Looking at the Middle Kingdom with Fresh Eyes

-

John Mauldin

John Mauldin

- |

- May 31, 2014

- |

- Comments

- |

- View PDF

More Questions Than Answers

Read the Tea Leaves Carefully & Expect Miscues

Pulling Back the Bamboo Curtain

China Beige Book, Regional Overview

China Beige Book, Research Highlights

Growth Is Slowing But Not Collapsing (So Far…)

Trequanda, Nantucket, New York, and Maine

I am writing this introductory note from London during a layover on my way to Rome, and I’ll append a personal ending tonight after I finally make my way back from dinner to the hotel.

One of the few consensus ideas that I took away from the Strategic Investment Conference is that China has the potential to become a real problem. It seemed to me that almost everyone who addressed the topic was either seriously alarmed at the extent of China’s troubles or merely very worried. Perhaps it was the particular group of speakers we had, but no one was sanguine. If you recall, a few weeks back I introduced my young colleague and protégé Worth Wray to you; and his inaugural Thoughts from the Frontline focused on China, a topic on which he is well-versed, having lived and studied there. Our conversations often center on China and emerging markets (and we tend to talk and write to each other a lot). While I’m on the road, Worth is once again visiting China in this week’s letter, summing up our research and contributing his own unique style and passion. I think regular TFTF readers are going to enjoy Worth’s occasional missives and will want to see more of them over time. Now, let’s turn it over to my able young Cajun friend.

Editors’ note: With John up to his eyeballs in prosecco and peaches there on the patio in Trequanda this morning and with Worth just getting the sleep out of his eyes in Houston, we are hereby making an executive decision to split this 22-page beast masterpiece right up its middle and bring you the second half next week … which will give both these guys some well-earned rest! – Charley & Lisa Sweet

Looking at the Middle Kingdom with Fresh Eyes

By Worth Wray (Houston, TX)

In my Thoughts from the Frontline debut this past March (“China’s Minsky Moment?”), I highlighted the massive bubble in Chinese private-sector debt and explored the near-term prospects for either (1) a reform-induced slowdown or (2) a crisis-induced recession. Unfortunately, it was not an easy or straightforward analysis, considering the glaring inconsistencies between “official” state-compiled data and more concrete measures of real economic activity.

More Questions Than Answers

Although John and I spend hours every week searching for the truth in a murky stream of official and unofficial reports, we always reach the same conclusion about the People’s Republic: There is really no way to know what is happening in China today, much less what will happen tomorrow, based on widely available data. The primary data is flawed at best and manipulated at worst. Sometimes the most revealing insights lie in the disagreement between the official and unofficial reports… suggesting that official data is useful only to the extent that we think about it as state-sanctioned propaganda. In other words, it tells us what Chinese policymakers want the world to believe.

This shortfall in credible and actionable data from one of the global economy’s largest and most interconnected members leaves us with more questions than answers – especially in the presence of a massive Chinese credit bubble, with clear signs of overinvestment and unsustainably high debt-service ratios. These are troubling signs for all investors, in every asset class, everywhere in the world today… and everyone should be paying close attention.

(I should note that John has access to a massive amount of research from a very wide variety of both traditional and nontraditional sources… and I say that after having extraordinary access myself as the portfolio strategist for an $18B Texas money manager. I am seeing and reading things every day that I could only imagine before, and the information flow is addictive. John’s sources give us a big, if sometimes overwhelming, head start on thinking through all the implications for investing around the constant collisions of macroeconomic forces. While we legally and ethically cannot share some of the best research we see, we can share a lot of the core ideas and do our best to give you a head start, too. That’s what this letter is about.)

Read the Tea Leaves Carefully & Expect Miscues

Most China economists – who do the best they can to read the economic tea leaves by focusing on a handful of economic indicators ranging from gross domestic product (GDP), purchasing managers’ indices (PMI), consumer/producer inflation (CPI/PPI), total social finance, and industrial production – end up expressing a rather bipolar view on Chinese economic activity, with wild swings in their outlooks from quarter to quarter. On this front, I was particularly impressed by an explosive letter (viewable by Over My Shoulder subscribers only) from our friends at Political Alpha, which remains one of the elite political intelligence/analysis firms on the Street. While China watchers tend to trade reactively around official and unofficial manufacturing PMI releases as monthly proxies for the broader economy, very few investors realize that “not only is manufacturing no longer the bellwether of the [Chinese] economy, more often than not it now performs counter-cyclically.”

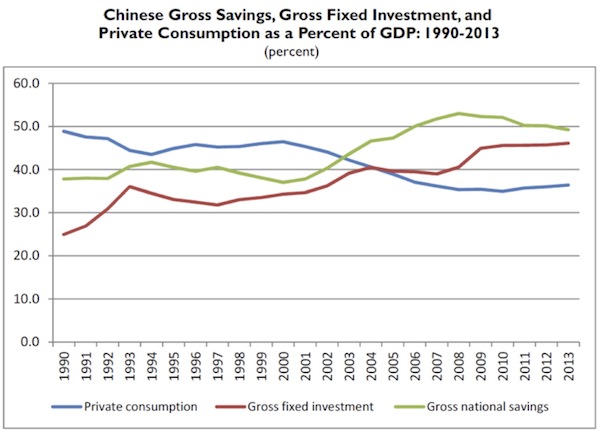

Although China is the world’s largest producer of value-added manufactured goods, it has not been an export-led economy for a very long time. As I detailed in last month’s letter, China’s growth has largely relied on extraordinarily high levels of fixed investment, supported by even higher levels of domestic savings and an unsustainable rise in private-sector credit.

Source: Wayne M. Morrison, China’s Economic Rise: History, Trends, Challenges, & Implications for the United States. Congressional Research Service, February 3, 2014

Even so, industry experts often fall into the trap of extrapolating flash manufacturing readings into forecasts for the broader economy.

Our friends at Political Alpha describe one such situation where HSBC’s China team (which puts out the unofficial monthly PMI each month in partnership with MarkIt) “was forced to backpedal from its September 23rd announcement that the flash PMI data was ‘further evidence [of] China’s ongoing growth rebound’ to a much more somber conclusion just seven days later: ‘There are still a lot of structural headwinds ahead. This is as good as it gets for the time being…. [D]on’t expect too sharp an acceleration from here.’”

Feel free to compare the clips yourself:

- HSBC release on 9/23: http://www.cnbc.com/id/101053388

- HSBC release on 9/29: http://www.cnbc.com/id/101071631

On a side note, I don’t mean to disparage the China research team at HSBC or question their competency by reprinting the comments above. I’m sure they get up each morning (just like I do) with a genuine intent to understand changing economic conditions as best they can and to help their clients protect and grow their savings. If anything, this example is a broader indictment of investors’ widespread reliance on a handful of flawed or misunderstood data points in the absence of credible Chinese economic data.

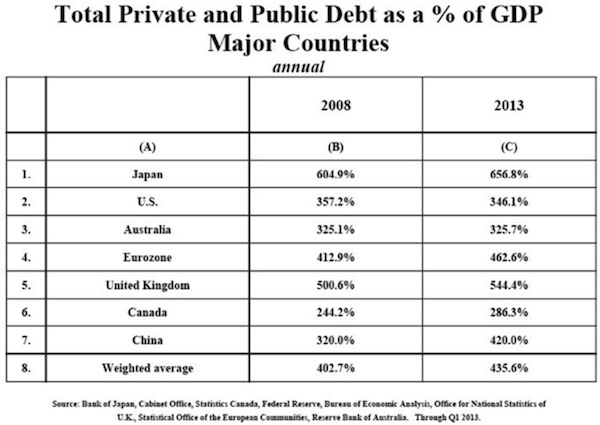

I don’t mean to be cute or coy on this issue. The lack of transparency of the Chinese economy is not just a problem for individual and institutional investors who make the choice every day to put their money at risk; it also carries enormous policy implications for central bankers and elected politicians in a highly unstable global system where total debt-to-GDP has risen across the world’s major economies by nearly 35% since 2008… and continues to rise.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Source: Hoisington Investment Management Company, May 2014

As you can see in the table above (which Dr. Lacy Hunt was kind enough to share with us at this year’s Strategic Investment Conference), China has seen its total debt-to-income ratio jump by more than 100% (another full turn of GDP) in the last five years… more debt growth than any other major economy on the planet, including Japan.

Pulling Back the Bamboo Curtain

Fortunately, my last letter on China’s debt build-up sparked a flurry of introductions and fresh conversations with investors, economists, and policymakers from around the world – in places like London, Spain, South Africa, Singapore, Dubai, Australia, Hong Kong, and Finland. Of course, John has also eagerly introduced me to many of his close friends (who happen to be serious A-list economists and money managers)… so needless to say, it has been an incredibly fun and enlightening couple of months.

But John introduced me to one man, in particular, who was able to pull back the curtain on the Chinese economy in a way I had not imagined… and it feels like I am looking at the Middle Kingdom with fresh eyes.

Meet Leland Miller, President of China Beige Book International. Along with Dr. Craig Charney, who oversees the firm’s vast research efforts, Leland spearheads the effort to supply the world’s elite institutions (from central banks and heads of state to multinationals, mega-banks, and hedge funds) with a comprehensive look into China’s economy, by applying the same survey methodology employed by each of the regional US Federal Reserve Banks in preparing their submissions for the national Beige Book.

Aside from the fact that Leland is an Oxford-educated China historian, a brilliant economist, and a genuinely nice guy, what first caught my attention was his remarkable track record of contrarian calls since the inaugural issue of the China Beige Book in Q1 2012… from the initial slowdown; to unexpected bounces in economic activity; and even the June 2013 cash crunch where interbank interest rates spiked dramatically in a matter of weeks, signaling that a wave of defaults was on the way. (I should note that John has sat on China Beige Book International’s advisory board and has worked closely with Leland for most of the firm’s history.)

Before we proceed, here is a short but important description of the history and methodology behind the China Beige Book. Although survey data has its limits in any economy, this is as good as it gets for a semi-closed economy like China’s.

Beginning in early 2010, our team set out to craft a Chinese analogue of the US Federal Reserve’s Beige Book. Over the next twelve months, we conducted a study of the Beige Book and the methods used to prepare it, including contact with officials at each of the regional Federal Reserve Banks involved in its preparation. We then worked to develop a method that would be similar, but more comprehensive and systematic, in its approach to the world’s second largest economy – a Beige Book “with Chinese characteristics.”

Our approach triangulates three methods, repeated every quarter: a quantitative survey of over 2,000 leading firms from key sectors across the country; qualitative one-on-one in-depth discussions with C-Suite executives in the same industries across every region; and a separate, targeted banker survey of loan officers and branch managers, designed to home in on the complexities of both the official and shadow economies. With the data from this approach, we are able to compare regions and industries within a quarter, as well as track changes over time, both in near and real time.

The result of these efforts is the largest and most comprehensive survey series ever conducted on a closed or semi-closed economy…

I cannot share the report in its entirety or reveal too much of its contents, but Leland did give me permission to share part of the regional overviews and research highlights from the Q1 2014 report. If you are able and willing to pay the six-figure annual subscription fee, Leland’s work will blow your mind and dramatically change your perspective. For the rest of us, the following excerpt can at least point us in the right direction… and I am discovering that Leland’s media interviews and tweets (@ChinaBeigeBook) are quite telling, as well. (You can also follow John and me on Twitter at @JohnFMauldin and @WorthWray, respectively.)

China Beige Book, Regional Overview (Excerpts from the Q1 2014 report)

China Beige Book regions (listed below

Region 1: Shanghai, Jiangsu, Zhejiang

Growth slowed – retail & real estate gains weakening sharply – despite stability in manufacturing and pickups in services, transport, and agriculture. Borrowing was stable with rates down at banks and up at non-bank lenders. Hiring slowed, as did margin growth. On-quarter weakness was modest, but the on-year drop was worrisome.

Region 2: Guangdong, Fujian

Despite the national slowdown, Guangdong’s pickup continued, driven by manufacturing and transport. Growth was steady in retail, off in services and property. Wage growth remained high but costs inflation eased, boosting margins. Borrowing ticked up, with bank rates steady and shadow rates up. The export power-house found an encouraging second wind.

Region 3: Beijing, Tianjin, Shandong, Hebei

The capital region saw Q1’s worst results, due to trouble in services and manufacturing. Property and mining were stable, retail slightly better. Margin growth suffered. Borrowing was stable and moved to banks, on the country’s lowest interest rates. Beijing is leading the national economic slowdown.

Region 4: Heilongjiang, Jilin, Liaoning

The Northeast slowed as mining contracted and manufacturing, property, and farming growth eased. Services was stable and retail saw a pick-up. Hiring and wages strengthened, while pricing weakened, pressuring margins. Borrowing ticked up, rates easing. Rebalancing does not look easy in this old industrial region.

Region 5: Hubei, Henan, Chongqing, Sichuan, Anhui, Jiangxi

Growth slowed sharply, slipping in retail, services, property, farming, and mining, with only manufacturing stable. Hiring was steady but input costs grew faster, narrowing margin gains. Borrowing slid again, with lower interest rates in both formal and shadow finance – not an encouraging trend.

Region 6: Shaanxi, Shanxi, Inner Mongolia, Ningxia

Growth took a hit, gains slowing in this crucial mining sector. Manufacturing, real estate and, especially, retail weakened. Services and transport were the bright spots. Hiring and margin growth both eased. Borrowing was flat as rates went up. The North remains dependent on struggling mining.

Region 7: Guizhou, Guangxi, Yunnan, Hainan, Hunan

Again out of sync with the rest of China, the Southwest sped up. Manufacturing, transport, and mining improved, but retail, services, and real estate saw growth slow. Hiring and input costs picked up, but so did pricing and margins. Borrowing ticked up, as shadow lenders’ rates moved back above banks’ rates.

Region 8: Xinjiang, Tibet, Gansu, Qinghai

The West again boasted China’s best overall growth, though manufacturing, retail, and services slowed. Only property picked up, with mining and transport stable. Hiring and input cost growth were steady, but pricing and margin growth eased. Borrowing remained China’s least frequent as rates jumped.

China Beige Book, Research Highlights (Excerpts from the Q1 2014 report)

Manufacturing is fine, yet the economy is not

The pace of Chinese economic expansion has painfully slowed. Revenue, sales, profit, and wage growth are all weaker than a year ago. The slowdown is particularly steep in the North [region 6] and Northeast [region 4] and also pronounced in Beijing [region 3] and Central China (region 5).

By sector, stable first-quarter growth in manufacturing confirms our long-standing thesis that it is no longer the economy’s bellwether...

A bounce-back later this year is possible

The worst performer according to CBB figures, both on-quarter and on-year, is real estate and construction. While property companies are getting crushed, the sector is also notoriously unstable for both structural and political reasons. It would be no surprise if real estate were to rally before the end of the year.

More immediate reason for optimism: Growth in new domestic orders was solid (save in the Northeast), and domestic orders and export orders were both stronger in powerhouse Guangdong. The results do not indicate a boom later in 2014, but they do suggest that linear forecasts of continued deterioration are overly simplistic.

Financial segmentation is profound

The ongoing debates about monetary policy assume that anticipated loosening or tightening applies across the spectrum of borrowers. CBB data say otherwise, and in multiple ways. First, while the number of firms reporting that they borrowed stabilized in Q1, it did so at a very low level. Shoving more liquidity at the credit market will have limited effects until participation expands. This includes RRR cuts – though of course these may occur for political reasons.

Second, shadow finance may be revving up for a comeback. CBB numbers show a recovery in the sales of wealth management products (WMPs), likely due to competition from online banking. This is cash leaving the traditional banking sector and, while non-bank lending did not pick up in the first quarter, the groundwork is being laid for it to do so.

Online banking may be encouraging riskier behavior

Online lenders are typically viewed as a force for liberalization, as well as a potentially healthier alternative to unregulated shadow finance. Yet our data show their proliferation would impart significant costs as well…

What appears to be happening is the higher returns available in online banking are forcing banks to move more transactions off-balance sheet, in order to avoid the interest rate cap. While this may accommodate policy goals in the short term, an uptick in off-balance sheet funding portends more shadow bank lending down the line.

Interest rate spread between banks & shadow banks highest in a year

Bank loan rates and bond yields eased slightly this quarter, but the cost of capital increased again for those borrowing from non-bank lenders. While the shifts were not dramatic, the spread between bank and non-bank loan rates nationwide is now the largest since Q1 2013. This highlights the still more challenging road for those firms, principally domestic private entities that are pushed outside formal lending channels.

Growth Is Slowing But Not Collapsing (So Far…)

After reading through the latest report, consulting with friends who are also familiar with the research, and bombarding Leland with a never-ending stream of questions for the last month, John and I still cannot claim to have enough information to make a directional call on the world’s most powerful (and least understood) macro force… but we know more about the inner workings of China’s economy than we did when we wrote to you a couple of months ago.

Great data often has that effect – it’s like shining a light into the shadows (including China’s shadow banks). We can see the nuanced regional contrast in economic activity, the modest (but still insufficient) rebalancing between sectors, and pressure points in the credit markets that suggest last summer’s interbank volatility may return in 2014.

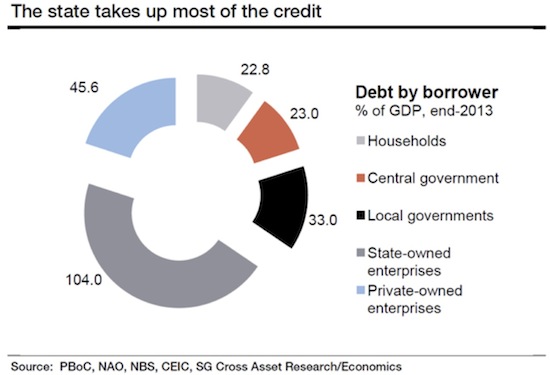

We also see a far more mixed picture of economic activity than a lot of the widely followed headline data suggests. The overall pace of Chinese economic growth is clearly slowing but not collapsing. The credit transmission mechanism is obviously broken, as you can see in the chart below (with government and government-sponsored borrowers in zombie industries consuming the majority of the country’s credit… in turn forcing households to borrow through shadow banks at massive risk premiums); but so far, the credit bubble is not imploding.

On that note, China Beige Book International is the only independent research firm in the world that tracks the non-bank (shadow) lending rates not just nationally, or by region, but for every sector in every region over time. Leland and his team have essentially solved the most difficult China puzzle of all: what is true cost of capital in the Chinese economy, and who is able to actually access it?

Source: Wei Yao, “China: A whiff of debt deflation.” Societe Generale Research, May 9, 2014

Of course – and Leland was emphatic on this point – China’s greatest challenge will lie in deleveraging the economy while also rebalancing toward a consumption-driven growth model for the first time in modern history. That cannot happen as long as households remain repressed by unequal access to credit markets or intentionally suppressed exchange rates, which essentially represent a transfer of household wealth from workers to state-favored firms. But reforming the system will require a greater slowdown than China’s policymakers are letting on. And, Leland warns, Beijing runs the risk of blowing its credibility and instigating capital flight if the divergence between official forecasts and China’s actual economic experience grows too large.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

To be continued next week

Trequanda, Nantucket, New York, and Maine

It is very early Saturday morning here in Rome (still late Friday night in the US) as I finish this letter, or at least my part of it. Worth is still up and reworking this piece (I really can’t keep up with him); then the editors, Charley and Lisa Sweet, will do their final runs; and then a whole team will make sure you get your letter. A far cry from the early days when your humble analyst did everything. And the mistakes I made showed up in print far more often. I am grateful to have a whole group of dedicated people working to keep the machine humming.

In a few hours I will meet George Gilder at the train station. I will buy a few local phones (I already have local sim cards for the iPads from the airport yesterday), find some cash, and have lunch before we hop the train to Chiusi with my daughter Melissa and some friends and then meet Tiffani and Lively, who are already there with the cars. We’ll drive to Sinalunga to shop for groceries and other stuff for the week before going the last short leg to Trequanda.

Other guests will come and go over the next few weeks, using the villa as a base to explore the Tuscan region; but I will probably stay “home,” reading and thinking and working out, doing some preliminary writing on my next book, and trying to take the speed of life down a gear or two. Vacation for me is being in the same place for an extended period. And getting to talk with Gilder in the evenings about our books is such a treat. He is one of the finest philosophical/sociological/economic/technological minds in the world (in my opinion), and having him to talk with in the evening will help me lay the proper intellectual framework for my book, though I have to work on not distracting him too much.

Last night I had dinner arranged here in Rome with my friend Steve Cucchiaro, his daughter (who was celebrating her birthday), and his son. My group was running late, even though our driver from the airport was driving like we were in a Formula One race. That is typical, but it was not long before we realized he was also drunk and half mad, talking and gesturing to himself the entire time. Obviously, we survived. When we got to our hotel, I was busy getting people to get ready ASAP so we would not be too late. I asked the concierge for directions, and he gave them to me but then said, “Signor Mauldin, you cannot wear that to the Imago restaurant. It is a very nice place.” I pointed out that I had not brought a tie, and he offered me one. So I went to the room and called Steve to tell him we would be a little late. He said jackets were required but no ties.

It turned out he had booked one of the finest places in Rome and got the corner window table overlooking the Spanish Steps and St. Peter’s, with a spectacular sunset/nighttime view. Another special night for the memory book.

It is time to hit the send button, as trains will not wait. I will report from Tuscany next week, by which time Worth and I should have China all figured out – not! But we’ll keep after it. Also, I hope to summarize the speech I did in San Diego. Until then have a great week!

Your thinking I need to get to China analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin