Here’s where we are in the crypto cycle

- Stephen McBride

- |

- June 13, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

We’re nearly halfway through 2024, and what a year it’s already been for crypto.

- First, the debut of bitcoin (BTC) ETFs, which launched in January...

- Then, bitcoin’s long-awaited fourth “halving” in April...

- And soon, the newly approved Ethereum (ETH) ETFs will start trading...

If you missed Monday’s Jolt, I explained everything you need to know about the Ethereum ETFs.

Today, I want to answer another important question on readers’ minds:

- “Where are we in the crypto cycle?”

Bitcoin and Ethereum are up 52% and 48%, respectively, this year.

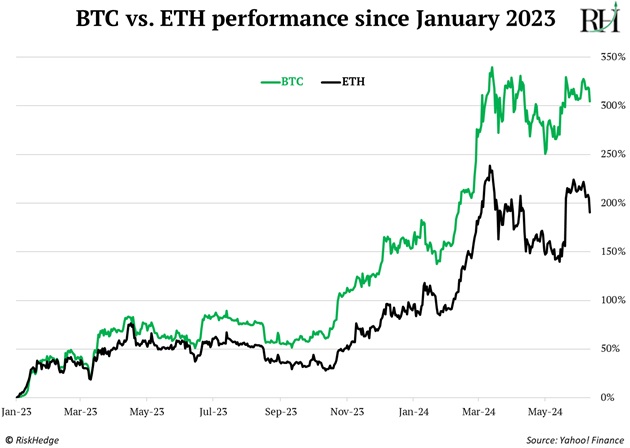

Since the start of 2023, bitcoin has soared around 300% and Ethereum is up around 200%:

It’s been a great run. But is it drawing to a close?

In short: No. My research shows we’re only roughly halfway through this bull cycle.

Let me explain. For one...

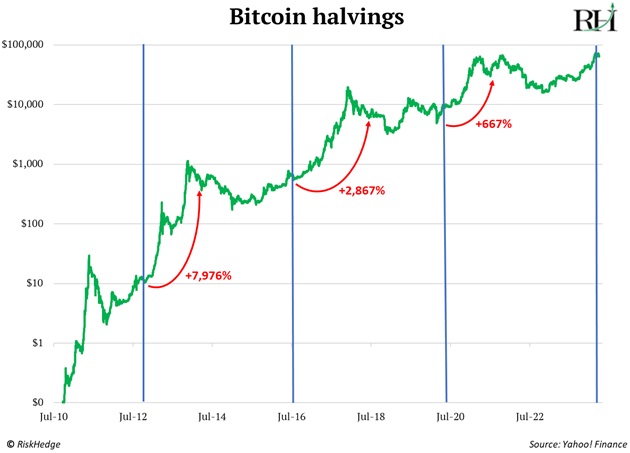

- Bitcoin has historically followed a predictable pattern before, around, and after each halving.

Bitcoin’s fourth halving was on April 19. Why did I dedicate so many Jolts leading up to it?

Because this preprogrammed event—which automatically cuts the new supply of bitcoins in half—has created a predictable upcycle every time it’s happened.

Crypto prices tend to bottom 12–18 months before bitcoin undergoes a halving. They then rally into the halving… then rally harder in the year following the halving.

Bitcoin jumped 8,000% after the first halving… almost 30X in the year following the second one… and it handed out 6X gains after the most recent halving four years ago.

Bitcoin is right on script for this cycle. Prices bottomed 17 months before the halving and have now jumped 300%+ off the lows. It’s up only slightly since the most recent halving, but that’s nothing to worry about. We’re in the window during which the biggest price gains typically occur.

Analyzing crypto markets through the lens of the bitcoin halving suggests we’re in the fourth or fifth inning of this bull market.

- I arrive at the same conclusion when I look at bitcoin’s gain since it bottomed in late 2022.

You can see the current cycle (black line) mirrors the last two market cycles:

Source: Glassnode

Everything that happens on a blockchain is transparent and open. On-chain analysis allows us to see what’s really going on in crypto markets—in real time.

All the on-chain metrics I’m watching tell the same story: The crypto bull market has another 12–18 months left to run.

Although we’re roughly halfway through the cycle time-wise, studying past bull markets shows us the lion’s share of profits are made in the back half. Roughly 80% of profits are made in the last 20% of the cycle.

It won’t be a straight line up. Remember: Crypto is the most volatile asset in the world. Nothing else comes close. But as I tell my RiskHedge Venture subscribers, “We’re still early. The best is yet to come.”

Don’t lose sight of the big picture.

- Every so often, it’s important to shut down the laptop, stop looking at charts, and ask: “Why am I investing in crypto, and where will this industry be in five years?”

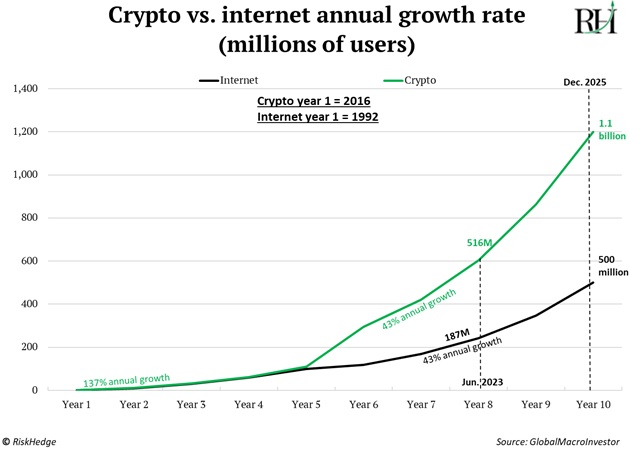

I always come back to this: Crypto remains one of the fastest-growing technologies in history.

The number of internet users jumped 70% per year between 1990 and 2000. Blockchain is surging 137% per year, doubling the internet’s golden-age growth rate:

Crypto has been the best-performing asset class over the past decade by a LOT. Even counting the multiple 80% drawdowns, bitcoin has surged 13,000% since 2014.

My research suggests it will blow stocks… bonds… real estate… and commodities out of the water again over the next 10 years. Crypto is the asset of a lifetime.

There are two mistakes investors are making in crypto today. One is not owning any. I think everyone should own at least a little crypto because of its rare wealth-making potential.

Mistake #2 is owning too much. I’ll reiterate what I said earlier: It’s the most volatile asset class on Earth.

Here’s a test to see if you own too much. Imagine your crypto holdings losing half their value by next month. Feel nauseous? Then you own too much. Reduce your position—because it’s only a matter of time until crypto’s next 50% drawdown.

|

To succeed in this space, you must persist. To persist, you must keep your crypto allocation small enough to sleep soundly.

I’ve said all along, I believe bitcoin will hit at least $150,000 this cycle. That’s about a 120% gain from here.

I think Ethereum—the world’s second largest crypto—performs even better.

But my favorite way to play this crypto bull market is investing in lesser-known crypto businesses making real money. That’s what we do in RiskHedge Venture (membership is currently closed, but we hope to take new members soon).

Talk Friday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com