The Financial Fire Trucks of 2021

-

John Mauldin

John Mauldin

- |

- November 25, 2020

- |

- Comments

- |

- View PDF

A Happy Thanksgiving weekend to all my US friends. This year was different for many of us—sometimes by choice, sometimes not. But there’s one bit of good news I think we can all share: The holiday season means 2020 is almost over. Soon, we’ll be able to turn the page.

Source: @my2cents_on via Twitter

Each year at this time, I find myself recalling 2007, which was (so far) the most eventful Thanksgiving of my life. I told the story in my letter at the time, and today I am sharing it again. Interestingly, the lesson I drew from that harrowing experience once again applies. Indeed, the financial firetrucks are once again gathering around the world.

Read this, then I’ll be back afterward with some closing thoughts.

A Thanksgiving Fire Drill

(Originally published here on November 30, 2007.)

Last Thursday, we sat down for a massive Thanksgiving dinner at my 21st floor apartment in Dallas. All seven kids, my 90-year-old mother, and an assortment of friends and relatives (about 15 of us) started to work on a 16-pound prime rib, 18-pound turkey, and massive amounts of potatoes, mushrooms, and lots more. Grace was said, the wine was poured, and we were feeling good about life.

And then about 15 minutes into the meal, the fire alarm went off, telling us to evacuate. This was annoying, as it seemed like we have had a false alarm at least once every few weeks in the past few months. So, we did what we have done in the past and ignored the alarm. After all, this is a modern structure (only 4 years old) with fire sprinklers everywhere. We assumed that someone had a grease fire in their kitchen that would quickly be put out.

But the alarm kept sounding quite loudly, which did tend to interrupt conversation. As my dining room table is near the floor-to-ceiling window, we tended to look out when we heard sirens. And sure enough, the fire truck pulled up alongside the building. "Good," we said, "they will get that grease fire under control." And we continued eating and drinking, although with a heightened sense of concern. Fires in apartment buildings are not to be taken too lightly. Especially if you are on the top floor. People do die from them.

And then a second and a third fire truck parked underneath the window. That was a tad disconcerting, but surely they were just making sure that there was adequate back-up. It was when the 8th truck pulled up within a few minutes that I began to get more than a tad concerned. They were pulling hoses and running around very quickly.

At that point, we started trying to figure out how to leave; but how do we get a 90-year-old fragile lady down 21 flights of stairs? We spent a moment pondering that, and then my youngest son came back into the apartment to report that he could smell smoke a few floors down in the stairwell. Well, that was not good. #2 son said to come to his window at the back of the apartment, where we looked out and could see a rather significant amount of smoke coming from the 2nd and 3rd floors. No, this was not good at all. No one was panicking, but we began to think about how to get us down the stairwell and soon.

And then I got a call from a friend who was late coming to dinner. "The fire marshal told me that you have to get out of there NOW!" All this in just a few short minutes, mind you.

So, we started to move to the stairs. Fortunately, there were two rather big, strong young men at dinner (one was my oldest son and the other was a boyfriend who was just back from a tour in the army, but both chiseled out of granite). After several attempts, we decided that taking mother down piggyback would be the best. The young men took turns carrying her.

At first, I still thought it was overkill, but as we got to the 16th floor the smoke in the staircase was very apparent. By the 12th floor it was hard to breathe, and at the 7th floor the smoke was too thick to go on. One of the kids opened the hall door and went and checked the next stairwell, which was freer of smoke. So we changed exits and got out to the street, smelling of smoke - but we were all safe.

It seems some idiot must have tossed a cigarette down the trash chute and started a fire in what is a rather large trash collection bin for hundreds of apartments on the bottom two floors. The fire should have been contained, but the concern was that if anyone had left a trash-chute door open, the fire could have easily spread to a higher-level floor.

And what about the modern fire sprinklers in the trash collection area - the ones I was relying on? They inexplicably did not go off in the trash bin, allowing the fire to blaze on garbage and grease, but the heat rising set off the sprinklers in the trash chutes on higher floors, causing a lot of smoke as the water fell onto the trash, with the smoke escaping into the stairwells.

But all was not lost. It seemed that three of us grabbed a bottle of wine as we left! ("Train up a child in the way he should go...") So, we sat outside and waited, sipping on a brilliant chardonnay and a full-bodied cabernet for an hour or so until the very professional firemen cleared the building of smoke and let us back up, where we finished dinner, with lots of stories to tell. And my middle daughter had her ten seconds of fame, as she made national news. It was more excitement than any previous Thanksgiving, and one we will talk about for years.

“As Long as It Takes”

All right, 2020 John here again. In that same 2007 letter, I went on to discuss some recent events. It’s a little eerie to read in hindsight, knowing now what would unfold over the next year. I observed what was going on in subprime mortgages and credit insurers, and concluded the Fed needed to cut rates.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I wrapped up the 2007 article with this:

Now, maybe this is all just a fire in the trash bin, started by a subprime mortgage market gone wild. Maybe the fire sprinklers will work. But it seems to be spreading. Did someone leave a trash chute open on one of the higher floors? The Fed needs to turn the fire hose onto the problem before it spreads any more. I think we see a 3% Fed funds rate sooner than most of us think.

Gentle reader, be careful as you exit the building, there might be more than smoke. And be sure and grab some wine on the way out. You might as well enjoy it while you wait to get back to dinner.

Ben Bernanke heard my plea (or someone’s) and dropped the Federal Funds Rate from 4.5% to effectively zero over the next year. Even so, 2008 almost brought the financial system to its knees.

Roll forward a dozen years and we are in a different but no less serious bind. Instead of crazy derivatives, a troublesome virus is afflicting the economy. The Fed acted quickly last March, cutting rates and launching a massive asset purchase program. Congress helped with a giant fiscal aid package. Together, these jolted the economy back to life.

The jolt wasn’t permanent, however. The patient is now wavering again, and this time, the fiscal part of the cure is not forthcoming, despite pleas from Fed chair Jerome Powell and many others that monetary policy has reached its limits.

Ah, but this word “limits” doesn’t really apply to central bankers. Particularly the central bank of the world’s largest economy and issuer of the global reserve currency. The Fed has constraints—some practical, some legal—but is highly creative in overcoming both.

Going back to my 2007 metaphor, the Fed has the world’s largest financial fire hose and will use it if the flames grow large enough. Powell repeated this quite clearly just last week. Speaking to a San Francisco business group on November 17, he said, “The Fed will stay here and be strongly committed to using all of our tools to support the recovery for as long as it takes until the job is well and truly done.”

That is not the usual equivocating Fedspeak. Powell promised to use all the Fed’s tools, for as long as it takes, until they are well and truly done. No mention of any limits.

Powell isn’t one to make promises he doesn’t plan to keep. So if the economy begins slipping into a double-dip recession, I believe he will open the spigot again. What the barrage will look like, I don’t know, but it is probably coming.

A quick note on all the angst surrounding Treasury Secretary Mnuchin taking back some of the Federal Reserve’s CARES Act funding. First, the Fed used a little bit in the beginning but much of that money was just sitting there. My sources say Mnuchin is looking for a way to make a deal with Democrats more palatable to Republican senators. Recovering unused Fed money gives him almost $500 billion to soften their frustration with the price tag. The Senate seems to want a number below $1 trillion. With the recovered money, they could pass a “new bill” for less than $1 trillion, while actually spending more.

Whoever you blame for the deadlock, the simple fact is a bill needs to pass soon. I believe there is a serious risk of a double-dip recession without some major unemployment funding. We have about reached the limits of jobs recovery absent a vaccine. That leaves us with a real-world unemployment rate higher than the Great Recession’s worst. Waiting until February to pass a stimulus bill simply tempts the recession gods to strike again.

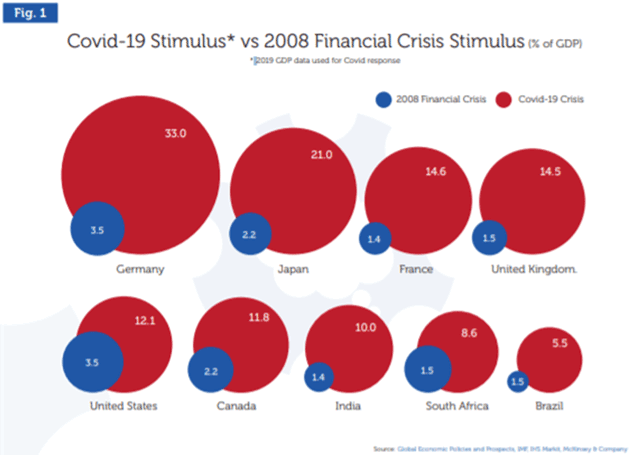

I wish they would just get a bill done. Forget about waiting for the Georgia elections; if Democrats take the Senate, they can pass a bigger bill later. The US has done nowhere near what the largest developed world economies have done relative to their GDP. From Grant Williams’ latest letter:

Source: TTMYGH

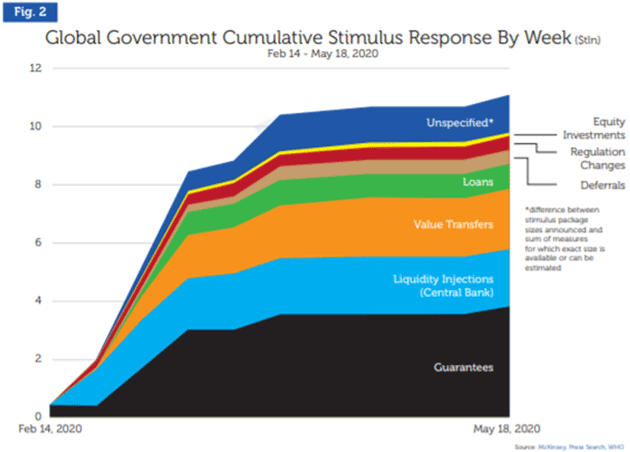

Further, when you combine all the stimulus from around the world, it is a rather staggering amount in both size and variety. The Western European countries alone have provided 30 times more stimulus (in current dollars) than the Marshall plan after World War II.

Source: TTMYGH

Total global debt will be close to $300 trillion by the end of the first quarter 2021, and global GDP will have been decimated. Every major central bank, not just the Fed, has opened the monetary spigots. It is no wonder the market is levitating.

Unlike 2008, this crisis has an identifiable end point if the new vaccines work as well as expected and are distributed in the next few months. I worry more about the damage already done. Many of those lost jobs aren’t coming back. Millions of small businesses will never reopen. Other new businesses will open, but that will take time and probably an effective, widely distributed vaccine. Some property owners will never again collect the kind of rent they used to. All that adds up, and it will take a long time to repair and adjust to. And once we do, we’ll still have the preexisting debt and other problems.

But, this being the time when we give thanks, let’s also remember the good news. The pandemic’s death toll, while much too high, could have been far worse. The crash efforts to develop treatments and vaccines will likely bear other fruit as well.

I think we are going to see some amazing new biotechnologies come out of this massive push for a vaccine. This is going to pull a lot of new health and medical technology forward from the future.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Entrepreneurs are meeting business challenges with innovative ideas. We are all going to have to figure out how to reprice commercial real estate, how we think about education, how we travel for business and pleasure, and scores of other things. Change is happening swiftly and not always comfortably. Events that would have stretched over years seem to be happening all at once, which makes it a little unsettling.

But I firmly believe we’re going to get through this and find a better world on the other side. For that, we can all be thankful.

A Zoom Thanksgiving

Thanksgiving is my favorite holiday. When I was a child, my dad’s rather large extended family (he was the youngest of 10) would all be together, sharing food and meals, while we played and watched football. Most of the kids around the table were second cousins, as dad was almost 40 before he began his family. His father was born in 1859 in Palo Pinto County, Texas. Dad was the last child, born in 1910. I had aunts and uncles who were born in the 1880s and had already passed away before I was born in 1949. And they typically had large families as well. So, when Thanksgiving came around, the entire clan would gather. Big Thanksgiving meals were an ingrained tradition.

With seven kids in my family by the mid-1990s, plus extended family, I began to host large Thanksgiving Day gatherings. A Thanksgiving dinner with less than 50 people would have been a small one. And while everybody brought something, I generally went overboard cooking prime rib, mushrooms, and assorted vegetables, and baking cakes.

This year, most of my children will be in Tulsa, and we will visit via Zoom. I can’t tell you how much I will miss seeing them all and cooking for two days, at least for me. But it is the prudent thing to do, as I want to make sure I’m around for another 40 or 50 Thanksgivings.

And I hope to be writing this letter to you for a very long time as well. One of the things I’m most thankful for is you and your gift of time and attention to my weekly musings. It has given me the ability to do what I enjoy and to actually make a living at it.

Someone asked me once about retiring. Why would I do that? If I retired, I would want to read, write, travel around the world, and talk to fun people over great meals. I would likely start a new business simply because I couldn’t help myself. Since I’m already doing that, why would I retire?

And with that, I will hit the send button, while reminding you to follow me on Twitter. I share a lot of useful financial and economic information, and a few ideas on hot button topics.

Shane and I both wish you a great week!

Your believing the future will be far better than we can imagine analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin