Controlling the Curve

-

John Mauldin

John Mauldin

- |

- February 5, 2021

- |

- Comments

- |

- View PDF

Brief Update on the COVID-19 Gripping Hand

Blunt Instruments

Zero Bound

“A Nasty Repricing Event”

White Papers, Where Do You Hide, and Finding Income

If time is money, then interest rates are the price of time. The most important interest rates in the world are for US Treasury securities. This is why I’ve long said it makes no sense for a committee to set those rates. The markets could do just fine without that help, thank you. But the Federal Reserve’s Open Market Committee arbitrarily decides the overnight Federal Funds rate. And lately, it doesn’t stop there.

Like the proverbial frog in a boiling pot, we are slowly being conditioned to accept this as normal. The warm water feels good at first. We think we can hop out in time. It’s not clear we can. And it’s not just the Fed. Central banks all over the world are turning the heat up on the various currency pots.

Today I want to discuss an arcane-sounding but incredibly important term you need to know: Yield Curve Control. Several central banks are already using it and I see a strong possibility the Fed will join them. But first we must again consider the Gripping Hand.

Brief Update on the COVID-19 Gripping Hand

Currently, we see good news. Cases, hospitalizations, and deaths are falling across the developed world, with a few exceptions. This is partially because a large number of people have already had the virus (usually mild cases), we are vaccinating the most vulnerable people at a better rate, and we are continuing to social distance and use masks.

I am sure that everybody wants this trend to continue. However, it is too early to give the all-clear signal, as the UK variant (B117) has spread throughout the United States and much of the developed world. It is a race between vaccine-induced herd immunity and the growing rate of B117 infections. The South African and Brazilian variants are in the US, but in smaller numbers (so far).

The bad news is that Israel and some other countries that have been extraordinarily successful in vaccinating their people are still seeing significant outbreaks. From what I’ve read, we should know in the next few weeks if we will face another round of outbreaks. So the best advice is get your vaccine, continue to social distance and stay safe, and hope for the best.

Now on to yield curve control.

Blunt Instruments

The Federal Reserve System has two mandates from Congress: maximum employment and price stability. It has rarely achieved both at once and certainly isn’t doing so now.

(Quick note on jobs: Interest rates are not the appropriate tool for promoting employment. Fiscal policy is. Today’s jobs report was ugly. Most of the very mild growth came in public education, with just 6,000 jobs in the private sector. Another 406,000 people dropped out of the labor force, keeping the unemployment rate artificially low. The broader U-6 rate is over 11%, which is more real-world. Low interest rates aren’t helping businesses hire employees. The Fed really can’t help boost employment. Preaching over.)

However, these twin goals are vague enough to let the Fed’s board and staff think they’re succeeding at times. This is the source of many problems. Thinking you are in control of something when you are actually not can be quite dangerous.

For such a powerful institution, the Fed is still surprisingly limited. It can’t force banks to lend, nor can it force people or businesses to borrow. It can highly encourage these things, though, and has many ways to do so. Most of them involve short-term liquidity and interest rates—the so-called “short end” of the yield curve.

What is the yield curve, you may ask? It’s simply a chart of how interest rates rise or fall by the loan’s length, or maturity. A “normal” yield curve looks something like this:

Source: Investopedia

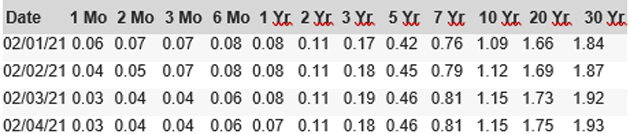

To put some numbers to this, here are the actual yields for the last four days (through Thursday) for the various Treasury maturities. Note that interest rates out to two years are only 11 basis points or less. The curve doesn’t “steepen,” if we can call it that, until after the five-year point.

Source: GuruFocus

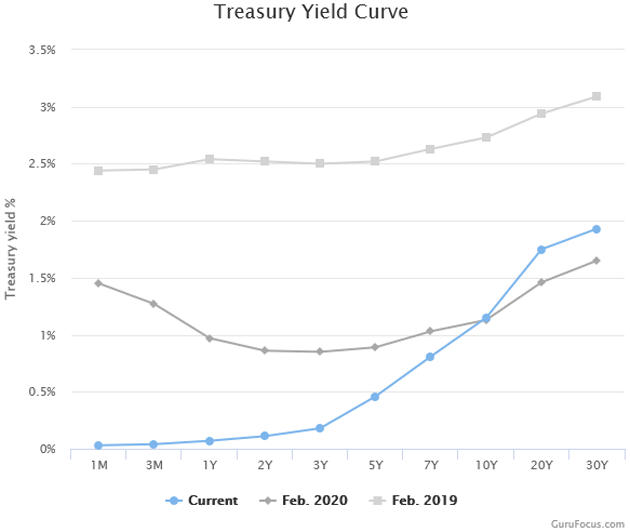

This is the actual graph of the above data from Thursday from gurufocus.com. The 10-year yield is now at 1.18% as of Friday morning.

Source: GuruFocus

The key point to notice is that above the 10-year point, today’s yields exceed those of February 2020, one year ago. That means the Fed may be losing control of the longer end of the yield curve. Investors in long-term bonds are losing money because as yields rise the value of the bonds falls. Those who bought TLT, the 20+-year iShares Treasury ETF, are now down more than 5% for the year.

Going back to the basics, interest rates typically rise with maturity because longer terms mean more risk for the lender. The Fed has little control over those factors, but it can anchor the left (short-term) end of that curve wherever it wants. The rest of the curve will then respond, getting flatter, steeper, or assuming other shapes. It can even invert, and frequently does so just ahead of recessions.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Since the Fed’s tools work mostly on the short end of the yield curve, it has limited ability to influence long-term interest rates. Quantitative easing is one way around this limitation. In QE, the Fed uses excess bank reserves (and there are a lot of them) to buy long-term Treasury and agency securities. This applies downward pressure on those points of the yield curve. Stopping those purchases or liquidating its holdings pushes that part of the curve back up.

QE is useful but cumbersome. Moreover, market forces can reduce its effectiveness. The Fed is a big buyer but it’s not the only buyer. A more direct method is outright “yield curve control” or YCC. I am beginning to hear this term from people I consider very knowledgeable. They are generally not happy with the prospect. My suggestion is you get used to the possibility because it will affect the way your bond investing works... and not in a good way.

Under YCC, the Fed would announce it wants, say, the 10-year Treasury yield (or some other target) to be x% and then use its unlimited buying power to purchase as many bonds as necessary to achieve this. In theory, the knowledge the Fed will do this would prevent others from demanding higher yields, and the Fed wouldn’t actually have to do much. The threat alone would achieve the goal.

This isn’t a new idea. The Fed actually employed YCC during World War II. But it has consequences that aren’t always predictable and may not be good. We can get an idea by looking at other central banks who are already doing it.

Zero Bound

I noted above the Fed’s vague dual mandate. One example is the way Fed officials interpret “price stability” to mean “2% inflation target.” That’s not stability. Indeed, it is the opposite of stability. But in their twisted thinking, a little inflation helps.

(And now, they have twisted their thinking further to make 2% average inflation the target. So let’s say that inflation rates for a period of time were about 1.5%, which is more or less what we’ve had for the last few years, so they would be willing to tolerate a 3% inflation rate for a year so they can get a 2% average over whatever period of time they wish, without telling us what that period of time is. It goes without saying that if a 2% inflation rate is not price stability, then there is no way in hell you could consider 3% inflation “stable.”)

But generating inflation isn’t necessarily easy. Japan is the prime modern-day example. Inflation there plunged after its economic bubble collapsed in the early 1990s. The Bank of Japan responded by dropping interest rates toward zero, with little effect. Within a few years the country was in outright deflation. That made it all but impossible for the BOJ to push real interest rates any lower. Over the next decade or so they pulled out every tool in the toolbox and invented a few new ones. None of them helped much, except maybe in preventing an even worse collapse.

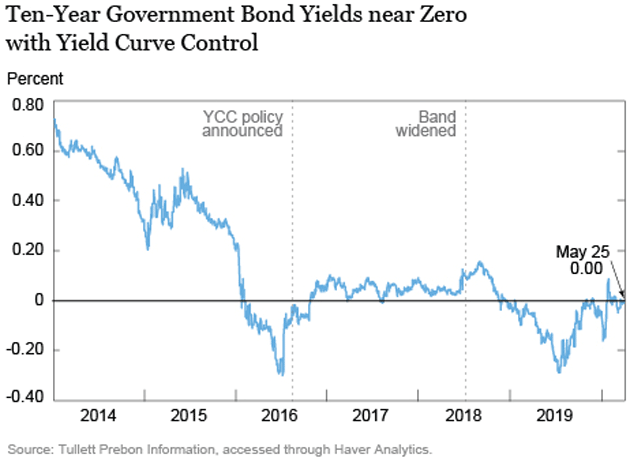

In 2016 the BOJ added YCC to its ongoing QE and other programs. Ten-year Japanese Government Bond yields were fixed in a narrow band around 0%. The BOJ said it would buy JGB securities in whatever amount necessary to maintain that band.

Source: New York Federal Reserve Bank

You can see the targeted JGB yield stayed at zero (± about 20 basis points) once the YCC policy took hold. It’s still there now, and the BOJ hasn’t had to enforce this policy because traders haven’t seriously challenged it. Could they? Maybe, but the BOJ is now buying practically every bond the Japanese government issues. And they issue a lot of them. What used to be one of the most liquid markets in the world is now moribund. If the Bank of Japan doesn’t show up to the bond market, there is no trading. There are days when the Japanese government bond markets literally have no trades. This is truly a world gone mad.

Nevertheless, the pandemic inspired other central banks to consider Japan’s methods. In March 2020, the Reserve Bank of Australia set a 0.25% “target” for 3-year Australian Government Bonds, later lowering it to 0.1%. This is another form of YCC. And now the European Central Bank is doing something similar, though with different mechanics.

The goal in all these cases isn’t so much to generate inflation, but to prevent or at least minimize deflation. Generating growth is hard when prices are falling because buyers are being rewarded to wait. Fear of the virus and government responses to it are profoundly deflationary.

“A Nasty Repricing Event”

YCC has another feature, though, one that makes it attractive to fiscal policymakers as well as central bankers. Government spending, and debt issuance to finance it, rise even in normal recessions. This one has put it on steroids in many countries. That’s a lot easier to manage if your central bank is pledging to buy all the bonds you issue at very attractive rates. Since many of the bonds are already at negative rates (which, if you are government, has to be considered attractive), there is very little if any financial constraint on government spending.

(Sidebar: Italy is on like it’s 29th different government over the last 40 years, and it looks like “Whatever It Takes” Super Mario Draghi will become the next prime minister. My bet is that he can talk his old friend Christine Lagarde into buying more Italian bonds at ridiculous prices. Europe is indeed the land of Yield Curve Control.)

This week the Congressional Budget Office updated its economic projections. Their scenarios are always a bit rosy but this one was even more so. They are basically saying the pandemic is over, at least economically. From their summary:

Over the course of the coming year, vaccination is expected to greatly reduce the number of new cases of COVID-19, the disease caused by the coronavirus. As a result, the extent of social distancing is expected to decline. In its new economic forecast, which covers the period from 2021 to 2031, the Congressional Budget Office therefore projects that the economic expansion that began in mid-2020 will continue. Specifically, real (inflation-adjusted) gross domestic product (GDP) is projected to return to its pre-pandemic level in mid-2021 and to surpass its potential (that is, its maximum sustainable) level in early 2025. In CBO’s projections, the unemployment rate gradually declines through 2026, and the number of people employed returns to its pre-pandemic level in 2024.

They are also predicting large deficits for 2021.

I sincerely hope this GDP projection is right. Nothing would thrill me more than for vaccinations to bring COVID-19 cases down from crisis to nuisance level by the end of this year. I think this is possible, but not probable. We have way too many unanswered questions about how well the vaccines work and what impact the variants will have. We’ll learn more over the coming weeks and months, but we just don’t know yet.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

But set that aside for a minute. The US economy and the federal budget didn’t look great even before COVID-19 came along. Excess debt, which is mostly the result of monetary policy, has capped economic growth while demographics and entitlement spending have the budget on an unsustainable path.

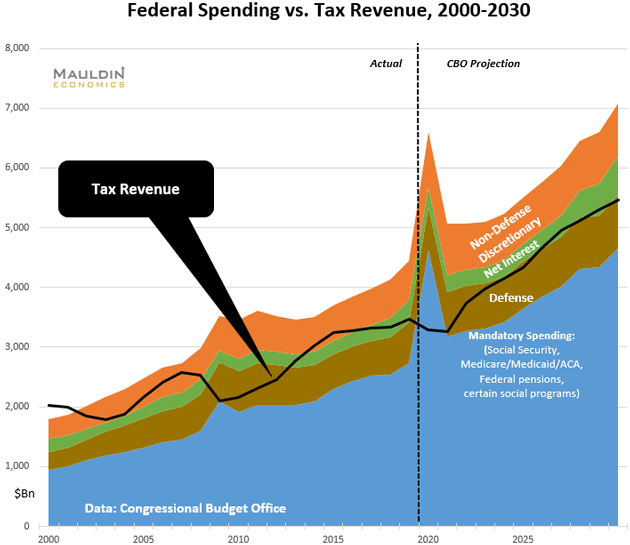

Here again is the chart I occasionally share of CBO’s tax and spending projections. There is no good way out of this.

As I have noted with chagrin, even Republicans are no longer fiscally conservative. They wouldn’t have cut spending to any meaningful degree if they were now in control, and might have increased it. As it is, Democrats control the White House and (tenuously) Congress, and they would raise spending even without the pandemic. Now they will raise it even more.

I think it is highly likely that President Biden gets at least $1 trillion or more for his COVID-19 relief package. Further, I think there may be some real bipartisan support for a $1 trillion infrastructure program, which we actually need. I would go further and create a new federal “infrastructure bank” that would issue GNMA-like bonds to finance revenue-generating infrastructure programs like electricity and water which can generate their own repayment plans. Then use the federal government infrastructure program for things that don’t have income tied to them like bridges and roads. It would double our bang for the buck and upgrade our woefully inferior infrastructure.

But I digress. In any scenario, Treasury issuance is going to grow considerably in the 2020s. We are already at a $2 trillion deficit without any pandemic relief or infrastructure spending. Who will buy that debt? Or, more to the point, how high will long-term yields need to go to draw out enough buyers? Anything above 2% or so would raise debt service costs to problematic levels. But that would likely happen if the virus fades and we get the kind of snap-back recovery CBO expects. (Count me dubious. I think the massive debt is going to be a drag on growth and this will be a slower recovery than the one in the 2010s.)

As rates rise and federal financing becomes more expensive, I see a significant probability the Fed will impose some kind of YCC policy on Treasury yields. They will essentially be monetizing the debt, though they’ll come up with ways to “sterilize” their purchases. And I fear, like the BOJ, a policy that starts out as temporary will become semi-permanent.

My friends Karen Harris and Austin Kimson at Bain’s Macro Trends Group pointed out some of the risks in a recent report.

While yield curve control has undeniable benefits (from the perspective of central banks), the strategy also carries several meaningful risks. Among these is the fact that it distorts market pricing for all risk assets. [Emphasis mine] Arguably, this is a feature and not a bug, but, like all exercises in price control, one cost of the policy could be the misallocation of resources. In the case of sovereign bonds, the mispricing problem could leak into all other risk assets. The price controls will eventually have to end (presumably), at which point the clash between reality and asset prices could produce a nasty repricing event. This is the stuff of which financial crises are made.

Yield curve controls also greatly increase the incentives for governments to borrow, with potentially inflationary consequences. It is often said that the bond market vigilantes are the only real check on government spending; yield curve controls effectively silence these market players. In extremis, the central bank could finance the central government in all but name, as has effectively happened in many developed economies (including the US and UK) over the last year. As we noted in a previous article, the unique circumstances of 2020 broke the traditional link between central bank-facilitated deficit spending and inflation, but that relationship will likely return to normal faster than politicians and the citizenry rediscover their interest in frugality.

And with Janet Yellen and Jerome Powell both in the mix now, I can’t imagine how this ends well. US Treasury yields are the benchmark for all kinds of other financial asset prices. If they aren’t floating freely, the entire global economy is basically one giant price control. The result, as Bain says, will be widespread resource misallocation and asset mispricing. And eventually a “repricing event” that will make the recent GameStop fiasco look like a child’s tea party.

White Papers, Where Do You Hide, and Finding Income

I’m still working on getting that vaccine, hopefully this next week. Meanwhile I visited the dentist, a very good one I know here in Puerto Rico, but it was still a visit to the dentist. I had a painful evening when the analgesic wore off.

Next week’s letter will have a link to a new white paper I am just finishing. It outlines with some rather definitive specificity my views on investment portfolio construction, the difference between absolute and relative return strategies, strategies you might want to consider and places to find income in a zero-yield world. Believe it or not, mid-single digits and higher are out there if you know where to look. Which of course, my team does. I am more convinced than ever that passive index investing is going to end in tears.

And with that (plus a suggestion you follow me on Twitter), I will hit the send button and wish you a good week! Stay safe and in touch with your friends.

Your old dog learning new tricks analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin