- June 28, 2019

Ray Dalio-John Mauldin Discussion, Part 4

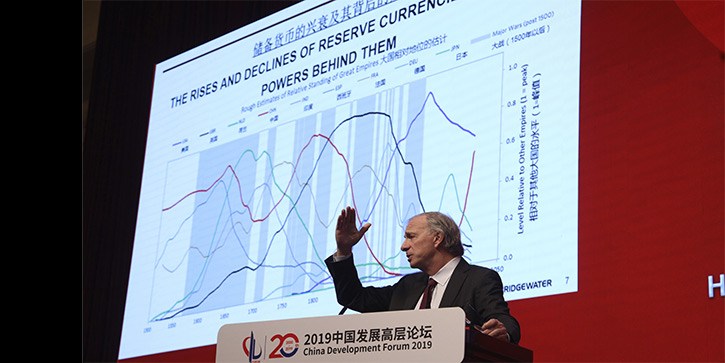

This week is the fourth in a series of five open letters responding to a series of essays by Ray Dalio, the founder of Bridgewater Associates. His original letters are Why and How Capitalism Needs to Be Reformed, Parts 1 and 2 and It’s Time to Look More Carefully at ‘Monetary Policy 3 (MP3)’ and ‘Modern Monetary Theory (MMT)’. My replies are here, here, and here. Today I continue my response.

Read more