Assumptions Equal Problems

The Best of Times

Dashed Surplus

Growth Is the Cure

The Great Reset

Charlotte, Fort Lauderdale, Chicago, and Raleigh

The future is tantalizing because it is both unknown and unknowable. At best, we can make educated guesses about tomorrow or next year. Sometimes, it’s actually hard to understand what happened in the past, much less to chart how the future might unfold.

The problem is that some guesses are more educated than others, and even the best are often not good enough. This fact of life matters because we use those guesses to make important decisions about, for instance, government tax and spending policies. Mistakes can have terrible consequences.

These are subjects on which it is hard for any of us to be truly neutral. Most people want to lower their own taxes and simultaneously see more spending on whichever services they think government should deliver. The politicians we elect know this, so they try to give us what we want. The charade never ends well, but we and they keep at it.

Today we will look back at what economists thought the federal budget and tax policy would be in 2001 and thereafter. Let’s just say the government projections were a tad optimistic.

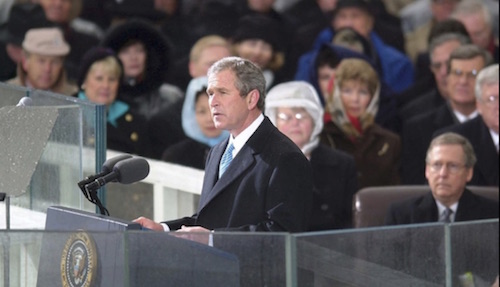

Photo: Getty Images

Dial your mind back to January 2001. The world had survived Y2K; the stock market was topping out; George W. Bush had moved into the White House; and the US government had a balanced budget.

Wait, say that again? Yes, the budget was balanced, and indeed we were running a surplus. Actual black ink. How did that happen? For one thing, a Democratic President Clinton and a Republican Congress led by Newt Gingrich had found ways to work together and get things done. But more important was the previous decade’s economic boom, including four consecutive years of 4.4% or better real GDP growth. Truly it was the best of times, economically speaking.

Photo: Wikimedia Commons

This happy situation would not last long, but many intelligent people sure thought it would. In researching this letter, I poked through news articles from the time and found a treasure trove of horribly embarrassing-in-hindsight quotes. Some were from experts quite well-respected now – perhaps in part because they learned something from being so wrong then.

Five days after the Bush inauguration, then-Fed chair Alan Greenspan testified before the Senate Budget Committee. Congress was considering how to spend a rapidly accumulating budget surplus. Jerome Powell can only wish for the chance to say something like this:

The most recent projections from the OMB indicate that, if current policies remain in place, the total unified surplus will reach $800 billion in fiscal year 2011, including an on-budget surplus of $500 billion. The CBO reportedly will be showing even larger surpluses. Moreover, the admittedly quite uncertain long-term budget exercises released by the CBO last October maintain an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs.

The most recent projections, granted their tentativeness, nonetheless make clear that the highly desirable goal of paying off the federal debt is in reach before the end of the decade. This is in marked contrast to the perspective of a year ago when the elimination of the debt did not appear likely until the next decade.

Greenspan went on to give all the usual qualifiers, but his point was clear: Paying off the debt was both desirable and possible. He was so confident of it, he described at length the practical challenges of prepaying all the outstanding long-term Treasury bonds.

In February of 2001 I wrote about the growing budget surplus; and in that letter, entitled “Greenspan Interpreted,” I and others talk about some of the problems of not having US Treasury debt for many businesses, especially financial businesses, that actually are required to hold US debt. I smile as I go back and read those letters. These particularly optimistic paragraphs leap out at me:

#1. There was a remarkable exchange with the new Senator from Michigan. She was sticking to the questions her staff had prepared for her (generally good practice for freshman senators when talking to Greenspan), when all of a sudden she thought she had this brilliant insight that would support her position that tax cuts are bad. Basically, she asked, “Do I understand you to be saying that in 2005 we will only have $500 billion in surplus?” getting ready to imply that the surplus was not really going to be enough for tax cuts. (Her staff had to be cringing when she left her script.) Before she could really put her foot in her mouth, Greenspan graciously interrupted and said, “No, Ma’am, I am saying that without tax cuts the surplus will be $500 billion in ONE YEAR. There will be no debt to buy. We will have to do something with that money. Whatever it is will be a huge stimulus to the economy.” His implied threat was that he would have to raise rates, cut the money supply, or do something equally nasty to offset that type of stimulus.

Greenspan plainly said that 5–6 years ago no one could have credibly argued we would be where we are today. No one thought that we could remotely pay off the portion of the debt that is not held by Social Security and Medicare as early as 2005–2006. Then he asked throughout both hearings, as I have done over the past months, what do we do with the “excess” surplus, especially the Social Security and Medicare surplus? Put it in a lockbox? Buy corporate bonds? Buy stocks?

These are all good problems, but they are going to be problems, nonetheless. He basically insisted that Congress needs to begin to decide now what we are going to do.

As for him, he clearly favored tax cuts. It would provide a steady stimulus, rather than a massive one. It would postpone the problem of paying the debt to a manageable period.

In other words, Greenspan saw eliminating the federal debt as a matter of “how,” not “if” – if, as he said, current policies remained in place. Obviously, it didn’t happen that way. Congress and the Bush administration decided to cut taxes and add the Medicare Part D prescription drug benefit. Then September 11, 2001, precipitated the very costly War on Terror.

(Note: At the time Greenspan said all this, the US economy was only weeks away from entering a recession. It would be short and relatively shallow but still an honest-to-God recession. Keep that in mind when you hear today’s experts confidently predict further growth.)

The Congressional Budget Office (CBO) surplus projections Greenspan mentions are still online here. Then, as now, the economic assumptions were optimistic, to say the least.

As of January 2001, the CBO foresaw another decade of 3% real GDP growth, 3% inflation, unemployment at 5% or below, and flat-as-a-pancake interest rates. That scenario was never likely to happen, and indeed it did not. These assumptions fell apart almost immediately and the situation only worsened. But by then the assumptions had been used to justify decisions that were, for various reasons, all but irreversible.

In fairness to the CBO, their report discussed how the projections could go wrong. They even disclosed their own historical inaccuracies. But because this was a political process and not a business or scientific one, those warnings received little heed.

I have talked about this before: All economic and budget models are based on assumptions. Those assumptions generally draw upon the past to make projections about the future. I have actually heard a well-respected Fed economist admit that using the Phillips curve for some of their projections is fraught with problems. When asked, “Then why do you keep using it?” the answer that came back was, “We have to have something that we can base our projections on. We don’t have any other better model, so we use it.” Knowing that its us is going to result in faulty predictions, they still use it anyway.

And knowing that government agencies that do budget projections are forced to make assumptions about an unknowable future, we shouldn’t be too critical of them. Then again, because they are government entities, they are disinclined to forecast recessions or anything that might be negative about the economy. Generally, government forecasts are packed with lots of rainbows and ponies.

Nevertheless, the 1990s surplus wasn’t imaginary. And it was growing. The government was taking in more cash than it was spending. The overall debt had stopped growing and may have even shrunk a little, depending how you defined it. That was good.

Now, 17 years later, the surplus is gone, and we could easily see a $2 trillion annual deficit soon. How did we get from there to here so fast?

The answer is in the assumptions.

If your average picture is worth a thousand words, the one below is worth many more. It comes from former Treasury economist Ernie Tedeschi. On his Twitter page, Ernie pointed out that seemingly reasonable assumptions back at the time of the January 2001 surplus celebration would have added up to a $15 trillion cumulative budget surplus through 2028.

That would have been nice, and probably allowed Greenspan to be right about paying off the debt. It didn’t happen. Instead, Ernie now foresees a $28 trillion cumulative deficit. In other words, over a 27-year period the assumptions will have been about $43 trillion off, if Ernie is right. Maybe he’s not, but let’s go with his numbers for the sake of argument.

What accounts for that gaping difference? Lots of things, but they fall into three broad categories, none of which are surprising.

• Higher than expected government spending

• Lower than expected tax revenues

• Worse than expected economic growth

Ernie’s chart breaks down the effect of each wrong assumption. Note that the October 2000 long-term projections from the CBO anticipated $15 trillion in savings by 2028.

Source: Ernie Tedeschi. Reproduced with permission

Let’s dig into this chart. Start by finding 2011 at the bottom axis, then go up. That’s the 10-year projection period CBO published in the 2001 report linked above. It’s history now, so we can evaluate it without making further assumptions. You can see the gap at that point came in roughly equal proportions from missed spending and missed revenue estimates. GDP had a relatively small effect, even though the original projections didn’t assume the 2007–2009 recession. When all was said and done, the 10 years ending 2010 saw an average of less than 2% GDP growth per year. And all that lost growth began to show up in the form of budget deficits this decade.

As time passes, the consequences of excessive GDP optimism grow more significant, especially as the CBO now projects lower growth than it did in 2001. Lower growth shrinks revenues. When these impacts are compounded over time, the difference between 2% and 3% real GDP growth is enormous. Just as those repeated years of 4% and better growth in the 1990s added up to a stunning surplus, our recent string of 2% and worse years add up to the opposite – and will keep doing so, unless something sparks much higher growth.

GDP projections involve both revenue and spending. Lower GDP and especially recessions tend to mean higher spending as more people become eligible for unemployment benefits, food stamps, and other social programs. Congress uses recessions to justify “stimulus” spending, too.

Likewise, recessions or just lower growth mean lower revenue because our tax system depends mostly on income. Less income for people and businesses means less tax revenue for the government.

But even if the CBO were to estimate GDP on the dot, and even if tax policy stayed constant, spending is still a huge variable. The services we want government to provide change over time. So does the composition of Congress, which decides which services to provide. Spending grows under either party, but not in the same ways. Then there are occasional bolts from the blue like 9/11, which in short order led us to spend multiple trillions on wars in Iraq and Afghanistan and smaller involvements elsewhere.

We can’t blame the CBO for not knowing how much those wars would cost or how long they would last, even if it could have somehow anticipated them. To a lesser degree, that is also true of budget busters like natural disasters. We can go years without needing to spend much on them and then have several hit at once.

There are ways to handle the unexpected. Keep the budget balanced or run a small surplus, then have a “rainy day” fund for emergencies. That’s how families and businesses operate. The government could do the same if the political will existed. Obviously, it doesn’t.

This example of how badly assumptions can go wrong offers some valuable lessons. Forecasting the future is hard even in the best circumstances, but you must make assumptions in order to plan ahead. The key is to make conservative, reasonable assumptions and adjust them when they prove wrong.

(I am facing that problem head-on every day as I try to write my new book on what the world will look like in 20 years – knowing that I’m going to be laughably wrong at various points along the way. I hope to be right more than I’m wrong. But the problem is, I’m obliged to makes scores of forecasts. So I have to make the best assumptions I can and move forward.)

That’s not how our federal government works. It makes hasty decisions and then compounds the bad effects. As noted above, we had a giant surplus on hand when the economy entered recession in early 2001. A little stimulus via tax cuts or extra spending made sense. Was that still the case after September 2001? Or should the government have changed course to account for new circumstances? As it happened, we kept the tax cuts, added new military and Medicare spending, and did nothing to raise new revenue or cut other spending. Bye-bye, surplus. Then came the financial crisis and Great Recession, and and you know the rest.

Even with wars and two recessions, we might have avoided today’s huge deficits if GDP growth hadn’t fallen to this frustratingly low plateau. The last calendar year with real GDP growth over 3% was 2005. Some people think 2018 will be the next one. I doubt it, but even if that happens it won’t make up for the years of missed growth opportunities.

All that said, this problem isn’t unsolvable. Growth really is the key. If real GDP can jump 3% or more this year and keep doing the same thing for three or four more years after that, and we can put in place some spending reductions, we would go a long way to solving our deficit problem. We might not have a surplus, but we’d be much closer to balanced.

Unfortunately, I can’t presently imagine a scenario in which that happens. The tax cuts and deregulation are helping a little, but not enough. Picking trade wars with China or tearing up NAFTA won’t help at all. Nor will continued gridlock over healthcare, or failure to solve the public pension problem or to reform entitlement spending. On the monetary side, it’s clear the Fed has no magic bullets. So what’s the best-case scenario?

I can only imagine one event that might help: a positive bolt from the blue, one that reduces government spending and raises government revenue.

Sound like a dream? Maybe it is, but I can imagine some major healthcare breakthroughs that would do it. Cures for Alzheimer’s, cancer, and heart disease would be a huge help. So would anti-aging breakthroughs. People would be able to work longer, adding productivity to the economy while reducing Social Security and Medicare spending.

Mind you, I am not predicting those things will happen soon – but I don’t count them out, either. Smart people are working on all these challenges and making progress. A large part of the budget problem is really a healthcare problem, both directly and indirectly. Healthier workers with longer working careers will translate directly into economic growth.

Today’s debt problem traces directly back to those 2001 assumptions that proved so wrong, but that’s not all. Every subsequent Congress and administration has relied on equally flawed, implausible assumptions and made similarly flawed decisions, right up to the present one. This short-sighted, wishful thinking afflicts both parties and the nation. It is a systemic problem that requires a systemic solution. Playing the blame game will not fix it.

And just for the record, I would like to say that the $28 trillion debt projected for 2028 is going to be seen in hindsight to have been extraordinarily optimistic. I think we are at $30 trillion of total debt by the middle of the decade, and by the end of the decade we could be scaring $40 trillion. We are beginning to see the drag on growth brought about the inexorable rise of total (not just government) US debt.

As I’ve said many times, we can’t pay that debt down through any realistic budget process. We, along with the rest of the countries in the developed world, are going to have to take extraordinary measures to control and reduce our debts and interest payments. I’ve called it the Great Reset. There are several ways to reduce the debt, but they all amount to essentially changing the terms of the debt (an anathema) or some form of monetization. Making such a prediction now seems rather stark, as any of those choices will not be popular or pleasant, so they are unthinkable today. But when we have our backs to the wall, we will all start thinking about unthinkable things and actually doing some of them.

All the while, technology is encroaching on more jobs, and the politics of many countries are becoming increasingly harsh. The 2020s are going to be extraordinarily volatile in so many ways – which of course means that there will be lots of opportunities. Stay tuned.

Charlotte, Fort Lauderdale, Chicago, and Raleigh

I travel next week to Charlotte, then later in the month to Fort Lauderdale, Chicago, and Raleigh for mostly private speaking engagements. The exception is a seminar open to financial advisors and brokers and sponsored by S&P, happening in Charlotte on April 11. The event is built around the theme of strategic and tactical ETF trading strategies.

Thank you to the thousands of you who took the survey I shared last week. My team is crunching through the results as I write, but some interesting findings jumped off the page straight away. One I found particularly interesting is that a massive 82% of you prefer to receive investment information by email.

It’s wonderful to know that, some 18 years after I first started sending out Thoughts from the Frontline, you still enjoy opening it up and reading it each week. I truly do appreciate that investment of your time in an era when we’re all battling the overload in our inboxes.

And I want to thank you, too, for the time you took to share your thoughtful and detailed answers about where we go from here with both Thoughts from the Frontline and Outside the Box.

Thankfully, your vision and mine converge pretty closely. That makes me even more excited about unveiling my plan to you. I’m still dotting some i’s and crossing some t’s, as well as conducting an avalanche of meetings, but I can say for certain that I’ll be able to let you in on what’s happening within a couple of weeks. Stay tuned!

You have a great week. I can reliably project that I will be watching the Masters this weekend. Having been at Augusta last year for the Masters, I have a much better sense of what it’s like, and that will make watching it on TV a lot more fun.

Your thinking about the Great Reset analyst,

Scroll down for comments.