Tsunami Warning

-

John Mauldin

John Mauldin

- |

- April 16, 2021

- |

- Comments

- |

- View PDF

When Every Lot Is Odd

A Key Difference

The Contest of Supply Versus Value

SIC and Amanda’s Stroke Recovery

A tsunami is a wall of water that wipes out everything in its path, typically caused by earthquakes. But first, the water actually disappears from the usual shoreline, leaving land where there should be sea.

If you are on the shore and see that happen, the correct response is to run for high ground. Tragically, though, people often rush toward this new and unusual sight. It’s hard to blame them; we humans are drawn to the unknown. This impulse explains much of our progress, but it has costs, too.

Right now, the stock market is in the land-where-there-should-be-sea phase. What we don’t know is when the wave is coming. Maybe there’s time to venture out and see what treasure was hidden beneath the waves... or maybe not. Prudence would suggest that we go searching for treasure on higher ground.

This is an age-old investor conundrum. How do you balance risk and reward? You have clues, but you can’t be certain of what is coming, or when it will arrive, or what it will look like. You know you need positive returns, but you also need to avoid major losses. The answers are never easy. You take your chances, no matter what you do. Today we’ll see what some of my favorite market wizards see on the horizon.

First, I’m pleased to announce the Strategic Investment Conference ticket counter is officially open. We are only two and a half weeks away from (virtual) curtains up. I can hardly wait, and I think once you see our all-star list of 45+ presenters and panelists, you will feel the same. We have pretty much wrapped up our faculty and agenda—now we are down to the last details.

I’m going to give you a quick list of some names you know. But just as important, the names that you don’t know are going to be the ones that will simply amaze you. My team and I have spent countless hours listening to videos and working our contacts to assemble an incredible fountain of knowledge over the five days of the conference, just for you.

By the way, you’ll know many of the names but take note of the new ones, too. Trust me: I have good reasons for bringing them. Think of them as undiscovered gold.

Alphabetically: Ron Baron, Peter Boockvar, Ian Bremmer of the Eurasia Group, Danielle DiMartino Booth, former Dallas Fed President Richard Fisher, George Friedman, Louis Gave of Gavekal, Karen Harris of Bain, Lacy Hunt and Jim Bianco in conversation, Ben Hunt and John Hussman in conversation, Constance Hunter, chief economist for KPMG, former GE CEO Jeff Immelt, Doug Kass interviewing Byron Wien (whom he calls the greatest strategist of all time) and Jerry Jordan (whom Doug calls the greatest trader of all time), Joe Lonsdale (co-founder of Palantir and a major venture capitalist), Dr. Mike Roizen and an all-star COVID panel, David Rosenberg of course, David Rubenstein, chairman of the Carlyle Group, Liz Ann Sonders of Schwab, Bill White (former BIS chief economist), Cathie Wood of ARK, and the absolutely brilliant Felix Zulauf. Plus several dozen more.

My team and I have spent countless hours and a lot of elbow grease creating an event that, I believe, will wow both seasoned SIC fans and first-time attendees. We added even more panels and fireside chats, plus an extra half-day of programming... all for the same low price as last year. Order your discounted SIC 2021 Pass here.

Now on with today’s topic.

When Every Lot Is Odd

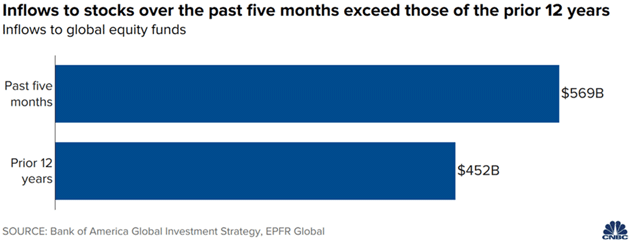

One sign the water may soon rush out of stocks, indicating tsunami, is the amount of money rushing in. My friend Doug Kass recently shared this staggering chart. It shows the inflows to stock funds since November exceed the total inflows of the last 12 years. Doug helpfully pointed out that one of the legendary Bob Farrell’s rules is that “individuals buy most of the top and buy the least at the bottom.”

Source: CNBC

Note also, this is just stock funds. It doesn’t include individual trading accounts, and I suspect the amount entering the market via those is equally staggering.

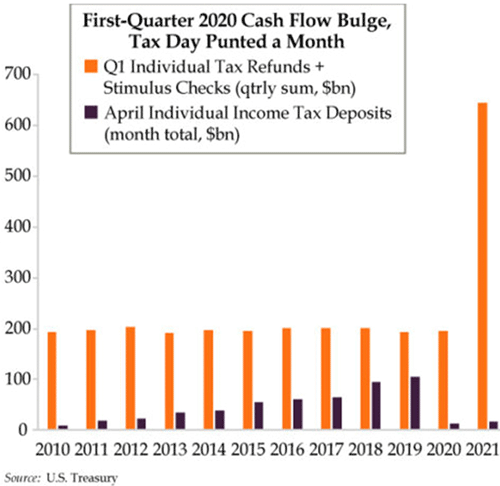

Where is the money coming from? The obvious answer is from the Federal Reserve and government stimulus. But Danielle DiMartino Booth gives us a visual chart to understand just how completely out of historical context the current levels are (from Quill Intelligence):

Yes, some of this is showing up in retail sales (which were gonzo last week), but clearly some of it is showing up in stock purchases (see some reasons why below). We see well over three times the normal tax refund and stimulus number (pushing $700 billion), and I assume this doesn’t even include state unemployment and other indirect stimulus. Also, notice the tiny blip on income tax deposits. The differential is even more stark.

When markets change, as they clearly have in the last two years, you want to ask if something else changed that might explain it. Federal Reserve activity and COVID stimulus payments are obvious factors, but I think something else is contributing. Some history may clarify it.

Way back in ancient times, which some of us can remember, stocks traded in 100-share “round lots.” If the share price was $30, you had to invest $3,000, or $6,000, or some other multiple. You could trade in smaller increments but brokers frowned on it and some charged higher commissions, which back then were already extremely high compared to today. And odd lot orders often got executed at inferior prices, too.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

(I have a friend who once ran serious money for a family office, focused entirely on buying bonds in odd lots. He didn’t need to find odd lots, as they had plenty of money. He could simply get 1 to 2% more yield for the little bit of extra work.)

Over time, “odd lot” trading became a sign of amateur activity, to the point some used it as a contrary indicator. More odd lot activity meant uninformed people were entering the market and a top was approaching.

By the 1990s, back office technology had made the whole round lot preference obsolete. Brokers stopped caring how many shares you traded. In effect, a “round lot” became one share. But now it is even less. Robinhood and many other trading platforms let users trade fractional shares, as little as 1/1,000,000 of a share. I believe this may be more consequential than is generally recognized.

Look at the share prices for of some of today’s top companies: Apple (AAPL) is around $130. In the old round-lot world, you would have needed $13,000 to trade it efficiently. Now you need less than a penny. This vastly expands the universe of people who can trade Apple shares. And Apple is low-priced compared to some other popular names like Tesla (TSLA) around $750, or Amazon (AMZN), which is over $3,000 per share.

We have, without really noticing, severed the connection between share price and liquidity. This matters in ways I think we may not fully understand. Combine it with game-like mobile apps that let people buy and sell in individually tiny amounts that add up to the big numbers once reserved for giant institutions. And without any kind of institutional decision-making process to constrain rash moves.

Further add trillions in government cash payments, often to people with time on their hands because they are unemployed, and who need ways to generate income. Of course, some turn to stock trading. It’s an attractive “side hustle” for a time when Uber driving is less attractive. If all you have is $100, that’s okay.

We have raised a generation playing adrenaline-charged video games. For a relatively small stimulus check, they get to play in a game where Dave Portnoy assures them that stocks only go up, or they can “stick it to the man” in GameStop. Sigh….

In the bigger picture, all those small accounts add up to enormous sums of hair-trigger money. Some of it has much higher risk tolerance. The app users don’t see it as a nest egg to preserve. In their minds, it’s more like buying gas to get to work—something you have to burn. The whole concept of a stock being overvalued or undervalued doesn’t apply. They just want it to move.

Where all this leads is uncertain but I suspect it won’t be good.

A Key Difference

One of the first rules my mentors taught me: All it takes to create a bull market is for buyers to show up. All it takes to create a bear market is for the buyers to disappear. Just reading the zeitgeist, I don’t think they’re going to disappear for a while.

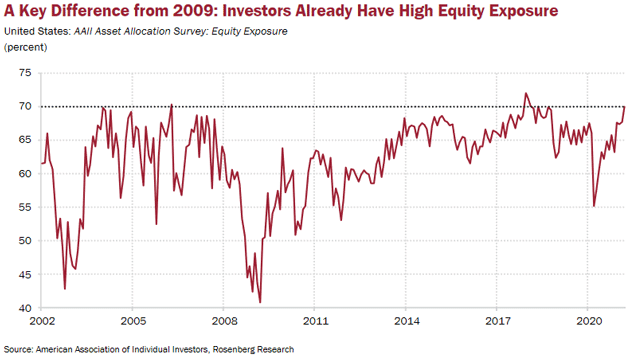

Dave Rosenberg at Rosenberg Research has also been following these inflows, and finds them problematic. He added another perspective in his latest monthly chartbook. The line in this chart shows current equity exposure in the AAII Asset Allocation Survey going back to 2002.

Source: Rosenberg Research

As you can see, equity exposure dropped in early 2020 as the coronavirus struck, climbed sharply and is now far stronger than it was when the last bull market began in 2009. I’m not sure the AAII survey captures the individuals (it’s hard to call them “investors”) trading small amounts on Robinhood and other apps. But their inclusion would only make the point stronger. A bull market needs fuel and this one has already burned a lot of it.

This is important also because we are talking about percentages, which include whatever money people may have received from the various stimulus programs. That money is already in the woodpile and being burned along with preexisting cash.

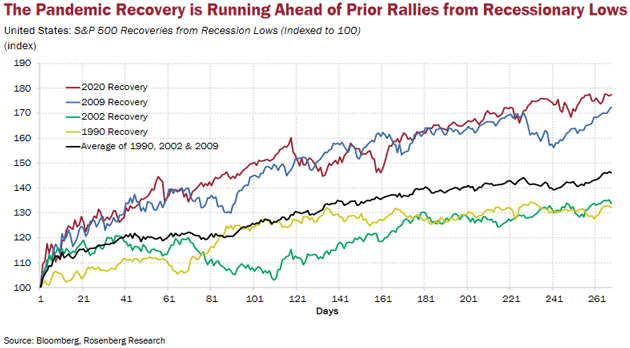

Dave has another chart showing the result. Comparing S&P 500 gains in the last four recessions, this one is stronger than the others were.

Source: Rosenberg Research

This market recovery has actually tracked the 2009 one pretty closely. But remember the previous chart: In 2009, investors had pulled out and then spent months furiously reinvesting. The current recovery happened with people closer to fully invested. That means it is even stronger than the price action shows.

None of this means the bull will tire in the near future. Major market trends often persist far longer than we think possible. Precedent is reliable until something unprecedented happens. It is certainly plausible to think the economy will bounce once the pandemic is out of the way, which we all hope will be soon. I’ve noted how crises often generate growth-sparking innovations. Good things may be coming. The question is whether they will both justify today’s valuations and even higher future valuations that justify further price gains.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Let’s think about this. The Fed is adding QE at an ~$1.5 trillion annual pace. They say interest rates won’t rise until 2023 at the earliest. The US government (by my latest count) has thrown, or soon will, $5 trillion of stimulus money, almost 25% of annual GDP, into the economy. Yes, not all of it goes directly to individuals, but it will eventually find a home, creating new jobs or programs.

At some point the government stimulus simply has to stop. Job openings are plentiful and the economy is opening up. Employers are having to pay much higher wages to get someone to come to work. When you can make $20-$30,000 a year staying at home, $10-$12 an hour just isn’t appealing. Ironically, the unemployment checks are actually creating wage inflation.

While we may get a massive infrastructure bill later this year, it will be spread out over a decade. I don’t think we are going to see anything like the current free-for-all, multi-trillion-dollar injections like the last 12 months.

The Contest of Supply Versus Value

Central banks and governments worldwide are supplying massive amounts of rocket fuel for supercharged markets. The yields on high-yield bonds (junk bonds) are close to the recent all-time lows. Investors are desperate for yield and the only place that seems to offer return, if you’re only paying attention to price momentum, is the stock market. So Baby Boomers and retirees, along with their Millennial children, are taking more risk than they can possibly imagine.

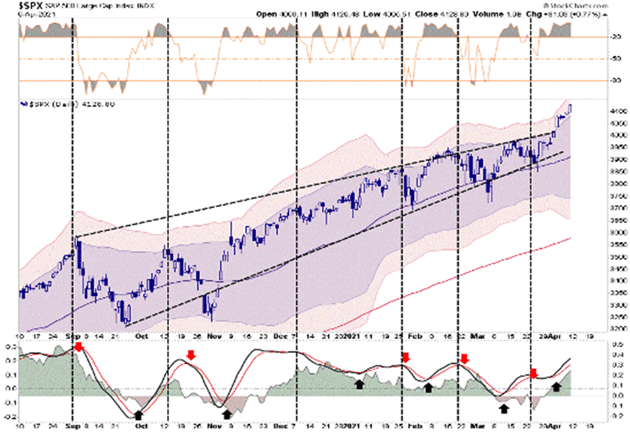

The stock market is trading at more than three standard deviations above its 50-day moving average (courtesy Doug Kass).

Source: Doug Kass

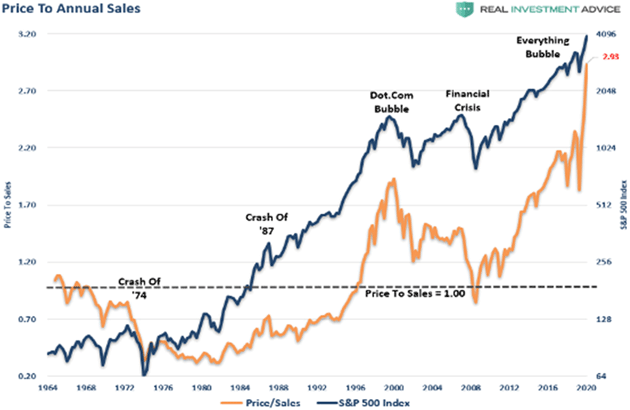

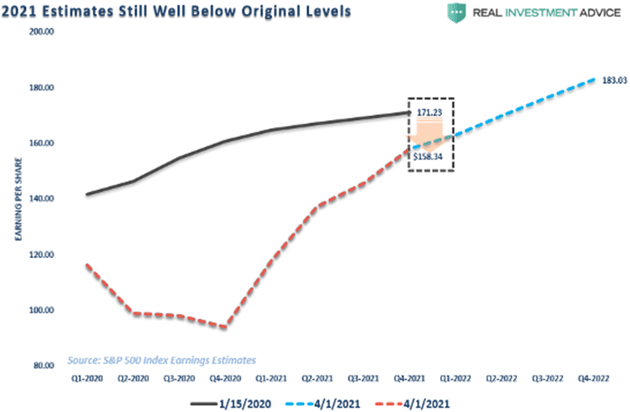

Our friend Lance Roberts at Real Investment Advice offered these two charts

Source: Real Investment Advice

I don’t know of a time when valuations and markets were more stretched than they are right now. I also don’t remember a time when monetary and fiscal stimulus was more than it is right now. I would not be surprised to see the market rise considerably more from here. That being said, let me repeat what I said last week. I do not want to play the stock market or bond market game. There are other, more profitable games with much less risk. I am not bearish. I am 100% invested and as aggressive as I have ever been in my life. Just not in index funds.

CPI inflation has a real chance of approaching 3% and maybe 4% this year. Something could easily become the tipping point (it literally doesn’t matter what it is) that makes the market roll over 20% or more.

In that scenario, I will bet you a dollar to 47 doughnuts the Federal Reserve steps in, and in giant size. QE increases another $50 billion per month? Or Whatever It Takes! If that’s not enough, then some clever lawyer will find a loophole to allow the Federal Reserve to enter the stock market through the back door. Or Janet Yellen walks over to her friend Nancy Pelosi and says we need a bill letting the Fed be more aggressive. It won’t be Hank Paulson on his knees to Pelosi this next time. Literally nothing—I truly mean nothing—will be off the table. When you are in the middle of a crisis, you channel your inner Mario Draghi and do whatever it takes.

Will it work? Who knows? I truly don’t know what will happen. We are exploring brand-new territory this decade. The new era we are entering can bring challenges as well as opportunities. Time to think about changing your game if you are still playing the old one.

SIC and Amanda’s Stroke Recovery

As noted above, SIC registration is open and we’ve posted the full speaker list. Doug Kass, Dave Rosenberg, and Louis Gave are all on the agenda, and I’m sure we will talk about the issues I just described, plus a lot more. Click here for more details and registration info. You saw the list of speakers above, and I guarantee you the ones that I didn’t mention are just as powerful. You want to be in that room. You can watch it live or at your leisure, you can read the transcripts and see the PowerPoint decks. The technology is truly state-of-the-art. This will be the best SIC ever.

As proud as I am of the SIC, some of you may remember that my daughter Amanda had a stroke last year. It was pretty frightening. Last night, I got a video of her after physical therapy doing a fairly complex balancing act on one leg, moving a ball to the other hand and changing legs. She was walking down the hall with two nurses to catch her if she had a problem. Her physical therapy is grueling, but she stays with it and works hard. With tears in my eyes, I am as proud of that girl as anything in my life.

With that, I will hit the send button and wish you a great week. And sign up for the SIC!

Your meditating on what’s really important analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin