Stumbling to Scarcity

-

John Mauldin

John Mauldin

- |

- April 23, 2021

- |

- Comments

- |

- View PDF

Plastic Explosion

Abundance to Shortage

Wage Inflation

Puerto Rican Opportunities, Thoughts on Taxes, SIC, and Airplanes

In economic forecasting, reality is usually somewhere between the extremes. The best-case and worst-case rarely happen. That’s why, when they do happen, markets react so quickly to the “missed expectations.”

I saw this early in my career. Realizing we will “muddle through” most of our problems was immensely valuable and sometimes profitable. But as our problems grow in scale, I’ve had to change my attitude. Now I usually expect to “stumble through,” as we see more of those extremes, and more extreme reactions to them. We still make it, but with some bruised knees and painful scrapes.

Consider two views of the current US inflation outlook.

Some expect major economic growth as we subdue the coronavirus and stimulus spending moves through the economy. Prices will rise and generate significant inflation, due to both increased demand and supply chain disruption. That’s why the Fed maintains (and I agree) that we will likely see higher inflation but it will be transitory. Nine to 12 months from now, much of the supply/demand mismatch should be back in balance—at least in the US. Much of the world is far from that point.

Another view is that controlling the virus will simply send the economy back where it was in 2019, with low growth, low inflation, low interest rates, and already-excessive debt that is now far worse. People saw problems coming but thought they had time.

My view is somewhere in between those. I think we will probably have a few months of significantly higher inflation. It will fade but meanwhile hurt certain people and industries. It will be like one of those extremes causing bruised knees and volatile markets.

That means we must juggle two seemingly incompatible outlooks: We don’t need to fear generalized inflation, but localized inflation could be a significant problem just ahead. With some prices rising while others hold steady or even fall, there may be little change in the broad CPI and PCE benchmarks. You may not feel it personally, depending on your location, business, and so on. But it will be there.

Then we have to think about long-term changes. The trends that were underway in 2019 are still unfolding. Even as we put this horrible time behind us, the Great Reset of global debt is still coming—and probably sooner now because the debt is growing faster.

If we rationalize the debt, we will also have to rationalize the things the debt bought, especially in government spending. Think it can’t happen in a major country? Think 1993 in Canada and Sweden. Those were painful periods.

I hear some of you now: “But John, you’re Mr. Optimist! What are you saying?”

It’s all about the timing. We can be concerned or even pessimistic in the short term but long-range optimistic. That’s not inconsistent. Though, I’ll admit, it is a kind of fine distinction that is hard to make in the social media age. Today I’ll try anyway.

Meanwhile, the countdown to our Strategic Investment Conference 2021—again fully virtual for your safety and convenience—is ticking down. We now have 48 top-of-the-line presenters and panelists, including Howard Marks, co-chairman of Oaktree Capital... John Hussman, founder and president of Hussman Strategic Advisors... Ron Baron of the famous Baron Funds... Richard Fisher and Danielle DiMartino Booth, who used to work together at the Dallas Fed... Cathie Wood, venture capitalist extraordinaire… Joe Lonsdale who co-founded Palantir among other companies... David Rubenstein… Ian Bremmer…

Doug Kass just wrote to his readers:

This might be the best conference ever... I mean it! Just gaze at the roster below!! …This is going to be super fun and what a roster of speakers! I can't wait to interview Byron Wien, the greatest strategist of all-time, and Gerry Jordan Jr., the smartest trader in the world.

For just $395, you’ll get five and a half days packed to the brim with valuable information you won’t find anywhere else. I want you to go to the webpage showing the speaker list, and from there you can register. Doug is right. There has never be another conference with this much firepower. Imagine sitting down to dinner with each one of those speakers.

Click here to see the list and get your tickets now. And remember, video/audio recordings are part of the package, so even if you can’t see everything live, you won’t miss a thing.

Now let’s talk about inflation.

Plastic Explosion

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

An inflationary economy is marked by widespread price shocks, often in products you don’t expect. And, less obviously, prices of other things may not rise, but they stop falling. We have all benefited from technology-driven lower prices for 30 years. It has been a deflationary/disinflationary positive environment of abundance. That trend is not going to stop during the decade, but simply slowing down for a year or so as we rebalance the supply chain will mean more inflation in some segments.

You know about more expensive energy, housing, food, labor, and healthcare. But here’s one you may have missed: plastics. And no, I’m not quoting Mr. McGuire giving his famous tip to a young Dustin Hoffman in The Graduate. Plastics really are hot.

Source: YouTube

Here’s a note from Bain’s Macro Trends Group (whose head, Karen Harris, is on the SIC agenda, by the way) that crossed my desk last week.

Plastic resins—the ubiquitous building blocks that are used to make the soda bottles we drink from, the fibers in our athletic clothing, the personal protective equipment that medical providers rely on, and the dashboards in our cars—are yet another input facing unexpected supply and price shocks due to the COVID-19 crisis. Over the last year, the prices of the two most common resin types, polypropylene and polyethylene, have increased by around 100% and 60%, respectively, in the US. In Europe, which has access to a broader range of suppliers, prices for the two resin types have increased by 20% and 5%.

Like many of the shortages we’ve seen recently, the resin shortages are due to the pandemic’s effects on both supply and demand. Demand for resins did not decline as much as expected due to the virus because locked-down consumers started purchasing more consumer electronics and packaged food, milk, and juices. At the same time, the global supply of resins grew more slowly than expected, as cautious producers delayed new plant openings and opted to draw down inventories in the early months of the recovery rather than ramping up production. Unplanned production outages caused by hurricanes in the fall of 2020 and the winter storms across much of the US South in February further curtailed supply.

Plastic resin isn’t in everything we buy, but darn close. If its price doubles, other prices get pressured in turn. Often, it’s just in the packaging of something more valuable. Packaging can be changed. But sometimes the product is plastic. Think of outdoor furniture, waste baskets, many automotive parts. They’re just pieces of plastic in different shapes and colors—and they’re getting more expensive.

This is exactly the kind of thing that will, if it persists, feed through to other prices. That may not happen; the Bain analysts think plastic resin prices will ease later this year. But it still has an effect in the meantime. Companies that need resin have to respond. They will find alternative materials, swallow the cost as lower profit margins, or raise selling prices. Competitive pressure may prevent the latter.

Another obvious example is lumber, up as much as 200% according to the NAHB. Part of the problem is a beetle which has been destroying trees for decades, plus forestry and lumber mills have faced lower labor availability and COVID-19 restrictions. Trucking costs have increased. But again, this should smooth out as we return to normal business activity.

Rising prices in key goods have a psychological effect, too. People wonder what prices will rise next. They may begin stockpiling or stop buying other goods to offset the higher cost. The impact is unpredictable, but quite real.

The inflation talk we hear right now doesn’t all emanate from Wall Street bond traders. Some of it is from real people and businesses seeing inflation firsthand. It may not last, but they’re not imagining it. They are thinking about how to “do without” items they once thought critical. That thinking, if it takes hold, leads nowhere good.

Abundance to Shortage

My friend, Gavekal co-founder Louis Gave, is a systematic thinker. He doesn’t simply say that A leads to B. He adeptly identifies the multiple components that combine to produce an economic or market effect. It is one of his trademark abilities (we will also hear from him at the SIC).

Recently Louis explained (Over My Shoulder members can read his full report here) why we may be moving from an age of abundance (my basic position) to an era of shortages. Obviously, not everything has been abundant, nor will everything become scarce. But the general trends matter.

I will try to summarize Louis’s vision. I don’t 100% agree, but he brings up critically important points. First, recognize what happened in recent decades.

- Globalization created abundant labor. Or actually, the labor was already there; transportation and communications technology unlocked it, letting people in Asia “work” in the US and Europe without actually moving. Job automation is having a similar effect.

- Energy became cheap and abundant thanks to the shale oil revolution, which put the nail in the coffin of the “peak oil” fantasy [which I have said was a silly idea for decades]. Recent advances in other energy sources—solar, wind, nuclear, hydrogen, etc.—amplify this trend. The same was true for other commodities.

- Information flowed freely around the world, enabling rapid innovation and technological advances.

Abundant labor, energy, and information combined to generate the economy we’ve known since 1990 or so. Hence, it may be a problem that all three of these are now in the process of changing direction.

- The COVID-19 pandemic, along with US-China trade tensions, is accelerating the re-localization of global supply chains. Technology was already doing this (hundreds of thousands of jobs have already come back from offshore) but the trend is accelerating. Louis argues labor is no longer in surplus, which leads to price (wage) pressure.

- Fossil fuel prices are rising faster than “green” energy sources come online to replace them. Energy and food prices seem to be entering long-term uptrends. These are related because energy is necessary for growing and transporting food. The same is true for commodities generally, so it seems we will also lose the advantage of cheap, abundant natural resources.

- Knowledge is ceasing to propagate as freely as it did a few years ago as companies try to maintain monopolies, public debate becomes more constrained, and governments see technology as a military advantage they must protect.

Louis concludes:

Setting aside the near-term data—whether year-on-year inflation figures, the growth of US money supply, the surge in the US budget deficit, or the growing US trade deficit—we face an important structural question. Do we still live in an age of abundance? If so, the environment will remain fundamentally disinflationary over the longer term. Or are we now entering an age of shortages?

Admittedly, there appears to be no shortage of capital in the world today; and central banks do not appear keen to engineer any such shortage. But beyond that, the “abundance versus shortage” equation might be changing in front of our eyes. In the coming decade, it is unlikely that knowledge will be shared as freely as in the past two decades. Labor is unlikely to be as plentiful as it was in the early years of the century. And, most visibly, a number of commodities are already showing telltale signs of shortages—you can’t find them.

I think the problems Louis brings up are very real. But like my view on inflation, I think they are “transitory.” Reshoring was already increasing. Over the next few years, I expect the reeducation and redeployment of unskilled labor to skilled jobs will become a major factor. Just as businesses in the early part of the last century took farm workers and made them factory workers, the same will happen all across the spectrum.

What does this mean for financial markets? The inflation vs. disinflation question is important but only scratches the surface. This is structural. The megatrends that enabled the economic growth we enjoyed for so long didn’t form overnight and won’t disappear overnight, either. But as they change, growth prospects in the traditional sense diminish. It’s not as simple as buying miners because gold will go up. Bigger things are happening.

Wage Inflation

I want to go deeper on Louis Gave’s labor point. He looks at China’s 2001 admission to the World Trade Organization as a key event. Companies moved jobs to places with lower-wage workers as a vast new supply of labor became available. This produced a flood of inexpensive goods from Asia to the West. In theory, the Western workers whose jobs were being moved overseas were going to be retrained for better things. That didn’t happen.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Moreover, low-wage countries that couldn’t compete with China became even more impoverished, leading many of their workers to seek work in Western countries, at wages high by their standards but a bargain for their Western employers. This affected the overall wage level, capping growth for other workers.

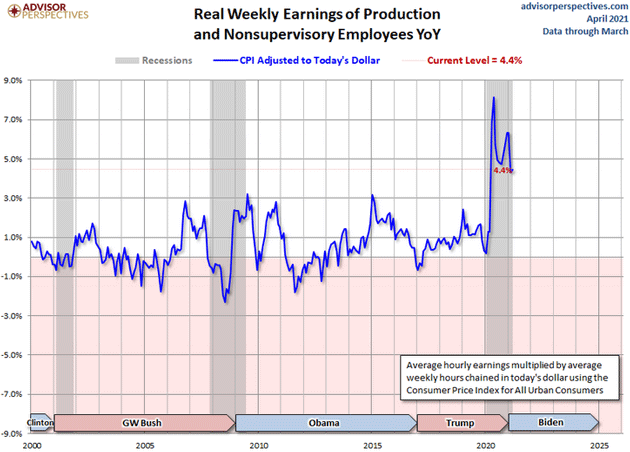

The chart below shows inflation-adjusted annual US wage growth since 2000, considering average hourly earnings and average weekly hours. That adjustment is important because sometimes fewer work hours can offset a higher hourly wage. You can see that until 2020, real wage growth only rarely touched 3% and didn’t stay there long. Often it was negative wage growth. By this measure, real wages rose a total (not annualized) of about 11% from 2000 to the end of 2019.

Source: Advisor Perspectives

Keep in mind, CPI doesn’t necessarily reflect real-world living costs. As I’ve discussed, it underweights housing, for instance. This “real” wage growth wasn’t as real as it appears for many workers. Wages were stagnant for many, perhaps most, blue-collar workers… for the better part of 20 years. Is it any wonder we saw discontent, populism, and resentment of immigrants?

By the way, that wage spike you see in 2020–2021 is largely a “compositional” effect showing the disproportionate 2021 job losses for low-wage workers. If you lay off millions of restaurant workers while keeping all the software engineers, average wages will rise even if nobody gets a raise.

But at a more basic level, this shouldn’t be surprising. Globalization increased the labor supply. Other things being equal, that should push wages lower, or at least keep them from rising, which is exactly what happened. Louis Gave points out that all this is now reversing. The COVID crisis showed producers that highly optimized global supply chains, built on lower-wage overseas labor, are inherently fragile. Manufacturers are looking more at their total cost of production versus just labor costs. A recent survey showed that 71% of those operating in China don’t plan to move jobs back to the US, which suggests 29% are at least thinking about it. That’s huge in real terms.

Meanwhile, policy changes are also raising the cost of labor: rising minimum wages in many countries, higher unemployment benefits, and so on. National security concerns are making governments hesitant about imports as well.

All that points to less abundant labor, which should raise wages. But how much is not yet clear. Also, some kinds of labor will be in higher supply than others.

How all this will shake out is unclear. If, going forward, we see even 2% real annual wage growth for middle-class workers, it will be a big turnaround from the last two decades. It would certainly mean some inflationary pressure, but I don’t think it would be Weimar Germany kind of inflation.

Some of today’s inflation hawks have short memories. Not so long ago, 3% annual CPI inflation was normal and expected. We had higher interest rates, yes. But that meant you could get a decent return on fixed income investments, and real GDP growth was often much better than we’ve seen lately. It wasn’t ideal, but it wasn’t hellish, either. We got by.

Inflation may become a challenge ahead, and sometimes a big one, but we will stumble through. And the kind of technology breakthroughs I expect may well create enough new abundance to offset it after the initial transitory uptick.

Puerto Rican Opportunities, Thoughts on Taxes, SIC, and Airplanes

My business partners, Steve Blumenthal of CMG, Kevin Malone of Greenrock Research, and Dick Pfister of AlphaCore will all be here next weekend to visit local Puerto Rican business leaders and discuss opportunities here. There are just so many. I really think Puerto Rico is getting ready to boom. Reshoring, green energy, affordable housing, and pharmaceuticals. It’s all here… And I want to be part of it.

Seriously, look at the list of SIC speakers and tell me there has ever been a better conference anywhere in terms of speakers. Certainly not for the price. Then sign up and make a date to be with me. It is just a little over one week from now and I am truly pumped over the entire thing.

I’ve been asked in a few media interviews for my thoughts on the Biden tax proposal. It will apparently (though we don’t have full details yet) raise capital gains rates for top-bracket taxpayers. If that’s the plan, I give it four thumbs down. Basic macro 101: You don’t raise taxes in a nascent recovery. Just Not Done. It would spark recession and the mere threat will have implications. Fortunately, I don’t think it would pass as presently described and probably wouldn’t even get through the House. But the simple proposal, even as an opening gambit, is wildly offsides.

After SIC, I will start planning to travel somewhat. It now looks like Dallas may be my first stop rather than Florida. I want to get to New York City, and Maine in August for the annual fishing trip. I would like to visit NYC/Washington/the East Coast every 4 to 6 weeks. I miss it, the friends and the dinners, and the opportunities to meet clients and investors.

With that, let me hit the send button and wish you a great week. Follow me on Twitter @JohnFMauldin.

Your beyond excited about the SIC starting in 10 days analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin