The 6 Biggest Threats to the Stock Market in 2016

- Tony Sagami

- |

- January 14, 2016

- |

- Comments

BY TONY SAGAMI

2015 has been a tough year for investors. We have witnessed a number of macro-economic events that not only shocked the markets but also set the tone for 2016 or even further.

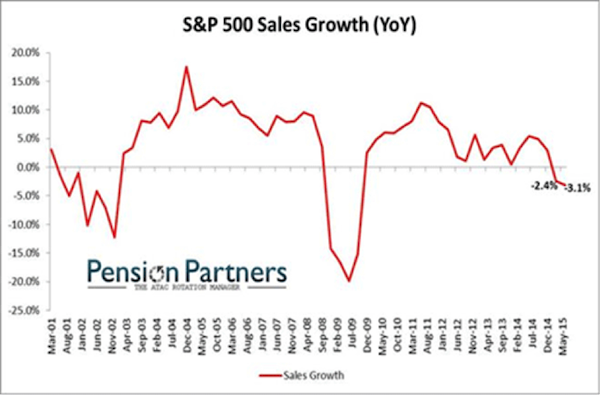

2015 has been the first year since 2009 when S&P 500 profits declined for the year—not to mention the first hike in interest rates over almost a decade.

And the list goes on…

I expect that 2016 is going to be an even more difficult year for investors. Why do I say that?

For any number of reasons, such as:

Reason #1: The Strong US Dollar

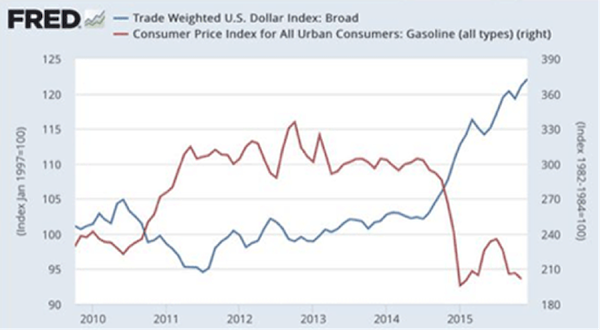

The US dollar index was up 9% in 2015 after gaining 13% in 2014.

A strong dollar can have a dramatic (negative) impact on the earnings of companies that do a significant amount of business outside of the US—for example, Johnson & Johnson, Ford, Yum Brands, Tiffany’s, Procter & Gamble, and hundreds more.

Reason #2: Depressed Energy Prices

I don’t have to tell you that oil prices have fallen like a rock.

That’s a blessing when you stop at a gas station, but the impact of petro-dependent economies on the finances has been devastating.

Plunging energy prices are going to hit everything from emerging markets to states like North Dakota and Texas.

Reason #3: Junk Bond Implosion

You may not have noticed because the decline has been orderly, but the junk bond market is on the verge of a total meltdown.

Third Avenue Management unexpectedly halted redemption of its high-yield (junk) Focused Credit Fund. Investors who want their money… tough luck.

The investors who placed $789 million in this junk bond fund are now “beneficiaries of the liquidating trust” without any idea of how much they will get back and or even when that money will be returned.

Third Avenue admitted that it may take “up to a year” for investors to get their money back. Ouch!

The problem is that the bids of the junkiest part of the junk bond market have collapsed. For example, the bonds of iHeartCommunications and Claire’s Stores have dropped 54% and 55%, respectively, since June!

What the junk bond market is experiencing is a liquidity crunch—the financial equivalent of everybody trying to stampede through a fire exit at the same time.

In fact, the International Monetary Fund (IMF) warned that blocking redemptions could increase redemption requests at similar funds.

Reason #4: Rising Interest Rates

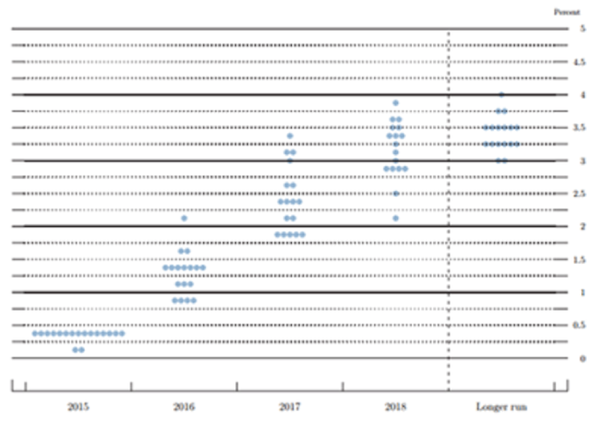

As expected, the Federal Reserve hiked interest rates at its last meeting. The reaction (so far) hasn’t been too negative; however, we may have several more interest rate hikes coming our way.

Every single one of the 17 Federal Reserve members expects the fed funds rate to increase by at least 50 bps before the end of 2016, and 10 of the 17 expect rates to rise at least 100 bps higher in the next 12 months.

I doubt our already struggling economy could handle those increases.

Reason #5: Government Interference

Sure, 2016 is an election year, which brings uncertainty and possibly turmoil.

But the Obama administration could shove several changes down America’s throat via executive action—such as higher minimum wage, limits on drug pricing, gun control, trade sanctions including tariffs, immigration, climate change, and increased business regulation.

I don’t give the Republican-led Congress a free pass either, as I have no faith that it will put the best interests of the US ahead of its desire to fight Obama.

Reason #6: China Contagion

We do indeed live in a small, interconnected world, and it’s quite possible that something outside of the US could send our stock market tumbling.

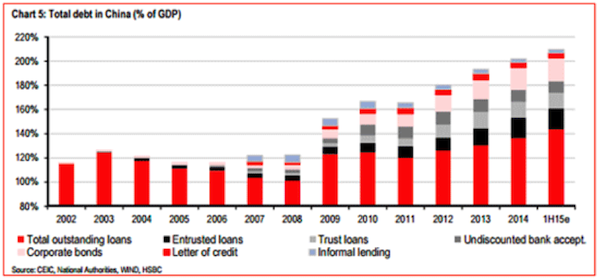

Aside from Middle East challenges, the one external shock I worry about the most is coming from China. The sudden devaluation of the yuan and the significant easing of monetary policy by the People’s Bank of China signal the brewing trouble.

I think, however, the biggest danger is an explosion of non-performing loans in China. Debt levels in China, both public and private, have exploded, and I continue to hear anecdotal evidence that default and non-performing loans are on the rise.

Trouble Is Coming

To be honest, I have no idea which of the above (or maybe even something completely out of left field) will poison the stock market in 2016, but I am convinced that trouble is coming.

Call me a pessimist, a bear, or an idiot… but my portfolio is prepared to profit from falling stock prices.

Subscribe to Connecting the Dots

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free publication Connecting the Dots.