Welcome to euphoria

- Stephen McBride

- |

- April 16, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

As I’m sure you’ve heard, Iran launched an aerial attack on Israel over the weekend, firing more than 300 drones and missiles.

If you’re a Disruption Investor member, look out for a special update soon in which I’ll analyze what this means for our stock holdings. I’ll also touch on this in my upcoming RiskHedge Venture issue on Thursday.

In today’s Jolt, let’s focus on the crypto cycle—because we’re now in the final countdown for bitcoin’s (BTC) halving.

In short: we just entered “euphoria”...

This is the fun part of the crypto cycle... where most of the money is made.

If you’re at all interested in crypto, now’s a great time to put money to work.

If you’re averse to crypto, this issue might change your mind.

Many folks I talk with think crypto is too complicated. Or that it’s “too late” to get involved.

Let me show you why neither of those is true.

- A disclaimer: I don’t own bitcoin.

And I’m not buying any ahead of its much-anticipated fourth halving event this week, for reasons I’ll show you in a moment.

But you can’t ignore bitcoin. It remains the bellwether for crypto assets.

If bitcoin is doing well, the crypto market is likely following. Bitcoin has surged more than 4x since bottoming in late 2022.

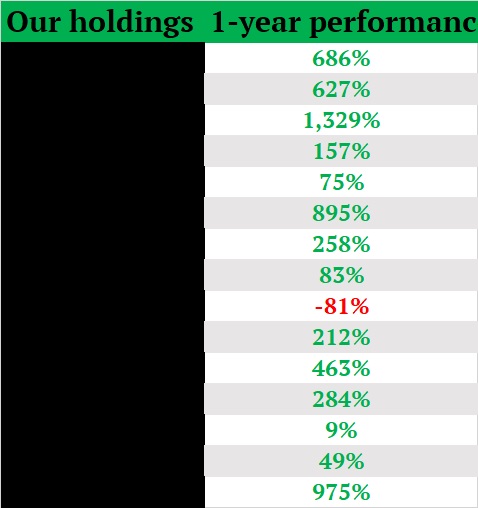

But many smaller cryptos have surged much more. Here’s a snapshot of the performance of our holdings inside my RiskHedge Venture advisory over the last year (names and tickers redacted):

Bitcoin hit a new all-time a few weeks ago. This is important. It’s what makes the “euphoria” phase possible.

Many people think all-time highs are a sign of frothiness. That can be true. But only when prices are extended far above a previous peak. You’re right to be skeptical of those kinds of new highs.

Bitcoin’s current situation is the opposite. It last peaked in late 2021 and had been stuck below its previous peak ever since. In other words, it just set its first new high in over 2.5 years. These kinds of new all-time highs are extremely, extremely bullish.

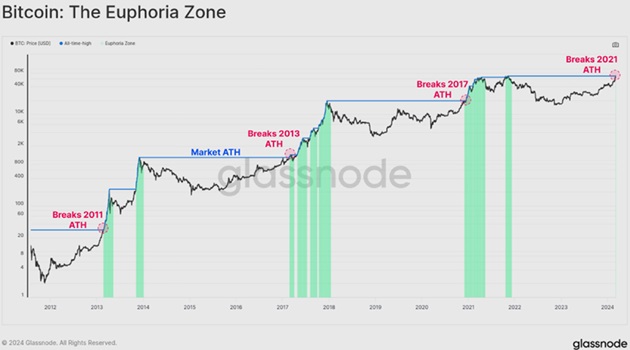

Bitcoin has had this setup three previous times. As this chart shows, each one led to a very profitable run, which typically lasted 12–18 months:

Source: Glassnode

The green bars are “euphoria” zones. You can see the faint one all the way to the right that we just entered.

Above all else, all-time highs in bitcoin are important because they change the market’s psychology:

- Every major news outlet starts covering crypto again.

- The people who called crypto a “scam” go quiet because scams don’t recover. (Dutch tulips never bounced back to new highs. Meanwhile, bitcoin has experienced four separate 75% selloffs and surged back to new highs each time.)

- They act like a “bat signal” shining in the night sky telling everyone, “Crypto is back”—and the tourists soon flood back into the market.

Like Louis Vuitton handbags, crypto is a “Veblen good.” Named after economist Thorstein Veblen, these items become more desirable as their prices increase. More people are interested in buying BTC at $70,000 than at $16,000.

- BTC $250,000?

My friend Julien Bittel recently shared research suggesting BTC could hit $250,000 within 12 months.

I set a target of $150,000 back in October. But $250,000 could easily be in the cards. People will be surprised how fast this market moves.

|

The last three times BTC made fresh highs, it doubled in 40 days, on average. If that pattern holds, we’d be looking at $138,000 BTC by the end of April.

That sounds hard to believe. But having invested through many crypto cycles, this is the time when things start to get a little crazy.

In RiskHedge Venture, we’re building a portfolio to outperform bitcoin.

- Although we’re entering the “euphoria” phase, remember this…

Crypto is volatile. Stomach-churning selloffs are part of the deal.

Bitcoin surged from $3,253 to $68,789 during the last crypto bull market. Along the way, there were a dozen or more 20%+ corrections.

There are two big risks in crypto today.

Risk #1 is owning too much.

Position-sizing is everything. When you own the right amount of crypto relative to your portfolio size and risk tolerance, sitting tight through the volatility isn’t all that hard. But when you own too much, your emotions are likely to get the best of you.

Risk #2 is not owning any crypto at all. I’m not saying crypto is for everyone; it’s not. But the opportunity at our fingertips today is rare. Setups like this only come around once every few years.

Consider seizing it.

Stephen McBride

Chief Analyst, RiskHedge

PS: In the new issue of RiskHedge Venture, I recommend an “AI crypto” that reminds me of the early days of bitcoin.

The idea of creating decentralized money used to seem outlandish. Nobody had pulled it off. And yet bitcoin went from a tiny, nothing asset to a $1 trillion giant.

Today, decentralized AI stands at a similar crossroads. In short: The risks of a few big players controlling AI is becoming increasingly obvious. We must fight to keep AI “open”—and I’ve found the crypto with the answer.

Its technology is real. I rate its “tokenomics” a B+... and with a strong community driving it forward, my research suggests it could be one of the biggest winners in crypto over the next 6–12 months. You can access this pick by becoming a Venture member today. Details here.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com