What Should My Asset Allocation Be in Retirement?

-

Jared Dillian

Jared Dillian

- |

- September 27, 2018

- |

- Comments

This question needs to be addressed, especially after a long bull run in the stock market. It was also asked a lot in the personal finance survey you guys filled in.

Let me lead with the conventional wisdom: your percentage allocation to bonds should be approximately equivalent to your age. So if you are 70 years old, you should have a 70 percent allocation to bonds.

In general, I think people should almost always have a higher allocation to bonds. Whatever you think your allocation to bonds should be, double or triple it.

I know first-hand that some financial advisors are keeping some of their older clients fully invested in the stock market well into retirement. I consider that to be financial malpractice. A 72-year-old grandparent does not need an allocation to aggressive growth.

Here’s why: when you are in retirement, you are no longer accumulating assets. You are decumulating assets. If you have an IRA, this is required by law—you are forced to sell a piece every year. An economist would say that you are selling investments to pay for consumption.

And consuming is exactly what you should be doing when you sell stocks and bonds in retirement: traveling to Europe and staying in an Airbnb for a month. This is the whole point of why you save and invest—so you can fully enjoy it at the end. My philosophy.

|

The Thing About Decumulating Assets

Of course, you want the assets to actually be there when you decumulate. Yes, there are instances where bonds are not safe. But bonds are generally safer, unless you are talking about high yield or emerging market debt.

I can see where this is going in the comments section—sure, in extraordinary circumstances, you could have a situation where an investment grade corporate bond fund loses 15-20% in value. Still better than what could happen to stocks in similar circumstances.

The point of target retirement date funds is that your portfolio mix goes from aggressive to conservative over time, so you are sure you have something at the end.

That’s why you don’t buy aggressive growth in your eighth decade, only to watch helplessly as it takes a giant dirtnap, forcing you to curtail consumption in your golden years—or leave less for your heirs. Bear markets are terrible things. People are pretty glib about them, nowadays, because it’s been so long since we’ve had one.

I am a bit like the Jiminy Cricket of asset allocation. I am very, very conservative. I make mistakes all the time. I prefer them to be small—the best a lot of people can hope for is to not make any big mistakes. A financial advisor worth his salt will not blow up his clients on stupid stuff.

NONE OF THIS IS NEW. This is what passed for conventional wisdom for years. But it’s a bull market, and people are getting aggressive. This letter has a great many readers in retirement. I would bet that up to half of them have an allocation to stocks of over 50 percent. No offense, Baby Boomers—you guys are not the best risk-takers in the world.

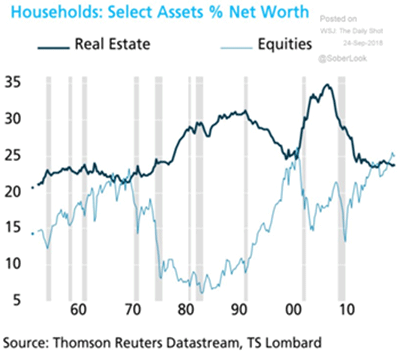

How do I know this? See below.

Source: The Daily Shot

Equities now make up a larger portion of household net worth than residential real estate. People are gorked up on stocks. As you can see, this happened a couple of times before—both resulting in bear markets.

If you bought a growth stock like Amazon or a growth mutual fund, you have watched it grow to the sky over the last ten years. It makes up a large percentage of your portfolio. Sell when you can, not when you have to.

Start Thinking like a Bond Investor

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

For years, people were incentivized to load up on dividend stocks—because they were yielding more than bonds! Soon, that might not be the case. And the dividend stocks themselves are very overvalued.

The sad truth is that there aren’t many options. Stocks are expensive. Bonds are not so cheap, either. I can envision a scenario where all financial assets fall together.

Always think of the worst-case scenario: if that happens, you want exposure to the least worst option. Stock investors are optimists. Start thinking like a bond investor—a pessimist.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian