Chris: When we discovered this stock, we realized this might be the opportunity of a lifetime.

We thoroughly vetted this company before we were satisfied that it was sound enough to make the cut for Mauldin Economics readers.

But the stock we’ll be talking about is not just a numbers game to me.

There’s a personal reason why it caught my attention.

You see, I’m something of a science buff.

Source: SWNS

Source: SWNSJust a few months ago, I read a biography of the late Stephen Hawking, one of the most brilliant theoretical physicists and cosmologists who has ever lived.

His book, A Brief History of Time, spent a record-breaking 237 weeks on the UK Sunday Times bestseller list, and he won numerous scientific medals and awards.

You probably know that Stephen Hawking was severely disabled for almost all of his adult life.

In 1963, he was diagnosed with an early-onset, slowly progressing form of amyotrophic lateral sclerosis (ALS), also called Lou Gehrig’s disease.

Over time, the disease completely paralyzed Hawking... to the point where his only way to communicate was through an adaptive word predictor device.

Source: AP Images

Source: AP ImagesHe died in March 2018 at the age of 76, after living with ALS for more than 50 years.

So when I found out about this tiny biotech company I’ll tell you about in a minute...

I realized that had their spectacular new treatment existed 10–20 years ago...

...Stephen Hawking might still be alive.

And not only that: He might even be walking and talking, and finishing up his latest thesis on the origins of the universe.

This is what I call the “Hawking Factor”:

A treatment that doesn’t just save the life of the patient...

...but could completely transform it by reversing the symptoms.

Reversing disease is the latest example of revolutionizing science, which Hawking was all about.

Jake and I will tell you about two different companies with this potential today, so please stay with us.

Sadly, it’s too late for Stephen Hawking himself.

But thanks to this first company we vetted, millions of ALS sufferers now have a chance to survive... and even regain part of their motor function.

We’re soon going to find out if the treatment is ready for the last step: an application for the final stamp of approval from the FDA.

If this is as ground-breaking as it looks right now, the rewards for shareholders will be enormous.

The moment of truth is close.

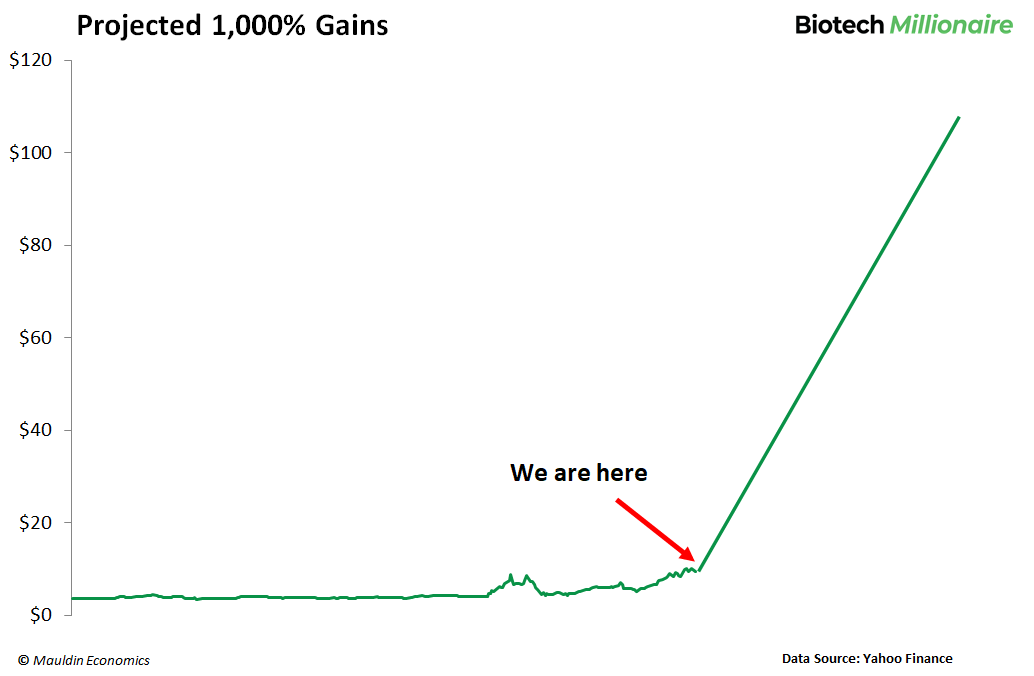

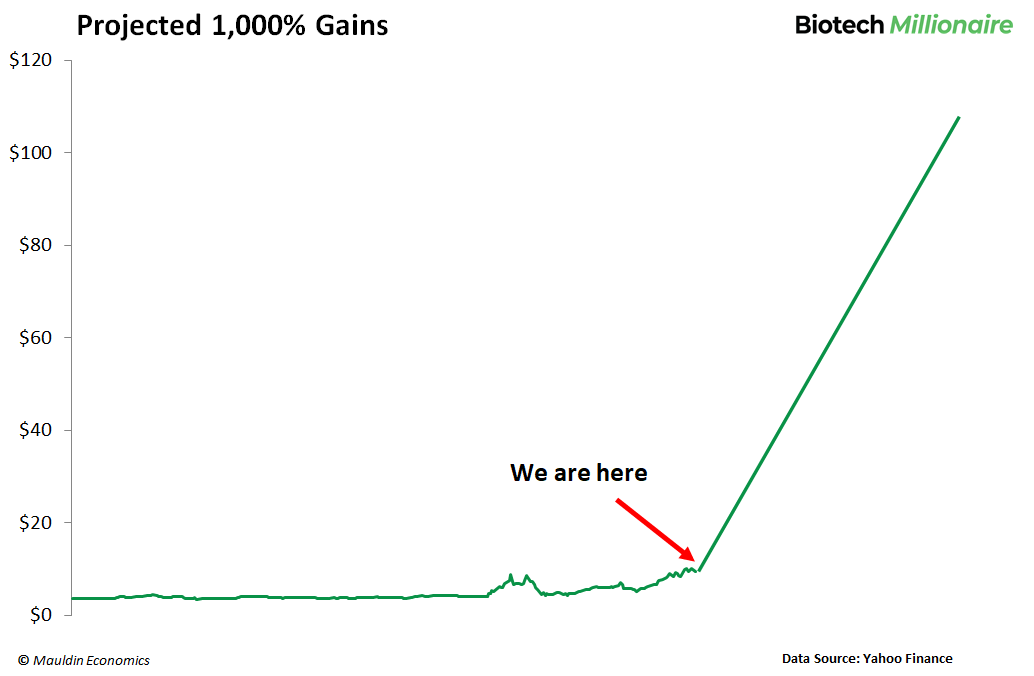

And when it hits, savvy investors could rake in returns of up to 1,000% within the next three years.

Because of the transformative potential of the “Hawking Factor,” this recommendation I am handing you today could be right up there with my best calls of all time.

And I’ll give it to you straight up, name, ticker, everything... with no strings attached.

Everything you need to know to get in before our first major “catalyst” hits.

After I give you the full details of this company, all you’ll have to do is go to your online brokerage...

...type in the symbol...

...say how many shares you want...

...and click a button.

The possible reward? Being extremely conservative, I’m expecting 195% within the next 6 months...

...and up to 1,000% in the next 3+ years, once this goes on the market and transforms the lives of millions of ALS sufferers.

It is already doing that to some degree.

Meet Matt Bellina, one of the first beneficiaries of the “Hawking Factor.”

This is a photo of Navy veteran Matt (on the far left) with President Trump as he signs the “Right to Try Act” into law.

Source:Forbes.com

Source:Forbes.com

This useful new law gives patients diagnosed with life-threatening conditions a chance to try experimental drugs before the FDA approves them.

Matt Bellina was diagnosed with ALS back in 2014.

There is no cure for ALS.

And while Stephen Hawking had a slow-moving form of the disease...

...the average life expectancy for patients is only 2–5 years.

So far, there are four FDA-approved treatments for ALS—but frankly, you can pretty much forget about them.

Only one of them can slow the disease down, and not very well either... plus, it is only effective in 7% of all patients.

But the tiny company I’m talking about is changing all that.

Its revolutionary therapy not only slows the progression of ALS in many patients...

...it could even reverse some of the effects.

If it works out, this will be the first regenerative medicine for ALS patients.

I want you to understand how incredible this is.

Mainstream medicine doesn’t like the word “cure.”

That’s because real cures for diseases are virtually non-existent.

Once a degenerative disease takes hold in the patient’s system, the best you can hope for is long-term treatment to keep the symptoms at bay.

This treatment goes way beyond that.

Matt Bellina was already wheelchair-bound and paralyzed.

This innovative “Hawking Factor” therapy was his only hope.

Unfortunately, he didn’t meet the strict criteria for the clinical trials.

But thanks to the “Right to Try” law—and the company’s CEO, who personally funded Matt’s treatment—he received his first injection in December 2018.

Just two weeks later, Matt suddenly got the urge to get out of his wheelchair...

...so his family propped him against the kitchen counter, and he stood!

One year later, after a total of six injections, Matt was able to stand on his own.

His lung capacity has improved by 37%, and he no longer needs a machine to help him breathe.

This is the “Hawking Factor” in action, transforming a patient’s life by reversing the symptoms.

And Matt’s recovery is not a fluke.

In August 2019, the ABC News show Nightline profiled 3 other patients involved in clinical trials with the same therapy from the same company I’ve been telling you about.

So what’s the catch?

Well, there is a catch, but it actually works in our favor...

...because it is the only reason that the stock hasn’t already shot up 200%... 300%... or 500%.

The catch is that so far we’ve had only observational results...

...but to fully approve this therapy, the FDA still needs to see definitive proof from the clinical data.

Fortunately, we won’t have to wait long for that.

Conclusive data from the company’s crucial Phase 3 clinical trial should come in by year-end 2020.

That’s only six months away.

And a positive outcome will likely catapult the stock into the stratosphere.

But we may not even have to wait that long to see a spike in the share price.

Because often, it is not the actual outcome of the clinical trial that drives the price up...

...but the investor anticipation of a positive outcome.

So this gives you a terrific opportunity to get in NOW, before the big profits come flooding in.

The 195% we’ve projected for the next few months is just the beginning.

Once this therapy makes it to market, the possibilities are immense.

Our best-case calculations show that we could easily see gains of about 1,000%.

Let me tell you some more about this.

You’re probably wondering why Jake and I are so convinced that this small company is going to succeed and make us tons of money.

After all, isn’t biotech a notoriously risky sector?

Yes. Yes, it is.

But there’s a difference between gambling and taking a calculated risk.

Gambling means you see a “hot pick”... it looks great... so you plunk down your money and hope for the best.

We’d never want our readers to put money into biotech stocks without a way to evaluate what they are investing in...

...and a way to calculate the risk of that investment.

With our combined 30 years of investing experience, Jake and I know all about taking calculated risks.

It means to explore all of the pros and cons, and then make a well-informed decision.

But as it stands, there are few places to go to get that kind of expert information in our industry.

We have a duty to our subscribers, who don’t just expect outsized returns from our recommendations...

...but also that we show them the safest, most sensible way to get there.

To that end, we have developed a proprietary evaluation system we use to vet biotech companies on behalf of our subscribers.

We call it the C.A.S.H. system.

The C.A.S.H. system is our “secret sauce.” It consists of five criteria that a company must meet before we recommend it to our subscribers.

It’s based on our decades-long experience investing our own money in these biotech stocks... and thousands of hours of research.

C.A.S.H. stands for...

Catalysts

Addressable Market

Science

Hype

Let me tell you how we use these criteria—and how you can too—to unveil the top biotech stocks with at least triple-digit gain potential.

The C in C.A.S.H. stands for Catalysts.

Any company we look at should have at least one catalyst—that is, one near-term event that will drive up the stock price.

Catalysts tell us when the time is right to buy into a biotech company...

...because they are the reason why the stock is going to jump up.

Catalysts to look for can be positive results of a Phase 1, 2, or 3 clinical trial...

...or a Big Pharma company buying up our small biotech firm...

...or pending FDA approval.

The A in C.A.S.H. stands for

Addressable Market.

That means the size of the potential patient population for a new drug or therapy.

To be financially successful, a new drug or therapy needs to have a big-enough potential market to move the needle on the stock’s valuation.

Now, don’t get me wrong...

...this doesn’t mean every drug needs a gigantic target market.

It might treat a relatively rare disorder but is the only treatment available. That can be a huge plus for a company.

The FDA grants special “orphan status” to drugs that treat rare diseases with less than 200,000 patients.

And if your drug costs $50,000 per treatment, you only need 100,000 patients to have a $5 billion market.

The S in C.A.S.H. stands for Science.

When we are conducting research, part of our duty to our subscribers is to make sure that the technology is sound and likely to succeed.

Only 10% of drugs that enter into clinical trials will eventually be approved.

Clinical trials are extremely rigorous.

New drugs have to prove that they’re more effective and have fewer side effects than the drugs that are already on the market.

That’s especially tough in a segment like cancer drugs, where the competition is huge.

Vetting the science is not always easy. Thankfully, Jake and I have years of experience in the biotech sector and deep contacts in the field to help us understand whether or not a promising technology is viable.

The H in C.A.S.H. stands for Hype.

I’ve seen plenty of biotech startups with breathtaking therapies in the making.

But because their stories weren’t “sexy”...

...or the science was too hard to understand...

...or the investor relations department didn’t do a good job...

...they never got off the ground.

Put simply, a captivating story that grabs investor and media attention and creates “hype” can really drive a stock up.

Hype is also the reason that stocks shoot up before a catalyst happens.

And last but not least, let’s cover the fifth criterion we use to vet our portfolio candidates: actual cash.

Because if a company we’re looking at doesn’t have enough cash to make it through the development phase...

...or burns through its cash too fast to last...

...it doesn’t matter how fabulous the drug or therapy is...

...we will not recommend it.

You have to remember, most of these are pre-revenue companies.

So if a company runs out of cash before the next value-driving catalyst...

...it will usually issue new stock to raise money.

When a company issues additional shares of stock, shares become “diluted.”

Share dilution reduces the value of existing investors’ shares and their proportional ownership of that company.

Dilution can ruin even the best catalyst, so we keep a very close eye on cash levels and burn rate.

But let’s not keep it too theoretical.

To show you how the C.A.S.H. formula works in real life, let’s demonstrate it on the company I’ve been telling you about.

And then right after, Jake will tell you all about a second “Hawking Factor” company that could give us even bigger gains.

In fact, this second company could hand us up to 6X as much in returns.

But first things first.

Our first “Hawking Factor” company is called BrainStorm Cell Therapeutics (BCLI), and its groundbreaking cell therapy is called NurOwn.

According to our analysis, BrainStorm could hand us 195% in the next six months... and up to 1,000% in the next three years.

So let’s dive right in and see how BrainStorm fares when seen through the lens of our C.A.S.H. system.

Catalysts

In the case of BrainStorm, the next catalyst is already underway.

Its crucial Phase 3 trial for ALS is being conducted at six top medical centers across the US, including the famous Mayo Clinic.

200 patients are participating in the US trial, and another 13 patients are being treated in Israel under the Hospital Exemption (HE) program.

We should see the results of these two trials as soon as the fourth quarter of 2020.

Even better, we can expect a second catalyst in about the same time frame.

The same therapy that treats and partially reverses ALS is also being used in a Phase 2 clinical trial for a rare type of multiple sclerosis called “progressive MS.”

[More about that in a moment.]

The study will include up to 20 patients at six US medical centers, and top-line data could come in as soon as the fourth quarter of 2020... just like the ALS data.

More likely, though, it will come in early 2021.

That gives us two different, near-term swings at a homerun.

Addressable Market

Our “Hawking Factor” platform performs really strongly here because remember...

30,000 Americans and about 450,000 people worldwide suffer from ALS. 5,000 new patients receive an ALS diagnosis every year in the US alone.

And there is currently no effective treatment for ALS.

This treatment won’t be cheap, but neither is caring for an ALS patient.

The price tag for the new therapy could be as much as $300,000—and a large part of it will be paid by health insurance.

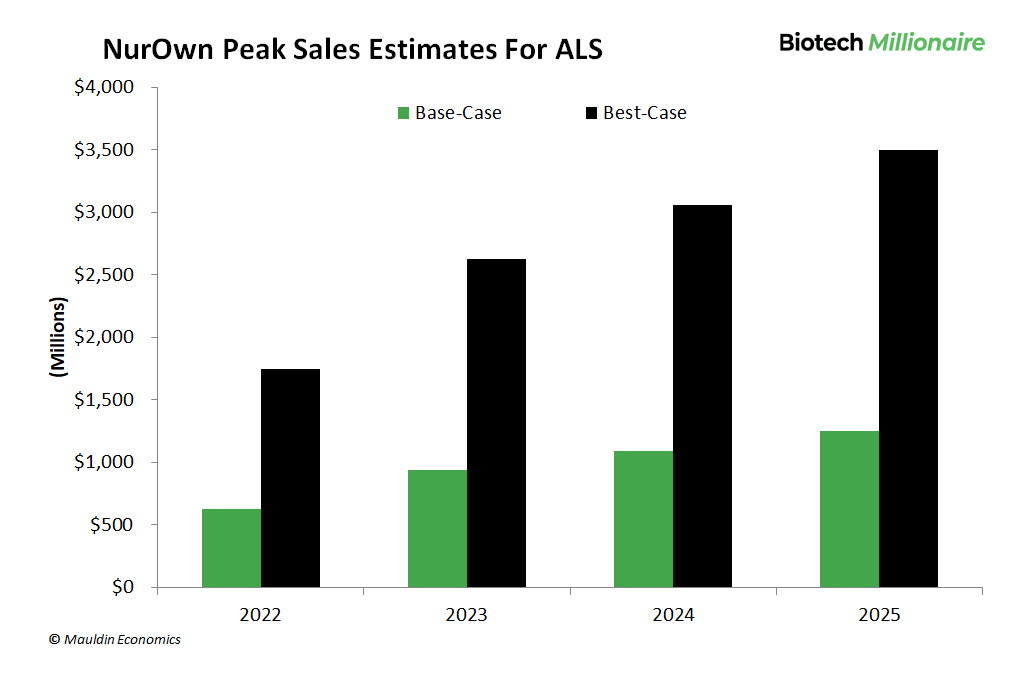

But even if we use a very conservative $150,000 per year treatment cost, like we did in our evaluation model...

...my best-case scenario for peak sales of BrainStorm’s ALS application could be up to $3.5 billion per year.

And as I said, that’s still a conservative estimate.

Plus, best-case sales figures for the treatment of progressive MS could add another $2 billion.

Multiple sclerosis affects 500,000 Americans and 1.25 million people worldwide.

But only about 10% of MS patients have the progressive form of the disease.

There are a number of drugs for relapsing-remitting MS, the more common form. But none of them make a real impact on progressive MS.

This is where the NurOwn cell therapy platform comes in.

Chances are it can make a real difference in the lives of those patients.

And if it does—which we’ll find out in late 2020 or early 2021—nothing stands in the way of a second tier of windfall profits.

Science

NurOwn fares especially well here too.

It uses a patented cell-manufacturing process that creates “autologous MSC-NTF” cells.

“Autologous” or “self-transplanted” means the platform uses a specific type of stem cells called mesenchymal stem cells (MSC) from the patient’s own bone marrow.

BrainStorm then harvests these stem cells and modifies them so they produce high levels of so-called neurotrophic factors (NTF) that help with the growth and repair of neurons.

These MSC-NTF cells are then reinjected into the patient.

Let me make it clear how fantastic this is.

Other stem cell therapies use donor cells that may be rejected or cause infections.

NurOwn uses no donor cells—only adult stem cells from the patient’s own body.

That’s a twofold benefit:

-

There’s zero risk of the cells being rejected.

-

There’s no need to treat the patient with harsh immunosuppressants to prevent rejection.

It’s a win-win. But that’s not all...

When an ALS patient receives the MSC-NTF cells, they are delivered directly to the site of the neuron damage.

There, they immediately go to work, slowing down the progression of the disease... alleviating symptoms... and potentially regenerating damaged neurons.

Source: BrainStorm Investor Presentation

Source: BrainStorm Investor Presentation

Another great thing: BrainStorm cryogenically preserves the patient’s cells, so multiple treatments can be produced from a single bone marrow sample.

And the injection of the cells doesn’t even require a hospital stay.

The results of the Phase 2 clinical trial NurOwn already went through looked great:

-

The cell transplantation was very safe and well tolerated.

-

The rate of decline in patients slowed down significantly.

-

The stabilizing effects from just one NurOwn dose lasted 2–3 months.

In Phase 3, the researchers are testing 3 doses per patient—with a break of 2 months between each dose.

As of now, most of the patients have already received all three treatments.

And after the data has been processed, we’ll get a look at the final results.

I’m confident that this will be a game-changer for hundreds of thousands of ALS victims around the world.

Hype

ALS gained attention in the public eye through Stephen Hawking...

...but also through the 2014 “ice bucket challenge,” a viral campaign to raise ALS awareness.

The race for an ALS cure is in the spotlight now.

And if NurOwn stabilizes or even restores motor function in ALS patients, the explosion of this news will be heard around the world.

The FDA thinks so too.

It has put NurOwn’s ALS trial on the fast track for a quicker review.

In February, FDA officials confirmed that the Phase 3 trial is collecting relevant data and indicated that it will put a rush on considering the “totality of the evidence.”

Cash

Cash looks very good for BrainStorm.

Its flagship therapy is such a game-changer that everyone wants it to succeed.

At the end of March, BrainStorm had $14.5 million in cash PLUS $3 million from non-dilutive grants.

In April, the Israel Innovation Authority (IIA) awarded the company another $1.5 million grant.

In Q1 of 2020, BrainStorm used about $5 million to fund its operations. The current cash levels will fund operations up to the catalyst later this year.

But it’s more flush than it appears.

There’s about $48 million available under its “at the market” (ATM) facility that allows it to issue shares to investment bank Raymond James.

But still, we decided to play it even safer for our subscribers.

So when we evaluated the stock, we assumed BrainStorm will raise enough money to fund operations up to 2022, which is when we think the company will start generating revenues.

We built in quite a bit of dilution that may never happen.

So you’ve seen how our proprietary C.A.S.H. formula works.

And when all the C.A.S.H. criteria come together perfectly—as they do in the case of BrainStorm—spectacular things can happen.

Remember I said that the FDA had some very positive things to say about the NurOwn ALS trial?

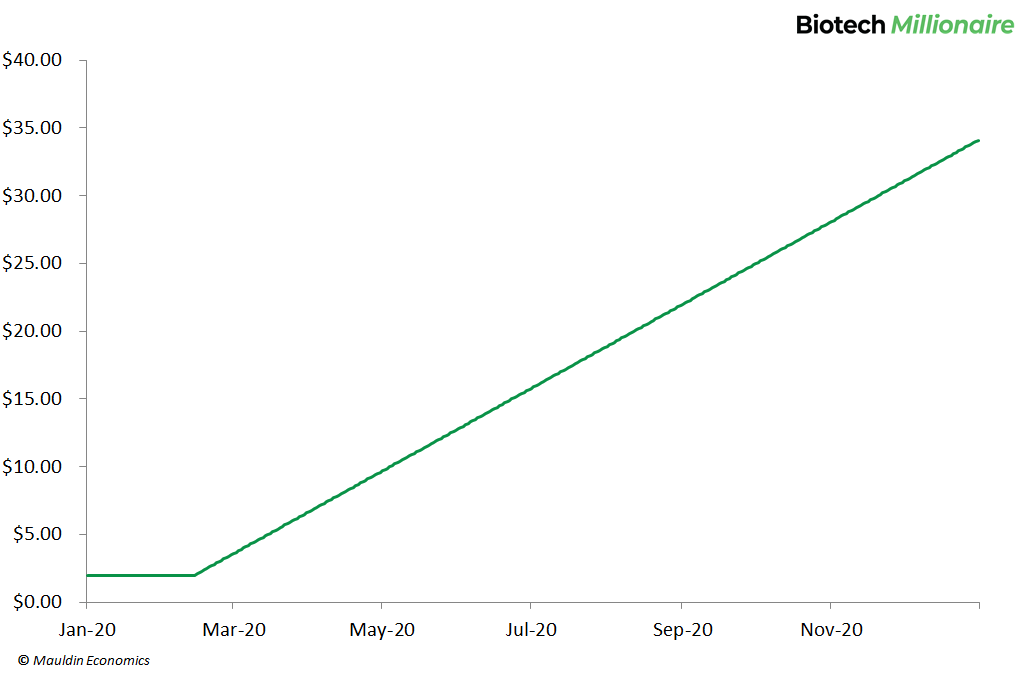

After that news broke, BCLI shares jumped 145%.

And remember, that was just the start.

In February and March, the US stock market saw a 34% correction, which took BCLI down with it and gave us more good entry opportunities.

Right now, the stock is on the move again, but there is still lots of room for growth.

In the next six months, when the data from the crucial Phase 3 ALS trial comes in...

...my analysis shows another 195% gain is possible.

And once the therapy is on the market, the sky is the limit. Even my best-case calculation of 1,000% might be too low.

But time is of the essence here.

Because the best time to buy a biotech stock is well BEFORE the catalyst hits.

For BrainStorm, that time is now.

There’s a good chance we could book some more profits before the news is even released.

And the same goes for the other “Hawking Factor” company that Jake will touch on in a minute.

But first... Jake and I recommend you buy your first tranche of BCLI now, at the market.

Then buy a second tranche with a limit order of $7 per share.

Our short-term price target for BCLI is at least $30 per share. That’s 195% above the current price.

The longer-term price target is $105 per share.

As you’ve seen, BrainStorm has tons of profit potential...

...and the other biotech company Jake will tell you about in a moment is even bigger.

We’re projecting gains of up to 1,270%.

You heard that correctly.

It sounds insane, but the potential is there.

And these are not the only stocks Jake and I are excited about right now.

The possibilities in this blistering-hot sector are endless.

That’s why we found a way to bring this crucial information to Mauldin Economics readers...

...so they too can benefit from the massive upside.

More about that in a minute.

I’ll let Jake take it from here.

Jake: Hi, Jake here. As Chris said, I just got finished vetting a small company for our biotech portfolio that looks even better than BrainStorm.

I know it’s hard to believe.

But according to my analysis, this tiny company could hand savvy investors more than 6X the returns that BrainStorm promises.

We could be looking at total gains of up to 1,270% in the next 12–18 months.

Like BrainStorm, this biotech company has a therapy so groundbreaking that it could make a vast difference in the lives of people in the US and around the world.

That's because it aids doctors in the fight against one of the world’s largest killers: stroke.

According to the CDC, acute ischemic strokes strike almost 800,000 Americans per year and kill 140,000.

There are about 15 million cases of stroke worldwide every year.

Stroke is the #1 cause of disability and the #3 cause of death worldwide.

When a stroke occurs, the blood supply to the brain gets cut off by a blood clot.

Within minutes, the blood-starved brain cells start to die...

...and if not treated quickly, this can result in paralysis and permanent disability, or even death.

So when someone has a stroke, time is of the essence.

For every minute without blood flow, 2 million brain cells die.

Unless the patient gets to a hospital within a few hours, the chances of a full recovery are slim.

You wouldn’t think this is a huge problem, because...

...there’s been extensive research into the treatment of ischemic stroke, the most common form.

There’s even a very effective drug to treat it—a potent blood thinner and clot buster that can restore blood flow to the brain and limit the damage.

The catch: Only 4% of patients ever receive the medication because...

... it MUST be given in the first few hours after they’ve experienced the stroke.

That’s where the trailblazing treatment of this tiny company comes in.

It’s not a drug in the traditional sense. It’s a stem cell therapy similar to BrainStorm’s NurOwn platform.

And here’s the kicker:

It can effectively treat patients up to 36 hours after they’ve suffered a stroke...

...which would make 90–95% of stroke patients eligible for treatment.

This is a HUGE milestone for modern medicine.

And this pioneering stroke treatment wasn’t just discovered.

We’re looking at late-stage clinical trials that are already well underway.

But this cell therapy has even more exciting applications.

Aside from stroke, one of the main killers of people worldwide...

...it has also been proven to work against COVID-19.

Let that sink in for a moment.

Don’t get me wrong: This is NOT a vaccine.

It will not prevent anyone from contracting COVID-19.

But it can treat the leading cause of death from COVID-19:

Acute respiratory distress syndrome (ARDS).

In patients with ARDS, fluid builds up in the alveoli—tiny, elastic air sacs in the lungs.

The fluid keeps their lungs from filling with enough air, which means less oxygen reaches the bloodstream.

And that deprives the organs of the oxygen they need to function.

Once ARDS develops, it becomes difficult to breathe without a ventilator.

And in up to 52% of cases, the condition ends in death.

The tiny company I’ve vetted is the only one in the world that has shown promise in the treatment of ARDS.

No wonder the FDA has granted it fast-track status for this application.

The therapy has received a “Highly Relevant” designation from the Biomedical Advanced Research and Development Authority (BARDA)...

...and the CoronaWatch Task Force.

A successful cell therapy like this would:

-

Reduce days on a ventilator

-

Days in the ICU

-

Overall days in the hospital

And it would:

-

Reduce mortality

-

Improve quality of life for the patient

Even outside of COVID-19, a therapy like this is sorely needed.

The rate of death from ARDS is high, and it affects 400,000–500,000 people per year in the US, Europe, and Japan alone.

Progress on the new treatment is looking good... clinical trials for ARDS are in an advanced stage.

But you need to understand HOW unique this earth-shaking treatment really is.

Most vaccines and antiviral treatments that are in the works to treat COVID-19 are specific to the virus.

This therapy is not.

That means we could use it to treat any future viral outbreak that causes ARDS—no matter what the virus is.

Also: This amazing “Hawking Factor” therapy can not only reduce inflammation in the lungs...

...like BrainStorm’s NurOwn, it can regenerate tissue.

Clinical evidence has already shown that these stem cells can repair damage and restore balance to the immune system of ARDS patients.

And they’re doing all of that without any major side effects.

Just like type 0 blood, these stem cells are universal, so patients need no immunosuppressants to prevent rejection.

They need no tissue matching prior to treatment.

And they need no personalized drugs.

It’s all one, off-the-shelf, generic product.

The stem cells can be taken from the hospital pharmacy and administered to the patient in less than an hour.

This is completely unheard of.

And if the next clinical trials pan out, they could catapult the stock into the stratosphere.

I’ve done a very conservative evaluation using our C.A.S.H. model...

...and I expect to see an 1,270% return for our subscribers in the next 12–18 months.

At least.

Both of the clinical trials for ARDS and stroke will be fully enrolled this year.

So the next big catalyst we’re waiting for will hit in early 2021.

Actually, two catalysts, to be precise.

And either one could lead to accelerated approval in Japan.

The current lead trial for stroke patients in the US, which is conducted on a larger scale, will bring us initial data in the second half of 2021 and final data in 2022.

You will definitely want to be invested before then!

Chris: Hi, Chris again. Thanks, Jake.

To sum things up: We have multiple irons in the fire here...

...and each of them could drive up the price of our tiny company...

...for truly spectacular gains.

Unfortunately, I can’t tell you the name of this small company right now.

That just wouldn’t be fair to our paying subscribers.

You see, the reason why I was able to talk about BrainStorm and give you the name and full details of this stock...

...is that our paid subscribers bought their first tranche and have already made some gains.

Our policy is that our paid subscribers always get first dibs on every stock we discover. Otherwise, it just wouldn’t be fair.

But I’m inviting you to get the full details in my brand-new subscribers-only Special Report, The #1 Stock to Profit from the Big Biotech Boom.

This report usually sells for $495, but today we want you to have it for FREE.

My writeup in this one-of-a-kind report only for subscribers gives you all the specifics you need to know to confidently invest in this company...

...for gains of up to 1,270% over the next 12–18 months.

You won’t have to wait years to cash in...

...and if you have lost money in the crazy stock market swings of the past months...

...this could be the way to recoup some of your losses.

With just one stock pick.

(Or two, when you count the fabulous BrainStorm pick that Jake just told you about.)

You can get our brand-new Special Report The #1 Stock to Profit from the Big Biotech Boom... valued at $495, at no cost to you... with our complete analysis of the company, plus the name, ticker symbol, our Buy instructions, and our target price.

...when you sign up as a charter member of our brand-new premium alert service...

...that was created for investors just like you.

Jake and I are inviting you to try Biotech Millionaire risk-free for 30 days at our very special charter member price. PLUS, the potential gains from this one stock could more than pay for the cost of your subscription.

And as a charter member, you will get our ongoing guidance on these two blockbuster stocks—as well as new, exciting stock picks every single month.

Now, granted, Biotech Millionaire is not a cheap service. And that’s intentional.

This is a premium alert service best suited for a certain type of person.

Namely, a serious investor who wants to make outsized gains from the red-hot biotech sector.

That’s why normally, we’ll be charging $3,495 for a one-year subscription to Biotech Millionaire.

And considering the gains we are hunting for, it is worth potentially way, way more than that.

But as a charter member, for a very limited time...

...you’ll get your one-year subscription at the lowest price we will ever offer.

This premium alert service combines a monthly newsletter, weekly updates, and timely trade alerts...

... and I want you to get as much value as possible when you say “yes” to Biotech Millionaire today.

Earn up to 1,270% with the

Hawking Factor!

And save 49% on your Biotech Millionaire Charter Subscription!

So I talked this over with Jake and the Mauldin Economics management, and we decided that...

...for just a few days, we are offering you this money-making service at the deeply discounted charter member price of just $1,795.

That’s a full 49% off the list price... and a savings of $1,700.

And that’s not all.

We want you to have the full package—everything that Jake and I publish.

So on top of becoming a charter member of Biotech Millionaire at a 49% discount...

...you’ll also get a FREE subscription to our popular healthcare investment service, Healthy Returns.

Even if you’re a Healthy Returns subscriber already...

...with your charter member subscription, you’ll get it free, for as long as you’re a Biotech Millionaire subscriber...

...at absolutely no additional charge.

This subscription to Healthy Returns alone is a $199 value, each and every year that you are a Biotech Millionaire subscriber.

And there’s no risk in giving it a try.

You get to test-drive Biotech Millionaire for 30 days.

If you’re not satisfied—for whatever reason—you can simply cancel within those 30 days and get ALL of your money back.

No questions asked, no strings attached.

If you decide to stay on, your deep-discount subscription fee will be locked in for as long as you’re a subscriber.

But even if you decide to cancel within those 30 days, you get to keep everything you’ve received from us.

That includes all your newsletter issues, updates, and trade alerts...

...and it includes our just-published Special Report on the company that works on beating stroke and ARDS and is on the verge of skyrocketing.

It’s all yours, no matter what you decide...

...all just for trying Biotech Millionaire risk-free today.

So let me quickly recap what you’re getting when you accept my invitation to try Biotech Millionaire today for just $1,795:

-

My fresh-off-the-press, detailed Special Report, The #1 Stock to Profit from the Big Biotech Boom (a $495 value)—with the name, ticker, Buy instructions, and target price of the company that could make you up to 1,270% over the next 12–18 months

-

Ongoing expert guidance on that company, on BrainStorm (BCLI), and on the other winning companies in our Biotech Millionaire portfolio

-

12 months of uninterrupted coverage of the red-hot biotech market

-

One new money-making stock recommendation each month PLUS a monthly review of our complete portfolio

-

Weekly updates on portfolio companies and new developments in the sector

-

Timely trade alerts telling you to sell or take profits if fast-moving events require fast action

-

Access to all special reports and archived issues for as long as you remain a subscriber

PLUS:

-

A FREE subscription to Healthy Returns (a $199 value, PER YEAR)

In total, that is a value of $2,394 in discounts and free research!

Just remember, this one-time charter member offer only stands for a few days.

This is the lowest price we will ever sell Biotech Millionaire at.

I’d love to see you become a founding member of one of Mauldin Economics’ most exclusive services.

But you’ll need to hurry and act before July 16, 2020.

Another reason why time is of the essence is because both of the stocks I’ve been telling you about will make big gains well before the next catalysts happen.

You don’t want to miss that sweet spot.

So I urge you to give Biotech Millionaire

a try right now.

With our iron-clad 30-day, 100% money-back guarantee, you literally have nothing to lose, but an awful lot to gain.