Why Debt Won’t Spark Inflation

-

John Mauldin

John Mauldin

- |

- May 24, 2019

- |

- Comments

- |

- View PDF

Missing Inflation

Debt Rubicon

Velocity Falling

The Complex Debt and Currency Dance

“Too High and Getting Wider”

They Shall Not Grow Old

Modern technology was supposed to make travel less necessary. We can meet by phone, video, and now in virtual reality. But we’re still traveling more than ever. I certainly am.

The reason is simple: Technology can’t yet replace face-to-face conversation, and especially group conversations. It is genetically hardwired in our species. We spend more time on the phone and Skype than ever but technology also makes information more complex and nuanced. Conveying it often requires a personal presence, so we fly around and talk in person.

I thought of that last week at the Strategic Investment Conference. I’ve been writing about “Japanification” of the developed world economy, explaining what I mean by that as best I can in these letters. But in talking to conference attendees, I found that I have not effectively communicated some of the nuances.

To be clear, I don’t want Japanification, nor do I think it will deliver the desired results. I believe that in the next recession…

- Policymakers will respond with massive fiscal and monetary stimulus, and

- Instead of producing growth, it will depress growth and leave us all in the same morass Japan has endured for almost three decades.

In other words, I believe that both government and central banks will try Japanification (of course under other names) but I don’t expect it to work in the way they would hope.

When faced with the imminent possibility of recession, depression, or even a crash, authorities will try to do something but they will have very few choices. The “default” option of ever larger stimulus will kick in. So, like Japan, the US will see yet more quantitative easing and extraordinarily low interest rates, along with annual federal deficits of $2 trillion and higher. Alternatives like restructuring the tax code and balancing the budget will be nowhere in sight.

At best, this “process” will result in an even slower-growing economy and avoid total meltdown. That’s the optimistic view. Given what I understand today about the political and economic realities as I see them, I also believe that it is the most likely scenario. The others are much darker.

However, I also believe there is an “off-ramp” that could short-circuit the Japanification effect, leading to something closer to “normal.” More on that below.

Today I want to go deeper into the intellectual and academic rationale behind this outlook. Dr. Lacy Hunt has long been an enormous influence on my understanding of economics. In this letter I’ll discuss his latest ideas. I should note that any errors are mine and not his fault.

Lacy briefly presented two theorems at the SIC. After his scholarly lecture (that’s really what it was), I brought up my favorite central banker and former BIS chief economist Bill White. The three of us had possibly the most stimulating discussion of the whole conference (at least for me). You can (and should) view it all on our Virtual Pass but I’ll share some highlights below.

This is important and you need to understand it, because it is the exact opposite of what many people think.

Missing Inflation

Let’s start with some facts that may be inconvenient for some, but are nonetheless facts.

Back in the 1980s and 1990s, many of us in the conservative and “gold bug” movements (me included) thought excessive government spending and the resulting debt would eventually bring inflation or even hyperinflation. We wanted a hawkish Federal Reserve or, better yet, a gold standard to prevent it. (I have many friends, close friends, who still deeply believe in a gold standard. But that’s a discussion for another day…)

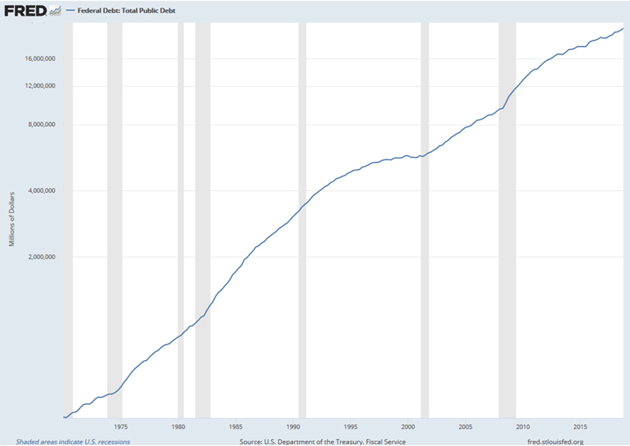

Reality turned out differently. Federal debt rose steadily, inflation didn’t. Here’s a chart of the on-budget public debt since 1970, using actual dollars instead of the more usual percentage of GDP, and with a log scale to eliminate the hockey-stick illusion.

Source: St. Louis Fed

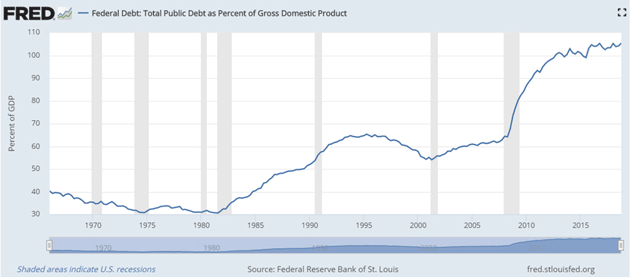

Here is the same data in terms of debt to GDP. Note the brief shining moment when the US was growing faster than the debt rose and actually ran surpluses in the late 1990s. These were also times when GDP grew faster than the deficits and debt. But the general trend is from the lower left to the upper right. There was a significant jump during the Great Recession.

You can see the debt growth started to level out in the late 1990s but then took off again. Yet the only serious inflation in this whole period occurred in the first decade. Paul Volcker stamped it out in the early 1980s.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I am not saying we had no inflation at all. Obviously we did, and in many parts of the economy significantly more than the official “average” measures reflect. Some of it manifested in asset prices (stocks, real estate) instead of consumer goods. We like that and typically don’t consider it inflation, but it is. But there was nothing remotely like the kind of major inflation that this level of government debt should, theoretically, have caused based on what we understood in the 1970s and 1980s. Remember Ross Perot and his charts? It hasn’t happened.

One argument is that technology reduced production costs enough to offset the higher debt burden. That’s probably part of it, but I think a minor part. The real answer is twofold.

- First is the way high government debt interacts with interest rates, over long periods and with a time lag, but almost inexorably.

- Second, but no less understood, is the demand for certain currencies even as government debt and obligations rise.

A little reminder: Interest rates and inflation are really two sides of the same coin. Interest is the cost of money/liquidity. That cost is heavily influenced by the risk of money being devalued, i.e., inflation expectations. If lenders expect higher inflation then they expect to be repaid in cheaper dollars, and thus demand more of them via higher interest rates. So inflation drives rates higher, while lack of inflation keeps them low, as we’ve seen since 2008.

This brings us to Lacy Hunt’s SIC session in which he presented two important theorems. They are related but I will discuss them separately.

|

Debt Rubicon

I’ll start by just quoting Lacy, then explain what I believe he means.

Federal debt accelerations ultimately lead to lower, not higher, interest rates. Debt-funded traditional fiscal stimulus is extremely fleeting when debt levels are already inordinately high. Thus, additional and large deficits provide only transitory gains in economic activity, which are quickly followed by weaker business conditions. With slower economic growth and inflation, long-term rates inevitably fall.

That first sentence should come with a little “Boom!” cannon icon. It will shock many people who think rising federal debt raises interest rates through a “crowding out” effect. That means the government, because it is the most creditworthy borrower, sucks up capital and leaves less available to private borrowers who must then pay more for it via higher interest rates or a weakened currency.

That is the case for most countries in the world.

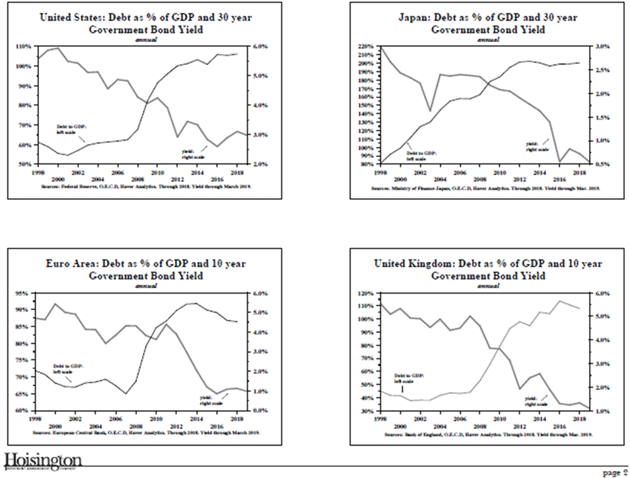

Yet clearly it has not been the case for some countries in recent decades, specifically larger developed economies. That’s not to say it never will be, but actual experience supports Lacy’s point, and not just in the US. Here are four charts he showed at SIC.

In the US, Japan, the eurozone, and the UK, sovereign rates fell as government debt rose. That is not how Keynesian or most other macroeconomic theories say debt-funded fiscal stimulus should work. Additional cash flowing through the economy is supposed to have a multiplier effect, spurring growth and eventually raising inflation and interest rates. This has not happened.

The reason it hasn’t happened is that we have crossed a kind of debt Rubicon in recent history. Past performance really is not an indicator of future results. Today, in much of the developed world, the existing debt load is so heavy that additional dollars have a smaller effect. The new debt’s negative effects outweigh any benefit. The higher taxes that politicians often think will reduce the deficit serve mainly to depress business activity. We see the result in slower economic growth, plus lower interest rates and inflation.

Note we are talking here about fiscal policy, i.e., government spending on jobs programs, infrastructure, etc., when financed by issuing new debt. Central banks aren’t directly involved until they start financing the government debt via QE or some version of MMT (which Lacy and the rest of the speakers at the SIC will hasten to point out are not equivalent).

Velocity Falling

Lacy’s second theorem supports the first.

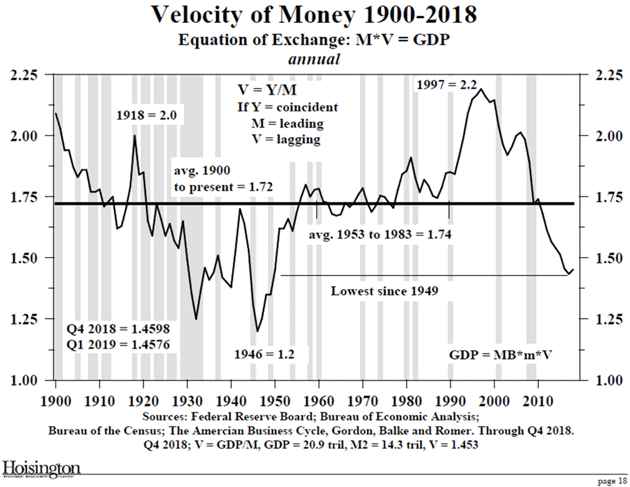

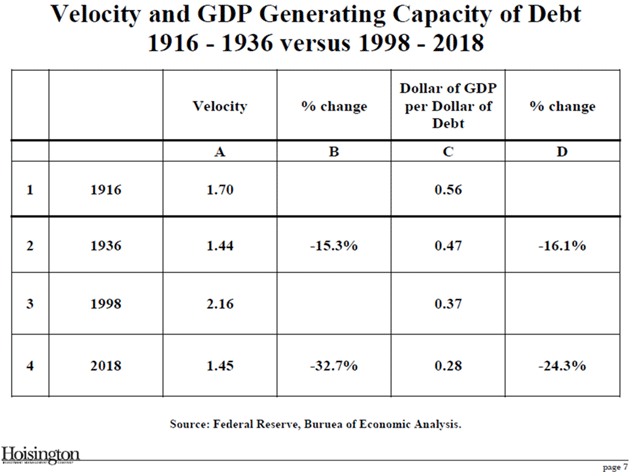

Monetary decelerations eventually lead to lower, not higher, interest rates as originally theorized by economist Milton Friedman. As debt productivity falls, the velocity of money declines, making monetary policy increasingly asymmetric (one sided) and ineffectual as a policy instrument.

Irving Fisher’s equation of exchange (M2*V=GDP) says GDP is equal to the money supply times its turnover, or velocity. The Federal Reserve heavily influences the former but not the latter. That, it turns out, is a serious problem.

The Fed’s Phillips Curve fixation gives it the illusion that every macroeconomic problem is a nail and monetary policy is the ideal tool/hammer to fix it. Of course, that’s not true. Looser financial conditions don’t help when the economy has no productive uses for the new liquidity. With most industries already having ample capacity, the money had nowhere to go but back into the banks. Hence, velocity fell 33% in the two decades that ended in 2018.

Now, if velocity is falling then any kind of Fed stimulus faces a tough headwind. It can inject liquidity but can’t make people spend it, nor can it force banks to lend. And in a fractional reserve system, money creation doesn’t go far unless the banks cooperate.

Later in the conference, Bill White observed that this is why monetary policy is increasingly ineffective. The banks respond to each crisis the same way, and every time they find that it takes more aggressive action to produce the same effect. Obviously, that can’t go on forever. Bill called it a “fundamental intemporal inconsistency.”

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

The result is that public and private debt keeps rising but also becomes less productive. Lacy showed how, in a world of falling monetary velocity, the amount of GDP growth produced by each additional dollar of debt fell 24% in the last 20 years. That’s why we have so much more debt now and yet slower growth.

This also explains why (this year’s first quarter notwithstanding) growth has been so sluggish since 2014. That was when money supply peaked. So for five years now, we’ve had both a shrinking money supply and slowing velocity. That’s not a recipe for inflation. And the more recent jump in federal deficit spending is making matters worse, not better.

In our Q&A, Lacy and Bill discussed how linear economic models are just not working and nonlinear analysis is so critical. A lot of practical people are turned off by this, thinking it shouldn’t be so complex. But, these same people would never tell a physicist to avoid nonlinear concepts.

The economy is complex and getting more so as the world adds new, seemingly critical variables. (I should also note that Lacy only had 30 minutes for his presentation and had to make a complex argument in an abbreviated time. There are scores more corollary points we could explore.)

The Complex Debt and Currency Dance

Astute readers will quickly point out that rising debt in places like Venezuela has brought extraordinary inflation and currency devaluation. Historically, that’s what rapidly rising government debt does. I simply point you to Rogoff and Reinhart’s This Time Is Different where they examine every debt and currency crisis for the last few centuries. The circumstances may have been different, but the result was the same.

Yet today, things do indeed seem different. Japan, the US, the UK, and other countries seem able to expand their government debts beyond historically acceptable levels and “get away with it.” Interest rates have stayed low, often getting lower and going negative, while currency valuations have remained relatively stable (the operative word here is relatively).

What is different is the international demand for currencies and debt denominated in those currencies. A globalized economy yielded a surplus of savings that seeks a home in what is perceived as “safe” assets. Nobody thinks Venezuela is safe. That is why, in a global crisis, money flies to the US and other “reserve” currencies. These “safe haven” currencies have the exorbitant privilege of running large fiscal deficits.

Thought experiment: If Italy were to remove itself from the euro and reissue the lira, does anybody really think that Italy would keep today’s low rates? Ditto for Greece and other countries. Left on their own, these currencies would devalue relative to stronger ones like Germany, and their interest rates would rise.

This is not necessarily a bad thing. The “safety valves” of currency devaluation and bond market vigilantes saved Italy numerous times before it joined the euro. What most people don’t realize is that Italy grew faster than Germany in real terms for the 20–30 years prior to joining the euro, despite its inflation and devaluations.

How long can this go on? The Japanese experience suggests much longer than we would think. Forever? No. There is a point where the zeitgeist, the perceived global narrative about a country and currency changes, and currencies and interest rates become unhinged. It can happen seemingly overnight.

Again, how long can this go on? We simply don’t want to know the answer to that question. We will only know after the fact, and it will be a horrible, painful fact to experience. Better to find a viable exit ramp.

“Too High and Getting Wider”

I’ll wrap up with a direct quote from Lacy Hunt, which you will probably want to read several times. His academic prose takes a little time to sink in. But when it does, you should be concerned… if not terrified.

The parallels to the past are remarkable, but there appears to be one fatal similarity—the Fed appears to have a high sensitivity to coincident or contemporaneous indicators of economic activity, however the economic variables (i.e. money and interest rates) over which they have influence are slow-moving and have enormous [time] lags.

In the most recent episode, in the last half of 2018, the Federal Reserve raised rates two times, by a total of 50 basis points, in reaction to the strong mid-year GDP numbers. These actions were done despite the fact that the results of their previous rate hikes and monetary deceleration were beginning to show their impact of actually slowing economic growth. The M2 (money) growth rate was half of what it was two years earlier, signs of diminished liquidity were appearing, and there had been a multi-quarter deterioration in the interest rate-sensitive sectors of autos, housing, and capital spending.

Presently, the Treasury market, by establishing its rate inversion, is suggesting that the Fed’s present interest rate policy is nearly 50 basis points too high and getting wider by the day.

A quick reversal could reverse the slide in economic growth, but the lags are long. It appears that history is being repeated—too tight for too long, slower growth, lower rates.

The Fed waited too long to raise rates and then overshot the mark when it finally got around to it. I was calling for rate hikes in 2012 and 2013. The Fed could have hiked 50 to 75 basis points per year, “normalizing” interest rates and letting the economy adjust slowly rather than all at once, late in the cycle. Having realized it, FOMC members then paused, but too late and possibly for the wrong reasons. Now they’re trapped. Lacy thinks an immediate 50 bp cut might help, but he’s not optimistic they will do it, or that it will work if they do.

If that’s right, then we are in for slower growth and probably recession sooner rather than later. In a debt-laden, highly leveraged economy, it probably won’t be a mild one, either.

I mentioned earlier that I believe there is an “off-ramp” exit for the US economy. In the coming weeks, I’m going to respond to Ray Dalio’s recent two-part letter and then his third longer piece seemingly endorsing Modern Monetary Theory (MMT). It will probably be a multipart series and will allow all of us to have a much larger thought experiment, a potentially educational experience, than we have been having.

In the spirit of Dalio’s own “radical transparency” philosophy, maybe it is time to start thinking the unthinkable.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Before we move on, at least in this letter from the Strategic Investment Conference, let me gently suggest that you take advantage of our Virtual Pass. You can see most of the 33 speakers on video, listen to them on audio, and read the transcripts of the sessions. I’m getting many responses raving about the conference from people who weren’t even there. They watched on the Virtual Pass, which is the next best thing.

And maybe think about joining us next year at The Phoenician in Scottsdale, Arizona on May 11–14. As my friend Kent K. wrote,

“One of the best things about attending SIC is not only the information learned from these “rock star” speakers, you get to actually have a drink with them and sometimes dinner and pick their brain. From a financial context, it would be like seeing the Rolling Stones or Paul McCartney perform and then having a casual conversation with them afterwards. I have never attended any other conference that provides this kind of experience.”

They Shall Not Grow Old

On the five-hour flight from Dallas to Puerto Rico this past weekend, I decided to watch a movie. Scrolling through the seemingly endless choices, I came across the documentary by Peter Jackson (of Lord of the Rings fame) called They Shall Not Grow Old. Jackson and his team went through World War I film archives to assemble an extraordinarily moving view of the reality, total brutality, and utter inhumanity of war. The entire documentary consists of actual film from the era, starting out black-and-white and eventually becoming colorized. It is a well-done homage to these soldiers’ bravery and patriotism. Over 10 million died during that single war and the civilian death toll was almost as large.

In the US, it is Memorial Day weekend, where we annually pay tribute to those who lost their lives to keep countries free and democratic. Spending less than two hours watching They Shall Not Grow Old would be a good way to honor their sacrifice. It is a window into times and events simply not imaginable to most of us.

And while you’re watching, remember that European bond markets were very calm almost up to the last moment. No one really thought war was coming. But then the unthinkable happened.

It’s time to hit the send button. And to those of you who served your country, wherever and whenever it was, thank you. I wish you a truly great week!

Your reflecting on the unthinkable analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin