Your chance to own a piece of the future

- Stephen McBride

- |

- January 14, 2025

- |

- Comments

This article appears courtesy of RiskHedge.

If Walmart closed tomorrow, you could buy groceries at Costco. If Nike stopped making sneakers, you could wear Adidas.

But if you want to make the world’s most advanced computer chips, you only have one option: machines made by Advanced Semiconductor Materials Lithography (ASML).

Without ASML’s machines, our modern digital world would screech to a halt. No iPhone in your pocket. No Nvidia (NVDA) chips powering ChatGPT. No robotaxis safely ferrying kids to soccer practice in San Francisco.

Longtime readers may know my first-ever RiskHedge essay back in 2018 made the case for ASML.

Its stock has more than tripled since then. But the $300 billion Dutch giant is in the midst of a nasty selloff, having dropped 30% since last summer.

Are ASML’s best days behind it? Or is this your chance to pick up shares of a world-class innovator on sale?

- Chips are the most important goods the world has ever known.

They are the “fuel” powering every modern technology, from the phones in our pockets to the planes in our skies to the credit cards in our wallets.

Even the most mundane objects now run on chips. Your rice cooker cooks perfect rice because tiny semiconductors precisely control the heat. A pacemaker keeps a heart beating because a chip sends perfectly timed electrical pulses.

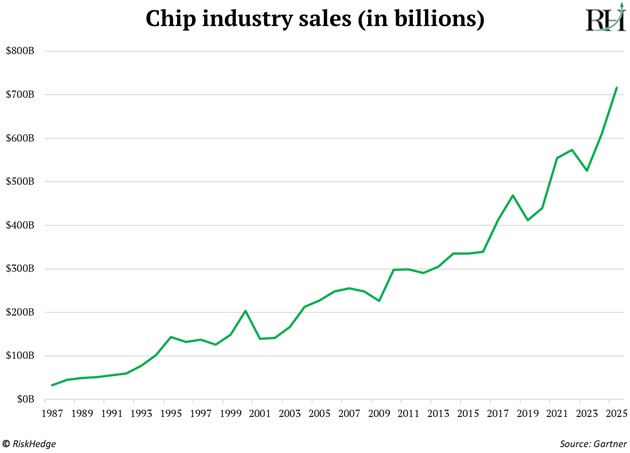

And chip sales have only gone one way our entire lives… UP!

In the next decade, the amount of money spent on chips will exceed that spent on oil.

Chips are also the key to enabling robotaxis, personalized tutors that teach our kids, and every future disruption you can think of.

- Almost all the tech progress in our lifetime has come from chipmakers figuring out how to cram more transistors onto microchips.

Look at your thumbnail. The chip in the latest iPhone is smaller, yet it contains 19 billion transistors spaced just five nanometers apart.

This is made possible by ASML’s super powerful chipmaking machine that uses extreme ultraviolet light (EUV).

The EUV machine is so complex, no other company on Earth can replicate it. ASML has a 100% total monopoly on it.

Imagine taking a pencil and trying to write thousands of letters on a grain of rice, each one perfectly formed and precisely placed.

That’s essentially what ASML’s EUV machines do. Except instead of rice, they’re working with silicon wafers. Instead of letters, they’re printing billions of microscopic transistors.

Each EUV machine is as heavy as a jumbo jet, packed with 100,000 precision parts and 2 kilometers of cables all working in perfect harmony. It towers over the engineers who run it like some kind of futuristic deity:

Source: Barron’s

Moving just one of these hulking machines requires a logistics operation worthy of a military campaign. Forty shipping containers, three cargo planes, and a fleet of 20 trucks. Price tag: $300 million, more expensive than a large passenger aircraft.

Inside each EUV machine, something almost magical happens. Fifty thousand times per second, tiny droplets of molten tin are fired through a vacuum chamber. Each droplet is hit twice by powerful lasers. The first one flattens it into a pancake shape, while the second superheats it into plasma that’s 40 times hotter than the surface of the sun.

This creates extreme ultraviolet light, which then bounces off a system of mirrors so perfectly smooth that if you scaled one up to the size of California, its biggest imperfection would be smaller than a grain of sand.

ASML’s EUV machine is the key to making the latest, fastest chips.

Technological supremacy is great for business. ASML’s sales have almost quadrupled since it started shipping EUV systems in 2017.

- The chip industry is notoriously cyclical, swinging between wild booms and busts.

After seven years of spectacular growth, ASML hit a speed bump in 2024. Sales growth turned negative, sending its stock cratering 40% from its peak.

When I first recommended ASML six years ago, it was a little-known company operating out of the Netherlands’ fifth-largest city.

As the world woke up to this Dutch juggernaut with a monopoly on the world’s most advanced machine, financial journalists wrote thousands of words salivating over this obscure marvel.

Investors rushed in, driving ASML to record highs. Its stock hit 50X earnings, a record-high valuation.

But 2024’s selloff knocked it down 40%. Now, it’s trading back below its five-year average price-to-earnings ratio.

Remember, chips follow boom-and-bust patterns. But the long-term trend is up.

That’s why the best time to buy chip stocks is usually when they’re emerging from a bust—when they’re cheap and hated but in an uptrend.

ASML is in that sweet spot right now:

The unexpected memory chip boom we discussed last Monday is another growth driver for ASML in 2025.

Until now, it’s been all about making AI and “logic” processors faster. Now chipmakers are focusing on turbocharging memory chips to solve ChatGPT’s “amnesia” problem.

To do that, they need ASML’s machines. Expect top memory makers SK Hynix, Samsung, and Idaho’s Micron Technology (MU) to buy some extra EUV machines this year.

ASML already took its medicine, and things are looking up for 2025. I predict it will reclaim its crown as Europe’s most valuable company soon.

ASML is a great business sitting at the center of tech innovation. This is your chance to own a piece of the future at a discount.

Stephen McBride

Chief Analyst, RiskHedge

PS: In my investing letter The Jolt, I sometimes write about companies like ASML that sit at the center of disruptive megatrends. Sign up now—it’s free.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com