Not So Good at Finance

-

Jared Dillian

Jared Dillian

- |

- March 16, 2023

- |

- Comments

We’re about a week into this, and already, I am sick of talking about Silicon Valley Bank (SVB). Soon, it will just be a footnote in market history, like Orange County and Procter & Gamble.

But as it turns out, the bankers at SVB were pretty good at tech but not so good at banking. They waved in billions of the lowest possible coupon mortgage-backed securities and Treasuries and forgot to hedge with interest rate swaps. I’m not entirely sure they even knew what interest rate swaps were. I’m being serious. They were that dumb. They had no business running a bank. It was basically just a grandiose Jiffy Lube for venture capital funds.

Problem is, SVB was the 16th-largest bank in the US in assets, and while you probably don’t remember who came in 16th in the race for the batting title last year, 16th-largest is big enough to be systemically important. If the Federales didn’t stop the run, it could have spread to several other banks. Hence, the unlimited deposit insurance. I disagree with it on libertarian principles, but we’ve abandoned free market principles to save the free market. I wonder where we’ve heard that before.

The politicians are framing this as “saving innocent depositors,” but the majority of SVB’s deposits were placed there by about 35,000 depositors with $4 million in deposits each, on average. These people were not innocent. They were big boys and girls and supposedly sophisticated enough to understand the risks. As it turns out, they were as dumb as SVB management. Dumb people losing money is supposed to be a feature of capitalism. It has a cleansing effect. But we never let it happen.

The Resulting Short Squeeze

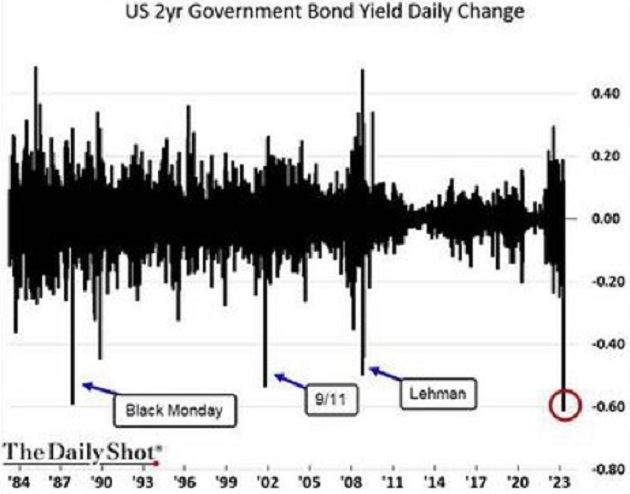

Anyway, that’s nowhere near the most interesting aspect of this situation. When it became clear the bank run had the potential to cascade, the market quickly began to price out rate hikes, betting that the Fed wouldn’t follow through with them. That turned into a short squeeze in two-year notes, which dropped over 100 basis points in yield in three days. It was the biggest move in two-year notes since the Crash of 1987… 13.6 standard deviations, in fact. Something so improbable it was never supposed to happen.

Source: The Daily Shot

I assure you, one or more banks or hedge funds got blown up on this move. It was mass panic. I’ve never seen anything like it. I mean, betting on endless rate hikes seemed like a sure thing, right? Just two days before, that is exactly what Powell said in front of Congress. The Fed chair had your back, and then a piano fell on your head. Wait and see. Pretty soon, you will see in the news that XYZ bank lost $80 million or XYZ hedge fund lost 30% on the short rates trade. It was the most consensus trade on the board. And so easy. You lose focus in this business for one minute, and people get hurt.

The Fed will probably hike one more time, 25 basis points, and that will be it. And the rate cuts will follow soon. This incident was the starting gun for the recession. You saw an absolutely gargantuan steepening in the yield curve. It will continue to steepen. And that’s when recessions happen—not when the yield curve inverts, but when it first starts to steepen.

Markets are hard.

Trades to Make

- Regional bank stocks are probably a buy, though they need time to bottom out and form a base.

- If the Fed ends up cutting rates, commodities will rip.

- Oil is a mess, but I’ve heard theories that the recent poor performance is a result of inflation hedges unwinding after the two-year note debacle.

- Gold wins in all scenarios.

- Commodities win, generally.

- Oil is a mess, but I’ve heard theories that the recent poor performance is a result of inflation hedges unwinding after the two-year note debacle.

- Stocks don’t necessarily go down, but they don’t necessarily go up, either.

- Not a good time to be in credit—as we enter a recession, defaults will pick up.

Do I think we will see more bank failures? Not likely. Although one interesting wrinkle is that Dodd-Frank incentivized banks to hold Treasuries and mortgages instead of commercial loans, whereas commercial loans are typically floating rate and would have been fine in a rising interest rate environment. The unintended consequences of regulation strike again.

I think this was an isolated case of financially unsophisticated people being responsible for billions of dollars. If I were a depositor, I wouldn’t be worried about rising rates as a threat to banks—I would be worried about competency. Is the guy running my bank a donut?

I am fond of saying that nothing is safe. If you want to avoid all of this, just buy a money market fund or invest in T-bills directly. You could do a lot worse.

Jared Dillian

P.S. It’s finally time to announce this year’s Strategic Investment Conference (SIC), “Thinking the Unthinkable.” You can find a signup link below with the dates and current list of expert speakers (with more being added every week). Plus, if you sign up today, you can reserve your SIC 2023 virtual pass at a 44% early discount—click here to preorder now.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian