Reader Mailbag: Is Pfizer (PFE) A Good Deal Right Now?

-

Kelly Green

Kelly Green

- |

- December 4, 2024

- |

- Comments

November was an interesting month for pharmaceutical companies in general. President-elect Trump officially announced that Robert F. Kennedy Jr. is his nomination for secretary of the Department of Health and Human Services.

RFK has said he wants to ban pharmaceutical advertising on television. He’s also criticized the nation’s food and nutrition standards and vaccine policies. The nomination was enough to send pharmaceutical company shares sliding last month.

I hope you used the price dip to grab shares of your favorite pharma companies as the market has moved on to other speculation. One company that I continue to get asked about in person and via email is Pfizer (PFE).

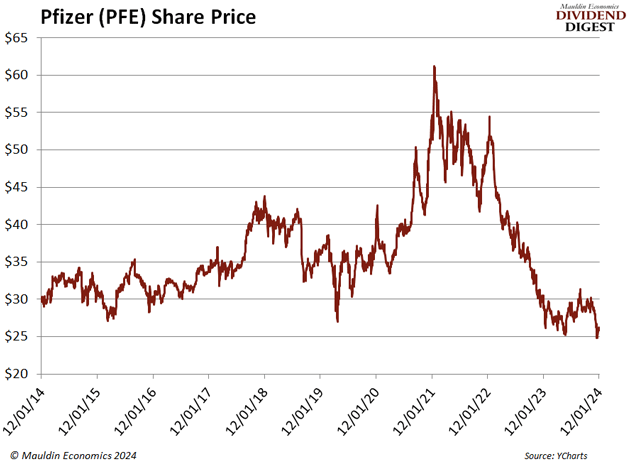

Shares are down 10% over the last year, and down 57% since their December 2021 highs. And this pharmaceutical giant now boasts a dividend yield of 6.5%!

Is This Giant Truly Undervalued?

Pfizer has been around since 1849 when cousins Charles Pfizer and Charles Erhart set out to build a chemicals business. The company’s first product was an anti-parasitic drug made to taste like toffee.

In the late 1800s, PFE produced citric acid that was needed for the emerging soft drinks industry. And in 1919, it successfully pioneered the mass production of citric acid from sugar through mold fermentation.

Throughout the 1800s and into the 1900s, the company pursued chemical innovations which set the tone for its pharmaceutical future.

In 1997, PFE released its cholesterol drug Lipitor which holds the title as the biggest selling prescription drug ever. Nearly two decades later, Lipitor remains a top prescribed drug, second only to AbbVie’s Humira.

Since the late ‘90s, shares of PFE have generally traded in the $25–$45 range with a few exceptions. That was the case prior to 2020.

Then the pandemic hit, and shares saw a giant spike as the company released a COVID-19 vaccine. Investors panicked as shares slid back to a “normal” range, and the falling price sent the yield steadily higher. PFE has raised its dividend every year for the past 15 years, and I expect that will continue.

Over the past year, shares have traded between $26–$30, which is at the low end of what I would call its historical normal. On top of the 6.5% yield, I think there’s the potential for a few dollars of capital gains. I don’t, however, expect the stock to clear $50 any time soon.

|

Boost Your Current Yield… But Stay Vigilant

Back in January, PFE announced five key priorities to carry it through 2024:

-

Achieve world-class Oncology leadership

-

Deliver the next wave of pipeline innovation

-

Maximize performance of new products

-

Expand margins by realigning our cost basis

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Allocate capital to enhance shareholder value

More importantly, it’s made clear progress on those goals throughout the year. On its latest earnings call, management said oncology is having a great year. The segment delivered 31% year-over-year performance growth in Q3. In the US, PFE was the third largest biopharma company in oncology by revenue through the first half of 2024.

The company maintains a robust pipeline of new drugs across all phases of discovery.

Source: Pfizer

On the same earnings call, management raised its guidance ranges for revenues and diluted EPS for the full year.

So back to the question: Should you be adding shares of PFE to your portfolio right now? The above average yield could make it a great addition to the Current Yield section of your portfolio. That’s the part of your portfolio that generates streams of income.

I do not consider Pfizer a company to use for dividend reinvesting. And it’s not a set-it-and-forget-it stock to hold for years or decades to come.

It’s not my favorite pharmaceutical company right now, and none of the above is an official recommendation.

However, earning a 6.5% yield from a pharmaceutical giant with a solid history of raising its dividend should not be overlooked. You could collect that yield for now, and if share prices start to run, collect your gains and move on to the next opportunity.

|

For more income now, and in the future,

Kelly Green

Tags

Suggested Reading...

|

|

Kelly Green

Kelly Green