Yet Another Debt Crisis Is Brewing

- John Mauldin

- |

- June 14, 2018

- |

- Comments

BY JOHN MAULDIN

The Institute of International Finance (IIF) has released a worrisome report about the state of global debt, which includes this note about US corporate debt:

US non-financial corporate debt hit a post-crisis high of 72% of GDP: At around $14.5 trillion in 2017, non-financial corporate sector debt was $810 billion higher than it was a year ago, with 60% of the rise stemming from new bank loan creation. At present, bond financing accounts for 43% of outstanding debt with an average maturity of 15 years vs. the average maturity of 2.1 years for US business loans. This implies roughly around $3.8 trillion of loan repayment per year. Against this backdrop, rising interest rates will add pressure on corporates with large refinancing needs.

I see at least three alarming points in this paragraph.

First, corporate debt is now 72% of GDP. That’s in addition to the government debt that is approaching (or has passed depending on how you count debt) 100% of GDP and household debt at 77% of GDP.

Add in 81% financial sector debt, and the US combined debt-to-GDP ratio is near 330%.

Second, 60% of new corporate debt is coming not from bond sales but new bank loans—and those bank loans have much shorter maturity, averaging 2.1 years. That means refinancing time is coming for much of it, and rates are not going lower.

Third, IIF infers about $3.8T in corporate loan repayments each year—just in the US. That’s a lot of cash companies need to find and I’m not sure all can do it. Aside from higher interest rates, the companies that need credit (as opposed to high-rated ones that borrow only because they can do it cheaply) tend to be riskier.

From a recent Moody’s report, we see that 37% of US non-financial corporate debt is below investment grade. That’s about $2.4T.

Corporations Are Getting Dangerously Leveraged

Furthermore, all corporations, both investment grade and speculative, added significantly more leverage since the Great Recession.

Again, not all leverage is the same. Some companies borrowed to fund share buybacks but have vast cash flow and reserves. They can easily deleverage if necessary. Smaller, riskier companies have no such choice. I think they present the greatest systemic risk.

That said, it’s still a bit mind-boggling that, even after the Great Recession, just a decade later the average non-financial business went from 3.4x leverage to 4.1x. They are now roughly 20% more leveraged than they were the last time all hell broke loose.

CEOs and boards seem to have learned little from the experience—or maybe learned too much. If you believe the Fed has your back, then leveraging to the moon makes sense.

Most Investment Grade Bonds Are One Step Away from Being Junk

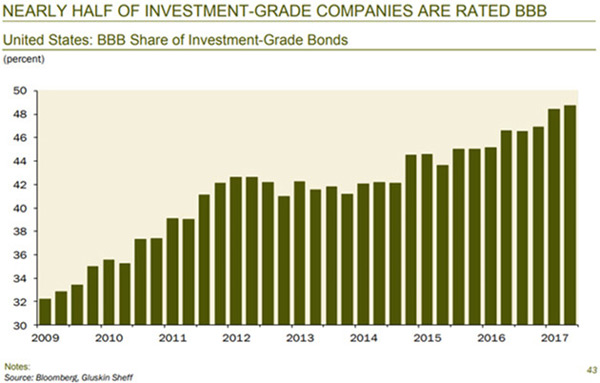

Now, I know some readers will take comfort in the fact that 63% of the corporate debt is rated investment grade. But as they say in Texas, hold on, cowboy, don’t ride away so fast. A lot of that debt is rated BBB, the lowest investment grade rating.

For the glass half-empty crowd, that means they are just one step above junk. The chart below from my friend Rosie (David Rosenberg) shows that the number of BBB-rated companies is up 50% since 2009.

Source: David Rosenberg

The problem, as I described in High Yield Train Wreck, is that bondholders and lenders won’t wait for the rescuers. When funds and ETFs, which hold BBB debt, start getting redemptions, investors won’t hang around to see which domino falls next.

Institutions have rules that will make them start selling troubled bonds early. Liquidity probably won’t be there. Clearing the market will require sharply lower prices, which will create more selling pressure and eventually recession.

To further exacerbate the problem, the rating agencies that didn’t react quick enough in 2008 may be a little bit more trigger-happy this time. This will cause heartburn for CEOs with BBB paper outstanding.

Another Debt Crisis Is Brewing

To be sure, regulators and Congress took measures to avoid a similar crisis repeating. The banks aren’t the problem. The “shadow banking system” is the source for much of the shaky debt. The same investors stretching for yield in emerging markets have loaded up on private debt, too.

We’re OK for now, but we will have a problem when recession strikes. The next crisis, which I think will be yet another debt crisis, won’t look like the last one, but it will rhyme.

Get one of the world’s most widely read investment newsletters… free

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.