Armageddon

There will be no Armageddon in the markets (at least not this month), although the other thing that probably comes to mind when you hear Armageddon is that God-awful Michael Bay movie where we send drillers into space to blow up an asteroid.

Allegedly, Ben Affleck had some questions about the plot of the movie, and asked whether it wouldn’t make more sense to teach astronauts to drill rather than teach drillers to be astronauts? Michael Bay told him to shut up.

So the timing on this is interesting, because San Francisco Fed President John Williams came out really dovish the other day, speculating that maybe we should increase our inflation target.

Translated, that means that we would be willing to tolerate a higher level of inflation before doing anything about it.

Translated, that means zero rates for longer.

Which is kind of the opposite of everything the Fed has been saying for the last year.

It means more coming from Williams, because he’s connected with Yellen (Yellen also came from the San Francisco Fed), and he’s not a hack.

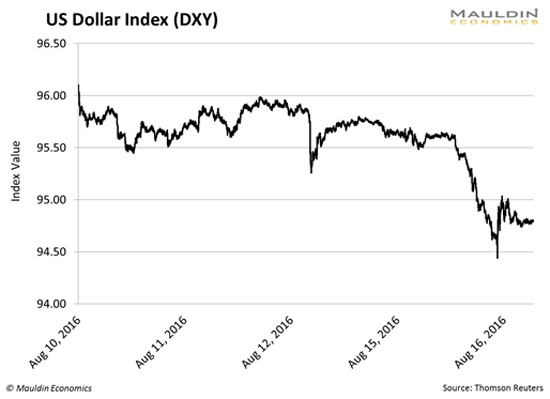

The dollar got monkeyhammered on Tuesday:

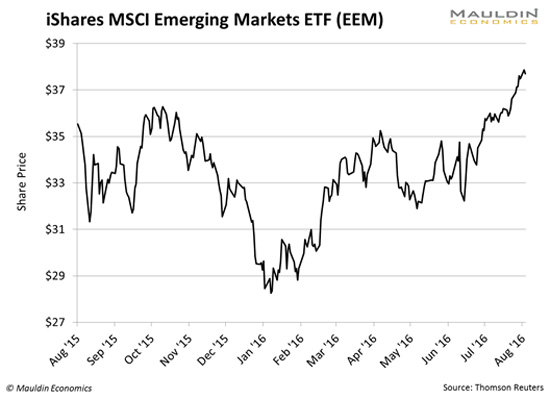

And as a consequence to the USD getting monkeyhammered, emerging markets have turned into a food fight.

This is not what was predicted by some people back in January:

In fact, emerging markets are up almost 40% from that date.

Oops.

Bad forecasts are excusable. The market will make a fool of everyone at some point (including me). To the tune of almost 8,000 basis points… I don’t know.

But you know what they say about being wrong. If you are going to be wrong, at least have company. Nearly everyone was calling for a much stronger dollar, lower commodity prices, and endless EM pain. It was unanimous. But it never came to pass.

You Heard It Here First

If you were a 10th Man reader back in January, you probably remember me getting my head caved in, squawking about how generationally cheap EM and commodities were, totally alone, watching them make new lows every day. And you had the “smart” guys on the other side of the trade, making me not feel very smart.

Meanwhile, as editor of the Street Freak letter, I was busy loading up the portfolio with EM and commodities. I think I was making the folks at Mauldin nervous. It was a very out-of-consensus view. But it has paid off—the portfolio is up 28.7% YTD.

So the answer here is that you really don’t have to know anything about anything—if you are a student of market sentiment, this should have been an obvious trade.

Now, for the macro thoughts. The dollar rallied about 30% over the course of a year—a truly massive move—and from a technical standpoint, it needed to consolidate. And it might consolidate for years.

This feels like a USD bear market, but it’s not. It’s just a consolidation in the context of a multi-decade trend of USD strength. But it could last for quite a while. And while the dollar takes a breather, it gives room for EM and commodities to rally.

That low in January, when we thought Brazil was ungovernable… when we thought Russia was checkmated by low oil prices… when we thought China was collapsing under a mountain of debt… when we thought there was endless corruption in South Africa… that was a generational low.

Ironically, the one EM country that investors did like, India, has massively underperformed.

You can always count on the market doing what surprises most of the people, most of the time.

The Jackson Hole

All of this culminates in Yellen’s Jackson Hole speech on August 26, where we are probably going to get a very clear picture of the Fed’s direction. I have been expecting rate hikes (especially post-election), but if the direction of the Fed’s thinking has really changed, we are going to find out then.

If the Fed is dovish, it is going to force other central banks to be even more dovish (to offset their own currency strength), and we will continue the race to the bottom in paper money.

Good for gold.

How do you invest in an environment where paper currencies (all of them) are going to zero? Dennis Gartman used to say that he liked to buy stuff that would hurt if he dropped it on his foot. That is what you have to do.

Which means you have to undo the last five years of conditioning, where you got caned every time you bought a mining stock.

Meanwhile, gold miners are roofing (disclosure: I own this):

And even the orphaned metals and mining ETF XME is extending the range:

You run into these people in the business who love mining stocks, all the time, they are obsessed with mining stocks. Not me. I don’t even think mining is a particularly good business. But it will be, for the foreseeable future.

Before I go, here’s an important announcement: If you live in the NYC area and would like to participate in the video taping of my new ETF Trading Master Class, please sign up here.

On September 10 and 11, we will be filming at Columbia University, in front of a live audience (you), and you get the benefit of a free master class by yours truly. There’ll be refreshments and lunch as well.

The catch? You’ll have to commit to stay for one whole day, and there might be retakes. But I think we’ll also have fun, so come on down and join me. Again, here’s the sign-up link. Seats are limited; we can only take 20 people per day, so first come, first serve.

Scroll down for comments.