Bitcoin > $40,000

- Stephen McBride

- |

- December 5, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Happy Monday!

Bitcoin soared past $40,000 over the weekend, a price it hasn’t touched in 1.5 years.

It means our “halving” roadmap is going according to plan.

A few weeks ago, I shared my research that shows why I expect bitcoin to hit $150,000 this cycle. Bitcoin was $27,000 when I first shared it. Already, the price has appreciated 56%.

If you’re at all interested in speculating in the fast-moving, high-risk, and potentially high-reward world of crypto, this is your best opportunity to do so since 2019. Crypto is extremely cyclical. And for reasons I show here, the next upcycle has likely begun.

Today, I’d like to share some important insights I learned from Charlie Munger—the billionaire investor who passed away at the grand old age of 99 last week.

First, some life lessons…

#1: Everyone loved Charlie. Billionaires are usually hated. Eat the rich and all that. Most of them live in fancy, gated communities far away from the riff-raff.

I’ve never heard a bad word about Charlie Munger. I think that’s because he generously shared so much wisdom for over 50 years through speeches and books. He was one of the great tutors of our generation.

And did you know Charlie lived in the same “normal” house for 70 years? He said moving into a mansion would have ruined his kids. Important lesson there!

#2: It’s never too late to get rich. One of the reasons I love reading biographies is they help me understand a person before they “made it.” You learn their struggles, hardships, and how they overcame them.

Charlie Munger didn’t team up with Warren Buffett (and get rich) until he was in his mid-50s!

Lesson: We can always change our circumstances. If you want something, go get it. It’s never too late.

#3: Munger was an unapologetic capitalist. Communists think the only way to get rich is by exploiting others. In Charlie’s own words, that’s a pile of “turds.”

Most folks who get rich end up creating a ton of wealth for others in the process.

If you invested $100 in Berkshire Hathaway (BRK-A) in 1978 when Charlie Munger joined the firm, you'd have $396,00 today!

#4: Now, the greatest investing lesson I learned from Charlie:

Great investors must evolve.

In the early days of Berkshire, Warren Buffett looked for “cigar butt” stocks.

These were companies on the verge of going broke and trading for less than the cash they had in the bank.

Charlie taught Buffett to invest in quality companies that could dominate for years rather than those that might have “one puff left in the cigar.”

Before Munger: Buy reasonable businesses at great prices.

After Munger: Buy great businesses at reasonable prices.

Buffett credits this shift for helping turn Berkshire into an $800 billion success.

But if Buffett and Munger were just starting out today… would they still invest this way?

Mostly, yes… but with one important evolution.

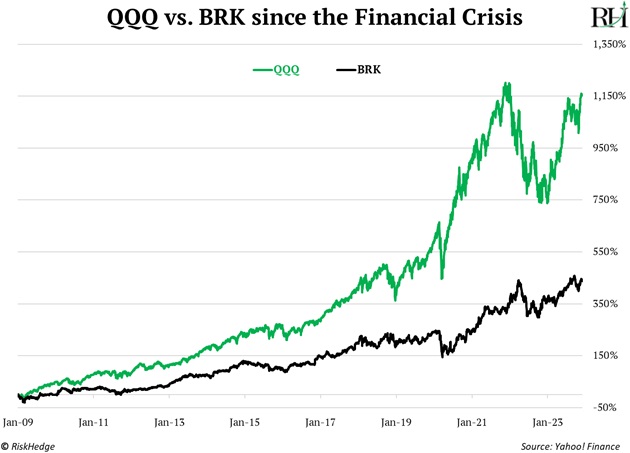

The tech-heavy Nasdaq has outperformed Berkshire 2-to-1 since the financial crisis.

In other words, tech stocks beat Warren Buffett’s portfolio—by a lot:

By their own admission, Charlie and Buffett missed the technology wave.

They could afford to because they were already billionaires. But ordinary investors simply can’t ignore fast-growing businesses.

Businesses like Amazon (AMZN) didn’t exist 50 years ago.

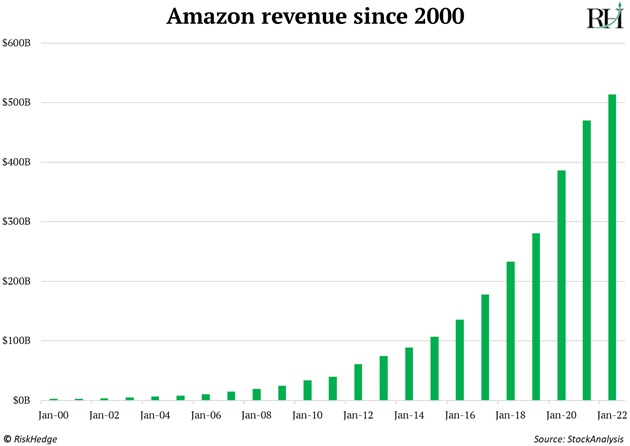

Amazon grew its sales by an average of 30%... per year… since 2000.

It now rakes in over half a trillion dollars a year:

Is it any wonder Amazon’s stock has surged 10,000% since 2000?

Unfortunately, many investors who had the chance to buy Amazon passed it up either because it was too expensive or it had run up too much in price.

They were looking for reasonable businesses at great prices.

Big mistake.

Two takeaways:

Businesses like Amazon that can grow rapidly for decades are a new breed. They basically didn’t exist prior to the 2000s.

Doesn’t it make sense that great businesses should trade at a higher valuation than, say, a copper mining operation?

And winners keep on winning. New highs are steppingstones to more new highs.

So how would Buffett and Munger have evolved if they were starting over today at age 40?

I think they’d make more investments like BYD (BYDDY).

A few years ago, Munger invested $230 million in Chinese electric car maker BYD, which was trading at 30X earnings. Traditional value investors would wince at that P/E ratio.

That stake is now worth $5.5 billion. Charlie said, “I have never helped do anything at Berkshire that was as good as BYD.”

Rapidly growing businesses—many of which trade at reasonable prices—have been the best-performing stocks over the past decade.

AI chip king Nvidia (NVDA) ranks as the #1 best-performing stock in the last 10 years.

I bet an investor who buys Nvidia at 25X earnings today will make a lot more than one who buys Ford (F) stock for just 7X earnings.

In Disruption Investor, we invest how I think Buffett and Munger would invest if they were starting over today.

We buy profitable companies that are growing rapidly and valued reasonably.

Because—as Charlie taught us—great investors evolve.

[Go here to see if a risk-free trial to Disruption Investor is right for you.]

Today’s dose of optimism…

In Poor Charlie’s Almanack, Munger wrote:

“Bad things are going to happen to you. Problems are an inescapable part of life.

“When they do, get up and keep going. You don’t have any other choice than to keep moving forward (especially if you have a family to feed).”

RIP to one of the greats!

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com