Mutual Funds vs. ETFs

-

Jared Dillian

Jared Dillian

- |

- November 8, 2018

- |

- Comments

My name is Jared Dillian, I used to be a big deal in the ETF industry. And I’m here to tell you to that I like open-end mutual funds better than ETFs—mostly because ETFs are misused.

Slow down, Turbo. What’s this all about?

I am not mad at ETFs or anything. On ETFs, I actually agree with Jack Bogle. He never wanted Vanguard to issue them, because they encouraged short-term trading rather than long-term investing.

He is right!

It’s because of a subtle difference in the structure. With a mutual fund, you mail them a check (or the electronic equivalent) and you buy shares of that particular investment company at the net asset value, determined once daily.

You can’t watch it during the day—it doesn’t do anything. Sure, you can guesstimate where they will end up at the end of the day based on market action, but that isn’t very productive.

In the old days, you would look at your mutual funds in the newspaper (really), once every couple of weeks or so. That is how it is supposed to be done.

An ETF, you can watch… second by second, tick by tick. I don’t care what kind of market psychology ninja you think you are—when you see something trading tick by tick, it’s a lot different than something that prints once at the end of the day.

If it starts to go down, you might feel compelled to sell it, which pretty much goes against anything and everything a financial advisor will tell you. Leave it alone, and let it compound. It’s what we do at ETF 20/20. But if you’re going it alone, it’s not so easy when you can pull it up on your Robinhood app and stare at it.

Some people think of ETFs as short-term money, and mutual funds as long-term money. That’s a dumb way of looking at it, because both should be thought of as long-term money.

I am the psychology guy. My core belief is that investor psychology drives the majority of returns. If you think about it, an active ETF should roughly equal an active mutual fund, and a passive ETF should roughly equal a passive mutual fund. But because they’re structured very differently, investors treat them very differently—all because of psychology.

For better or worse, people typically use ETFs for speculation, partly because ETF issuers encourage speculation. Blockchain, cannabis, double-inverse leveraged volatility, etc. The mutual fund industry is still pretty boring. And that is a good thing.

Implicit in the ETF vs. mutual fund debate is the active vs. passive debate, because most mutual funds are active and most ETFs are passive.

|

Pick Bad Mutual Funds

First of all, I’m a big proponent of active management. Active management has the potential to deliver good returns while minimizing volatility. Remember, if you invest in an index, you get the volatility of an index.

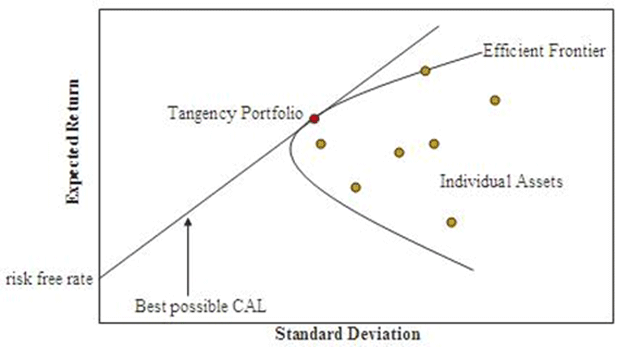

But there’s actually more to it than that. Hardcore finance people will be familiar with the term “efficient frontier.” It is the set of portfolios that deliver the highest level of returns for a defined level of risk.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Source: Wikipedia

Funny thing about everyone getting portfolios on the efficient frontier. The trade tends to get a bit crowded.

Finance is a non-ergodic system, which means roughly that people’s individual behavior has an effect on the overall environment.

Lots of people individually choosing a portfolio on the efficient frontier has the potential to create a system that is unstable and subject to, well, getting flushed. In a situation like this, it might be better to pick an objectively bad portfolio than a popular portfolio. By bad, we mean: something with worse risk/return characteristics. Something off the efficient frontier.

By picking a bad mutual fund, you will exhibit lower correlation with other funds and the rest of the market.

I bet you never had someone tell you to pick bad mutual funds. I’m being serious, go to Morningstar and look at the one, two, and three star funds. Besides, Morningstar’s track record on predicting which funds will outperform isn’t so great. It’s mainly a marketing tool.

Manager Risk

There is one important thing to know about actively-managed funds: the portfolio manager matters.

There is serial correlation. Someone who is doing a good job will likely continue to do a good job. Someone who is doing a bad job will likely continue to do a bad job. Unless the market environment changes dramatically, at which point good managers become bad managers and bad managers become good managers.

I can’t seem to find the article right now, but I seem to remember the Wall Street Journal writing about a mutual fund firm during the financial crisis. The firm, which some had considered to have the worst mutual funds, suddenly had the best mutual funds. The funds were mostly invested in banged-up small cap tech companies, which suddenly went into favor while everything else was getting s---housed. This is why it is not such a good idea to chase good performance and good managers.

Financial security usually comes from doing the opposite of what everyone else is doing, but you’ve probably heard that from me before.

Don’t Worry, New ETF 20/20 Subscribers

Every criticism I’ve made here of ETFs is really more about investor behavior around ETFs. As I said, I’m not mad at ETFs, so to the hundreds of you who have joined ETF 20/20 in the last couple of weeks… you made a great decision. We invest in ETFs in an intelligent, long-term fashion. No double-inverse leveraged volatility in sight.

(If you didn’t join, you still can—you’ll pay full price, but it’s still inexpensive for what you get.)

Now, you might remember that a few weeks ago, I said here that I was working on some big changes. All of these changes are now in place.

The philosophical question I wanted to answer was: “If ETF 20/20 offers what every investor needs—a balanced, core portfolio—how can I give readers more of what they want?”

As we all know, what you need and what you want are often very different things. I’ve been working on this question for months, and I’m happy to say that I now I have the answer(s). I’ll be telling you much more about it tomorrow—please watch out for an email from me.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian