The only “undisruptable” industry?

- Stephen McBride

- |

- March 31, 2025

- |

- Comments

This article appears courtesy of RiskHedge.

Google (GOOG) just made its largest acquisition ever.

It shelled out $32 billion (!) for cybersecurity startup Wiz.

My editor often accuses me of burying the lead. I won’t make that mistake this time.

I expect cybersecurity stocks to outperform every other software group over the next five years.

- An easy way to keep the odds on your side is by investing in trends that won’t change.

We call them “megatrends.”

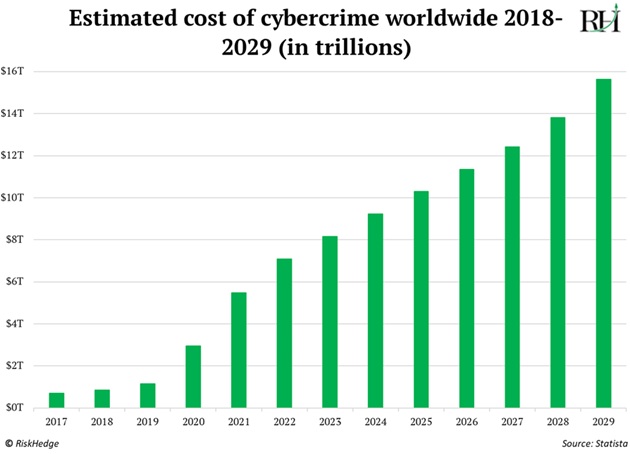

Cyber is as close to a guaranteed megatrend as you’ll ever get. The total cost of cybercrime is projected to surpass $10 trillion this year. Notice it only goes up:

Robust cybersecurity used to be a “nice to have.” Now, you can’t run a business without it. I can’t imagine a future in which CEOs say, “Cybersecurity isn’t THAT important…”

Companies will lay off employees and shut down offices before they even consider cutting security spending. A big hack is a nightmare legally, financially, and reputationally. One study shows 60% of small companies go out of business within six months of falling victim to a cyber-attack.

In just the past few years, everyone from the IRS… to the NSA… to Lockheed Martin (LMT)… to Google has been hacked.

Earlier this year, the FBI announced Chinese hackers likely gained access to all agents’ call and text logs.

To borrow a line from Fight Club: “On a long enough timeline, everyone gets hacked.”

- And hackers aren’t just stealing digital data...

They’re attacking vital infrastructure.

In 2021, hackers shut down the Colonial Pipeline. It supplies 45% of the East Coast’s fuel. Two-thirds of gas stations across South Carolina ran dry for days.

A month later, cybercriminals pulled the plug on JBS. It’s the world’s biggest meat processor, producing 20% of all US beef. JBS had to pay an $11 million ransom to get its systems back online.

And did you hear about the attack on a water plant near Tampa, Florida? Hackers broke into its systems and altered the levels of lye in the drinking water. Luckily, an operator noticed the chemical levels changing and shut off the pipes.

Today, a hacker in a hoodie from halfway around the world can do more damage with a few keystrokes than a thief with a gun.

- Hundreds of billions of dollars in revenue is pouring into cybersecurity companies… and that’ll only grow.

Cybersecurity companies protect organizations from hacks and cybercrime.

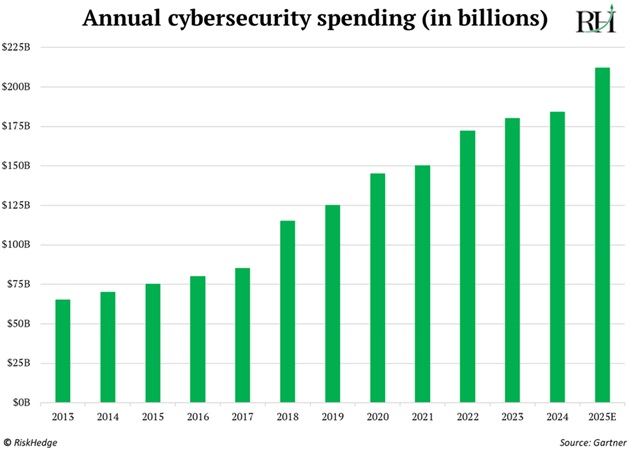

Top research firm Gartner expects cybersecurity spending will hit $212 billion this year (a 15% increase from last year):

Cybersecurity spending has grown steadily by 10%–15% per year without much notice. When that happens year in, year out for two decades running… you soon have a HUGE market.

Think about how rare it is for an industry to have a stream of income that simply does not stop growing. Many of today’s internet giants make money from advertising (Google and Meta), retail (Amazon), and entertainment (Netflix). Their streams of income rise and fall with the economy.

Even massive megatrends like spending on artificial intelligence (AI) datacenters will eventually slow down when demand is satiated.

- Most investment trends fade. Cyber can’t.

It’s a “forever growth” market.

We should be very careful about calling anything “undisruptable” in today’s age of rapid tech advancement and creative destruction. But I think the megatrend of cybersecurity spending is truly undisruptable.

And AI will pour gasoline on the fire. AI makes it much easier to impersonate someone online with cheap, unsophisticated tools.

Superinvestor Warren Buffett called cybercrime “the number one problem with mankind.” JPMorgan Chase & Co.’s (JPM) CEO Jamie Dimon warned it’s “the biggest threat to the US financial system.”

An easy, one-click way to play this is to invest in an ETF like the First Trust Nasdaq Cybersecurity ETF (CIBR), which invests in a basket of cybersecurity stocks.

But ETFs have their downsides. For one, they hold too many stocks. The most successful investors don’t follow a blind, broad diversification strategy. They make more concentrated bets on fewer high-conviction plays.

Here’s a better way to profit from the cyber megatrend: Build your own ETFs with three or four high-quality stocks.

This way, you can ensure you’re only investing in great business you have high conviction in… while reducing your risk to stocks you may only “kinda, sorta” like.

Stephen McBrideChief Analyst, RiskHedge

PS: In The Jolt, I track the biggest, most profitable megatrends in the market so you don’t have to.

If you’d like a way to stay ahead of the mainstream financial media—without doing the heavy lifting yourself—sign up here to get The Jolt delivered straight to your inbox every Monday and Friday.

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com