What’s taking so long for the Ethereum ETF?

- Stephen McBride

- |

- June 11, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

I’m back home after a great trip to Nashville and Boston. I’ll share some important insights from my trip with Disruption Investor members soon.

Today… let’s discuss the upcoming Ethereum (ETH) ETF.

Many RiskHedge readers are asking about it—and rightfully so, since the launch of the bitcoin (BTC) ETF led prices to double in a short period.

Will ETH see a similar surge?

- What’s taking so long?

As discussed, the US Securities and Exchange Commission (SEC) approved the Ethereum ETF two weeks ago.

But you still can’t buy it. What’s going on?

ETF approvals typically come in two stages. Ethereum passed the first one.

Now, ETF issuers like BlackRock (BLK) and Fidelity are busy working to complete the second stage. It’s an exercise in filling out paperwork, designed to make Wall Street lawyers rich.

The important thing is the debut of the ETH ETFs is a matter of “when,” not “if.” Our research suggests they should start trading within one month.

- Will the ETF launches move Ethereum’s price?

Yes. It’s a HUGE deal for Ethereum. The most important development since I started investing in crypto 5+ years ago.

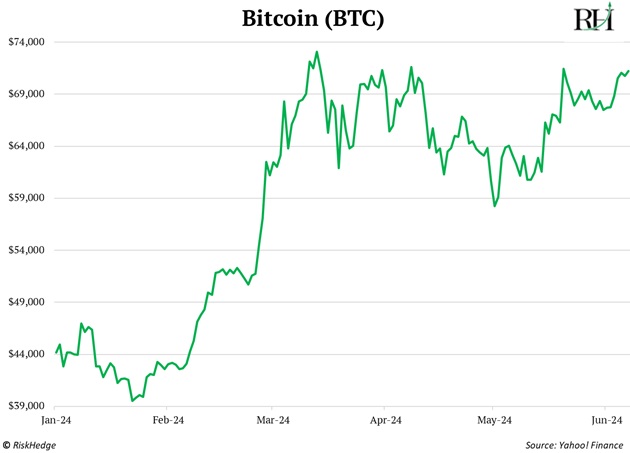

Just look at how bitcoin (BTC) has performed since its ETF launched on January 10. It’s up more than 50%:

In less than six months, BlackRock’s bitcoin ETF raked in $17 billion in assets. We’ve never, ever seen anything like this in ETF land.

Why do ETFs matter?

They introduce the “infinite bid” into crypto.

When tens of millions of Americans get paid every other week, they buy stocks on autopilot through retirement accounts. This creates a continuous demand for stocks and constant upward pressure on prices.

Crypto lacked this “infinite bid”… until the ETFs arrived. Now, many of the world’s largest money managers are having their clients buy and hold BTC in their 401(k)s.

|

Just as billions of dollars poured into bitcoin once it got its ETF, the same will happen for Ethereum.

And remember, Ethereum is only about one-third the size of bitcoin. That means it takes less money to move its price.

I think Ethereum could attract around 20% of the inflows bitcoin got. What will happen when billions of dollars that were previously walled off flows into Ethereum? Much higher prices, I expect.

ETH has surged 25% since the ETF news broke. I think we’re only getting warmed up.

- Will this open the floodgates for more crypto ETFs?

Unlikely.

Not to be a Debbie Downer, but it’ll be a while before more crypto ETFs get the green light.

The SEC approved the bitcoin ETF on the grounds that the BTC price closely tracks the price of bitcoin “futures,” which trade on regulated US exchanges like the Chicago Mercantile Exchange (CME).

Same deal for Ethereum.

No other cryptos trade on a regulated US exchange yet.

My guess is Solana (SOL) will be next in line to get an ETF. But even if its futures started trading on the CME tomorrow, it’d likely still take at least another year or two to push an ETF through.

When it comes to crypto ETFs, it’s BTC, ETH… and then a chasm.

- “Stephen… what about ETHE?”

You can buy the Grayscale Ethereum Trust (ETHE) through a regular brokerage account today.

But ETHE isn’t an ETF. It’s a closed-end fund.

I know that sounds like some financial jargon, but it really matters for investors.

Without getting too in the weeds, closed-end funds can trade at a discount to their underlying value. And ETHE has been a serial offender on this front.

Last year, ETHE was trading at a 50% discount. Which meant when Ethereum itself was $2,000, you could buy but it through ETH for $1,000.

I’m no fan of ETHE, but I couldn’t pass up an opportunity to make close to free money. Inside RiskHedge Venture, we bought the fund last August and tripled our money.

Bottom line: I think ETH is going much higher, and the ETFs could light a fire under it. Expect new highs soon.

- Today’s dose of optimism…

“And people are bearish on America?”

I jokingly said this to Dan Steinhart as we walked through Back Bay in Boston last week.

The city was buzzing. Every restaurant was packed… on a Tuesday night. People were out having fun. No signs of a slowdown anywhere. Nashville was the same.

Listen, I owe my life to the internet. It allowed me to get out of the crappy neighborhood I grew up in and learn from the smartest people in the world.

But I think we’re all a tad too online.

It’s easy to sit at home and “doomscroll” through Twitter, tricking yourself into thinking the world is bleak.

PUBLIC SAFETY ANNOUNCEMENT: Don’t exceed your daily limit of finance podcasts. Doing so may result in anxiety and not wanting to get out of bed tomorrow.

Turn off the phone. Get out there and do something in real life. Go to dinner. Bring your kids swimming. Take a vacation.

I promise you’ll be happier. And you’ll see the world is (mostly) a great place.

Bullish on America.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com