25 Years and Counting

-

John Mauldin

John Mauldin

- |

- August 9, 2024

- |

- Comments

- |

- View PDF

I can't let this month pass without noting a significant anniversary: This is the 25th year I’ve been writing Thoughts from the Frontline. The first few issues were lost to the electronic gods and my lack of technical prowess back then. That quickly changed. You can visit the archive and see every issue since January 2001 (including, trust me, some I would like to remove). That's roughly 5 million words, not counting 7 (soon to be 8) books, numerous papers and articles, speeches, emails, and more. Someday I should learn to type.

I started with 2,000 email addresses gleaned from 40,000 readers of a prior print newsletter. Not as many people used email back then. By the next year I had 6,000 names and then it was 25,000 and then it was 100,000 and then it went to well over 1,000,000 names at one point. The technology to handle that type of expansion was daunting. Somehow, we did it.

The letter was and still is free. All you had to do was give me your email. Now I know I should have at least asked for a zip code and maybe your name. There is actually no way we can go back and see how many of the original 2,000 names are still reading me 25 years later. But I know many of you subscribed early on.

I can't tell you how much I appreciate you inviting me into your home or office every week. I truly appreciate those of you who found value in my early and even now humble writings and then recommended my letters to your friends. In the beginning, free newsletters like mine were rare. But that changed over time. Now the competition for your attention is so over the top, and there are so many good writers.

Over time, we figured out how to turn a free letter into a business, through other publications, referrals, and other smaller services. So many people have helped me over the decades. Along the way I joined forces with a brilliant publishing management team. Without them, I’m not sure what my world would look like. And you, dear reader, have allowed me to explore so many thoughts and share them with you.

So many friends. My life is truly blessed because of you. From the bottom of my heart, I can't adequately say how much I appreciate you. Thank you, and here's to hoping we can do another 25 years.

Now, let’s jump into this week’s letter. Much has been happening on many fronts.

Known Unknowns

July was exhausting for news hounds like me. I can’t remember a month like it, except maybe in 2008, with every day bringing new shockers. Now August is taking it all to another level as we get blasted with unexpected economic data and huge market moves.

I think this will continue as we move closer to a critical Federal Reserve policy change on Sept. 18. Every data point will be dissected (and exaggerated) for how it affects the Fed’s choice, the election, and our daily lives. And it will be blown out of all proportion, as that is what makes viewers and readers listen and click. If it bleeds, it leads. Calm is not good copy.

I would like to wrap all this into a single, coherent narrative for you. We all want to think there’s some order to the world, that somebody can see what’s happening. Alas, that’s not how it works. No one knows where this is going. We are lucky if we can get the cardinal direction right.

What follows is some of the interesting analysis I’ve seen in the last week. Think of these as pieces of a puzzle. It’s not clear how they all fit together, or even if they fit together. But they give us a starting point.

These are what Don Rumsfeld called “known unknowns.” We may not have the answers… but at least we know some of the questions.

Crossing the Line

This month’s first big economic data point was the US jobs report, released last Friday. The labor market which has been slowing for a while appeared to cross a line. This sparked recession fears and market volatility.

My friends Philippa Dunne and Doug Henwood at TLR Analytics follow the employment data closely and systematically. They often pick up nuances that others miss. Here’s some of their takeaways.

“A weak report, and the two surveys were singing in gloomy unison. The Sahm rule was triggered, suggesting a recession is already underway. [JM—Although apparently even Claudia Sahm, who created the rule, is skeptical.]

“Temp employment, often thought of as a leading indicator, is in a serious downtrend—off 266,000, or 9%, since January 2023. Out of those 18 months, the sector was off in 16.

“The workweek fell 0.1 to 34.2 hours, tying the January 2024 low for the cycle, and at the 10th percentile of all months since the all-worker series began in 2006. The manufacturing week was down 0.2, but services were unchanged.

“Average hourly earnings (AHE) were up 0.2% for all workers and 0.3% for production/nonsupervisory workers (81.4% of the private-sector workforce). For the year, AHE were up 3.6% for all workers and 3.8% for the nonsupervisory. The yearly gains are the lowest since the early pandemic distortions cleared and are only a bit above 2019’s averages.

“Household numbers don’t offer much comfort. The labor force grew by a large 420,000, taking the participation rate up by 0.1, but employment gains were weak: up 67,000 overall and down 19,000 when adjusted to match the payroll concept. That took the employment/population ratio down by 0.1.

“The weakness of this report—with forward-looking elements like temp employment and the workweek especially saggy—makes a September rate cut a near certainty… It’s a pretty safe bet the interest rate cycle has turned.”

These latest numbers aren’t terrible, historically speaking. The problem is they are all getting steadily worse. At this pace, “terrible” is only a few quarters away. But will it keep this pace? Get better? Worse?

Valuation Concentration

I’ve talked a lot about stock market valuations, which have been frighteningly high for some time yet have gone even higher. That’s the nature of bull (and bear) markets. They go higher (and lower) than anyone thinks possible.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

My friend David Bahnsen had an interesting perspective in one of his recent Dividend Café letters (to which you can and should subscribe here). It turns out the excess valuation is entirely a function of one particular sector. You can probably guess which one but read this:

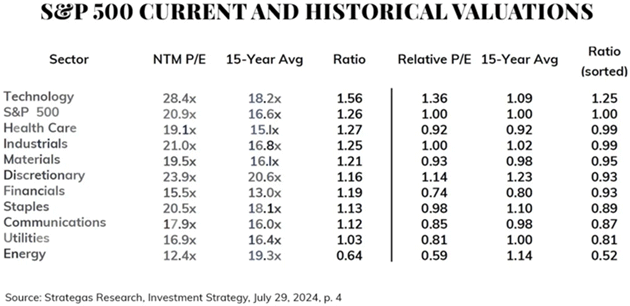

“This chart does three things that are worth noting. One, it shows the S&P 500 is 26% above its own historical valuation. That does NOT mean ‘it is about to go down 26%.’ It just doesn’t. Earnings can come up. Historical averages can move higher. Over-valuation can stay over-valuated for longer than expected. For our purposes, all this chart says is that the S&P’s FORWARD earnings multiple is 26% above historical averages.

“But then it shows a few other things in terms of valuation—it shows that, by their own historical averages, energy is deeply under-valued, Utilities are in line, and Technology is 56% above its own historical average. Now, Communications, Staples, and Financials are above their average, but not by a lot. In other words, this shows that (a) The market is over-valued, (b) Energy and Utilities are not, and (c) Almost all of the over-valuation is in Technology. Okay, fair enough. But what else does it show?

Source: David Bahnsen

“If you adjust the S&P to its current valuation, and then look at how all the other sectors are valued relative to the S&P’s current valuation, ONLY Technology is over-valued. It measures the sectors relative to one another, in terms of historical relationships and valuations.”

John here again. To some degree, this won’t matter in a severe downturn. The baby will get thrown out with the bathwater. But it does suggest, to the extent you want to be in stocks right now, decent valuations are more common outside the technology sector. And no surprise, in high and growing dividend value companies.

Breaking the Law

Stock market movements—in both directions—are now mostly a function of the mega-cap tech stocks, driven mostly by artificial intelligence hopes. My friend Doug Kass questions the whole concept of AI and whether it can work with any economically feasible technology. He thinks Moore’s Law (the idea that the number of transistors per square inch of microchip can double every two years) is breaking down. Here’s Doug.

“I do not think the foundational technology to generative AI will ever work, a whole new approach is needed. Hallucinations are a feature, not a bug. The new approach does not yet exist.

“But to continue to milk the generative AI approach, which is currently much too expensive—operating and capital costs, including power—huge advancements in silicon technology are necessary. The silicon needs to get cheaper, and much more efficient.

“However, it is already getting really hard to do that. We seem to be at the point where Moore’s law is close to being tapped out. It is getting incredibly expensive and complicated to move down process nodes now. We seem to be at the end of the rope. I wonder if the whole industry has gotten way out over its skis and has really bitten off more than it can chew?”

Doug went on to quote an MIT piece on “The Death of Moore’s Law.”

“Moore’s Law was never meant to last forever. Transistors can only get so small and, eventually, the more permanent laws of physics get in the way. Already transistors can be measured on an atomic scale, with the smallest ones commercially available only 3 nanometers wide, barely wider than a strand of human DNA (2.5nm). While there’s still room to make them smaller (in 2021, IBM announced the successful creation of 2-nanometer chips), such progress has become prohibitively expensive and slow, putting reliable gains into question. And there’s still the physical limitation in that wires can’t be thinner than atoms, at least not with our current understanding of material physics.

“If you ask MIT Professor Charles Leiserson, Moore’s Law has been over since at least 2016. In conversation with CSAIL Alliances, he points out that it took Intel five years to go from 14-nanometer technology (2014) to 10-nanometer technology (2019), rather than the two years Moore’s Law would predict. Although miniaturization is still happening, the Moore’s Law standard of doubling the components on a semiconductor chip every two years has been broken. The implications are far-reaching and, Professor Leiserson admits, concerning, especially with the recent frenzy around generative AI and large language models (LLMs). He says the only way to get more computing capacity today is to build bigger, more energy-consuming machines.”

If correct, this is a giant problem for AI hopes—and for the stock prices those hopes have been justifying.

I should note that my friend Joe Lonsdale (co-founder of Palantir and other AI-driven companies) thinks AI is in the early stages. Both Doug and Joe may be right. The current approach to AI may face some difficulties, but other approaches may succeed. Human progress is still moving forward. In the long run, my money will be on Joe and his friends. That's what we do as humans. We figure things out and move forward.

Unwinding Trades

You probably noticed some news from Japan, which I have long called “a bug in search of a windshield.” Did the bug just go splat? Not quite, but it had a close call. And the car is still moving.

My friend Jim Bianco had a nicely succinct explanation which he posted on X, where you should definitely follow him (and me too, while you’re at it).

Jim started off noting that the Bank of Japan’s larger-than-expected rate hike set off a bunch of fireworks that people mistakenly blamed on the Federal Reserve. The real issue is an unwinding of the “yen carry” trade. Here is Jim’s explanation.

|

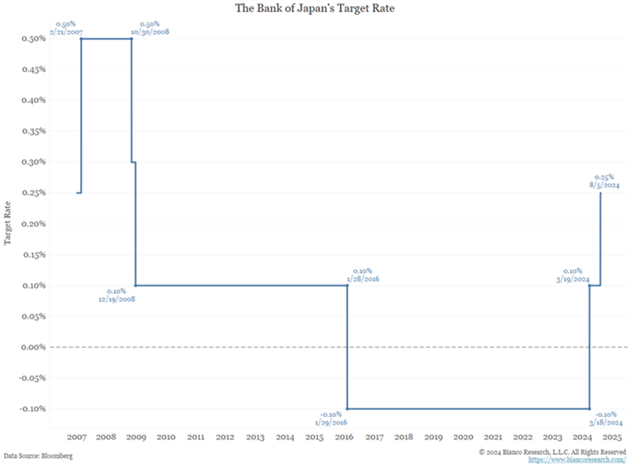

“Last Wednesday, July 31, the Bank of Japan hiked rates to 0.25%, its highest rate since 2008. This marked the second hike this year.

Source: Bianco Research

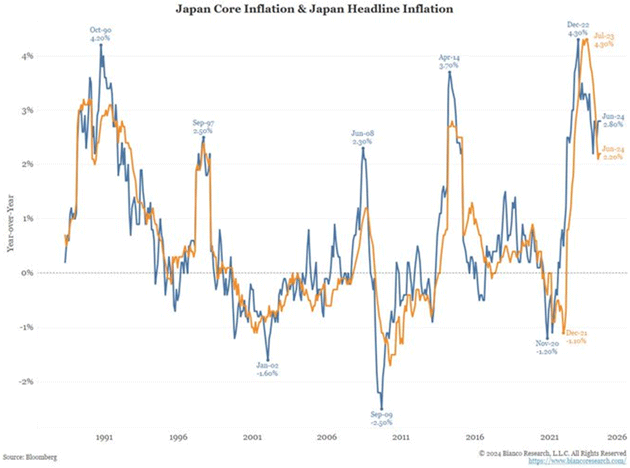

“The surge in Japan’s inflation drove this decision. While inflation has decreased over the past year, the concern is it will persist near current levels.

Source: Bianco Research

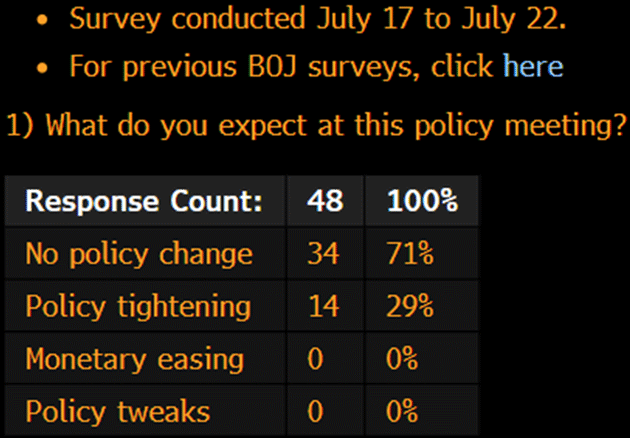

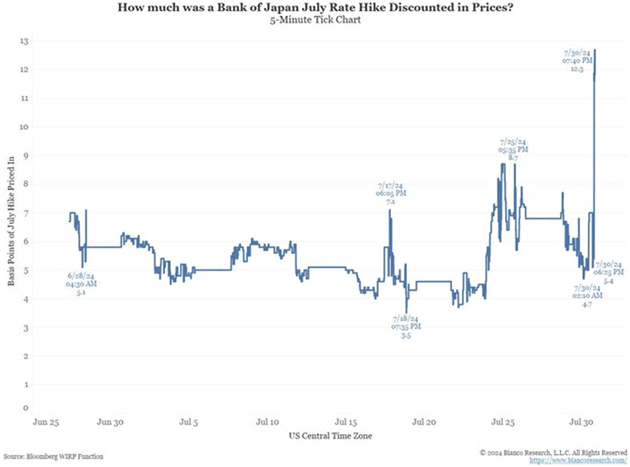

“Note only 29% of respondents to a Bloomberg poll expected a Bank of Japan hike on July 31.

Source: Bianco Research

“Overnight Index Swaps market (OIS) discounted just five basis points of hiking. When the Bank of Japan surprised with a 15 basis point hike (chart above), the post-meeting spike shown below indicates how much of a surprise this move was (last two labels).

Source: Bianco Research

“The surprise Bank of Japan hike led to one of the biggest unwinds of the yen carry trade.

“First, how big is this trade?

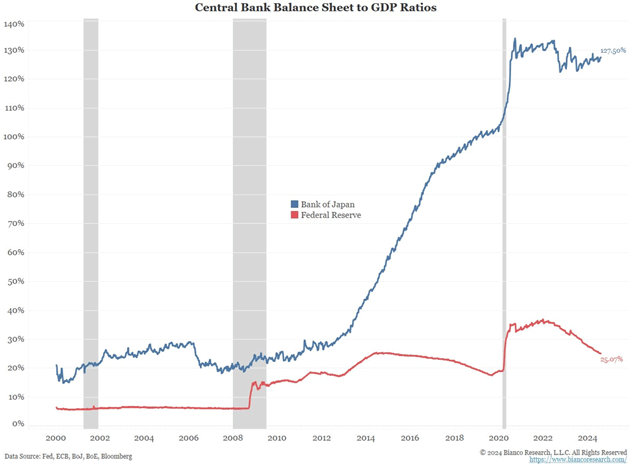

“No definitive statistic shows its size, so we have to infer it from the size of the Bank of Japan’s balance sheet.

“The chart below shows the Bank of Japan’s balance sheet is larger than the country’s GDP, at 127.5% of GDP. By comparison, the Fed’s balance sheet is 25% of GDP.

“If you think the Fed matters to markets, the Bank of Japan has a 5X larger influence on their economy.

Source: Bianco Research

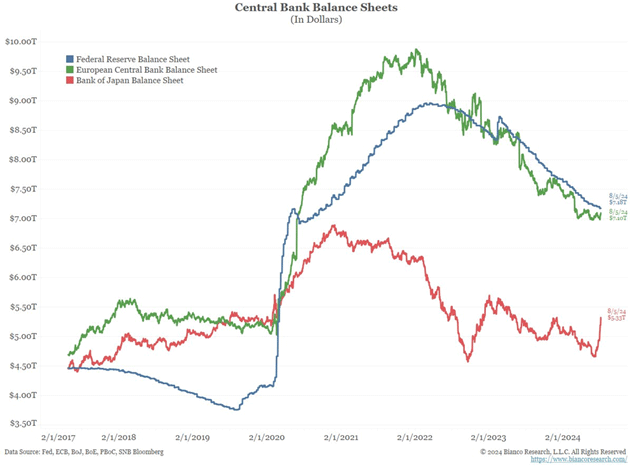

“Here are the absolute sizes of the central bank balance sheets.

Source: Bianco Research

“What Is the Yen Carry Trade?

“Japan’s short-term funding rates (shown above) were the lowest globally. They still are.

“However, short-term Japanese rates were also perceived to be predictable and would remain near zero for some time. When the time to hike rates eventually arrived, it would not look like last week: a surprise move with promises of more moves to come.

“With the cost of funding rising, we see massive liquidations of positions using this cheap money. [JM—The yen carry trade involves massive leverage, which magnifies a seemingly insignificant 15 basis point hike into a major bottom line hit for traders. Think Long Term Capital Management in 1998. When massive leverage is used, there is nothing long term about the trade.]

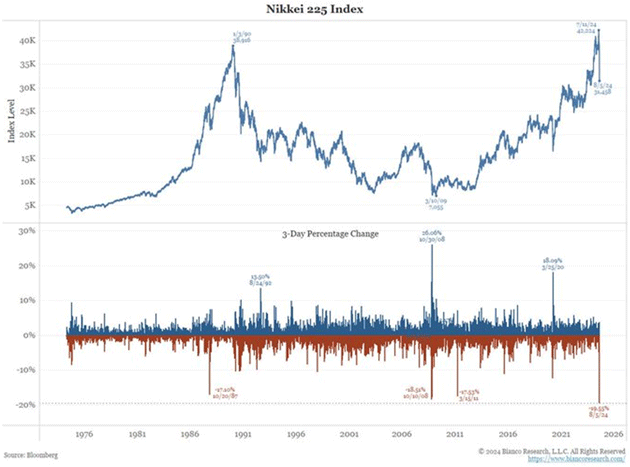

“Naturally, the biggest positions using the yen carry trade are in the Japanese markets. In the last three trading days, or since the surprise Bank of Japan hike on July 31, the Japanese stock market has crashed by 20%, even bigger than the three worst three-day moves during the October 1987 crash!

“If you’re looking for an indication of this trade’s size, this is as close to a smoking gun as you will find. Remember, the Japanese stock market does not crash because US payrolls missed expectations.

Source: Bianco Research

“The yen carry trade is also behind the funding of many markets outside Japan. But the Bank of Japan’s surprise move has strained these trades.

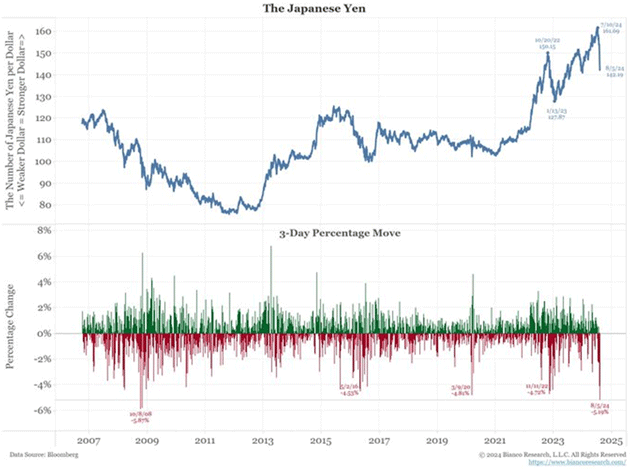

“The bottom panel of the next chart shows the dollar has lost 5% of its value against the yen over the last three trading days, again going back to the July 31 Bank of Japan meeting.

“Why? Global yen carry trades are being unwound in a big way. This involves existing positions in foreign markets, like the dollar, and bringing these funds home to Japan to close these funding positions. This causes massive buying of yen.

Source: Bianco Research

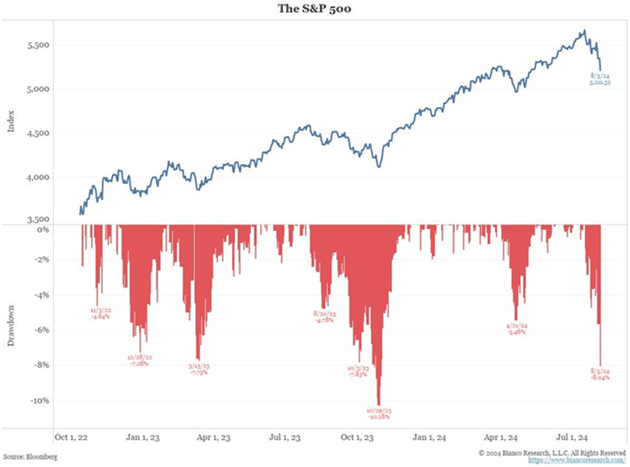

“This is causing a slump in foreign markets, such as the US stock market, which is seeing one of its biggest corrections since the October 2022 bear market low.

Source: Bianco Research

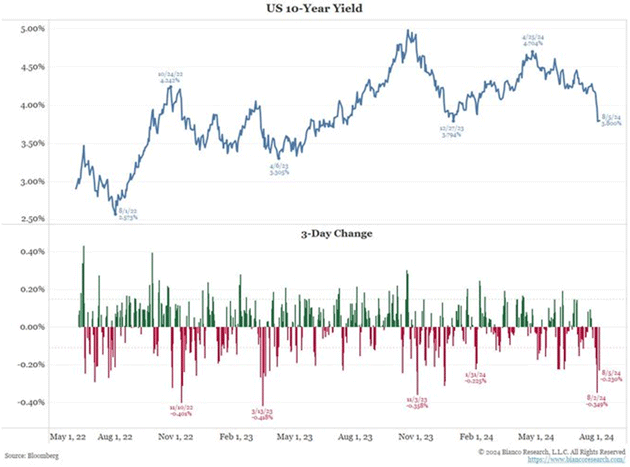

“As the next chart shows, the world is running to risk-off markets like US Treasuries, as all markets worldwide are under stress.

Source: Bianco Research

“Conclusion

“We would argue that much of the recent market chaos concerns financial issues around the yen carry trade. The Bank of Japan’s surprise move to increase funding rates, coupled with the belief that more such hikes are coming, spooked markets and led to an unwinding of this global trade.

“As this happens, we see plenty of stories attributing this move to the US economy. The Sahm Rule has been triggered, so there is concern the US economy is already in a recession.

“We frequently quote the late MIT economist Rudi Dornbusch:

“Economic expansions do not die of old age; they are murdered.

“Such financial moves can potentially ‘murder’ the economy into recession. The last such concern of a financial ‘murder’ occurred in March 2023, around the failure of Silicon Valley Bank. The economy was able to avoid this murder.

“We would guess the US economy can withstand the current yen carry unwind. Hence, we remain in the ‘no-landing’ camp.

“But there is a real risk the economy will not succumb to market volatility. Markets will remain chaotic until this unwind is done.”

John here again. I don’t have a good sense for how long this unwind will take. As Jim notes, this is a huge position for many large funds. I can imagine it taking several weeks, by which time we will be staring at the next FOMC meeting on September 18, followed by a BOJ meeting the next day. Any more surprises surrounding those could set off more fireworks.

Over the last 10 days, the bond, stock, commodity, futures, currency, and volatility markets have made huge swings up and down. There seems to be no rhyme nor reason to such moves, as often times after huge moves the various markets quickly go back where they started.

This is what happens when markets face true uncertainty. Will the Fed cut or not? Will the Trump-era tax cuts expire? When will the next recession start? So many questions and so few answers.

The Big Picture

The next three months could be one of the wildest and most volatile market periods in memory. Keep in mind, France still has a hung parliament, the UK’s new Labour government isn’t exactly off to a great start, missiles are flying in the Middle East and Ukraine is attacking inside Russia. The exhausting news flow seems certain to continue, one way or another.

Keeping up is easier if you read Over My Shoulder, where I share some of the best, most interesting research that crosses my desk. It’s surprisingly affordable, so check it out.

New York, Fishing, and Dallas

I’m flying to New York on Sunday for meetings with Dr. Mike Roizen, my daughter Tiffani and various investors and doctors about an exciting new venture in the longevity therapy space. I am very happy to be once again working with Tiffani and the amazing team she has assembled. And the connections Mike has? Unrivaled!

Then there are meetings with my partners in the publishing business I mentioned at the beginning of the letter, Ed D’Agostino and Olivier Garret. I am truly grateful for their support and that of the whole team. We are already working on next year's Strategic Investment Conference, which may be partially live.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Then at the end of the month I will be fishing in far north British Columbia for salmon, halibut, and cod with 31 of my readers. That will be fun. Maybe a quick trip to Dallas afterward? I turn 75 on October the 4th. Where has the time gone?

The letter is already running long so it is time to hit the send button. Have a great week and I hope you’re enjoying your summer.

|

Your happily busier than ever analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin