The Powell of Positive Thinking

Jay Powell has been named the next Chairman of the Federal Reserve. Provided he survives the confirmation process, it is a done deal.

This wasn’t the easiest pick for Trump. It’s not easy to find a Republican who is also in favor of low interest rates. Powell isn’t exactly a dove, but he’s significantly more dovish than John Taylor. Or at least he was, up until the complete 180 Taylor pulled after learning he was a candidate for the job.

Powell is a private equity executive and a lawyer, not an economist—which these days, some might consider to be an asset. The professional economists have delivered on their promise of low inflation, unless you count inflation in things like houses, stocks, and bonds. He’s enough of a hawk that Bernanke at least partially blames him for being on the wrong side of the “taper tantrum” in 2013.

The journalists all seem to think Powell represents “continuity,” and Mnuchin seems to think the White House can exert some degree of control over him. That is the consensus.

As the 10th Man, I’m always looking to poke holes in consensus. So:

1) What if Powell breaks with Yellen’s water torture rate hikes, and hikes faster?

2) What if Powell interprets Fed independence quite literally, and grows a brain?

The markets could be in for a big surprise.

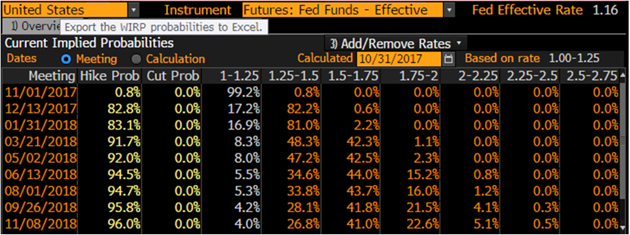

There is a screen on Bloomberg called “WIRP,” which stands for World Interest Rate Probability. You can see the likelihood of rate hikes over just about any timeframe.

Source: Bloomberg

You can see that that one rate hike is expected next year in the US. What happens if Powell grows a brain? More rate hikes, of course.

I think the market is a little mispriced.

Institutional Memory

The Fed, as an institution, hasn’t had to worry about rising inflation in 35 years. Volcker attacked it with both barrels, it declined, and kept declining for decades. For years, the Fed stayed vigilant. It would hike at the first sign of trouble. The Greenspan Fed in the late nineties would have done three 50bp intermeeting rate hikes with ISM above 60 and unemployment scaring the three handle.

It’s not exactly controversial to say that the Fed is complacent about inflation. It is currently below the 2% target. I say vigilance is still warranted. Plenty of people disagree—former PIMCO money markets head Paul McCulley had an insane interview in The New York Times the other day where he argued for, among other things, a new definition of full employment.

For every person like me who thinks that the Fed is complacent, there are dozens who think they are excessively cautious.

But I think that high inflation is a serious enough malady to warrant an asymmetric response. Think about this. What happens when you have really high inflation—over 20% a year?

- Hoarding

- Speculation

- Rationing

- Economic distortions

- Riots!

High inflation rips society apart. That is why it is so dangerous. And it can lead to political unrest.

Deflation, on the other hand… look at Japan! Thirty years of deflation and they have close to the highest standard of living in the world. Rich and prosperous—with legendary political stability. Everyone is happy.

If I had to choose between inflation and deflation, I know which one I’d pick every time.

So it’s not such a good idea to be cavalier about inflation. If inflation is 1.5% and the inflation target is 2%, I don’t think we should be revving the economy until it gets there.

Like I said, everyone who was at the Fed when people were worried about inflation is gone. There is no more institutional memory of it. People have lost their fear of it.

And here’s the thing about being an inflation-fighting central bank—if you want to stop inflation, you have to take early and effective action. Inflation is just now starting to ramp. That warrants a policy response.

Political Realities

Pretend Jay Powell has his own opinions on monetary policy. He’s never dissented, so we don’t really know what they are. But he’s a smart guy; it just seems like he doesn’t have an axe to grind. But he might.

That might one day put him at odds with the Trump administration. It wouldn’t be the first time the Fed Chairman wanted to raise rates and the President didn’t. Go read about how LBJ slapped around William McChesney Martin over monetary policy.

Trump has the option of one day dismissing Powell, but you’re not supposed to do those sorts of things, for the same reason you don’t dismiss a special prosecutor.

Up until this point, Trump hasn’t cared about monetary policy—because there hasn’t been any, save for the drip-drip-drip of quarter-point rate hikes. This we know for certain: the next Fed Chairman is going to have to worry about inflation.

Is Powell equal to the task? I think he is, actually. But if he hikes rates faster than Trump wants, it is going to be a big ____ sandwich and Powell is going to have to take a bite.

One more thing: be sure to check out the latest edition of The Monthly Dirtcast with guest Gregg Smith, city council candidate for Myrtle Beach. Gregg is a smart, reasonable guy running for city council here—we spend a lot of time talking about how to solve small town problems. The world needs more smart, reasonable people trying to solve problems, and is generally unkind to them. If you’ve ever thought of running for local office, you’ll want to listen in.

Scroll down for comments.