Invest like Lance Armstrong

- Stephen McBride

- |

- April 15, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

I have some bad news…

The latest US inflation numbers show prices rising at their fastest pace since last September.

Markets hate inflation, as those of us who were here in 2022 know.

The S&P 500 is flat since the news came out on Wednesday. But this could be the catalyst that sparks the correction we’ve been anticipating.

Should you sell your stocks to take cover?

As long as you own high-quality, cash-flowing, disruptive stocks in megatrends, absolutely not.

- There’s only one guaranteed way to lose money to inflation.

Not investing at all.

Beating inflation boils down to one thing: Owning assets that outpace rising prices.

My friend Julien Bittel is head of research at Global Macro Investor, a high-end investment research service. Last time we had dinner together, we discussed the concept of “don’t be suboptimal.” As in choose the best possible way to play an investment theme, instead of the second or third best.

The “optimal” way to beat inflation is to buy top-performing assets.

The best-performing asset, by a country mile, has been crypto. Bitcoin (BTC), the first and largest crypto, has surged 13,000% in 10 years.

Investors who bought bitcoin at almost any time in the past decade have made big returns. It’s been the best-performing asset in 11 of the past 14 years.

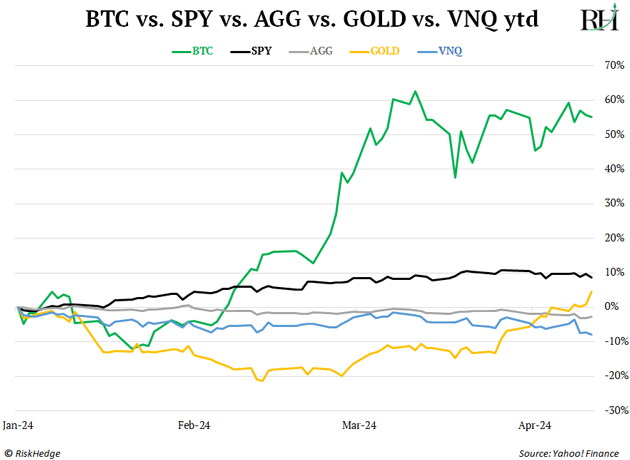

How is bitcoin doing today with inflation reaccelerating? It’s up 60% so far this year, beating every other asset on the planet:

Bitcoin has been an incredible asset to own, but I’m not buying it today.

Not because I don’t think bitcoin will continue to rise. Last October, when bitcoin was trading at $27,000, I laid out the case for why it was headed to at least $150,000. I’m sticking to that call. If anything, I lowballed it.

But I prefer to own smaller, faster-growing cryptos with higher upside.

|

- I first heard about bitcoin in 2011 when it was trading under $5.

Didn’t buy any. Big mistake.

But from this mistake, I learned to appreciate a unique trait of crypto. We all had the opportunity to buy BTC from the very beginning, when it was only a pup.

This is the opposite of how the stock market works.

Former cyclist Lance Armstrong was an early investor in Uber (UBER). He invested $100,000 in 2009 when the company was valued at less than $4 million.

He would see gains on his initial stake of around 25,000x—which would turn $100,000 into $2.5 billion.

That’s great for Lance. But he only got that opportunity because he was a rich, connected celebrity. Although an average person could have mathematically turned $1,000 into $25 million investing in Uber, no one did. Because Uber wasn’t available to invest in for regular folks until it IPO’d in 2019.

By that time… it was already a giant company.

Cryptos are different. They basically “IPO” on day one. Bitcoin went live in early 2009. That very same day, investors could buy it for fractions of a cent.

Most cryptos work this way. Their tokens launch alongside their businesses, on day one, when they’re tiny, early stage startups. It’s like investing in Steve Jobs or Bill Gates tinkering in their garages, long before Apple (AAPL) or Microsoft (MSFT) IPO’d.

Crypto lets ordinary investors truly get in on the ground floor.

- You notice how many of the people who got rich in crypto were nowhere near Wall Street?

You’ve surely seen the kids driving Lamborghinis… or the 20-year-olds who turned a couple thousand into a couple million in crypto.

Think about how unique that is. Typically, big early stage gains flow straight to Wall Street because it controls the deals and access. The rich get richer.

In crypto, it’s different.

Anyone could buy Ethereum (ETH) when it launched in 2014 for 30 cents. Today, ETH is trading around $3,500. Where else can a regular investor throw $100 into an early stage startup and see it balloon to $11.6 million?

It’s the same for Solana (SOL), which launched in early 2020 at less than $1. It’s up 170x since then. Today, Solana has a market cap of roughly $80 billion.

That’s the same valuation Airbnb (ABNB) had after it went public. Great company, and I love the product. But by the time you could invest in it, it was colossal. Bigger than FedEx (FDX).

- But remember our North Star in crypto:

There’s very little regulation or oversight. It’s the Wild West. Full of opportunity you’ll find nowhere else… but also risk you’ll find nowhere else.

I wouldn’t touch 99% of cryptos. But the other 1% will change the world… and reward early investors handsomely.

This is a market where which assets you own really, really matters.

If you just buy and hold bitcoin, I think you’ll do well. My job inside my RiskHedge Venture crypto advisory is to find much smaller cryptos—typically around 1/100th the size of bitcoin—that’ll do a lot better.

If you’re interested in joining me inside RiskHedge Venture, review the details here.

See you Monday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com