From the Mailbag: Fast Food Dividends and Pot Real Estate

-

Kelly Green

Kelly Green

- |

- January 22, 2025

- |

- Comments

If I screen for stocks on a US exchange that pay a dividend I get 2,941 results. If I filter for a minimum dividend yield of 3.5%, I still get 1,204 potential investments. And this doesn’t include preferred shares and exchange-traded debt.

I just can’t watch every one of these stocks. Lucky for me, I have you guys.

I love it when you ask me questions about the stocks I cover and those I haven’t mentioned. You can post questions for me and join conversations with fellow readers in our online community. And you can always write me through our customer service team.

If you’re a Yield Shark subscriber, we have a private community space where I host a live event once a quarter.

I do my best to answer your questions in an issue of Yield Shark or Dividend Digest. I use the same approach when I’m teaching yoga. When someone asks me a question, I answer it to the class.

Today, we’re looking at two reader mailbag comments I got last week. Although the stocks are in two completely different industries, both have above-average yields.

Cash Back from Your Fries and Frosty

I couldn’t tell you the last time I dipped fries in a Frosty. It will probably be later today since I’m thinking about it and there is a Wendy’s (WEN) literally outside the gate of my community.

Dave wrote and said he was surprised that I didn’t mention Wendy’s in last week’s Dividend Digest.

And he’s right. If we’re going to talk about a company that owns Burger King and Popeyes with a 3.8% yield, then we should look at Wendy’s with a 6.8% yield.

The burger chain known for its square never-frozen burger patties has over 6,000 US locations. You’ll also find 1,156 international locations in more than 30 countries.

The company pays a quarterly dividend of $0.25 for an annualized yield of 6.8%. The company has paid a dividend since 2001, but it doesn’t have a track record of stability or regular dividend increases.

That doesn’t rule out Wendy’s, but I see it as a Current Yield position and not a hold-for-decades stock. The unstable history of the dividend is important when we look at Wendy’s incredibly high payout ratio.

The payout ratio tells us what percentage of a company’s earnings are paid to shareholders as dividends. There are other ways to measure dividend health, but this is a quick and easy gauge. Simply divide the dividends paid per share by the earnings per share (EPS).

For Wendy’s, the $0.25 quarterly dividend was equal to the third-quarter 2024 EPS of $0.25 for a payout ratio of 100%. The company is paying out everything it earns in dividends. That’s not sustainable long-term. So, if you bought shares to lock in the above-average yield, you should keep an eye on that.

|

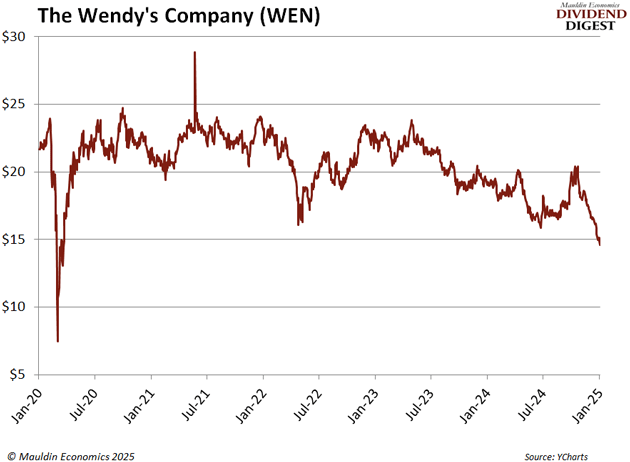

For the third quarter, the company saw just 1.8% sales growth and a slight decline in EBITDA and EPS year over year. I’m sure this contributed to the sliding share price which gives us the higher yield.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

The company also said it will continue to invest for growth and maintain the dividend. That’s a delicate balancing act. I need more information before I can say the dividend is safe through 2025.

The company reports its fourth-quarter and full-year earnings on February 13. If you’ve got your eye on the stock, I’d be looking to see if the company hits its full-year guidance, and if EPS comes in above $0.25.

|

The Modern 10-Bagger Blueprint: Friend of Mauldin Economics, Stephen McBride, has just put out a free special report: The Ultimate Guide to Modern 10-Baggers. Along with the help of a former forensic accountant, Stephen studied every US stock in existence over the last 20 years and was able to identify the four core traits that tend to be shared by true 10-baggers. It’s a real eye-opener. |

Will These Pot Dividends Go Up in Smoke?

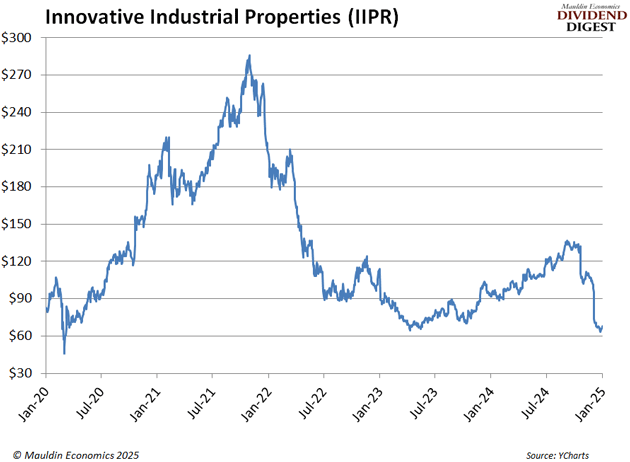

Unlike Wendy’s, the next stock has been in the Yield Shark portfolio. I recommended Innovative Industrial Properties (IIPR) back in August 2022. We sold our shares in July 2024 for a 24.5% gain.

Our timing was slightly off as shares had another $20 to run. But with shares down 44% in the past six months, I’m glad we’re on the sidelines.

Doug wrote in to say he locked in a 50% gain following my recommendation. His original entry price was $72, and he asks if shares are a good deal at their recent $68 price with an 11% yield.

IIPR is in the cannabis real estate business. Its properties are licensed for the cultivation, processing, and sale of cannabis. And its licenses are attached to the property not the tenant. That’s a big deal.

The stock has slid because its largest tenant, PharmaCann, defaulted on its December rent on six of its 11 leases. The missing payments totaled $4.2 million. This puts all 11 leases in default status.

PharmaCann’s payments are 17% of IIPR’s total revenues, and the fear is that the quarterly dividend will be cut. No one knows if that will happen, or by how much if it does. But a 20% cut would drop the quarterly dividend to $1.52, for an annualized 8.9% yield at today’s share price.

The good news is that IIPR is quick to take legal action and find new tenants. If it can line up a new tenant, I think it will do everything in its power to keep the dividend steady.

I’m sure IIPR will be able to replace or work out an agreement with PharmaCann. The real issue is the question of time. Once that happens, I think shares of IIPR will head back towards $100.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green