Memories from the Last Bubble

-

Jared Dillian

Jared Dillian

- |

- January 18, 2018

- |

- Comments

Longtime readers know my timeline by now. I graduated from the Coast Guard Academy in 1996, went to sea for two years, and then settled in the San Francisco Bay Area to work on the Coast Guard Pacific Area staff and go to grad school.

I was at the Academy from 1992-1996, and totally cut off from the outside world, and then at sea from 1996-1998, and totally cut off from the outside world. So when I rotated back to society in 1998, I wasn’t really up on current events. The last I heard, it was 1991 and we were having a great, big recession. What had happened? Everyone was happy all of a sudden.

San Francisco was a pretty magical place back then. First of all, it was a lot cleaner. The Tenderloin has always been a mess, and Market Street has always been a bit gritty, but it was better then than it is now. I never spent any time in Silicon Valley proper, but I went to business school at the University of San Francisco up at Lone Mountain, one of the most beautiful neighborhoods I have ever seen.

They had an entrepreneurship track in the MBA program, which I skipped. I was a finance major, and I was going to work on Wall Street.

Everyone else thought that was weird. Why would you go to the University of San Francisco if you are going to work on Wall Street? All my classmates were going to work in technology in some capacity.

So, my first-ever class at USF was financial accounting, and I remember the professor saying something about “venture capital.” I followed her into the elevator and asked…

“What’s venture capital?”

I was about as unsophisticated as you could possibly get, and I was plopped in the middle of one of the greatest stock market bubbles in recorded history. It took me a while to realize that was unusual.

I drove in and out of the city every day, and what I started to notice was that all the billboards were for internet companies. I remember a big one for WebEx right before I went over the Bay Bridge. I remember going to the Oakland Coliseum to see the A’s and seeing advertisements for Yahoo! and such.

This was before the time I spent on the P. Coast, where after one options expiry, my firm went out to dinner at a seafood place downtown called Blue. It was opulent beyond description. I had all the free food I could eat, so at least I was getting something tangible out of this bull market.

I missed the Pets.com commercial. I didn’t have a TV.

What I knew was that people were making money all out of proportion to their intelligence and work ethic, which has become my standard definition of a bubble.

There were some dumb people on that options trading floor making very good money. Some of them were making ridiculous money. They were lucky enough to be in the right place at the right time, which they didn’t really realize.

One day, the San Francisco Chronicle sent some reporters down to the trading floor. They interviewed one of the traders, who said: “I can’t believe how much money I’m making!”

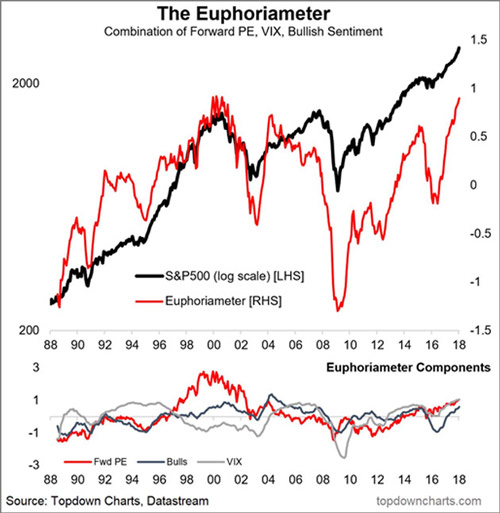

The Euphoriameter

To be a good trader, you need to have a good memory. I have very specific, experiential memories about the last big stock market bubble. I remember all the Coast Guard guys I worked with day-trading stocks. And making money! It was hard not to.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Or, you could just gaze at this picture of CoinDaddy, a bitcoin rapper.

Source: The New York Times

We’re there. My guess is, the tomb is sealed and we just don’t realize it yet.

The one thing about 2018 versus 2000 is that our society, our government, our central bank now have absolutely zero tolerance for financial pain. My guess is that the jawboning starts when the market drops five percent, when the VIX is getting into the high teens. In bull markets, jawboning works. In bear markets, it does not.

In every bear market, people lack imagination as to how bad it will get. That is true of the last one. For sure, there were a lot of people saying that housing prices would go down, and homebuilders, and the banks. Not many people thought it would blossom into a full-blown financial crisis.

And a bear market is one thing, but to get an actual financial crisis requires leverage. Is there leverage in bitcoin? Some—there is evidence that people are using credit cards to buy it. But not as much as there was in residential real estate ten years ago. Is there leverage in stocks? It’s elevated, but not unmanageable. But the problem with leverage is that sometimes, you don’t know it’s there until people start deleveraging.

People will always find something new to speculate on. This time around it is bitcoin, last time it was houses, the time before that, tech stocks, and maybe commercial real estate before that.

Next time: who knows? But the good thing is that all the young people will have seen an honest-to-goodness bear market, and will know what one looks like.

I am a terrible late-stage investor. I would have been one of those guys feasting on cheap stocks in 1982, but I would have been out by 1986, missing out on the next 14 years. It’s something I’m working on. I read that New York Times article about the bitcoin idiots. Would I like to be sitting on a phone number’s worth of crypto? You bet.

Maybe next time.

One Final Thing

I’m actually going to be moderating a panel on cryptocurrencies at Mauldin Economics’ upcoming Strategic Investment Conference, which takes place in San Diego from March 6-9. My guess is, it’s going to be a pretty fiery panel—which is great!

I’m also going to be talking about ETFs, and be interviewed on stage. The SIC has an incredible line up this year, including John Burbank, Niall Ferguson, Mark Yusko and Jeffrey Gundlach. You should join me there—it’s going to be fun.

subscribers@mauldineconomics.com

Tags

Suggested Reading...

|

|

Jared Dillian

Jared Dillian