A Little Harder

-

John Mauldin

John Mauldin

- |

- May 13, 2022

- |

- Comments

- |

- View PDF

The Strategic Investment Conference wrapped up this week with another wave of strong, fascinating speakers and panels. I gave you some highlights in last week’s Soft Now, Hard Later letter. Today I have more to share and, as you’ll see, the plot thickened considerably.

After 16 years I’ve learned how this goes. You begin with more questions than answers. As the event unfolds, you have even more questions and even fewer answers. That may sound frustrating, but it’s critical. Finding the right answers starts with asking the right questions. They aren’t always obvious.

Today we’ll review some (not all) of days 2 and 3, the heart of the conference. I’ll have more recaps for you over the coming weeks but you don’t have to wait. You can still buy a Virtual Pass and watch video recordings of the entire conference. We’re also posting transcripts as fast as my team can produce them. All should be up in the next few days. Click here to get your pass.

Habib & Stockton: Mortgages in Recession

I’ve mentioned Barry Habib a few times recently, and in depth about a year ago in Tiny Housing Bubbles. Read that letter again and you’ll see he was right on target about the residential real estate market. I brought Barry back to SIC for 2022, paired with technical market analysis expert Katie Stockton. It was a power-packed hour, to say the least.

Barry has a nuanced outlook. He foresees more inflation and probably a recession, but also thinks housing will continue to do well. It typically outperforms in recessions. The 2008‒2009 decline was a notable exception he thinks won’t happen this time.

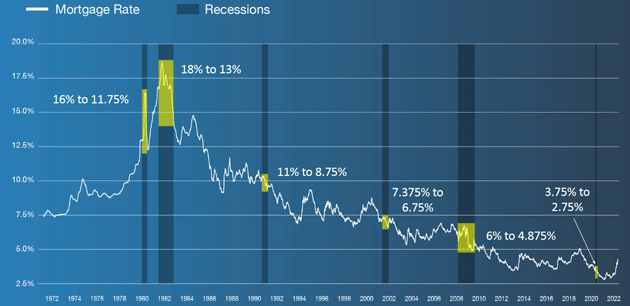

Here’s a chart from Barry’s slide deck (which, by the way, is included in your SIC Virtual Pass) showing the change in mortgage rates during the last half-century’s recessions.

Source: Barry Habib

As you can see, mortgage rates tend to peak just before or early in recessions. Barry expects the same this time if the Fed succeeds in dampening inflation. That would be good news for the housing market, and suggests a possible bond buying opportunity, too.

Speaking of bonds, Katie’s bond analysis got tested in nearly real time as the markets were in turmoil last week. The 10-year Treasury yield turned around right near the level where she said it would hit exhaustion. She expects several months of sideways to lower movement before it continues higher. She also gave us her outlook on stocks, crypto, the VIX, gold, and oil.

Resource Security Panel

We closed out Day 2 with a fascinating panel on National Security and Natural Resources, moderated by good friend and brilliant thinker Renè Aninao. He’s one of the most prescient thinkers I know. He brought his associate Sam Rines along with three top resource experts: David Brocas, Nicholas Hoyt, and Dan Pickering

Renè started by reviewing his 2020 SIC talk, called The Gods that Failed Us. He essentially argued that faith in central banks, technology, and healthcare was waning. He said we were entering a period when national security would drive markets. Barriers would rise against what had been an age of globalization and relatively free movement.

Source: Renè Aninao

He was certainly right about that, and now we are seeing how access to natural resources is so economically critical—and not just energy resources, but the panel started there.

Since he was so right on that prediction, I thought I would throw in one of his latest slides where he sees the world changing over the next 30 years. This wasn’t at the conference but it really speaks to me:

Source: Renè Aninao

Dan Pickering then broke down the energy situation over the last couple of years. We entered the COVID era with cyclical market tightness, a result of the shale boom creating excess supply and then a years-long downturn. COVID pushed energy demand even lower. So now we have an energy industry that hasn’t invested in new production capacity, combined with OPEC fighting for market share.

Meanwhile, in the background, many governments and consumers wanted to shift away from fossil fuels, leaving an industry even more reluctant to make long-term investments. Companies adopted “capital discipline,” which basically means plowing most of the profits into buybacks and dividends instead of future production.

All that was already happening then the Russia sanctions pushed energy prices even higher. Dan sees little hope for short-term relief. That means the energy sector is a good bet to keep outperforming, in his view.

High fuel prices are helping drive the trend to electric vehicles, but there you run into other resource constraints. David Brocas runs Glencore’s global cobalt trading. Cobalt is a critical material in most EV batteries. He pointed out the auto industry doesn’t quite know how to operate in a commodity-scarce environment. They’re used to buying parts and materials in vast quantities to get lower prices. Cobalt doesn’t work that way. The price rises as you try to secure more supply.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Another difference, though, is that the cobalt doesn’t get consumed. An old electric vehicle has the same amount of cobalt as it started with new. It can be extracted and reused. (Cathie Wood later mentioned that Tesla is running a massive effort to reuse the materials from old and used batteries.)

Next, Nick Hoyt, a veteran agricultural trader, talked about fertilizer and food challenges. It is a global mess, frankly, and we in the US will have it relatively easy. Many developing countries face terrible situations after losing Russian and Ukrainian food exports. Now some governments are responding to public pressure by cutting off exports—Indonesia recently banned palm oil exports, for example.

Weather is another giant wild card. Wet weather in the US Midwest will likely mean fewer corn acres planted, and a smaller harvest down the road. Nick says all the food we consume is likely to stay expensive for some time.

Finally, Sam Rines talked about the effects of all this on consumer behavior. People prioritize the must-have goods. If food and energy prices rise enough, they start reducing the kind of luxury goods (Sam called them “useless”) that drove economic growth over the last decade. Netflix, for instance, is a consumer good you can cut very quickly. Given a choice between videos and bread, people will buy bread.

Renè asked for a quick summary of their best ideas.

-

Sam Rines said his favorite trade is to sit on his hands until we get clarity on the economy and supply chains. Ask policymakers to please don’t do anything.

-

Nick Hoyt: Prices aren’t high enough. Policies are impacting countries and bringing higher prices everywhere.

-

Dan Pickering: On the policy side, decide if you will handle the energy market from demand or supply side. As an investment, energy is too cheap. Don’t be underweight energy. Energy is 4% of S&P and going to 8%.

-

David Brocas reminded us that if you want to electrify society you must create a mining-friendly environment. Recycling won’t replace mining in the foreseeable future.

As we saw in the April CPI data released this week, inflationary pressures may be stabilizing but they are not reversing yet. This has a cumulative effect the longer it continues. The pain is adding up.

Gavekal Times Three

We were extraordinarily privileged to have a panel of Gavekal’s three co-founders: Charles Gave, Louis Gave, and Anatole Kaletsky. All three are brilliant and still active in the business, but they rarely appear together this way. The interaction among them is fun to watch, on top of everything you learn.

Another point about Gavekal: They freely and frequently disagree with each other. Unlike many research groups, they don’t have a “company line.” I find this extremely valuable. It’s a bit like the adversary process in a criminal trial. Vigorously arguing different viewpoints is a great way to reveal the facts.

What they are uncovering now isn’t great news. Ahead of the Ukraine war, they still held out hope the pre-COVID trends would resume. Those trends were going to bring big changes, but in a slow, manageable way. Now they have a different outlook with a bearish bent.

Remember, inflation was already a growing problem by late 2021, long before Russia moved into Ukraine. Anatole called that the result of COVID-driven monetary expansion, and previous policies dating back to 2008. The additional war-driven increases in food and energy prices turned preexisting inflation into a hard-to-control bonfire. Anatole has been an enormous bull since 2009. He turned bearish less than a month ago which was quite a shock to some of us.

Charles Gave emphasized how passive management is dying. Decades of generally (though not always) positive market conditions trained generations of money managers in a certain worldview that is now gone. Managers will have to adapt, and some will adapt slowly. You could get by without tactical asset allocation in the non-inflationary times. Not anymore.

Another problem is globalization’s reversal. This was already underway, but the pace is increasing. While we usually think of it in terms of physical supply chains, Louis stressed it includes financial flows, too. Trade policies, sanctions, and security concerns are all constraining capital into regional boxes. US money increasingly stays in the US instead of going to China, for instance. There may be good reason for those policies, but they will have side effects. Charles said we are in the beginning stages of a major liquidity crisis. He thinks the panic stage is getting closer.

Friedman: Transition Point

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Next, we heard from Dr. George Friedman of Geopolitical Futures. George has the unique gift of observing history unfold with a long-term, dispassionate eye. His past life in the CIA lets him view events as the various participants see them. It’s a rare and valuable perspective.

As George sees it, history goes through cycles. There are transition points between them. In 1945 the world changed radically as Imperial Europe gave way to American dominance. Europe itself was split in two, the US controlled the seas, and a long Cold War followed. That period’s military and economic struggles ended very suddenly in 1991. A lot happened that year. The Soviet Union fell, Europe united (or tried to), Japan’s long boom ended, the US put boots on the ground in the Middle East with Desert Storm. A different world was born.

What followed was a period where economic collaboration was going to render national borders irrelevant. The world would have a single integrated economy that would solve all our problems. That was always a bit of a pipe dream, but it lasted a few decades. George said it would have lasted longer if not for COVID.

The pandemic exposed the limits of globalization. China’s growth relied on perpetually rising exports, which is impossible. Chinese leaders know this and have been trying to build domestic demand. For now, though, China is still the world’s largest exporter and the US is the world’s largest importer. This puts the two in an awkward balance.

Meanwhile, Russia under Putin was trying to reconstruct its old borders against the wishes of people in places like Ukraine. Their invasion has not gone well; rather than splitting, the NATO alliance is stronger than ever. Moreover, Russia didn’t anticipate the economic warfare and massive weapons transfers to Ukraine.

George says Russia is essentially a third-world country, its military is a joke and it is a “power” only by virtue of having nuclear weapons. The country lacks the ability to process its commodity wealth, especially with the brain drain of Western technology experts leaving the country. How do you keep your oil wells producing without Schlumberger and Halliburton? Texas production would grind to a halt in short order without these companies. What makes us think it will be different in Russia? George sees a real chance Russia could fragment again. Eastern Europe could become a larger economic power and maybe the next export powerhouse.

From there, George had some specific thoughts about Europe, Canada, India, and other places. It was such a wide-ranging conversation I can’t do it justice. You really need to hear the whole thing.

Bianco, Boockvar, and Inflation

Jim Bianco and Peter Boockvar have been among my most valuable sources for many years, but especially so since 2020. Both have been doggedly following the economic data and, more important, pointing to where it will go. And doing it pretty accurately, I must say. I put them together for SIC just to kind of see what would happen.

Peter went first. Back in late 2020, he was expecting serious inflation while many others were still on the transitory bandwagon. One reason for that is he is a bottom-up money manager and listens to so many corporate executives on their quarterly earnings calls. He has a good sense for how they think and react to changing conditions. Here’s a bit from the transcript.

“If I'm a company making widgets and my transportation costs spike, my labor costs jump, the cost of my raw materials jump by 30% all of a sudden, I'm not calling up Walmart and saying, ‘Hey guys, I need to raise your prices by 30%.’ You're going to spread out those price increases over time to regain that lost profit margin. Now you will cut costs as much as you can, you will set your labor force to where you think it should be right.

“But those price increases, even if your cost pressures stop going up, you want to get back to where you were pre-inflation in terms of profit margin, you are going to continue to raise prices…. Pass on as much as you can. Mitigate it as much as you can via faster productivity and cost cuts and what fully can't be priced or recovered is obviously lost profit margins.

“And then at some point, the question is, and I'm going to go through that in this presentation too, when does the consumer say no more? Where is that breaking point where price increases to the consumer, or to that business, stops because it can't be absorbed anymore and there's pushback? And that's what we're about to find out.”

That’s an ominous note for inflation. It means consumer prices could stay higher for longer as companies try to recover their own higher costs and lost profits.

Jim Bianco then had one of his magnificent slide presentations. He has a screen where he can actually draw on the slides as he speaks, a bit like John Madden doing football analysis. (I can’t reproduce that here, obviously, but you’ll see it on the video).

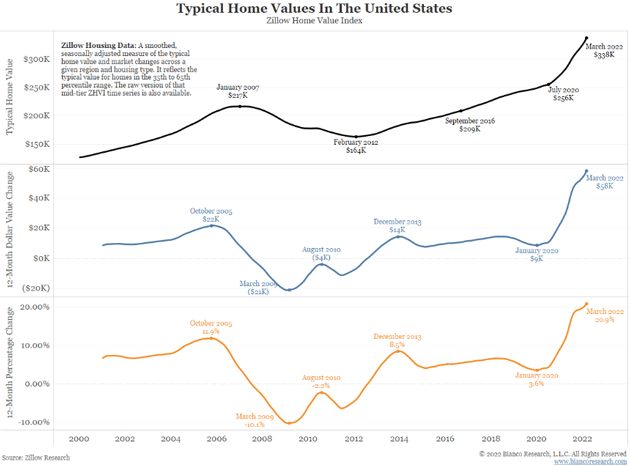

In Jim’s view, the US has more inflation than other countries because we stimulated more than other countries, through both fiscal spending and monetary policy. This showed up in home values. Here’s one of his slides, with the accompanying comments below.

Source: Bianco Research (Click to enlarge)

“As of March, the typical home value was $338,000. As the middle panel shows, the 12-month change on that was $58,000 or a 20.9% increase. So let me restate that for emphasis. The median home in the United States went up $58,000 last year. As was pointed out by the chief economist of Zillow right here, the median income in the United States, it's $50,295. Sitting in your house, your house made you more money than you earned on your job. That has never been the case, anything close to that. Not even in 2006. Median income then was $47,000. And we peaked out at $22,000 of the average home price gain in October of 2005. Massive stimulus in the housing market.”

That’s just a staggering data point. And if Barry Habib is right, those home prices may hold up for quite some time.

All right, we aren’t even through Day 3 and I’m already bumping up against my word limit. So, we will stop there and pick up next week with the incredible China panel, Felix Zulauf, Howard Marks, Henry Kissinger, and more.

Better yet, get your own Virtual Pass and you can watch it all right away, including the parts I can’t include here.

Vancouver and Old Friends

I have been so fixated on the SIC, I almost forgot that Monday I fly to Vancouver for the Cambridge House conference. I’m really excited about being in front of an audience again. Looking at who else is on the agenda made me feel good, too. I’ll get to see old friends that I’ve only met on video calls these last two years.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The trip does have a downside, though. Getting from San Juan to Vancouver is a long 12-hour day, and another one to return. I’ll have a lot of reading time, and maybe a little Twitter time. You should be following me on Twitter.

It's time to hit the send button. You have a great week and if you’re in Vancouver look me up.

Your still meditating on what we’ve heard analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin