I Am the Greatest of All Time!

-

Jared Dillian

Jared Dillian

- |

- March 3, 2016

- |

- Comments

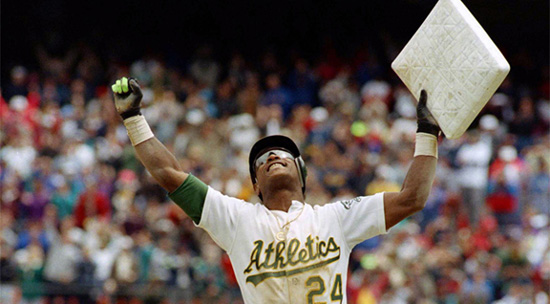

Rickey Henderson never suffered from a lack of confidence. I’m sure if you asked him, he’d tell you that he could still play baseball and steal 50 bases a year.

I also remember the anecdote about Lenny Dykstra from Moneyball. A young Billy Beane was sitting with Dykstra in the dugout, watching Steve Carlton warm up. Dykstra said to Beane, “Who is that old man? I’m going to stick him.”

Beane replied, “Lenny, that’s Steve Carlton, one of the greatest pitchers ever. He’s number two on the all-time strikeout list.”

Dykstra said, “I’m going to stick him.”

I think baseball perhaps is one endeavor where you can never have too much confidence. Same with a lot of things in life. In investing, not the case. You need to have a healthy dose of skepticism in your own abilities.

Trump, for Example

Trump obviously does not suffer from a lack of confidence. Nate Silver didn’t, either.

The well-known statistician predicted early and often that Trump wouldn’t last long in the Republican presidential race. And he wasn’t alone: a lot of people said Trump would flame out over time. Pretty much everyone was saying it.

What distinguished Nate Silver from everyone else was the confidence with which he was saying it. He was all but guaranteeing it. He operates in a world filled with mathematical models that had never before failed him. Then they failed him.

When you deal with large quantities of money, you try not to say things like “This absolutely, positively cannot happen.” Because anything can happen. It’s just a matter of measuring the probability, no matter how remote.

There is no such thing as a sure thing.

But people outside of finance often don’t understand that. They go through life with a level of certainty that people like us just don’t have.

Trading makes you really humble. You’re wrong a lot, and you have to admit that you’re wrong, or you will get carried out.

Typically, people get into trouble with overconfidence when they find themselves in a trade they feel strongly about and it progressively goes against them, day after day after day. So they double and triple down and keep adding to the position.

This is not a mistake professionals make. This is an amateur mistake, to forget your discipline like that. Pure ego. “I know better than the market.”

Nope.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

In The Daily Dirtnap, I recently asked my subscribers if they could think of a trader who went on to occupy a position of authority, because I couldn’t think of any.

They thought of one! Jon Corzine. But his undoing at MF Global was because of… you guessed it—overconfidence!

Zero Hedge’s tagline is, “On a long enough timeline, the survival rate for everyone drops to zero.” Of course that is a Fight Club quote, but it applies here. Eventually, given enough time, everyone will suffer from overconfidence and blow him- or herself up.

You will find that the investors who last into their seventies and eighties are very boring, cautious people. Not the types of folks that make triple-digit returns.

A Complete Lack of Introspection

Politics aside, when I look at potential leaders, I like to look at how introspective people are, their awareness of themselves, their strengths and shortcomings.

I try to imagine XYZ presidential candidate in a position where they have to admit that they’re wrong. Can they do it?

It’s one thing to do it as a trader, when lots of money is at stake. But what if you are president—and lives are at stake?

Otherwise, they are in the position where they have committed an error and continue to compound the error, doubling down, with possibly grievous consequences.

Of course, this quality isn’t often found in presidential candidates, because you need the confidence of a Rickey Henderson to run for president. You have to be that insane.

This cycle, we have a slate of candidates who appear to be fully convinced of their own infallibility. I think the problem is more acute than in previous years. You might confuse overconfidence with strength this time around, but that is an error you won’t make twice, I assure you.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian