The Ant and the Grasshopper

-

Jared Dillian

Jared Dillian

- |

- December 27, 2018

- |

- Comments

A Note

Now seems like a good time to reprint my piece (first published in November 2017), which defends the investors who chose slow and steady returns instead of chasing moonshots—and warns the investors who had their heads turned by crypto/cannabis/FANG, etc.

Through December 24, this month is so far the worst month in the history of the S&P Index, going back to 1923. So these days, the ants who busted their asses through the multiple bubbles we had this year are surviving, while the grasshoppers are figuring out they have nothing to eat now that winter has arrived.

I also talk about the importance of wearing a seatbelt, metaphorically speaking. That advice still stands. If you’re not strapped in yet, please do so. We’re just getting started.

* * * * *

I’m sure you’ve heard the fable of the ant and the grasshopper. The ant busted his ass all year growing some grain to store for the winter, while the grasshopper was laying about, playing the fiddle. When winter came around, the grasshopper had no food, so he went to the ant’s house to beg for some. The ant told him to beat it, and the grasshopper starved to death. The end.

Source: read.gov

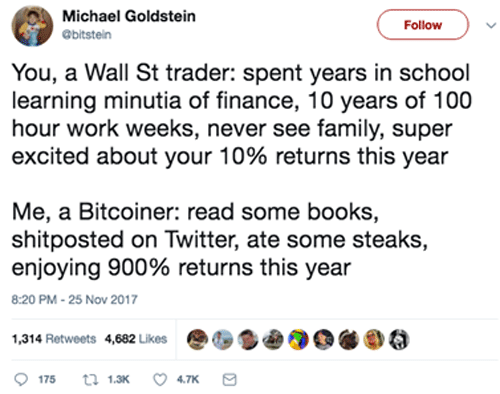

This tweet was getting retweeted all over the place last weekend. Apologies for the bad language.

For starters, the guy’s Twitter handle is “bitstein.” But anyway. This is the fable of the grasshopper and the ant.

The ant is busting his ass, schlepping into work every day, trading and analyzing securities, making liquid markets, providing clear social benefits.

The grasshopper is a ponzi monkey refreshing his crypto app every five seconds. We’ll see who’s got something to eat when winter comes.

At the top of the cycle, there are always people who look down on the working stiffs, the ants. Actually, it seems like the loudest voices in finance these days are people who tell you to be long SPY, Amazon, or even bitcoin—unhedged. I don’t think we should be denigrating people who think it’s prudent to wear a seat belt.

|

Getting Rich Slow (with an Option)

I’m a big fan of getting rich slow. But I should add a caveat. I’m a big fan of getting rich slow with an option to make more.

I am channeling Taleb here. A wonderful portfolio strategy is to put 90% of your money into safe assets with a stable return—and to speculate on long shots with the remaining 10%, stuff that can give you 10x or 100x or 1000x returns.

Of course, bitcoin falls into that category, but you could argue that the bitcoin ship has sailed—we’re in full tulipmania. 2014 would have been a nice time to have that idea1. Now, it is too late.

It is too late for a lot of longshots—venture capital, cryptocurrencies, Internet stocks… the 100x returns have already been made. Yes, there is always a bull market somewhere, but the trouble with investing in 2017 is that there are bull markets everywhere.

This is why I am a big proponent of wearing a seatbelt. It’s stupid to be short or flat, but it’s prudent to be careful. Will you miss out on some upside? Possibly. Will you miss out on the downside? Yes, that is the point. Just like the ant—slow and steady wins the race.

Captain Moonshot

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

But that sentiment—anything is possible—is not always present. There are some points in history where it seems like nothing is possible. That was the case not long ago—in 2009.

If you know a little bit about finance, you know that valuing equities without dividends can be tricky, and a lot of it depends on your assumption of what a “terminal value” might be. This also depends heavily on interest rates, which happen to be low.

So, lots of ebullience + easy monetary policy means these moonshots have very high valuations. With a little foresight, we might have been able to predict that these conditions would develop—but I think no reasonable person thought it would go this far.

No Shame

If you’re the ant, schlepping back and forth to work, you have nothing to be ashamed of. Please, please, please, do not have fear of missing out. Fear of missing out is currently manifesting itself in the number of Coinbase accounts exceeding the number of Schwab accounts.

You may think watching other people get rich is bad. But there is nothing quite like the smug satisfaction of sitting on a pile of grain in the winter, with the grasshoppers starving outside, and knowing that all the schlepping paid off.

Sure, some people just have a higher tolerance for risk. Their life isn’t complete unless they are watching their net worth rip around at a rate of 15% a day. There has always been a fine line in this business between investing and speculating. Reflect a little on which one you have been doing.

Grasshoppers May Be Refused Entry

A quick PSA to let you know that the Alpha Society are still open, but for a limited time.

All it takes is an initial one-time membership fee and small annual maintenance fee and you're a lifetime member of the Society. A club where you're surrounded by smart people sharing smart analysis on the most critical investment and economics topics today.

A network can be a very powerful thing. It’s good to know people who know people. That’s the most important feature available to Alpha Society members.

Getting every service published by Mauldin Economics for as long as it’s published is a pretty spectacular benefit, too.

You should take a careful look at your invitation to see what else you stand to gain by joining the Alpha Society. It’s a great time to join—2019 is going to be stormy.

________________

1Someone actually pitched me on Ripple (XRP) few years ago and I was sold on the idea. I fully intended to do the heavy lifting on how to buy some of that stuff, but life intervened and I never got around to it. Shame on me.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian