The High-Water Mark

-

Jared Dillian

Jared Dillian

- |

- October 12, 2023

- |

- Comments

I was on a plane flying back to Myrtle Beach two weeks ago, sitting next to a man in his fifties who worked as a computer geek for a community college. He was ex-Navy, and, of course, I am ex-Coast Guard, so we had a good chat about being in the military. Anyway, he asked what I did. I told him that I vaguely had something to do with the stock market, and he told me that he was the owner of one mutual fund. He was waiting for it to get to its previous high, at which point he was going to sell it and move into T-bills.

In these situations, I never offer people advice. People are going to do what they’re going to do. Frequently, they do the opposite of what I tell them to do, so it is a huge waste of time. What I would have told him was that he should sell his mutual fund and move into T-bills now, which has nothing to do with my opinion on the direction of the stock market. It is just the smart thing to do.

Reason number one: This is a cognitive bias called anchoring. According to the internet, anchoring is defined as follows: Anchoring bias refers to people’s tendency to give disproportionate weight to the first piece of information they receive in a decision-making context. As a result, this becomes a reference point or anchor that influences people’s perception of subsequent information.

In this case, the piece of information is the all-time high of the mutual fund. How many times have you heard someone say that they were waiting for a stock to get up to the price at which they bought it? How many times have you said that you would sell a stock as soon as it got to your buy price?

Let me tell you, in mathematical terms, why this is a bad idea.

The Binomial Tree

Nerd warning: We are going to talk about binomial trees.

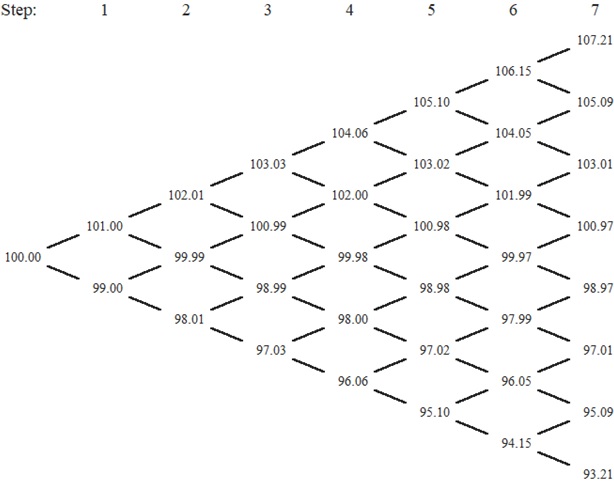

If you’ve ever studied options pricing, you have probably heard of a binomial tree before. A binomial tree models the behavior of a stock or of a particle moving through space. It has a 50/50 chance of going up or down. Then, it has a 50/50 chance of going up or down. And so on.

This is what it looks like:

Source: macroption.com

This particular binomial tree measures 1% moves in an asset. At time t=0, the asset is at 100. At time t=1, it is either at 101 or 99. At t=2, it is at 102.1, 99.99, or 98.01. And so on. Each time interval is a coin flip. If you flip tails seven times in a row, your stock is at 93.21.

Well, as you can see from the binomial tree, a lot needs to go right in order for you to reclaim your $100 starting price. You would essentially have to flip heads seven times in a row. Or it could take longer, but you would have to flip a lot more heads than tails. The likelihood that you will reclaim your starting price after t=whatever is very, very low. Probably about 10%.

But hope springs eternal. It will come back. On the comeback trail. But when you look at the binomial tree and compute the odds, they are very much stacked against you. In fact, the stock is as likely to go down as well as up, so you could be worse off than you were before. The conclusion here is that you should just sell it, get on with your life, and invest in T-bills or something else.

This is a bit of a simplification because it assumes that asset prices follow a random walk, which they don’t, and that they’re mean-reverting, which they’re not. Something that goes down is likely to continue going down in most cases.

Cutting Your Losses

Old traders know that you are supposed to cut your losses and that hope is not a strategy. It’s such an old saw that I don’t spend much time talking about it anymore. But even the most disciplined traders occasionally lose their discipline and hang on to losing trades (to their detriment).

And there are also some people who cut losers too quickly and then watch helplessly as they go on to become winners. There is such a thing as being too disciplined—you need to give trades time to work. If you are going to trade this way, your entry points must be impeccable.

Anyway, the point of this piece is to have some discipline for crying out loud. Take small losses before they turn into big losses. If you make a career of taking small losses and big wins, then you won’t need to be reading this newsletter.

No Worries

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Jared Dillian, MFA

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian