Imagine kissing your kids goodbye…

- Stephen McBride

- |

- April 23, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

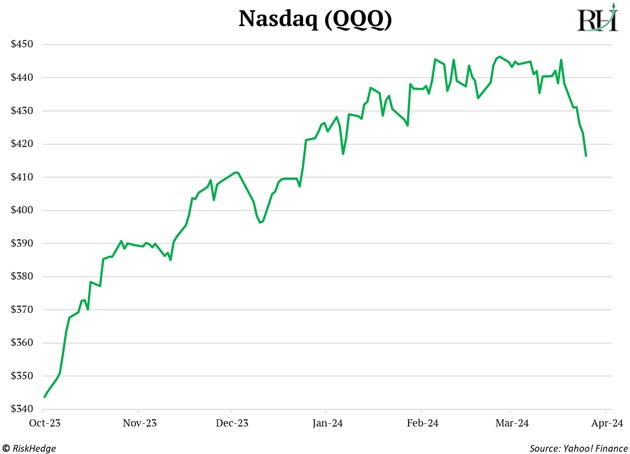

Back in February, I warned a stock market correction was looming.

My timing was off, but the pullback we’ve been anticipating is here.

The S&P 500 has dropped 5%, and it likely has further to fall. Remember: On average, the market sells off 14% each year.

Plus, we’re in a presidential election year. So it’s perfectly normal for markets to pull back here.

The S&P had surged 28% since last October’s lows. That’s four years’ worth of average gains squeezed into three months.

Markets got too hot. Now, we're experiencing a healthy pullback. Here's the Nasdaq:

Don’t be surprised if US stocks trade sideways until the summer, or even until after November’s US presidential election.

Again, this is totally normal—even healthy—behavior.

What I’m doing: continuing to own only great businesses profiting from disruptive megatrends inside Disruption Investor. We’re long-term investors and don’t try to trade every 10% market move.

- A blind kid in Miami can now see thanks to these new eyedrops.

Antonio had multiple surgeries to restore his sight. They all failed.

As a last hope, doctors gave the 14-year-old kid a special kind of gene-editing eyedrops.

Often referred to as “CRISPR,” gene editing allows scientists to “cut” out bad genes that cause disease and replace them with healthy genes.

Gene therapy was invented around a decade ago. After years of scientists toiling away in the labs, we’re finally seeing real breakthroughs.

|

Antonio’s doctors essentially infused regular eyedrops with CRISPR technology. He took them once a month for about a year, and now he can see for the first time ever. Woah!

This tech will allow kids who’ve stared at darkness their whole lives to enjoy movies and play tag.

And we’re only getting started.

Gene editing can be used to tackle thousands of diseases, which today are “incurable.”

The term “incurable” may not exist in 50 years.

Deadly diseases from breast cancer to Alzheimer’s are caused by a few rogue genes. By editing a handful of genes, we could all but eliminate today’s biggest killers.

If we embrace this tech, our great grandkids will view the 2020s as barbarous times, when millions died helplessly from cancer each year…

Similar to how we view tuberculosis today, which was the biggest killer a century ago. Now, it’s only in the history books.

Looking for reasons to be optimistic about our future? It’s staring you in the face.

We’re entering a golden age for biotech. As Matt Ridley (the original Rational Optimist) said over breakfast a few weeks ago, biotech is the next big transformational disruption.

Investors must pay attention to this industry. We own two world-class biotech businesses in the Disruption Investor portfolio. Both can double in the next year.

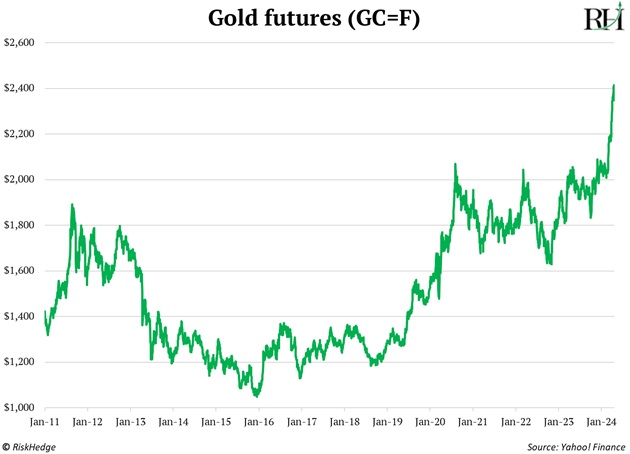

- Did you see what gold just did?

It jumped above $2,400 for the first time ever.

After trading sideways for a decade, gold is finally breaking out to new all-time highs:

I have a confession to make.

Fifteen years ago, I was a total “doom and gloomer.”

Governments printed trillions of dollars after the financial crisis. To protect yourself, you had to own assets that couldn’t be created out of thin air.

So, I put all my money into “smart” investments like gold and silver. It felt like I was in on some secret only intelligent investors knew about.

But the joke was on me. Precious metals have performed terribly over the past decade. Luckily, I figured out early on that betting on the end of the world is a terrible investing strategy.

That’s not to say gold has no place in a portfolio. It does. But only a small part. Buy some gold, forget about it, and get on with your life. Hope you never need it, and then pass it on to your kids.

It’ll likely reach $10,000 eventually. Because, like it or not, we live in a world of endless money printing.

Don’t own any gold? The easiest, cheapest, and most secure way to buy gold and hold it in your own personal name is through Hard Assets Alliance. We have a partnership with them that gets all RiskHedge readers free storage for 12 months. Go here for details.

Hedge fund manager Dan Tapiero said something interesting to me last week. He pointed out that while gold is ripping, it’s down 90% over the past five years when you measure it against bitcoin (BTC).

Back in 2019, an ounce of gold would get you a quarter of a bitcoin.

Today, that same ounce is only worth 0.04 of a BTC!

I think bitcoin will prove to be a better store of wealth long term. But you don’t have to pick one. Own both.

I’m looking forward to chatting about gold, bitcoin, and much more with Dan and Lyn Alden at The Strategic Investment Conference this Friday. You can join us here.

- Today’s dose of optimism: Imagine kissing your kids goodbye…

…as you put them onto a makeshift raft and watched it float off into a 90-mile stretch of shark-infested waters.

Hoping and praying they make it to America.

Imagine how bad life would have to be for that to be the best option?

Thousands of Cubans did exactly this under communism.

It’s open season on capitalism these days. We’re told it’s the root of all evil and that it needs to be scrapped.

But I’ve never heard of a mom risking her kid’s life to flee from Miami to Havana.

No wonder Cubans love America more than most Americans. They know the alternative.

See you Wednesday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com