AI’s future hinges on crypto

- Stephen McBride

- |

- April 22, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Tonight’s the big night.

By the time you wake up tomorrow, bitcoin’s (BTC) big “halving” will be complete.

If you’d like to join my RiskHedge Venture crypto advisory, now’s the best time to do so.

Go here to review the details of the special pre-halving deal now available.

It ends tonight when bitcoin “halves.”

Today… we’re talking about artificial intelligence’s (AI’s) future.

This future could be very bright… or very dark.

It all hinges on crypto.

The intersection of AI and crypto, while not well understood, is a huge opportunity for investors.

- Why do the most powerful tech companies want to regulate AI?

ChatGPT creator OpenAI, Google (GOOG), Microsoft (MSFT), and Amazon (AMZN) are all calling for a government clampdown on AI. Look at the headlines:

Sources: Financial Times; The New York Times; CNN; The Wall Street Journal

This legitimately scares me, for reasons I first explained here.

AI is the most important tech breakthrough since the internet.

It can give us personalized AI tutors that turn our kids into straight-A students (already happening).

It’ll create robo-chemists who invent new lifesaving drugs.

And self-driving cars that save thousands of lives a year.

It can also create trillions of dollars in wealth for businesses and investors.

But if regulators smother AI in its crib, forget about progress. Innovation will be strangled by red tape.

|

- Never forget why big companies LOVE regulation.

Take Obamacare. It was supposed to rein in costly health insurance.

Turns out, it was the best thing to ever happen to healthcare stocks.

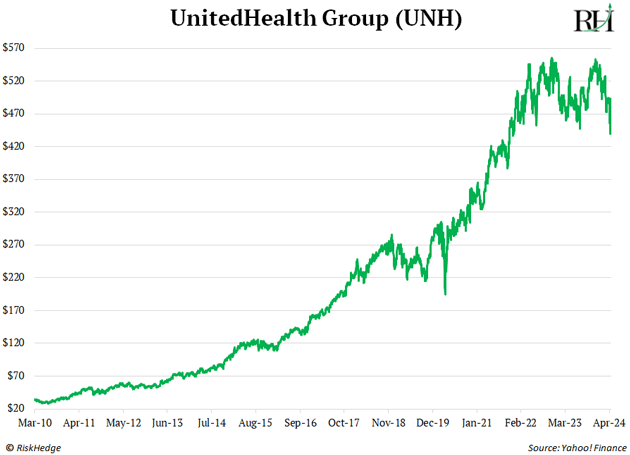

The Affordable Care Act passed in March 2010. Since then, UnitedHealth (UNH)—America’s largest health insurer—has surged 1,600%:

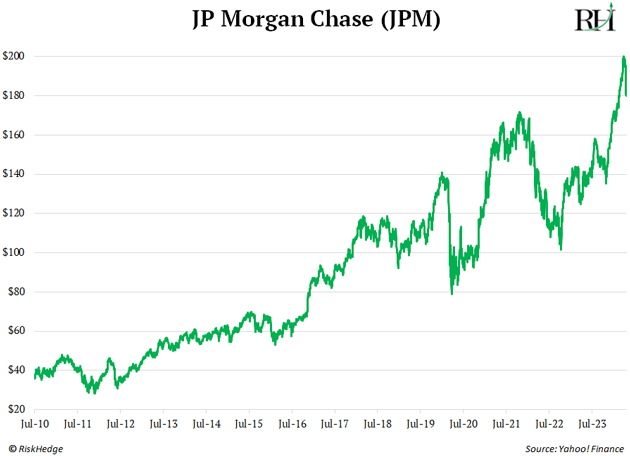

Remember when investors worried looming regulations would crush profit margins for Wall Street banks?

America’s largest bank, JPMorgan (JPM), has gained 456% since Dodd-Frank financial regulations were pushed through 14 years ago:

Big companies have the kind of money needed to hire armies of lawyers to comply with regulations. They love complex, burdensome laws because they lock out the small disruptors.

I’ll hand it to them, it’s a great business strategy. But it’s also evil. We can’t let them get away with it.

Not only because it will stifle innovation. It’s downright dangerous, as we saw in February with Google’s Gemini calamity.

Remember, Google fine-tuned an AI model that refused to depict white people.

This wasn’t a silly mistake. The AI worked as designed and reflects the political leanings of those who built it. This is why we must fight to keep AI open.

If “Big AI” wins, a handful of companies will be able to censor what we see online. These companies are unlikely to be staffed by freedom lovers and truth tellers.

Soon, every schoolkid will get their information from AIs. Think of the consequences if those AIs are biased like Gemini. A propagandist’s dream.

- Only crypto can save us.

Blockchain is the key to keeping AI open. Simply put, it’s big tech’s kryptonite.

Remember, blockchain allows strangers to do business without knowing or trusting each other.

Bitcoin employs this tech for a monetary purpose. It gave us money that wasn’t controlled by any company or country.

Now, one small crypto is using blockchain to build and train AI systems that aren’t controlled by giant corporations.

It works just like ChatGPT. Users type to talk to it, and it talks back. The big difference is how it functions behind the scenes.

ChatGPT is powered by a few giant centralized data centers around the world. Whereas this blockchain-based AI is decentralized. It runs on a vast network of individual computers spread across the globe.

- Blockchain: What is it good for?

That’s every crypto skeptic’s favorite question.

I don’t know what to tell investors who still give bitcoin the “side eye” after its 13,000% runup.

I hate to say it, but crypto is probably the only tech that can save AI from being monopolized by big tech.

AI is currently a game of kings. Only cash-flush tech giants can play. That’s because training really smart models requires absurdly expensive amounts of computing power and data.

Blockchains essentially connect independent computers into one powerful network. By marshalling these decentralized resources and allowing them to combine their might, they can challenge big tech.

This allows individual people to directly contribute to—and profit from—technologies like AI.

For example, a crypto project I recently recommended inside RiskHedge Venture is working to get millions of people around the world to pool their data and compute together to build the world’s best AIs.

Anyone can build or contribute to AI models on the network. They can get paid when their model or data is used.

We need to keep AI in the hands of the many, not the few. Millions of AIs should be competing with each other. This blockchain protocol is helping achieve that.

We added it to the RiskHedge Venture portfolio last month. Our work suggests it could be one of the biggest winners in crypto over the next 6–12 months.

Go here to see how you can access this recommendation and my entire Venture portfolio.

And remember, bitcoin officially “halves” tonight. At midnight, your special “pre-halving” deal will expire. I’d love to have you onboard, but only you can decide if Venture is right for you. Go here to make your decision.

Stephen McBride

Chief Analyst, RiskHedge

PS: I’m holding a live “AMA” session—the Post-Halving Roadmap—for Venture members only on Wednesday at 10 am ET. If you’re wondering what happens next or what to do once the halving is over, you’ll want to tune in.

Click here to see everything else that comes with your pre-halving membership.

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com