The Return of Stagflation

I have been writing this letter for 22 years. Sometimes I look into the future and other times merely try to explain the present. Today I’m going to look at several possible futures. There are forces at work in both Congress and the Federal Reserve that could take us down radically different paths. There are also changes in the Zeitgeist, the way we act and think both in and as a society, that are going to have major impacts.

What I am not doing today is predicting the future. I am looking at events and saying if “this” happens we need to be prepared for it. I’m increasingly concerned we are in an economic situation with almost no wiggle room. We had serious issues before the pandemic which haven’t gone away. Massive fiscal and monetary stimulus obscured this reality, but can’t do so forever.

The late 2020 and early 2021 recovery was exactly that: a recovery from an exogenous event. It wasn’t new, organic growth—or at least not most of it. Moreover, the “exogenous” event is proving less than exogenous. We have wonderful vaccines, very effective in preventing severe disease and death. They help protect the people who get them, but the macro benefit is limited because they aren’t being administered widely enough and quickly enough. This limits global trade and travel, without which sustainable recovery is difficult.

Yes, we’ve learned to cope. We’re making adjustments but still a long way from normal. Much like the COVID-19 disease itself, the economy endured a severe acute phase followed by a chronic “long COVID.” The ongoing symptoms are less severe but still problematic.

Today we’ll explore all this and consider the possibilities. Longtime readers know I call the shots as I see them. Maybe I’m wrong but I fear we have consumed all the wiggle room. Now we need everything to go exactly right… and I have serious doubts it will.

Weaker Expansions

This year’s economy is built on top of last year’s, which was on top of the year before, and on back. It’s an iterative process. Nothing, not even COVID, wipes out the past. We keep feeling its effects.

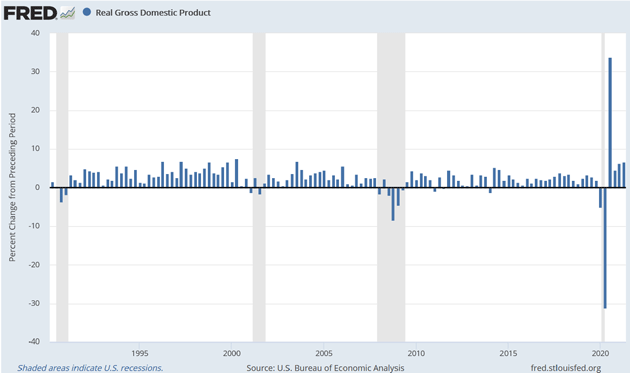

So before we talk about future growth, let’s look back. I have said many times GDP has serious flaws as a growth measure, but it’s what we have. The bars in this chart are real GDP growth by quarter back to 1990, at a seasonally adjusted annualized rate. The gray vertical bars are recessions, of which there were 4 in this period.

Source: FRED

I want you to look at the periods between recessions, what business cycle theorists call the “expansion phase.” Looking only at those (omitting the recession quarters), here is the average quarterly GDP (annualized rates) for the last three expansions.

-

1991–2001: 3.6%

-

2001–2007: 2.8%

-

2009–2019: 2.3%

The last three expansion/recovery phases were each weaker than the last. Maybe that’s coincidence, but it matches a lot of other data showing “growth” isn’t what it used to be.

Remember how this is supposed to work. If you want, say, 3% average GDP growth over long periods, which you know will include recessions in which growth is zero or negative, math says the expansion phases need to average well above 3%. They didn’t do so over the 2 years before COVID struck. The last 21 years have seen sub-2% growth for the entire period.

However, in the four quarters since the COVID recession, growth averaged a stupendous 12.8%. If you go back another quarter and include Q2 2020 (which was -31.2%), it’s still 5.8%. In either case, GDP says we are now experiencing the most gangbusters expansion in decades.

Does that really make sense? Is it where the economy would be right now if COVID had never happened, and the 2019 trends continued? That’s just not plausible. Growth was only 1.9% in Q4 2019 and prospects for more looked pretty bleak at the time.

I and others were saying the mild growth was a consequence of Federal Reserve policy and would only get worse unless the Fed changed course. This is from my December 20, 2019, Prelude to Crisis letter. It’s doubly haunting to read now.

The Fed began cutting rates in July. Funding pressures emerged weeks later. Coincidence? I suspect not. Many factors are at work here, but it sure looks like, through QE4 and other activities, the Fed is taking the first steps toward monetizing our debt. If so, many more steps are ahead because the debt is only going to get worse...

Just this week Congress passed, and President Trump signed, massive spending bills to avoid a government shutdown. There was a silver lining; both parties made concessions in areas each considers important. Republicans got a lot more to spend on defense and Democrats got all sorts of social spending. That kind of compromise once happened all the time but has been rare lately. Maybe this is a sign the gridlock is breaking. But if so, their cooperation still led to higher spending and more debt.

As long as this continues—as it almost certainly will, for a long time—the Fed will find it near-impossible to return to normal policy. The balance sheet will keep ballooning as they throw manufactured money at the problem, because it is all they know how to do and/or it’s all Congress will let them do.

Nor will there be any refuge overseas. The NIRP countries will remain stuck in their own traps, unable to raise rates and unable to collect enough tax revenue to cover the promises made to their citizens. It won’t be pretty, anywhere on the globe…

Crisis isn’t simply coming. We are already in the early stages of it. I think we will look back at late 2019 as the beginning.

COVID was nowhere on the radar screen when I wrote that. A few weeks later it made the Fed intensify an already-loose policy stance while Congress passed gargantuan spending bills that sent the debt even further skyward.

These had initially beneficial effects, as seen in recent GDP numbers. The question now is how long those effects will last.

Back on Its Own

Hindsight is always 20/20. It’s easy to look back and say governments overreacted in the initial COVID crisis, both with economically harmful protective measures and added spending to mitigate that harm, but there was much we didn’t know at the time. I think they were right to err on the side of caution. The first massive stimulus was necessary; subsequent rounds were more questionable.

Necessary or not, the spending was truly staggering. Here’s a chart comparing the inflation-adjusted per-capita spending with two previous crises. In fiscal terms, we just lived through the equivalent of two New Deals. And instead of 10 years, it happened in less than two.

Source: The Washington Post

The scale and speed of this spending explains much, if not most, of the recent GDP growth. Putting an extra $14 trillion on top of normal government spending into a $20 trillion economy is a massive sugar high. It wasn’t a free lunch by any means; the national debt went up accordingly. But it still had a short-term stimulus effect.

The stimulus effect is now ending. The last round of $1,400 payments is either spent or banked. The extended and enhanced unemployment benefits ended this week in the states that hadn’t already canceled them. The small businesses who received payroll support are reaching the end of their rope.

Yes, Congress is considering a pair of infrastructure bills whose price tags, if they pass in the proposed form, will outweigh the prior COVID bills. But passage is increasingly dubious. (More below.) Even if they do, the spending will be spread over many years. It won’t come close to replacing the other programs that have ended, or will end soon.

For all intents and purposes, without more stimulus the economy is back on its own as the fourth quarter approaches—and basically where it was in late 2019. It may even be worse, considering changes to the workforce. Millions have died, become disabled, retired early, or are retraining for career changes. While this may be long-term positive in some cases, it’s not necessarily positive for the next quarter’s GDP.

Danielle DiMartino Booth at Quill Intelligence looked at data from Burning Glass Technologies, which analyzes almost every job posting in the country. It is amazingly comprehensive. I will quote one paragraph and then ask that you look at the data. But the point is the total job postings are essentially unchanged from January 2020. Danielle did highlight a few details.

Lucky for us, unlike some real-time data sets started after the pandemic, Burning Glass also provides weekly data job postings baselined in January 2020. That gets us from the JOLTS July data to The Conference Board’s August data to the week ended September 3rd, depicted in the bottom two charts above. In the aggregate, job postings are UNCH, up 0.1% (light blue line). But it’s the slicing and dicing by industry and educational attainment that’s most edifying. After peaking at +34.1% in the week ended June 11th, postings in Financial Activities (red line) are up a scant 0.7%. Meanwhile, after peaking in the week ended May 14th, openings for those with Extensive education (yellow line) are down by 17.7%, a level last seen in February. At the opposite end of the spectrum, postings for those with Minimal education (purple line) are still up 30.1%; but they’re well off their July 16th peak of +75.1%. Leisure & Hospitality openings (orange line) peaked that same week at +46.5%; they’ve since fallen to +13.4%.

Source: Quill Intelligence

I find this simply astounding. Job postings requiring extensive education are down 17% and job postings requiring minimal education are up 30%. This isn’t the world we told our children about when we urged them to get college degrees. Other statistics show there is a great deal of complacency in the job search market among the unemployed. This is most strange given the higher wages being offered, etc.

Workers are clearly looking not just for higher wages but for better working conditions and higher wages. I’m not sure that will change for quite some time. We are in a wage-price spiral. Every region in this week’s Federal Reserve Beige Book highlighted the increased cost of labor. One line stuck out to me: A hotel firm raised the wages for their cleaning staff to $15 an hour. They noted the current staff was very pleased with the raise but it attracted no new workers.

Dangerous Assumptions

One serious downside risk is inflation. Economists talk about “nominal” and “real” GDP, the latter of which is adjusted for inflation. Higher inflation pushes real GDP lower. An economy showing 4% nominal growth and 1% inflation would have 3% real growth. Not so bad. But if nominal growth stays exactly the same but inflation rises to 4%, real growth would be 0%.

It gets worse. If nominal growth falls just a little, say from 4% to 3%, then a 4% inflation rate would push real growth down to -1% recession territory. A little bit of inflation can amplify a mild setback into a serious one in real terms.

I mentioned the 4% inflation rate because that is exactly where we are when we look at PCE (Personal Consumption Expenditures) inflation, the Fed’s favorite measure.

Despite that, the FOMC projects inflation falling toward 2% within just a few months, and below 3% today. Oops:

Source: FRED

CPI has run well north of 5% over the last six months. The Atlanta Fed’s wage growth tracker is now at 3.9% on its way to 4%. Newsweek reports national average apartment rents rose about 9.2% in this year’s first half. The average apartment in the US now costs $1,200 per month.

These things aggravate each other, too. Inflation pushes input costs (wages, materials, rent, etc.) higher. This can reduce output, and result in lower nominal GDP if common across the economy. With the Fed likely to reduce its asset purchases slowly, if at all, extended inflation in the 3% or higher range is entirely possible, and maybe likely, at least for the next year or so. (I am still in the long-term deflation/disinflation camp, but I also optimistically assumed the Federal Reserve would lean into inflation and take its foot off the gas pedal.)

This is only now beginning to show up in growth forecasts. We see it first in the non-subjective models that react faster than human forecasters. Here’s the Atlanta Fed’s GDPNow forecast as of Sept. 2. Notice how the green line (their model) turned down in late August. I expect it to turn down even more by the end of September. The Blue Chip consensus runs a little behind but I doubt it will retreat as fast. Then again, they are more often wrong than not, nearly always to the upside.

Source: Federal Reserve Bank of Atlanta

Last week’s Human Capital Losses letter outlined why as many as 4 million people may no longer be considered part of the labor force, at least for now. That is almost 3% of the total labor force and since GDP is the number of workers times productivity it can be expected to be a 3% drag on GDP starting with the fourth quarter, unless an enormous amount of people come back to work. It’s certainly not in the data yet.

COVID has had labor force effects we are still struggling to understand. Whether it’s early retirements, health concerns, long COVID disability, a doubling of the number of homeschooling families, excessive government benefits, or (more likely) some blend of all those and more (like preexisting demographic trends), worker shortages limit output. Rising productivity can offset some of this, but not all. And maybe not fast enough to avert another recession.

Other things could help, too. We see significant new demand for certain products and services, as well as desire to rebuild inventory. Those would be positive for GDP. But they’re not assured and it is not clear how much they would help. Businesses are struggling to adjust.

The Human Infrastructure Wrench in the Gears

This is where I will get into trouble. The current $3.5 trillion infrastructure bill if passed as proposed would be a massive blow to the economy. You can’t raise taxes to the extent this proposal would and not expect a negative impact. And those are just the major tax increases. There are hidden cost increases all throughout the legislation.

Senator Manchin has said he will not support a bill of that size. Senator Sinema has also indicated she will not. My Washington sources say there is a number somewhere between $1 trillion and $1.5 trillion they might accept, which would raise capital gains and corporate taxes (along with personal taxes on higher incomes) to pay for the expenditures.

To further the plot, the government will run out of borrowing authority in the next month or two unless Congress raises or suspends the debt ceiling. It may end up being part of the infrastructure reconciliation bill. I have no idea how that would work out, but we will know soon.

I’m not really making a prediction here. These labor issues, inflation, and legislative maneuvering create a great deal of uncertainty. COVID and so much more will all be impacting the economy over the next few months. The market is currently priced for perfection. And admittedly, S&P 500 profits are through the roof. A lot of good is happening at the same time all of these issues are coming into play. If the problems I highlighted above are resolved in a positive manner, we could see the market explode to the upside.

My point is it’s exceedingly dangerous to assume the recent strong growth will continue into 2022 and beyond. COVID’s economic impact will remain significant but diminish as we all learn to deal with it. We are either going to return to the previous trends, which weren’t great, or see new trends form. If the latter, they could be different but not necessarily better.

These potential problems could develop into actual problems and recessionary conditions. The economy is way too close to stall speed. If the engines stop turning, your portfolio needs to be ready.

I am increasingly concerned that the Fed is toying with inflation and the economy could slow down more than they currently project. They are roughly projecting 2–3%+ growth and slightly above 2% inflation. That would be a very good outcome. I am more worried they are wrong, as they have often been in the past, and we’ll get the worst of both worlds: higher inflation and lower growth—in a word, stagflation.

Dallas and Optimism

The only trip I have actually scheduled is to Dallas for Thanksgiving with my family. I really do expect to make more trips but they are just not planned yet.

As noted last week, I met with scientists in Palm Beach last weekend to talk about new antiaging medications, and their data blew me away. At some point I will be able to write about it. We are not that many years away from having therapies which will extend our health spans significantly.

I know my writing sometimes makes people think I’m bearish. I am the opposite. I have two very different core businesses, a publishing business and an investment management business. Along with my partners in both of those businesses, we are making aggressive plans to expand and grow.

I’m developing business plans for other more transformational healthcare/aging related businesses, and hope to push forward on those plans no matter what the economy holds in store for us. Opportunities don’t go away simply because we don’t live in the best of economic times. I will admit that I prefer to launch businesses in a significantly growing economy, but it is not required. What is required is management, capital, and vision. A difficult environment just means you need more of all three.

And with that, I will hit the send button. Have a great week!

Your planning on living a lot longer analyst,

Scroll down for comments.