The most ridiculous true story I’ve ever told in The Jolt

- Stephen McBride

- |

- December 7, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Wednesday!

The S&P 500 made new all-time highs last week.

That’s a big deal because we haven’t seen new highs for almost two years.

I think we’re setting up for S&P 5,000 next year (more on this below).

First, let’s talk about the artificial intelligence (AI) infrastructure buildout… and the most ridiculous true story I’ve ever told in these pages.

- Are you invested in the largest buildout ever?

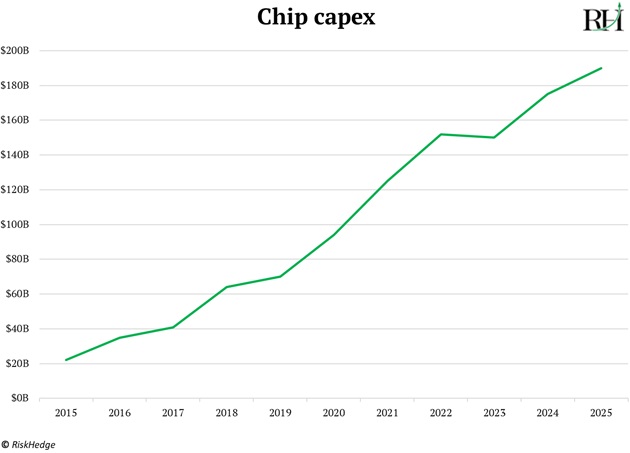

Chip (semiconductor) stocks just hit new highs:

I’ve been recommending great chip firms like ASML (ASML) and Nvidia (NVDA) for five-plus years. And there’s not another group of stocks on the planet I’d rather own for the next decade.

AI tools like ChatGPT are powered by chips. Tens of thousands of chips. This is fueling a historic boom for semiconductor companies.

Look at this chart. Microsoft (MSFT)… Amazon (AMZN)… Google (GOOG)… and Facebook (META) will splash out $150 billion on chips this year alone to bolster their AI capabilities:

This is the biggest infrastructure buildout in human history. Seriously.

Big tech will spend more money on AI datacenters than we spent building out railroads, dams, and even space programs to land on the moon!

We’re slap-bang in the middle of the first phase of the AI boom: the infrastructure buildout.

There are very few no-brainer choices in investing. Investing in the companies capturing the hundreds of billions of dollars of guaranteed AI chip spending is one of them.

Nvidia is obviously a big winner here. We own several other companies profiting from the AI boom in Disruption Investor.

- The most ridiculous true story I’ve ever told in The Jolt.

I hate the idea of the government regulating AI.

Do you expect the same bureaucrats who brought you a student loan crisis… broke the healthcare system… and racked up $30 trillion in federal debt to get AI regulations right?

Rule #1 for tech innovators: DON’T INVITE THE BUREAUCRATS IN.

Elon Musk just proved my point…

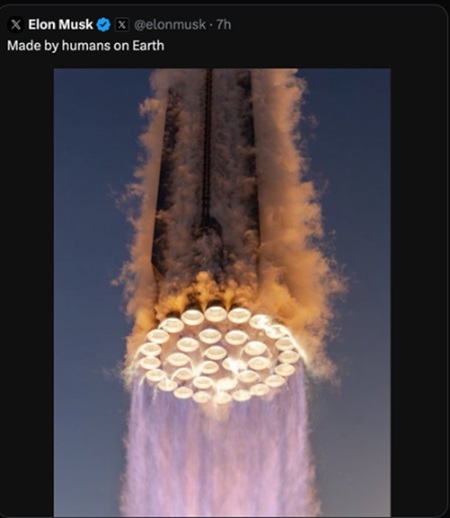

Elon’s SpaceX successfully launched a 400 ft., 11 million lb. rocket into space a few weeks ago. This is literally (new) rocket science. Never been done before.

Look at this incredible photo of 33 huge engines firing during SpaceX’s most recent launch. Future’s bright.

@elonmusk on Twitter

@elonmusk on Twitter

You know what bureaucrats are concerned with?

“A rocket hitting a shark,” as Elon mentioned on a recent podcast.

No joke. Some environmental agency forced SpaceX to calculate the odds of hitting a shark with a rocket in the vast ocean.

Regulators also wanted to make sure rocket launches won’t disrupt seal mating.

So they forced SpaceX to kidnap a seal, strap it to a board, put headphones on the seal, and play sonic boom sounds to it to see if it would be distressed.

This is 100% true. You can’t make this stuff up. Look at this poor guy:

Source: Teslarati

Source: Teslarati

But sure, let’s trust these fools to impose reasonable AI regulations.

They’d enact all sorts of crazy rules that would neuter the tech. It would be a disaster.

The government should get out of the way like it used to.

We built the Empire State Building in just 400 days.

Yet it’s been 15 years… and the high-speed rail line that’s supposed to connect San Francisco to LA can’t even get started.

Let’s go back to the future to a time when America could build.

Long technology; short bureaucracy.

- Should you buy stocks at all-time highs?

The S&P is up 20% this year. The tech-heavy Nasdaq 100 surged 45%.

To quote Owen Wilson in Meet the Parents, “There’s a lot of Benjamins to be made.”

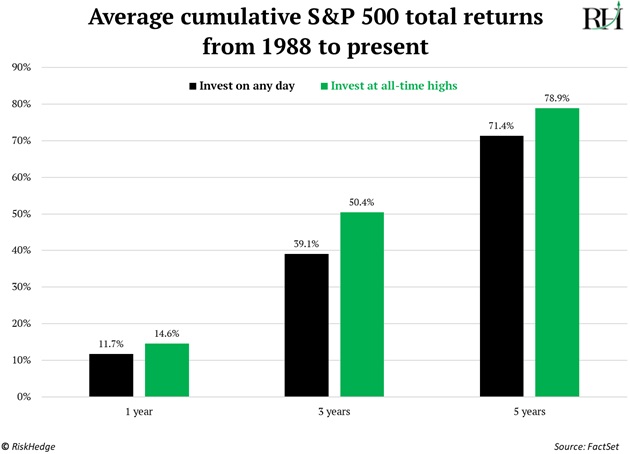

It might seem counterintuitive, but one of the best times to buy stocks is when they’re making new highs.

This chart shows that your chances of making money over the next one, three, and five years rises when you buy stocks at all-time highs vs. any other time:

LESSON: Don’t fear record-high prices. New highs are simply a stepping stone to more new highs.

My message to folks predicting a crash: We took our medicine last year when stocks dropped 25%. Don’t count on another bear market.

Continue to buy great businesses profiting from disruption. That’s our strategy in Disruption Investor.

- Today’s dose of optimism…

On these cold, wintery days, it’s easier NOT to set the alarm for 5:30 a.m.

It’s easier NOT to go for a walk or go work out in a freezing-cold gym.

But you HAVE TO do it.

Doing hard things is the most powerful gift you can give yourself. Go places (mentally and physically) others aren’t willing to go to.

I promise it’s worth it.

Now let’s get after it!

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com