Elites on the Edge

-

John Mauldin

John Mauldin

- |

- December 4, 2020

- |

- Comments

- |

- View PDF

Counter-Elites

Financial Neutron Bomb

We Are on a Journey

What Are Your Favorite 10 Technology Stocks?

Puerto Rico Turns Quiet

Growing income and wealth inequality were on my (and probably your) radar screen long before COVID-19 came along. The pandemic has made them both more obvious and more urgent. The actions by the Federal Reserve have widened the gap. We are now in a situation where society’s upper echelon can easily stay safe and prosperous while the lower segments live precariously and dangerously.

It’s actually worse than that. The upper end is safe precisely because millions of “essential” workers are producing and delivering the goods we need, placing themselves at risk in the process. That’s always been the case to some degree. Now it is clearer, and the stakes are higher.

Two weeks ago I talked about Peter Turchin’s idea of “elite overproduction” leading to social and economic crisis. What I read sounded disturbingly like our present situation. Further reading wasn’t any more comforting. While he doesn’t have any solutions, Turchin helps illuminate how we reached this point. Today we’ll go a little deeper and think about the implications. As you’ll see, there are many.

Counter-Elites

The “memes” we see on social media, even the anonymous ones, are often revealing. Here’s one that made the rounds this year.

Source: TruthorFiction.com

As far as I can tell, no one has been able to verify this story or trace it to the source. It might not be true but it’s completely plausible. I know people who went through such experiences. You probably do, too. They followed the rules, did everything right, then cancer or some other bolt from the blue demolished everything. Happens all the time.

But here’s the thing: This doesn’t happen to everyone. The top layer, the fabled 1% or 10% or wherever you want to draw the line, don’t lose everything when somebody gets cancer. They are, to use Peggy Noonan’s term, a “protected” class. The link is to a letter I wrote in 2016, describing the frustration in both political parties with what they considered “the elites.” I talked about how the protected class doesn’t really understand the stomach-churning reality of the unprotected class for whom just one blown tire, a trip to the emergency room, or other personal disaster completely wipes out their meager savings. They look at those who appear able to afford whatever they need, “the protected class,” and wonder why is that not me? They want to be in that class, too.

But it’s not easy to join, as I’ve been lamenting for years. Peter Turchin’s work adds to my concern. He notes, looking at many civilizations through history, that prosperity creates more wealth and wealthy people. The problem is their numbers tend to grow faster than the number of “elite” positions or jobs. In the US, for instance, we have 100 senators and 435 House members. Those numbers are fixed while the number of people who think they are qualified to hold office grows. Hence our large chattering class that circles the Washington beltway without any real power. Wall Street has a similar pattern. So do large companies, universities, state and local governments—basically all the institutions that compose society’s backbone.

Meanwhile, a layer or two below are large numbers of people who want to join the top ranks. They think education is the key. Get a college degree and the doors to success will open. That’s not wrong, either. But here again, not all degrees are equal. Much depends on where you go to college and who you meet there. Grades aren’t the only factor.

Regardless, millions load up on debt trying to get those degrees. Many find themselves without the desired diplomas but still saddled with the debt. And it’s not just college degrees; people go into debt seeking law, MBA, medical, and other credentials they think will open the desired doors. Loose monetary policy subsidizes and encourages these ambitions while simultaneously inflating asset prices, which make them difficult, if not impossible to achieve.

So you end up with a group of potential educated elites who can’t attain or maintain the status they think they deserve, and another group below them demanding that same status. Turchin says the next step is for some of the disaffected elites to become “counter-elites” and make alliances with the lower classes, which then seek to take power. Think of 2016, when the UK had the Brexit referendum and the US saw Trump win the White House. Populist movements around the world are partly a manifestation of elite conflict.

Financial Neutron Bomb

Some of my critics (whom I love dearly, by the way) accuse me of thinking central banks are the root of all evil. That’s not what I think at all. I believe we need central banks, just not the policies we are currently getting. I believe ill-considered central bank actions cause and/or aggravate many problems.

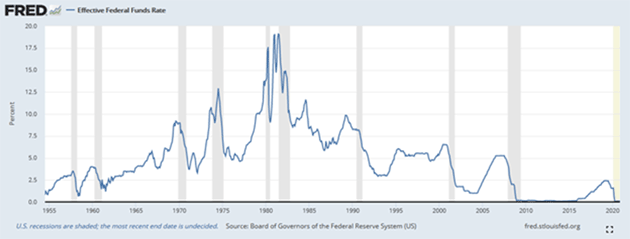

The income and wealth inequality that now plague us are, to a great degree, the result of persistently and artificially low interest rates. This goes back long before the Great Financial Crisis. Here’s the Federal Funds Rate, which the Fed directly controls, since 1955.

Source: St. Louis Fed

You can see rates have been generally falling since the early 1980s. I think it is not coincidence this is the same period in which wage growth lagged productivity growth, and the gap widened between the wealthiest Americans and the middle class.

This is easy to understand if you follow the process. Interest rates are the price of money, and money helps you make more money. Hence, lowering its price is a gift to those who are in the best position to invest it. This is an investment newsletter, so most of you reading it are probably in that category. But most of America isn’t.

Until recently, the most sophisticated “investing” most Americans did was to have a bank savings account or maybe a certificate of deposit. And for a long time, that was enough. An average person could save a little of every paycheck, make risk-free 5% or 7% yields, and build up a nest egg or the down payment on a house. That is now impossible. You are lucky to get 0.1% from your bank.

This “financial repression” has all kinds of negative effects. For one, it encourages excess consumption. Why save anything when you get no reward? Easier to go on vacation or buy a nicer car. Those who do save anything have to take risks for which they may not be prepared. We know how that usually ends.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

So over time, a growing number of people reach middle age or retirement age with little or no savings (and often a lot of debt) and find the kind of lifestyle they were told to expect isn’t possible. This is a recipe for discontent and resentment. No surprise, we have plenty of both.

But it’s even worse.

Those same low interest rates encourage speculation that raises asset prices, particularly for housing. So lower-income people have to spend more just for a place to sleep. This is good for the landlords collecting rent from them, at least for a while. Ditto for the university administrators and trade schools that offer a chance to climb the ladder—for a price.

Similarly, low interest rates subsidize job automation. In the long run, that’s actually good for workers, but in the here-and-now it eliminates jobs and suppresses wages. So the middle class finds itself making less and spending more. That can’t go on indefinitely.

Now bring in COVID-19. This pandemic hit our economy like a neutron bomb, wiping out millions of low-wage service jobs while leaving the protected classes unharmed and in some cases actually better. And even the rescue wasn’t even-handed.

- Jobless restaurant workers got a few months of generous unemployment benefits, which have now expired (and may not be extended).

- Small business owners got PPP “forgivable loans” that came with complex rules and strict limits on how they could spend it (and many who couldn’t apply quickly didn’t even get that).

- Large businesses got, thanks to the Fed (and Congress), trillions in practically free cash and permission to spend it however they wanted. In many cases, that meant share buybacks and executive bonuses.

Is it any wonder people want to join the elite, and are angry they can’t? The process Turchin describes fits our present circumstances to a T. And they come at a time when we are already bitterly divided in so many other ways.

Cameron Murray, in a review of Turchin’s latest book, offers this foreboding paragraph:

[T]here is a pattern that we see recurring throughout history, when a successful empire expands its borders so far that it becomes the biggest kid on the block. When survival is no longer at stake, selfish elites and other special interest groups capture the political agenda. The spirit that “we are all in the same boat” disappears and is replaced by a “winner take all” mentality. As the elites enrich themselves, the rest of the population is increasingly impoverished. Rampant inequality of wealth further corrodes cooperation.

In past centuries and millennia, the lack of internal cooperation invited aggressive neighbors to conquer the disorganized country. Rome was not so much conquered by “barbarians” as it committed societal suicide, when the glue that held it together, the cooperation of all factions, simply disappeared.

Gary North, (one of my first true historical mentors), in a long and technical 2011 essay, talked about the famous historian Robert Nisbet.

In 1953, his [Nisbet’s] book, The Quest for Community, was published by Oxford University Press. It received some attention, mostly favorable, but it was hardly a bestseller. He asked these questions: "Why was it that the modern world had turned to totalitarianism in the middle of the 20th century? What had taken place in the societies that gave birth to totalitarianism?" He concluded that it had to do with the breakdown of social order. Those institutions to which men had given allegiance throughout history, such as the family, the church, the guild, the fraternal order, and similar voluntary institutions, had faded in importance in the twentieth century. This left only the isolated individual and the modern nation-state. Men gained a sense of belonging through their participation in mass-movement politics. Totalitarian leaders began to attract individuals who were isolated, even though they were living in large cities. These leaders were able to offer a sense of brotherhood to millions of people who felt alone in the midst of cities. The modern totalitarian state functioned as a substitute for the family, church, and voluntary associations that for millennia had given people a sense of purpose and participation. So, totalitarianism was born out of radical individualism, institutionally speaking, even though as a philosophy, totalitarianism is completely opposed to individualism.

Sound familiar? In a world of increasing identity politics, it may not be the same, but it certainly rhymes. North went on to analyze another equally famous philosopher of history, Jacques Barzun, who wrote his final opus at 93 in 2000 (his first book was in 1927):

He asks the question: "What makes a nation?" He answers his own question. "A large part of the answer to that question is: common historical memories. When the nation's history is poorly taught in schools, ignored by the young, and proudly rejected by qualified elders, awareness of tradition consists only in wanting to destroy it." Nisbet had made the same point two decades earlier.

Thus we tear down the monuments to our founding fathers and even the heroes of the anti-slavery movements because we have no sense of human progress, only a concern for the grievances of today

We Are on a Journey

I like to end these letters on a positive note. We won’t have much to celebrate if the process unfolds the way Turchin says it historically does. But that doesn’t mean we are all doomed. Having the walls collapse on top of you isn’t the same as having them collapse around you. The latter is survivable, though hardly pleasant.

Neil Howe, George Friedman, Peter Turchin, (and may I humbly include myself), all point to the 2020s as a stressful, tumultuous period. But we also expect a period of calm afterward, a sense of unity not unlike the post-World War II years.

You must not let yourself get so caught up in political partisanship and societal angst that it takes your eyes off the fact that “this too shall pass.” We live in an age of wonderful transformation. If you focus on attention-grabbing media you will miss the truly important events, the things that will actually change society and make our lives better. The very things you should be participating in to make sure that you and your family not only survive but prosper in a new golden age.

While it goes without saying that nobody will want to go back to the year 2020, I believe in the 2030s no one will want to go back to any prior time period. Clearly, we have a number of things that have to be sorted out. We will do that, perhaps using the maxim (often attributed to Winston Churchill), “Americans always do the right thing after they’ve tried everything else.”

And so I write this letter full of warnings and not exactly “feel-good material” We need to recognize where we are on the map to the future. We must also recognize we have not arrived. We are on a journey. It is time to gird up our loins and fight the good fight, to, as William F. Buckley said when launching the National Review: “Stand athwart history and yell stop!”

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Decades later that line should be more than a conservative talking point. It needs to be on the lips of those who believe in the rightness of the American experiment, whether politically left or right. I don’t think I am going too far out on a limb when I say that what we’re doing is not working: politically, economically, socially, or culturally. The concerns over the protected versus the unprotected are real. The remarkably accelerating pace of change is unsettling to many, and is in fact forcing a change in many lifestyles. There is much work to be done, not just in the US but globally, to create a sense of “we’re all in this together.”

We are entering a decade in which many walls will come down. The goal is to not be under them at the time. That will require us to stay nimble and informed. I’m presently recalibrating all my businesses and investments to get through this time, and I suggest you do the same.

Speaking of which, we will shortly, and briefly, reopen membership to the Mauldin Economics Alpha Society, which is the most cost-effective way to get all our research and also gives you exclusive access to some extra benefits. Look for more details soon.

What Are Your Favorite 10 Technology Stocks?

Catherine Wood, founder of ARK Investment Management, was a highlight of my 2020 Virtual Strategic Investment Conference. I was spellbound listening to her. ARK is a global investment firm solely focused on disruptive innovation in things like artificial intelligence, DNA sequencing, robotics, energy storage, and blockchain technology. They seek to invest in tomorrow’s leading technologies—the breakthroughs that will change and improve our lives. ARK sees a dramatically different future with mobile connected devises thanks to AI, gene editing and immunotherapies from DNA sequencing, adaptive robots, neural networks and autonomous batteries that power cars and houses to frictionless transfers in blockchain technology.

After the conference, I and my investment management team reached out to Cathie and asked her if she would be willing to work with us. Specifically, anyone can buy her ETFs and they are very good. We were interested in her highest-conviction stock ideas. After several months of due diligence work with her and her team, we are thrilled to be able to offer access to ARK’s highest-conviction top-10 stocks via a managed account on the CMG Mauldin Portfolios Platform. I encourage you to click here, provide some basic contact information, and my team at CMG Mauldin will send you a link to the video of Catherine’s conference presentation along with a description of the strategy and her highest-conviction ideas. I think you’ll really enjoy watching the interview and learning from Cathie. (Full disclosure: I am the chief economist for CMG. Mauldin Economics, LLC is not affiliated in any way with CMG.)

Puerto Rico Turns Quiet

Here in Puerto Rico the governor just issued a series of new restrictions to hopefully reduce COVID-19 cases. Whether they accomplish that or not, they will certainly put stress on the economy and individuals. Especially small businesses and, again, those in the unprotected class. We need the vaccines ASAP, for both health and economic reasons.

The crises I talked about above? I’ve written several times on how we will have to “Think the Unthinkable.” That is going to be the mantra for the 2020s. I expect we will be doing the unthinkable more than any of us can imagine and it will make us all very uncomfortable. But we must do it anyway.

And with that I will hit the send button. I trust you will have a good week and stay safe.

Your trying to find the sunny side of the street analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin