China’s Command Innovation

-

John Mauldin

John Mauldin

- |

- September 7, 2018

- |

- Comments

- |

- View PDF

Hardly a day passes without some sort of China news in the financial headlines. There’s a good reason, too. China is the global economy’s 600-pound gorilla, second in size only to the US. Yes, it was largely a copycat business economy up until the early 2000s, but Chinese entrepreneurs have really taken charge in the last 10 years. Fueled by the profits from huge consumer demand, they are expanding not only in China but globally. This story is largely ignored in the US and in much of Europe. We hear about a few projects here and there, but we don’t understand the extent.

China is on its way to becoming the largest economy in the world, which because of its population, it should be (possibly with the exception of India, if they ever get their act together). Short-term events and arguments sometimes obscure this longer-term reality. China’s transition from rural poverty to export powerhouse to consumer goliath may be the most consequential economic event in centuries. Possibly ever—I can’t think of a historical example to rival it. Historians might argue the British Empire or even the US from 1800–2000, but that took centuries. China has done it in a little over 30 years.

When I say “consequential,” I mean they can be either good or bad. We’ve seen both and will continue doing so. Along with Worth Wray, I wrote a 2015 anthology on China called A Great Leap Forward? So this is not my first deep-dive into China.

Even so, periodically I like to step back and assess where we are in this massive change, and that will be my focus for the next three letters. Today and next week, we’ll look at the bright side: The good things happening in China, much of which will help the rest of the world, too. Just like the work going on in the US and Europe and other countries is helping the rest of the world. Entrepreneurs and scientists inventing new ways for us to better our lives is good for everyone everywhere. Then the third letter will consider some darker possibilities. It is not all sweetness and light in China, as long-time readers know.

I could start by going through all the stats on how big China is, but they are so mind-boggling, we really can’t process them. In just one generation, something like 300 million+ people went from rural subsistence farming to urban industrial and technology jobs. Some of the cities in which many now work, didn’t exist when they were born. Hundreds of millions more are waiting in the wings to make that same journey or have already made a journey to “smaller” cities of just a few million people (note sarcasm).

I can find 13 cities with over a 10 million population in China. There are literally scores over 5 million. But that doesn’t tell the story. China is currently creating 19 “super city” clusters by strengthening the links between them. HSBC projects that 80% of Chinese GDP will come from those cities.

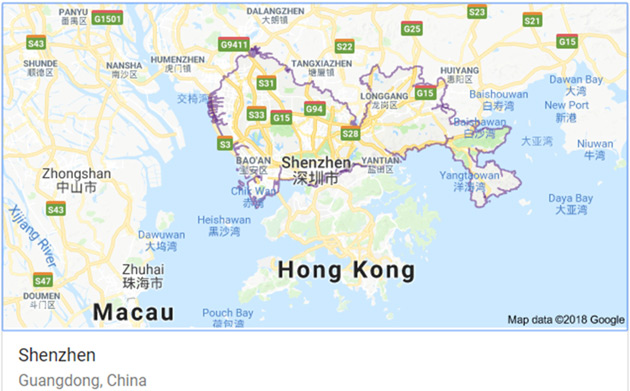

Last week, Financial Times reported Beijing plans to integrate former Western colonies Hong Kong and Macau with other nearby urban areas including Shenzhen and Guangzhou into this “Greater Bay Area.” Already, it accounts for 12% of Chinese GDP and 37% of the country’s exports. Beijing wants the GBA to lead the nation’s innovation and economic growth.

Photo: Getty Images

To that end, the government is pouring infrastructure investment into the region, including a 22-mile bridge connecting Hong Kong and Macau (not cheap!) with the mainland and a new $11 billion rail link for Hong Kong. It also plans to eliminate some of the bureaucratic barriers that presently slow down commerce.

“The GBA is home to a high concentration of dynamic private businesses, such as Tencent, Midea, and Huawei. It is also China’s most innovative urban cluster, generating more than 50% of the country’s international patent applications. And, according to HSBC, the GBA is the least burdened by inefficient state-owned enterprises and excess capacity.

“The reason is simple: The GBA is far more market-oriented than its counterparts, with Hong Kong and Macau much more open to the outside world than any other Chinese cities. Both cities not only permit the freer flow of goods, services, capital, technology, talent, and resources, but also meet global standards in terms of regulations, business practices, soft infrastructure, and even lifestyles.”

(Source: Andrew Sheng and Xiao Geng, Project Syndicate)

Part of this area is Shenzen, just north of Hong Kong.

Image: Google Maps

In 1980, Shenzhen was a fishing village of 30,000 people. Today, it produces 90% of the world’s electronics and is home to over 12.5 million people. It has 3 million registered businesses. It is compounding its growth at over 12% a year, doubling in the last six years.

The size of this region is hard to comprehend. With nearly 70 million people and $1.5 trillion GDP, it is economically bigger than Australia or Mexico. Guangdong (the mainland China part) alone exported $670 billion in goods last year. Three of the world’s ten busiest container ports are in the region. It will be Silicon Valley on steroids.

For that matter, it could be the US on steroids, at least geographically. From Hong Kong you can fly to Singapore, Kuala Lumpur, Bangkok, Manila, Shanghai, Seoul, and Tokyo as fast as I can get from Dallas to San Francisco. This Greater Bay Area will be the center of the world’s fastest-growing region, with billions of smart business people, scientists, and consumers.

According to Wealth-X, Hong Kong just overtook New York as the world’s largest concentration of ultra-wealthy people (net worth of $30 million or more). Their study specifically attributes it to enhanced links with mainland China. Look for this to continue.

Research Capital

When Americans import Chinese goods, we get stuff we want and China gets our US dollars to spend. Ditto for China’s other customers. They receive goods, China receives cash. On this end, much of what we purchase ends up in landfills, or like our iPhones, being replaced every few years. Not so over there. They often spend our cash more wisely than we use their doodads. (Infrastructure is a good example. Many Chinese highways, railroads, and airports are far superior to ours.)

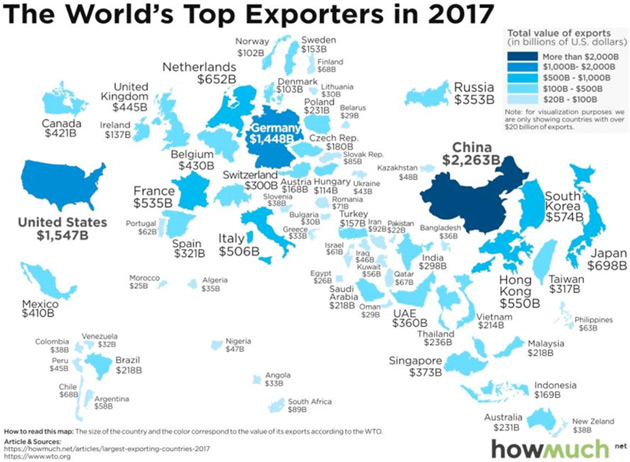

This is a great chart on the world’s top exporters in 2017. While you can easily see that China out-exports the US, I find it interesting that Germany is almost the size of the US, and that the Netherlands, with only 17 million people (barely 5% of the US population), exports $652 billion. On an export dollar per population, why isn’t the US worried about the Netherlands?

Image: Visual Capitalist (Click to enlarge)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Beijing sees this same data and realizes its leadership is not guaranteed. China needs to develop its own technology, and doing so requires research, and research requires capital. So, through a combination of government edicts and profit-seeking, it is right now in a major effort to build its own innovation economy.

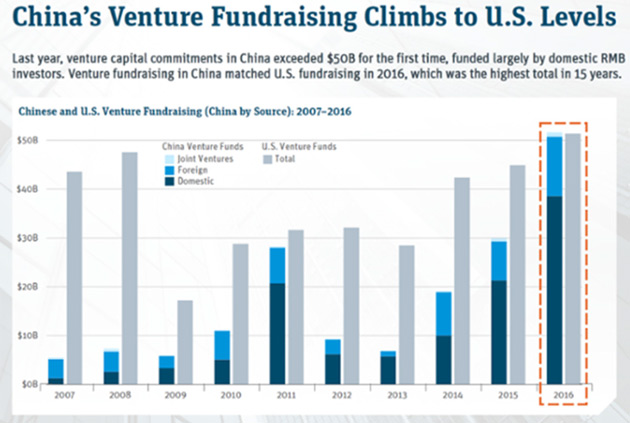

The plan isn’t complicated. To summarize, “Throw money at it.” Beijing is forcing money into venture capital at an astonishing pace. My friend Peter Diamandis toted up the numbers last month.

By end of 2017, 3,418 Chinese VC funds were launched within the year, raising a combined $243 billion USD or 1.61 trillion RMB.

Of the $154 billion worth of VC invested in 2017, 40 percent came from Asian (primarily Chinese) VCs. America’s share? Only 4 percentage points higher at 44 percent.

In the first three quarters of 2017, 493 state-backed funds were founded with a capital size of 114 billion USD (756.8 billion RMB).

And as of two years earlier, Chinese VC coffers had surpassed a remarkable $336.4 billion USD.

In a great push to scoop up intellectual property and drive growth in key tech sectors, China’s VC scene is booming.

As of 2016—before the numbers Peter lists there—China VC investment had roughly caught up to US level. Now it is probably ahead.

Image: VentureBeat

Of course, merely spending money isn’t the same as spending it wisely, nor does it mean the resulting products will succeed. But the research is the first step, without which little is likely to happen. AI doesn’t invent itself (yet).

Peter Diamandis says Chinese VC firms are targeting three segments: robotics, driverless vehicles, and biotechnology. I can see why, too: demographic necessity. It’s odd to imagine labor shortages in such a huge country, but that is a growing problem for China. Decades of the one-child policy produced a severe age imbalance. Robotics and driverless vehicles will address that problem, while biotechnology may help China avoid the healthcare spending that weighs down the US economy.

Yet this is good news for the whole world. Chinese innovation in these segments won’t stay in China. They will export it and, if it’s better than what others produce, the market will let everyone benefit. So, I hope they go full speed ahead. May the better tech win. (Of course, I will still root for the home team!)

Paper Wars

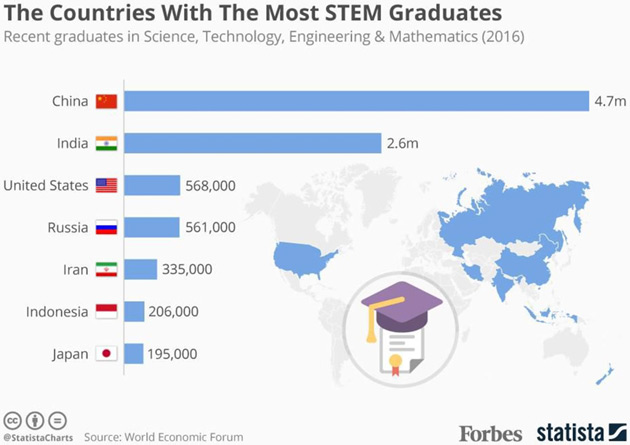

It is common knowledge that China has produced more scientists and engineers for decades than the West has combined. Many of us had suspicions about the qualities of the universities and their degrees. They couldn’t be as good as ours, could they? Well, we’re beginning to see the answer to that, and it turns out they were comparable and possibly even better in some areas.

As a graphic indication, here’s the countries with the most STEM graduates:

Image: Forbes

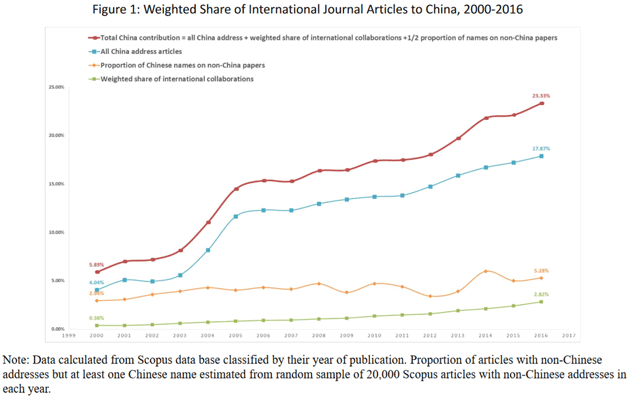

We know China’s contribution to scientific knowledge has grown, but how much so is less clear. Exactly what counts as “Chinese” research? You have Chinese people working both within China and in other countries, including at many top US and European universities. How do we categorize their contributions? It’s hard to assess.

A recent study gives us new data. Last month, Quartz cited a study by Qingnan Xie of Nanjing University and Richard Freeman of the National Bureau of Economic Research, which looked at the number of scientific papers with Chinese authors. Unlike other such studies, they included not just authors in China, but those with Chinese names but located elsewhere.

That’s an imperfect standard, of course. You can have a Chinese name and live in Singapore. Many US citizens have Chinese surnames, and the Chinese diaspora is well known. Likewise, not all research by ethnically Chinese researchers will find its way back to Chinese businesses or government agencies, nor is every paper an equally valuable contribution to the world’s knowledge base. But the study seems as rigorous as possible, so I think the general findings are probably right, at least in their direction.

Xie and Freeman found that in 2016, roughly 24% of scientific papers had an author with a Chinese name or address. If you include Chinese-language papers, it jumps to 37%.

Image: NBER

Looking at it another way, China has 15% of global GDP but produces more than a third of the scientific papers. It seems those university degrees are beginning to pay off in actual research.

Again, we’re not considering the value of those papers. Some may be worthless. But just in terms of output volume, China is producing far more research than its share of the world economy and population says it should. As the chart shows, this figure has been trending steadily higher, too.

Now, recognize how breakthroughs happen. They are often a consequence of large numbers. The more smart people you have trying to solve a problem, the more likely one of them is to solve it. Most will fail and that’s ok. All you need is one success.

If China has more scientists working on more problems than anyone else—and it does—then we can expect China to find more solutions, other things being equal.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As I said, this is okay from a global perspective because we will all get the benefit of those breakthroughs. But we won’t get it free, and the price will be higher for us in the US if we have to import it from China.

So, this is not a race the US or Europe or the West or anyone should concede, but we are conceding it in some ways. For instance, when we admit Chinese students to study at our top universities then don’t let them stay here to build their careers. We educate them and send them back. It makes no sense. We should give them a green card and an open door. You think they are taking jobs? No, they are creating jobs in China when they could be creating jobs here. Just saying…

A Place to Innovate

Matt Ridley says human progress and prosperity make the greatest leaps when “ideas have sex with each other.” They produce offspring, in other words. This creative process happens faster and more easily when the idea-holders share proximity. Many inventions come from large cities not because city folk are any smarter, but because the necessary mix of ideas was in the same place, at the same time. In the US, Silicon Valley often serves this purpose. Along with Austin, Dallas, Boston, New York, and others.

China has abundant venture capital to fund research and large numbers of researchers cranking out ideas. It needs a central place for those ideas to have frequent sex with each other. The government is aware of this and, in true command-economy style, has decreed it will happen in the Greater Bay Area I mentioned above.

Economic growth is largely a numbers game: workers times productivity. China already has both ingredients and is working assiduously to enhance them further. For now, the US is still ahead, but we shouldn’t be complacent. Nothing requires the global economy to keep us in the lead, and we are not doing what we should to keep it.

There are literally books written on this. Everywhere you turn is an amazing story. Many readers are going, “Okay, China has a lot of large cities and fast trains. So what?” Serious research shows that creativity goes up the larger the city gets, measured in either new businesses or GDP or patents. Putting humans together has been a spark for new ideas since man first began to organize cities 10,000 years ago.

But large cities are not the real story. China is shifting from an export-driven to a consumer-driven economy. That will be a rough transition in itself, but the government is leaving little to chance. Here in the US, we’re skeptical of central planning. I certainly am. But I have to admit, if it’s possible for a centrally planned economy to achieve sustainable long-term growth, China will be the one to do it.

And again, there is decades old accepted economic research to demonstrate that a centrally planned economy has some advantages in the early stages of development. The transition to a consumer-oriented society is the most difficult for a top down, centrally planned economy to manage. So far, China seems to be letting entrepreneurs put capital to work without having to tell them how to do it. They just give them the tools and, sometimes, the money as well.

Next week, we will look at some even more astounding data, then later go on to what could cause China to stumble. Remember those 1980s predictions Japan would own the world? It turns out you can only do so much on credit. Stay tuned.

New York, Houston, and Dallas

I leave for New York City on Sunday to meet with my Mauldin Economics partners, Ed D’Agostino and Olivier Garret, to talk about some new ventures and the conference and so on. We try to get face-to-face every few months to go over the details and keep up with what is happening with each other.

After a day of meetings, the next night I will have a small dinner with Art Cashin and some of the usual suspects. The next day will be videotapes and maybe some media. Then in theory, I’m in Houston next Thursday night for a meeting at Rice University and dinner with the RISE committee (The Rice Initiative for the Study of Economics). This is an extraordinarily interesting group of people and gives me a chance to get back to my old college stomping grounds. Sometime that day, I have to do the next letter. And then maybe some more meetings Friday before I fly home.

I will be doing two presentations in Dallas on October 4 (my 69th birthday) at the Dallas Money Show, which is at the Hyatt Regency Dallas. Click on the link to register for free.

This letter is long enough, so I’m just going to hit the send button and wish you a great week!

Your trying to get into the gym more analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin