A Problem of Accumulation

-

Jared Dillian

Jared Dillian

- |

- January 23, 2020

- |

- Comments

Yo, pls follow me on Twitter, thx.

People complain about the Fed. Endlessly. Incessantly.

I get the feeling that we give the Fed too much credit.

The Fed simply controls one interest rate, the Federal funds interest rate, which isn’t all that important of an interest rate. It also does so incompetently.

It can print money and buy securities like it’s doing right now, and that makes stocks and bonds go up in the short term. But it doesn’t explain the last 30 years of behavior in the capital markets.

If you’re looking for an explanation for why the stock market is going parabolic, it’s not the Fed.

Ok, it’s not entirely the Fed.

It’s the Baby Boomers.

Baby Boomers are, as you know, a giant demographic bulge in the population. They’re responsible for the prosperity that we enjoy, and they’ll be responsible for the downturn that we won’t enjoy.

They’ve been working and enjoying high salaries and saving and investing for years. And for the last 10 years or so, they’ve been retiring and living off their retirement savings.

Sometime in the next few years, more of them will be retired (and dis-saving) than working (and saving). And we will experience capital starvation rather than capital surplus. Stocks should go down, and interest rates should go up.

Years ago, I bought Peter Zeihan’s The Accidental Superpower and never got around to reading it. Read it on a flight last week. His chapter about demographics is compelling.

To Zeihan, demographics (and geography) are destiny. I agree with that to a certain extent. But I will add that ideology is also destiny, though he would probably say that was a function of demographics and geography.

|

The Bad Good News

We will experience a shortage of capital for a number of years. The good news is there’s another large generation coming along to pick up the slack from Generation X: the Millennials. And there will be an echo of the previous boom. But times are going to be hard for Gen Xers like me in their peak earnings years.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

So in the long run, things will get better. You know what they say about the long run.

Up until recently, I never paid much attention to demographics. As a quote unquote “trader,” I ignored demographics because it didn’t provide useful signals.

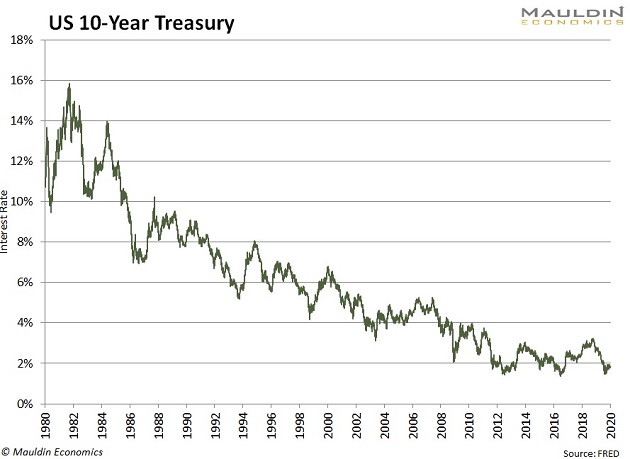

But demographics provides the cleanest possible explanation for this:

Not whatever the Fed was doing.

You don’t have to be Garry Kasparov to figure out what happens next: stocks go down, long-term yields go up, and the Fed goes into overdrive to forestall what looks like a recession. It cuts short-term rates—a lot, possibly into negative territory—and the yield curve steepens dramatically.

If you’re wondering, real estate doesn’t do well in this scenario, either, as Boomers unload their primary residences, downsize, and indebted Millennials can’t pick up the slack.

I have a reputation as sort of the macro doom guy, and I see no shortage of ways for things to go wrong. But nobody looking at US demographics could reasonably come up with a happy ending here. And that’s before we even get into a conversation about entitlement programs, which is unpleasant.

There Is No Escape

How does this affect your asset allocation?

2020: Long stocks and bonds and real estate

202?: Cash, maybe commodities

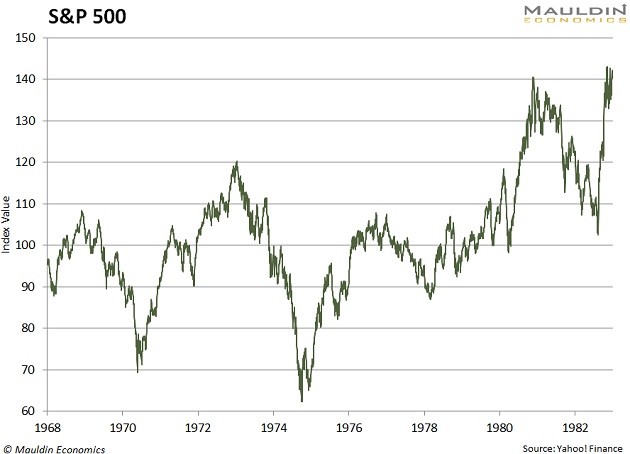

What I’m looking for is a period of underperformance of equities that lasts a really long time, like, possibly as long as 1969–1982.

On Wall Street, beliefs change over time. The current belief is that stocks will go up forever. That belief will change—all beliefs change.

After all, investors in Japan probably don’t think that stocks go up forever. Investors in Europe probably don’t think that stocks go up forever. In fact, there probably isn’t another country in the world where people think stocks go up forever. The average investor really doesn’t have a good grasp of how unusual this is.

What we have now—and what we have had for years—is a historic gap between the performance of financial assets (stocks and bonds) and other assets (commodities). I expect that mispricing to resolve itself eventually.

When? Again, demographics gives us no clue on timing. If you have a portfolio that is mostly stocks, it is probably worth thinking of a little diversification. You don’t have to sell the top tick.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Speaking of the Boomer-caused prosperity and the subsequent downturn: Both can be equally scary, but a great way to deal with that is through strength in numbers. I’m kind of a loner myself, but I can appreciate what John Mauldin has done by creating the Alpha Society. It’s like being a part of a power group of serious investors and financial experts who know what they’re doing.

And with lifetime access to all the research, you’re pretty much set when it comes to diversification. The Alpha Society is only open until midnight tonight, Thursday, Jan. 23. So if you want to join the club and get a great deal on just about everything we publish—plus a free ticket to the SIC 2020—click here to jump right in.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian