You’re being lied to about AI

- Stephen McBride

- |

- October 19, 2023

- |

- Comments

This article appears courtesy of RiskHedge.

Sam Walton’s first boss told him, “Maybe you’re just not cut out for retail.”

Haha. You know the punchline. Sam went on to build a retailer you might have heard of: Walmart (WMT).

Yep, Walmart started with one determined 44-year-old man.

And thanks to the magic of the stock market—which lets us piggyback on exceptional guys like Sam—investors got rich too.

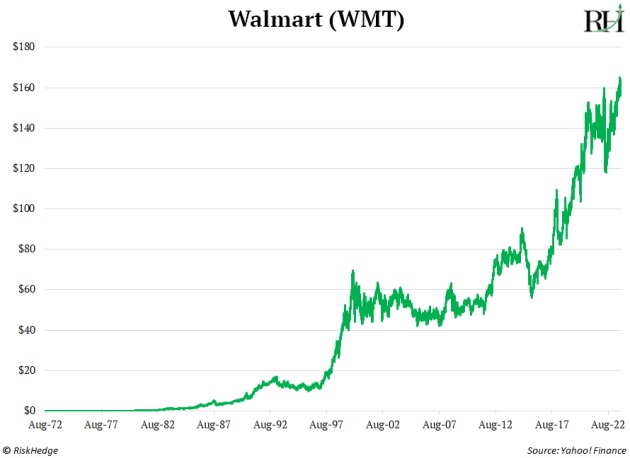

Walmart’s stock has surged 447,694%:

Let’s channel our inner Sam Walton and get after it today…

- Earnings update: So far, so good.

Last week, I wrote strong earnings from corporate America would send stocks roaring higher into the end of the year.

So far, so good.

All of Wall Street’s big banks crushed earnings. Key consumer stocks like Johnson & Johnson (JNJ) and Procter & Gamble (PG) also grew more than expected.

I realize a recession “should” be at our doorstep. But facts are facts. These results show the US economy is strong and stocks can keep grinding higher.

After a nasty August and September, the S&P 500 is up 4% this month.

Thousands of companies report earnings over the next month. But less than 50 really matter.

These big boys produce most of the earnings—and gains—so they’re the stocks to focus on.

Here are three I’m looking forward to:

- Tesla (TSLA) reports results today after the closing bell.

- American Express (AXP) announces earnings on Friday.

- Visa (V) is out with results next Tuesday.

Great businesses profiting from disruption will achieve much stronger results than many investors are expecting… which should push the market higher.

I remain bullish.

- It’s time to invest in the “new” military kings.

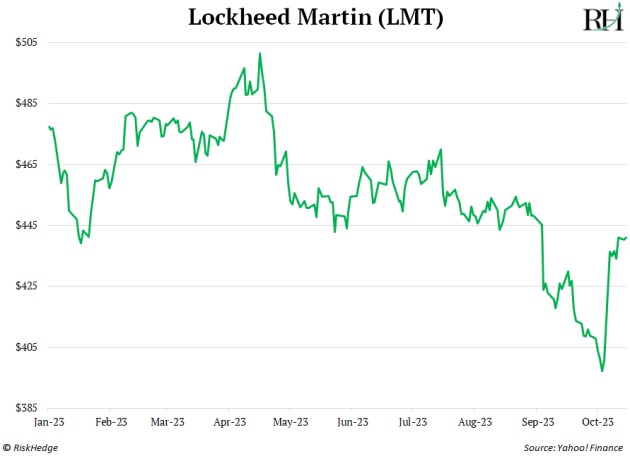

Lockheed Martin’s (LMT) stock jumped higher when Hamas attacked Israel:

Nothing new. War is good for companies that sell war machines.

But make no mistake: Warfare is being disrupted. And investors who own defense stocks need to listen up.

One of the ways Hamas broke into Israel was by dropping grenades from drones to rip through 20-foot-tall border barriers.

These weren’t sophisticated AI-powered slaughter bots. They were the type of drones you can buy at Walmart.

Wars used to be won with expensive missiles and machine guns. Now you can challenge a world-class military with a few $200 drones—identical to the ones many kids will get as toys this Christmas.

The Lockheed Martins of the world have dominated military spending for our entire lives. And their stocks have marched higher year after year.

This is ending.

An F-16 fighter jet costs $64 million. It takes years to make. Now you can build swarms of killer drones for 1/100th the cost… in a few months.

If you’re blindly piling into old-line military contractors like they’re still “sure things,” you’re making a mistake.

The real money will be made in the new crop of military disruptors shaping the future of war.

That includes cyber companies, which we’re already profiting from in Disruption Investor.

We’re analyzing drone makers for a potential investment.

I’m also keeping a special eye on start-up Anduril Industries (the Lockheed Martin of the 21st century). Its self-flying fighter jets can fly at 700 miles/hour!

- You’re being lied to about AI: Here’s what to do.

We’re told artificial intelligence will steal our jobs… rot our children’s brains... and possibly even wipe out humanity.

It’s all a lie.

AI will save millions of lives before it kills anyone. Here’s the latest proof.

Central nervous system (CNS) tumors are among the most lethal cancers. And cutting them out of patients is like walking a tightrope. Things can—and often do—change rapidly mid-surgery.

Enter “Sturgeon.”

Dutch researchers created an AI tool that classifies changes in CNS tumors during surgery. Sturgeon has a 90% accuracy rate, meaning it will help doctors avoid costly mistakes during surgery and ultimately save lives.

It’s ChatGPT for brain surgeons.

People often ask me why I’m an optimist. How can you be a pessimist when we have lifesaving inventions like Sturgeon?

For investors, there’s another big AI lie to watch out for: There will be one AI to rule them all.

That’s false. There will be millions of specialized AIs all tackling different problems. Sturgeon could save your life during surgery. Then a robo-taxi (also AI) will drive you home after recovery.

I’ve been investing in AI since 2018, which is when I recommended Nvidia (NVDA). With all the new opportunities debuting now, there’s never been a more exciting time to invest in this industry.

We already own three AI winners in Disruption Investor, and we’ll soon add more (more on this soon).

- Today’s dose of optimism…

“Pessimists sound smart; optimists make money” is a motto I live by.

The optimist who expects a wonderful future seems naive.

The pessimist who points out risks seems clued-in and savvy.

The data confirms this.

A research paper titled “The Cynical Genius Illusion”—which profiled about 200,000 people across 30 countries—found people tend to believe in cynical individuals’ cognitive superiority.

Researchers also found cynical people generally do worse on cognitive-ability tasks.

In other words, pessimists seem smarter… but they’re not.

This holds true in the stock market.

Every year, every month, every week… there’s a smart-sounding reason to dump all your stocks.

Yet, here we are:

Source: Macrotrends

Do you want to sound smart or do you want to make money?

I’ll take the money every time.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com