Chinese Coronavirus Changeup

-

John Mauldin

John Mauldin

- |

- March 6, 2020

- |

- Comments

- |

- View PDF

Masked Bike Rides

Overly Optimized

Exogenous Causes

Silver Linings

A Suggestion

New York and Final Thoughts

In baseball, there is a kind of pitch called the “changeup,” designed to look like a fastball while actually going slower. The deceived batter swings too soon and misses. Strike, you’re out. The world has thrown a wicked biological changeup at the global economy.

This is kind of how coronavirus fear is spreading from China to the rest of the world and now the US. We think it’s coming fast. Many Americans have swung at the pitch by selling stocks, stocking up on food, cancelling travel plans, and so on. Those may prove to be wise choices. But in fact, the ball is still coming.

As of now, the medical data is a still evolving. What’s clear is we face an easily transmitted, flu-like virus. However, it’s more dangerous than the normal seasonal flu, particularly to the elderly and people with other health conditions. And it is spreading. The US appears to be a few weeks behind other countries where the situation is already much worse.

Every death is sad, and we should all take precautions. But we will adapt, and in due course have a vaccine that reduces the risk. The economic damage will be both harder to control and harder to repair. This week’s letter will focus on the economic impact globally—but specifically in China.

The Federal Reserve cut rates this week and bond traders clearly see more cuts coming. Jim Bianco says Fed officials know markets will keep falling anyway; they just want to manage the decline. Maybe so, but the problem began in China, and that’s where the solution will have to begin, too.

The good news is there are things we can do to help. I’ll mention one big idea at the end of this letter. But first, we’ll take a closer look at what happened in China and how it affects the world economy.

Masked Bike Rides

Aside from everything else, coronavirus is generating some amazing charts. The out-of-nowhere waterfall declines in various China stats are remarkable. For example, here is a manufacturing activity index.

Source: Seeking Alpha

That’s just one example of many. February in China was unlike anything seen since 2008. And back then, the decline happened over a few months. This one was just as deep but nearly instant. And we don’t yet know if it is over.

Just as the Lunar New Year holiday ended (during which many people travel and business activity declines), Beijing quarantined entire cities and regions in an effort to stop the viral outbreak. Workers who had left for the holidays couldn’t get back. Others couldn’t leave home to go to work. Much of the country essentially shut down.

The most reliable source of on-the-ground data I know is China Beige Book. Their flash survey in February found 31% of companies still closed, and many of those that had reopened still lacked staff or materials and couldn’t operate at full capacity.

Simon Hunt shared this anecdote from one of his contacts.

Here in central Shanghai, the usual rush-hour traffic kicks off at 8 am and remains nose to tail until 9 am when the streets become curiously empty. So, leaving Browning Towers yesterday, I took a shared bike (RMB 1.5, USD 0.21) and cycled around my local neighborhood.

I can report 70% of street-side shops and businesses are open, however, 100% of the restaurants and 50% of the hotels are closed. Like mine, all residential compounds are gated and closed except to residents with huge piles of deliveries waiting outside for collection under makeshift awnings. Everyone, and I mean everyone, wears a mask, and on a bike, breathing through an N95 mask is no easy business.

I stopped at my local Starbucks to find it open, but all the furniture was stacked and swept to one side and a barista took my temperature before serving me. Seeing that my fellow customers were heavily wrapped delivery guys (Deliveroo, Sherpa etc.) I realized my usually cozy Starbucks was open for takeaway only. I mention this as Shanghai with 42 confirmed cases has not had any meaningful increase in virus cases for some weeks. Wuhan, where the new cases are declining but still averaging about 400 a day is only 460 miles away. Clearly, the numbers in Shanghai are static because of the level of precaution the local community is happy to make.

I returned to my compound, the street-side gate security took my temperature and waved me through, and I finally I arrived home with my coffee.

So that was life a long way from the outbreak’s center, and we know conditions are much harsher in Wuhan. The measures seem to have been effective in slowing the virus spread, but at tremendous cost.

Note what he said about hotels and restaurants being closed. Those are low-margin businesses that employ millions of low-wage workers. How many lost income during this time? Their incomes are low, but the numbers add up. This will certainly affect China’s consumer spending. Many of the small businesses that had to close have outstanding loans. The government may shield them for a time, but somebody will have to absorb those debts.

Other statistics also show China still reeling. Estimates say anywhere from 40 to 50% of the trucks that are used to bring containers and product around China are simply not moving. It appears at least 30% of the workers who travelled away from home for the lunar holiday have not returned.

Apparently, the lockdown in Wuhan and other cities is effective as the numbers of new cases and deaths appears to be dropping rather rapidly. That’s good, but it doesn’t solve the problem.

Overly Optimized

The bigger issue, at least for the US, is supply chain disruption. It is hard to explain how finely calibrated these have become. US retailers and manufacturers depend on China for a steady flow of both finished goods and components. Tariffs made this more expensive in the last couple of years, but the flow continued, mostly uninterrupted. Coronavirus may accomplish what the trade war couldn’t.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

My best sources think most Chinese manufacturers should be back at full staff levels in the next month or so, and in some cases, a few weeks—barring a secondary virus wave (which Simon Hunt thinks is possible; he notes schools are still closed with no reopening scheduled). But that doesn’t mean normal operations. Shipments for all kinds of items have been so scrambled, it could take months to get all the right stuff in the right places.

Charles Gave raised an interesting and scary question in a recent Gavekal report. Is the fine-tuned engine of our global economy now thrown off its axis?

In a fully optimized world, almost all the manufacturing would take place in China, the design and sales in the US, and all the profits would magically appear in Dublin, Amsterdam, Hong Kong, or the Cayman Islands. The world would then be as optimized, fast-paced, and high-performance as English rugby player Manu Tuilagi. Yet, as England fans know, the problem with Tuilagi is that injuries mean he is seldom available to put on the white shirt.

The more optimized a system is, the more fragile it potentially becomes. Ming dynasty porcelain is undeniably finer and more beautiful than any tin cup. But what the tin cup gives up in beauty, it makes up for in resistance. Clearly, the current Covid-19 uncertainties are revealing the global system’s fragilities, both short term and long term.

We have seen disruptions before. Many cite the 2011 Japan earthquake and tsunami, which essentially brought that nation to a halt. It recovered. But China in 2020 is far bigger and far more integrated with the rest of the world economy.

It’s also unclear if reports of business re-openings are true. A March 4 Caixin report said the lights may be on, but that doesn’t mean people are working.

As new coronavirus cases in China slowed in recent weeks, local governments in less-affected regions pushed companies and factories to return to work, typically by assigning concrete targets to district officials. Company insiders and local civil servants told Caixin that, under pressure to fulfill quotas they could not otherwise meet, they deftly cooked the books.

Leaving lights and air conditioners on all day long in empty offices, turning on manufacturing equipment, faking staff rosters, and even coaching factory workers to lie to inspectors are just some of the ways they helped manufacture flashy statistics on the resumption of business for local governments to report up the chain.

Chinese data is “dynamic” in the best of times. If Beijing is now punishing local governments and businesses for not doing the impossible, then it’s not surprising they would try to generate the appearance of activity.

In any case, the full impact hasn’t yet reached us because businesses in the US, Canada, Europe, and elsewhere have some inventory of the things they need from China. Some ships were already on the way before China shut down in late January. But we will start feeling it soon.

Then what? Much depends on how the virus spreads here and what measures we take to control it. In a worst case, this could turn into a simultaneous supply shock (with the US unable to obtain critically needed imports) and demand shock as millions can’t work or travel. Either of those alone would be bad. Together, they would be devastating. But it’s a real possibility if the Seattle-area outbreak intensifies and spreads like the one in Northern Italy.

Exogenous Causes

For the last three years, I’ve said the United States wouldn’t sink into recession unless there was some exogenous event, meaning from outside the US. I think the coronavirus qualifies as exogenous.

A significant part of the world will likely enter recession. I don’t care how they cook the books in China, because that’s what they do, but China will be in a recession in the second quarter and perhaps the third quarter. Europe was already at stall speed and could be in recession soon, if not already.

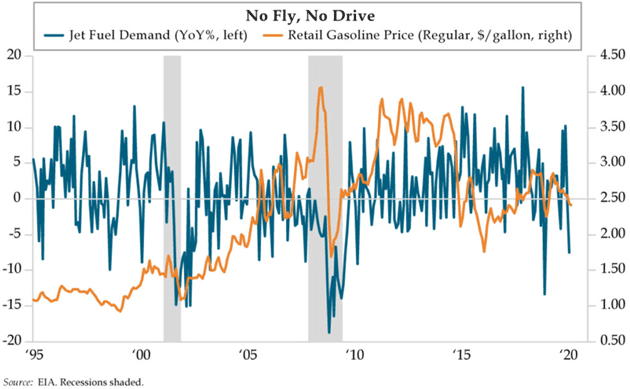

Ominously, jet fuel demand is beginning to drop. Some of this is clearly because of international flights being cancelled. But airlines are starting to cancel domestic flights as well. The coronavirus is clearly having an impact on our travel. The chart below is from Danielle DiMartino Booth’s Quill Intelligence.

Source: Quill Intelligence

I see at least a 50% chance we have a US recession soon. If it doesn’t cause a crisis in the overstretched corporate bond markets (namely high yield and triple B), something I have written about, the economic impact should pass in less than a year—maybe six months. The accompanying equity bear market should recover in a V-shaped manner.

However, if the biological crisis creates an economic crisis, we will have a deeper bear market and a much slower recovery. The important word in that last sentence is recovery. Much depends on how deep the recession is, if that’s what happens.

Silver Linings

In my last letter on this subject, I ended with some silver linings. Let me give you another one.

Globalization was already changing and possibly reversing before any of us heard of COVID-19, mainly due to technology. The labor-cost savings of manufacturing overseas are no longer as stark as they once were. Add to this the political changes as working-class Westerners complain, correctly, that their jobs were outsourced to either machines or foreigners and somebody else got the benefit. Furthermore, there’s now a widespread US belief that China is a strategic rival on which we shouldn’t be overly dependent.

I think the current supply chain problems will likely accelerate an ongoing move of manufacturing closer to consumers. Robotics, 3D printing, artificial intelligence, and all sorts of new manufacturing technology are already encouraging this process. I think a number of businesses will see the writing on the wall and speed up their plans. This could raise capital investment enough to actually boost growth—a very good thing.

Unlike some, I would not want to cut off trade with China. I do think we need to be more careful how we trade. Coronavirus could spur a restructuring of the relationship that was going to happen anyway. We will all be better off if it happens in an orderly manner. I don’t know if that is possible anymore, but we should try.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In that regard, I have a suggestion for the Trump administration:

Take the high road. Cancel the tariffs on Chinese goods “for the duration of the crisis” and recognize we are all in this together. This is not a US or China problem. It is humanity’s problem. Lifting the tariffs will set the tone for more amicable negotiations and, if nothing happens, you can slowly restore them after the crisis passes.

Yes, we need China to change some of its policies. I think Beijing is probably more willing to negotiate now than it was three months ago. The tariffs are an unnecessary obstacle to further progress.

A Suggestion

As you might suspect, my extensive network keeps me plugged into the latest coronavirus data. I’m getting reports from all over the world, and I’ll tell you this much: No one is sure where this is going. We are truly in uncharted territory.

In Thoughts from the Frontline, I can only skim the surface, but I’m aggressively covering the rapid economic developments in Over My Shoulder. My co-editor Patrick Watson and I are on the phone several times a day, reviewing info, and trying to separate the wheat from the chaff. We pick the best analysis and send it to you.

Often, these are confidential, client-only reports and letters that you would otherwise never see and that we have special permission to share with Over My Shoulder subscribers. Thanks to Patrick’s short, to-the-point summaries, you can quickly scan each issue and read only the ones that matter to you.

A few examples of what you get…

- Policy expert Bruce Mehlman reveals what’s going on in Washington in the Time of Corona—and how the virus is rearranging the DC policy agenda.

- Unlike most pundits, economist Anatole Kaletsky doesn’t think the coronavirus outbreak signals the end of economic growth, in When to Catch a Falling Knife.

- In China Private Sector and Coronavirus, China veteran Simon Hunt discusses why he thinks the damage isn’t over for Chinese small and medium businesses, which make up 80% of employment.

- An in-depth analysis from our friends at Gavekal on why the Coronavirus Is Far from Priced In.

- After the Fed lowered interest rates, we got a pretty strong Fed Action Reaction from our friends Peter Boockvar and Michael Lewitt, with the latter calling the Fed a “confederacy of dunces.”

In short, COVID-19 is not just a health concern. The global economy is so intertwined that a factory worker who coughs in China can wipe out Italy’s GDP.

We will keep reporting on the coronavirus and its economic fallout in Over My Shoulder as long as the threat lasts. To make it easy for you to stay informed, for a brief time you can get an Over My Shoulder subscription for just $9.95 a month. Do yourself a favor and sign up today.

New York and Final Thoughts

I will be flying to New York next Tuesday for several meetings and dinners. I am curious what I will find in the Big Apple.

This week, I was on a conference call with several hundred, high-net-worth investors. I told them I think this crisis will present a number of positive opportunities. There are already high-quality stocks whose prices have fallen enough to put dividends in the 7% range. A US 10-year bond below 1% vs. 7% in a company that has increased its dividend every year for decades? I know which I would want.

I encouraged the listeners to make a “watch list.” At what price would you like to buy X company? When do dividends become absolutely compelling? For those with more to invest, the private, fixed-income world has some absolutely screaming opportunities.

Look, we know many thousands of coronavirus tests will be done in the US in the coming weeks. Obviously, these tests will give us a spike in virus cases, and the media will breathlessly report it. Maybe you buy the rumor and sell the fact. Perhaps it is time to buy today. I don’t know. But I think I would wait to see the reaction. And by waiting, I mean with my “watch list” in hand, waiting for my own personal buying opportunity. Some are already here.

We have no way to know what will happen in the short term. It is tragic for many, and we should all take the health risks seriously. But it will pass. As investors, we need to both manage the risks and consider the opportunities.

And with that, I will hit the send button. You have a great week. I am looking forward to being in New York with lots of friends. Maybe doing a little more fist-bumping than hand shaking, but enjoying the time nonetheless.

Your simply going about his life analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin