal is to rejuvenate all the cells of our bodies. Patrick and I have taken the first step by having our genomes sequenced and our cells rejuvenated and banked in preparation for a time when it is legal in some jurisdiction to perform the regenerative therapies we're waiting for.

Yes, Pat and I are part of *that* group. Can we, as Ray Kurzweil said, "live long enough to live forever"? Neither of us thinks that total regeneration is possible in the next twenty years; but partial, organ-by-organ regeneration will clearly be available. So we may have to settle for rejuvenating one organ at a time as they learn how to get those cells from the lab into our bodies, thereby fixing the problems of aging one by one as they crop up – until we can fix them altogether.

Aging is becoming an engineering problem. So are cancer and other diseases. Patrick introduced me a few years ago to a private company, Bexion, that in a few months will start phase one human trials on a molecule that cures any cancer it comes in contact with in mice. Will the cure work in humans? We’ll see. While that would be nice for me as a tiny investor in the company, the implications for humanity are self-evident. But whether it is Bexion or any of the dozens of other companies seeking a cure for cancer, a cure will be found. In fact, one of the real risks to my investment is not that Bexion is not successful with its technology, but that another company finds a cure that works better and cheaper and makes our research obsolete almost as soon as we get launched.

Patrick and I began to share our enthusiasm for the accelerating nature of change over five years ago, and we have talked weekly if not daily ever since our first conversations. It is hard to contain our excitement about the prospects for our human future. And that future is being created not just in biotech but also in a dozen other fields where we are seeing life-altering technologies turn up every day.

But the personal and economic impacts will be most pronounced as a result of the biotech revolution. It is not just new cures that will be the source of that impact. It is the increase in human capital that will become available to all of us. How many people we know have died from some disease that will become preventable in the next 10-15-20 years – people who, if they had lived, would have added so much more to the human experiment? Living longer is not just about the pleasure that we will gain from having a longer time with our loved ones; it's also about the contributions we can make to society, made possible because we are living longer and healthier lives.

I encounter people all the time who give me the tired old argument that they don’t want to live longer. They see old people in nursing homes and don’t want that sort of life to be their own protracted future. I can certainly sympathize with that point of view. My mother is now totally bedridden; and while she is still mentally active, a great deal of the joy of life is gone. Dad’s time in a nursing home was not fun, either.

If that were our future – just growing ever older and more frail – I’m not sure I would want to sign up for that. But that dreary prospect is not what Patrick and I are talking about. Instead, we are talking about not just increasing our lifespans but increasing our healthspans. We are following (and in some cases participating in) technologies that have remarkable short-term implications for the problems of aging. (For the record, I am 64 and Pat is 63.) As I mentioned above, the implications of advances in computational research on nutraceuticals is simply astounding.

The first human being who will live 150 years is alive today. Pat and I hope that person is somewhat older than we are so they can blaze a trail that we can follow, but we are perfectly willing to be guinea pigs if and when the time comes. I told Mike West (only somewhat jokingly) that I don’t want to be the first person whose body parts he tries to rejuvenate. But I would like to be the 100th when they have the science down. Mike is shopping for a venue for those first procedures even as I write. That he is having to look outside the United States to utilize research done in the United States is testimony to the backward-looking focus of the FDA, which is mired in a history of regulating medical treatments that are quickly becoming antiquated and that are nothing like what we are seeing done today. But I hope even that bureaucratically encumbered and backward-looking regime will change. Japan, for instance has just modernized their regulatory structure and given us a model that we should emulate.

It might be helpful to think of the race to defeat aging as something of a horse race. While Mike West and BioTime may be the lead horse today (and in our opinion they are), we are barely out of the starting gate.

The drive for regeneration is just one of a hundred different life-impacting transformations that we are going to see over the next twenty years. There are a hundred different racecourses with thousands of horses all being jockeyed to some distant finish line.

We are involved not just in an industrial revolution but in a total Human Transformation Revolution. If we limit our focus to the problems created by government and central banks, we may be distracted from the truely epochal events happening all around us today that are going to give us amazing opportunities for investment growth and the creation of wealth. There is more to life than simply watching the Federal Reserve.

We have to be keenly aware of our surroundings as we explore this exciting new world, avoiding dangers and pitfalls as they present themselves, but keeping our eye on the destination.

I’m running long in this letter today, and so I'll close, but the Human Transformation Revolution will be a theme we'll return to from time to time this year.

And if you’ll indulge me for a marketing moment, my regular readers will have noticed that Patrick Cox has come to work with us at Mauldin Economics to write a newsletter called Transformational Technology Alert.

This journey of exploration and greater understanding isn’t always going to be fun or easy. We fully expect to end up exploring a few dead-end canyons as well as finding our share of fabulous and fruitful valleys. But both Patrick and I firmly believe this journey will alter the course of human history. It will, in short, allow us (and you) to live longer, happier, healthier, more prosperous lives. Patrick's new letter is our way of inviting you to join us on the journey. And maybe we can all make a little money along the way.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

You can begin reading Patrick’s letter for 50% off the normal price (and lock in that low rate for a very long time) by clicking here. In addition to regular monthly issues, we'll send you several special reports on why we think BioTime is a uniquely promising company, along with reports on other very hopeful technologies and companies that Pat has discovered.

Dubai, Riyadh, Vancouver, Edmonton, and Regina

Next Wednesday evening I'll fly to Dubai (via London) to explore the city for a few days and perhaps visit Abu Dhabi before flying on to Riyadh for a speech. It is my first trip in 25 years to the Middle East, and I’m curious as to what I will see. I then return home for a few days before heading off on a speaking tour for CFA chapters in Vancouver, Edmonton, and Regina. I notice that Regina is -8°F (-22 Celsius) today. I will have to go shopping for a little extra cold-weather gear before I head up there.

My partners Olivier Garret and Ed D’Agostino and other Mauldin Economics associates are flying in Monday and Tuesday for planning meetings on our course for the coming year. On Tuesday evening we will be joined by Jon Sundt and Jack Rivkin of Altegris Investments, along with several other leading investment professionals, and we'll be talking about how best to help you in your personal investment explorations. I will be cooking for 13 of us as we think hard about how a transforming world will affect our businesses and how we can deliver better products and services to you. As I mentioned a few weeks ago, we will soon be launching two new newsletters that focus specifically on portfolio design and construction. This project has been in the works for some time. Watch this space for how you can access these letters, hopefully for free. I am truly excited about the changes in what we will be able to offer; but rest assured, Thoughts from the Frontline will not change. It will be free, as always!

It truly is time to hit the send button, as my yoga instructor will be here in a moment. Sadly, all of our research has turned up no magic pill that will take the place of exercise and a healthy lifestyle. I am beginning to feel positive effects from working with her, although I must hasten to add that what I am doing does not resemble what you think of as yoga. This is more like Remedial Stretching 101 for someone who has sat on too many planes and in front of two many computers for far too long. But the plans we are making here at Mauldin Economics really do need me to be involved for another ten years at least, so I need to make sure my body is up to the task. It will be a long time before we can replace even a small part of it.

Have a great week, and I’ll write you from Dubai.

Your wondering where my flying car is analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin