What a Coincidence

-

Jared Dillian

Jared Dillian

- |

- December 15, 2016

- |

- Comments

The Fed is finally, after eight years, normalizing interest rates.

The timing is awfully interesting, though—what a coincidence that the rate hike comes right after the election!

If they had hiked before the election, they could have affected the outcome of the election. So here we are. Just a few weeks after the election, and we got ourselves a rate hike.

But that wasn’t the big news yesterday. The big news was that the Fed had previously committed to two rate hikes in 2017—and suddenly upgraded their assessment of the economy to justify three rate hikes next year.

What a coincidence!

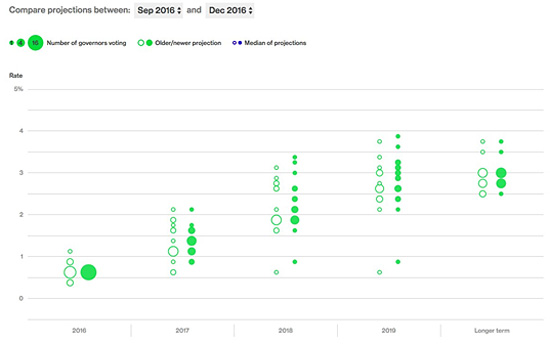

I am betting that we will get more than three rate hikes next year. I am betting that we will get four—or more. It’s possible that fed funds will be close to 2% at the end of next year.

The dots!

Source: @business

A lot of people reflexively call BS at this point, given the Fed’s long track record of overpromising and underdelivering.

Not anymore.

- Trump is president

- The Board of Governors is all Democrats on their way out, and they have nothing to lose

- The economy will legitimately get stronger

- Inflation will legitimately go higher

We could spend ten 10th Man issues talking about 3. and 4. in some detail, but I’ll summarize in one sentence:

Money velocity is going to go higher.

Source: St. Louis Fed

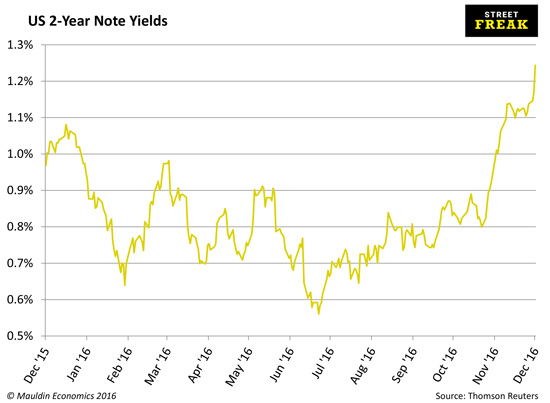

Did you know that twos are now at 1.25%?

That you can get 1–2% on ultrashort-duration funds?

That you can get close to 1% on yieldy money market funds?

That you will soon get interest in your bank account?

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Here is the quick take: In previous issues, we’ve talked about why Trump is good for (most) stocks. In a Fed-free world, you’d expect the SPX to easily exceed 2,500 in short order. But if the Fed is jacking up rates, not so fast.

And forget about my political conspiracy theories for a moment. Two rate hikes in 2017 is just not hawkish enough. The Fed does care about inflation (even though it explicitly hasn’t in the last eight years).

Things haven’t been this hot in a long time. They’ll hike rates. They’ll take away the punch bowl.

My honest-to-goodness best guess of where the S&P 500 ends up at the end of 2017?

Unch.

For the Love of God

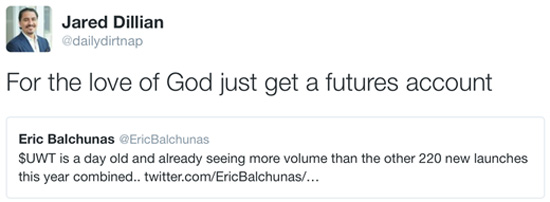

Eric Balchunas2 (the ETF expert over at Bloomberg) tweeted the other day about how some new 3x oil ETN was getting tons of volume.

I quipped:

UWT is the VelocityShares 3x Long Crude Oil ETN. It traded 4 million shares yesterday.

Humanity, I’m sort of disappointed in you. You aren’t investors, you are a bunch of degenerate gamblers.

Fair enough: leveraged ETFs are fine if you are trading them on an intraday basis. But almost nobody does. Just like nobody does heroin “recreationally.”

So I’ve been yapping about this ETF class for the last two months nonstop, and yes, in the final module you get to learn the math about why buying and holding leveraged ETFs is bad for your health.

Right now, you can get the class at a special holiday price—$149 instead of $299—and you can buy it here.

$149 is certainly a lot cheaper than the lesson you are going to learn when you don’t take my advice and you buy and hold UWT.

Trading leveraged ETFs is like gambling in a casino. But not like a friendly game of craps, where if you just play the pass line and take max odds, you are giving up about 50 bps of edge. There is a big rake, and it is the daily rebalancing of the ETF.

I attended Inside ETFs a few years ago and walked by a conference room filled with angry investors who were practically yelling at executives from the leveraged ETF issuers. I lingered by the door and listened for a while. People didn’t understand why they were losing money. It was really quite tragic.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I would never advise anyone to run out and get a futures account, especially people who are unsophisticated, but the leverage in leveraged ETFs comes at a cost, and the problem is, the cost is invisible.

Stop screwing around with these things and maybe crack a book on fundamental investing instead if you want to make money the right way. There is nothing better than getting rich slow.

In case you missed the link above for the ETF Master Class, here it is again. Learn about these products. If you need adrenaline, ride a motorcycle instead._______________

1 The Fed lost control of fed funds some time ago, and now targets a range instead of a rate, which is a story unto itself.

2 Eric is a terrific guy and has done a great job of turning his office into the nerve center for news on ETFs. You should follow him on Twitter.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian